The latest Bitcoin halving event is right around the corner, and if history and the opinions of many analysts are anything to go by, we could be in for a massive increase in the price of the digital asset. Despite this, many are warning that this time will be different, with all-time high prices realised pre-halving for the first time in history.

In this article, we’ll describe what the halving is, the historical impact of each event and how it is expected to affect the price of Bitcoin.

What is the Bitcoin Halving Event?

In the Bitcoin ecosystem, miners receive a reward each time they write a block to the blockchain. This process is designed to incentivise participation to promote security within the network.

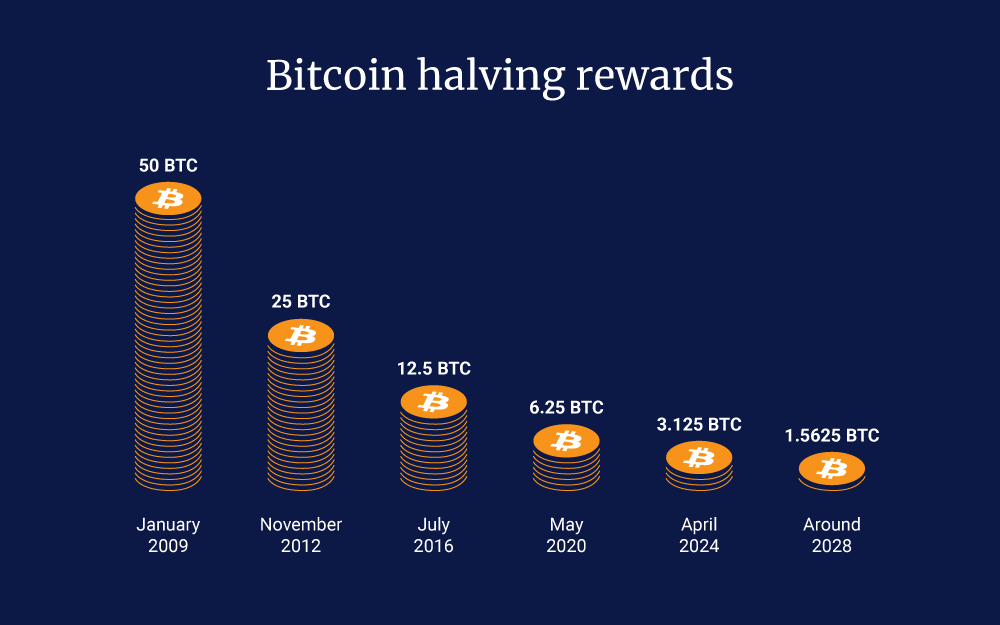

On 3 January 2009, Satoshi Nakamoto mined Bitcoin’s genesis block and received 50 Bitcoin as a reward. This process continued on each subsequent block, with each miner receiving the same 50 BTC reward for validating transactions on the network.

By November 2012, the first 210,000 blocks had been added to the ledger, and the reward was automatically reduced by 50% to a total of 25 BTC. Known as the “halving”, this reduction in miner rewards is programmed to occur every time this threshold of 210,000 blocks is crossed.

Historically, halvings occur approximately every 4 years, and since Bitcoin’s inception we have experienced three such events. The most recent halving occurred on May 11 2020, with rewards being slashed from 12.5 to 6.25 BTC. The next Bitcoin halving event is set to occur on April 20th 2024, after which mining rewards will be reduced by 50% to 3.125 BTC.

What will happen when the reward halves?

To date, we’ve already witnessed three Bitcoin halving events. The first time was in November of 2012, followed by the 2016 halving event, with the latest occurring in May of 2020.

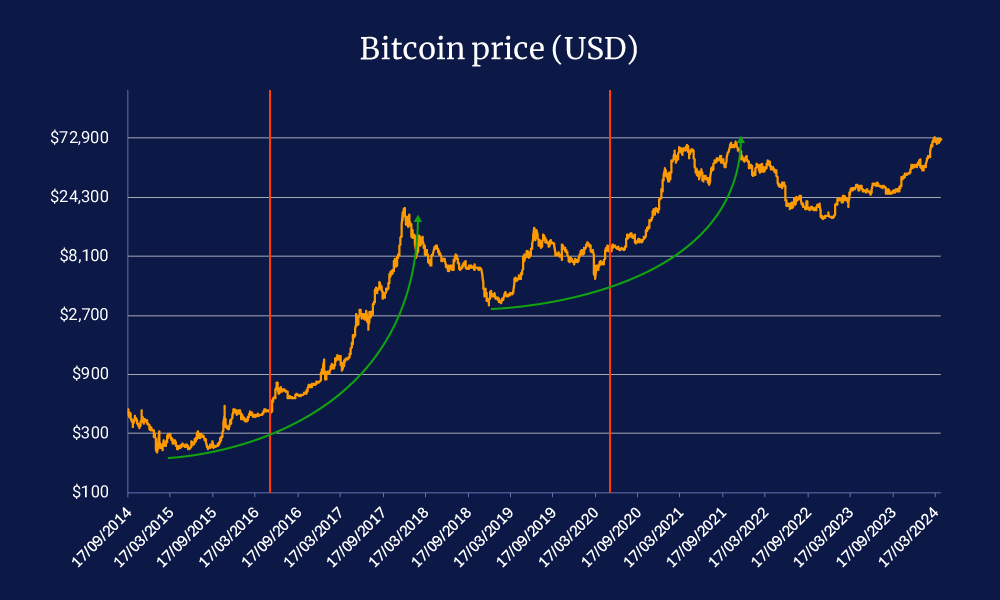

After each BTC halving, the following year saw Bitcoin’s price rise significantly. Within 12-18 months, prices surged to new all-time highs with many analysts believing that the halving is the catalyst for each of the bull runs experienced in the crypto market to date.

Historically, there is a precedence. A year after the 2012 halving, the price of Bitcoin rose to USD 1,000 by November 2012, a record high at the time. Four years (210,000 blocks) later, the 2016 halving event took place. By mid-December 2017, less than 18 months later, BTC had reached another new record, marking an all-time high of USD 19,800. It was a similar story in 2020 when the halving inspired a price surge that culminated in an all-time high price of USD 68,789 in November 2021.

Why does halving impact the price of Bitcoin?

To understand this question, you first need to appreciate the deflationary nature of Bitcoin’s supply side. With a fixed amount of 21 million coins hardcoded into the ecosystem, Bitcoin cannot increase the total supply of its network. Similarly, there is a capped amount of remaining Bitcoin that is left to incentivise miners. As of today, approximately 19.6 million Bitcoins have already been mined, with only 1.4 million remaining.

With this in mind, it’s much easier to understand the impact that reducing the amount of mining rewards can have on the price. As the block reward reduces, miners have less bitcoin to sell, and over time this reduction in sell pressure can have an upward effect on the price. As participants observe this mechanic, it helps reinforce the immutability of the protocol and the fact that BTC is a scarce digital asset.

Will the next Bitcoin halving create a new all-time high in the price of BTC?

As with any prediction, there are a lot of variables that can impact whether or not it will live up to historical performances. The following are just a few things to take into consideration when making price predictions.

1. Bitcoin ETF inflows have triggered a pre-halving all-time-high

The launch of Bitcoin trading ETFs in January of this year has created a scenario not yet seen in the crypto market. Large amounts of liquidity has flowed in from institutional investors to these ETFs, rallying the price of Bitcoin to an all-time high of USD 73,738 in March 2023. Many analysts believe this strong performance prior to the halving may dilute the assumed price surge in the 18 months to come.

2. The cost of mining Bitcoin is increasing

Mining Bitcoin is an expensive process, both in terms of hardware and the often exorbitant power requirements needed to operate a complex proof-of-work network. With the amount offered to miners set to reduce by almost 50%, it may become financially untenable for many miners to continue to operate. This is especially true for smaller mining operations that aren’t connected to cheaper energy sources. Some analysts have predicted that the price of BTC will have to remain above USD 80,000 post-halving in order for many miners to remain profitable. However, it’s important to remember that the block reward isn’t everything – miners also collect transaction fees for every transaction that is included in the block they are mining. As the Bitcoin mining reward reduces, the transaction fees play a larger and larger part in their profitability.

3. Each halving has been less dramatic than the last

While we have witnessed a Bitcoin price surge after each halving event, the percentage increase is diminished each time.

- After the 2012 halving, prices increased from US$13 to US$1,152, a change of 8761.54%

- After the 2016 halving, prices increased from US$664 to US$17,760, a change of 2574.7%

- After the 2020 halving, prices increased from US$9734 to US$67,549, a change of 593.95%

Frequently Asked Questions

What is a Bitcoin halving?

A Bitcoin halving (also sometimes called “the halvening”) is an event that halves the block reward given to miners for validating new blocks on the Bitcoin blockchain.

Why does a Bitcoin halving occur?

Bitcoin halvings are built into the Bitcoin protocol as a way to control the rate at which new Bitcoins are created and released into circulation. By halving the new supply approximately every 4 years, it allows for a predictable reduction in revenue for miners. In ~116 years time, there will be no block rewards anymore, and the miners will earn only transaction fees. These factors combined allow us to have a fixed total supply, and at the same time, try to limit the revenue shock to miners.

How often does a Bitcoin halving occur?

The exact timing of each halving event is determined by the number of blocks that have been mined on the Bitcoin network. A Bitcoin halving occurs roughly every four years, or more specifically, every 210,000 blocks. Blocks are targeted at being mined every 10 minutes, but due to changes in computing power (hash power) of the miners, this can vary slightly.

A history of Bitcoin halvings

2009 – Bitcoin mining rewards start at 50 BTC per block.

2012 – The first Bitcoin halving reduces mining rewards to 25 BTC.

2016 – The second halving reduces mining rewards to 12.5 BTC.

2020 – The third halving, mining rewards dropped to 6.25 BTC.

2024 – The fourth halving, rewards will be cut to 3.125 BTC.

2140 – The 64th is the last halving and no new Bitcoin will ever be created.

How many Bitcoin halvings are left?

If a Bitcoin halving happens every 4 years until 2140, that means there will be about 29 more Bitcoin halvings until there are no more Bitcoins left to mine. In total, Bitcoin will have 32 halvings, and after the last one no more Bitcoin will be paid to reward miners and all 21 million Bitcoins will have been minted.

What effect does Bitcoin halving have on the price of Bitcoin?

The effect of Bitcoin halving on the price of Bitcoin is not certain and can vary. Typically Bitcoin halvings in the past have led to an increase in the price of Bitcoin, as the reduced supply of new Bitcoins lead to less sell pressure, increased demand, and higher prices.

What happened during previous Bitcoin halvings?

During previous Bitcoin halvings, the price of Bitcoin has generally increased in the months and years following the event. However, it is important to note that past performance is not necessarily indicative of future results, and the effect of future halving events on the price of Bitcoin is uncertain.

How can I prepare for the next Bitcoin halving?

If you are interested in preparing for the next Bitcoin halving, you may want to keep an eye on the Bitcoin price and mining difficulty, as well as the overall health of the Bitcoin network. To keep track of the next halving, check out the Bitcoin halving clock.

How can I get involved in Bitcoin and participate in the next halving?

If you want to be involved in Bitcoin and participate in the next halving event, you can start by buying some Bitcoin. You can also consider becoming a Bitcoin miner by setting up your own mining rig or joining a mining pool.