In Markets

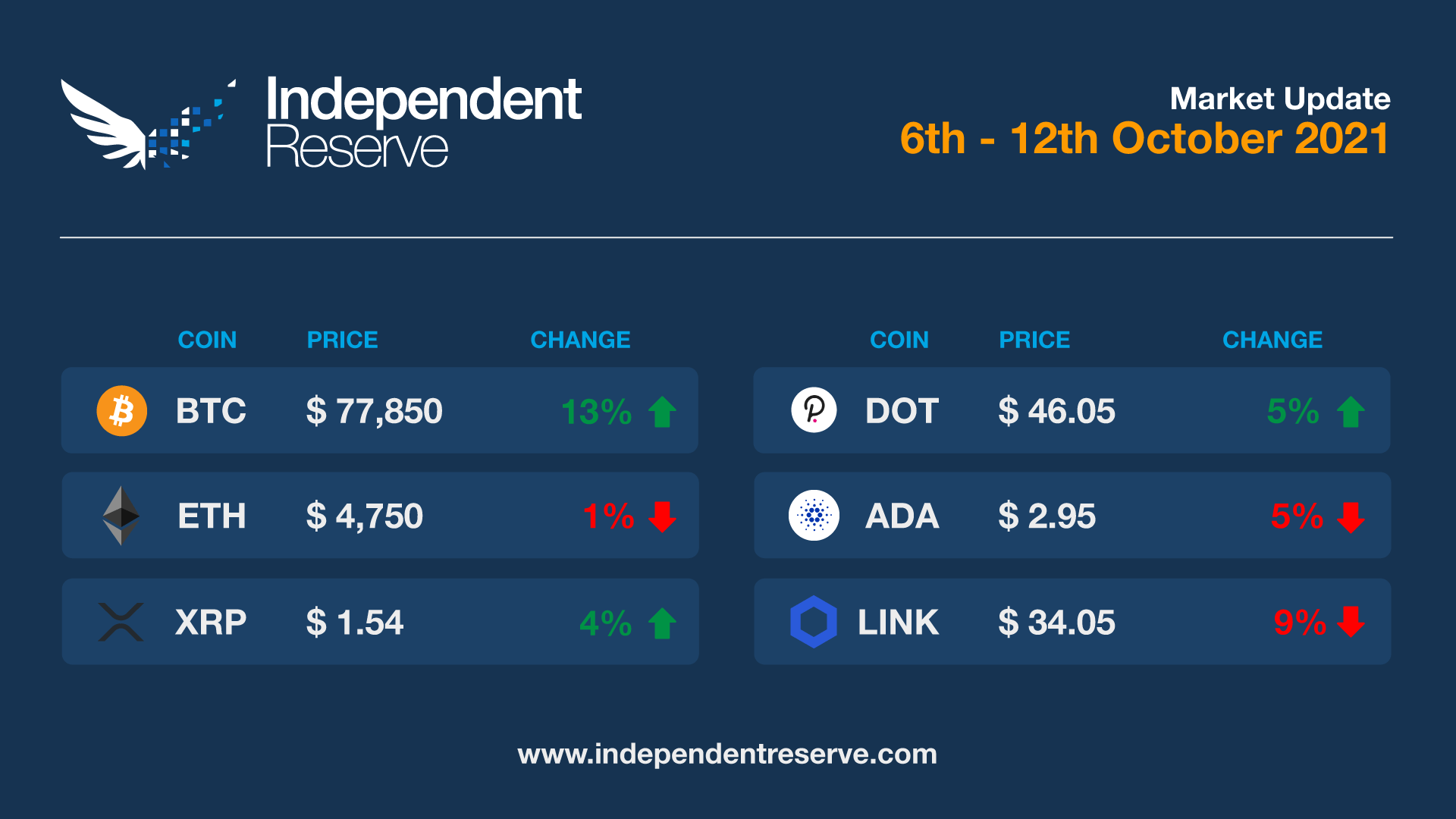

‘Uptober’ seems to be going well for Bitcoin in particular, with the price increasing 13% this week to around AU$78,000 (US$57.3K), its highest level in five months. Expectations are now high for a big fourth quarter, and with April’s ATH of AU$84.7K (US$64.9K) back in sight, “all data science models suggest that BTC will peak much higher than US$100,000 (AU$136K) in this cycle,” analyst Rekt Capital said. While alt season may be a little way off just yet according to trader Pentoshi, it is coming. Ethereum was up 4% to around AU$4,800 (US$3.5K), XRP (9.35%), Polkadot (9.1%). But Cardano fell 1.1%, Dogecoin (-3.8%), Chainlink (-5.6%). The Crypto Fear and Greed Index is at 71, or Greed.

From the IR OTC Desk

The Reserve Bank of Australia (RBA) meeting last Tuesday was by and large a non-event. As communicated, the Bank has historically shown a very calming approach toward forward guidance, with the October meeting being no exception. Of interest however, the Statement mentioned “inflation is running at around 1.75 per cent and wages, as measured by the Wage Price Index, are increasing at just 1.7 per cent.” The RBA continues to forecast – in their central scenario – that 2-3% inflation will not be met before 2024. A prudential focus on lending, as well as any update to a monetary policy framework review will now be of particular interest for Australia.

In a somewhat divergent path, the Reserve Bank of New Zealand (RBNZ) lifted the underlying cash rate from 0.25% to 0.50% (a 25bps increase). Inflation is expected to increase above 4 percent in the near term, before returning toward the 2 percent midpoint over the medium term. The Bank communicated that COVID-19 related restrictions have “not materially changed the medium-term outlook for inflation and employment” justifying the cash rate increase. Traders will now focus their attention on the shape of the yield curve to understand and forecast the initial speed of the tightening cycle.

On the OTC desk, the outperformance of BTC and ETH has been orderly, and of high conviction. Across the desk, we have seen good two-way flow (both buyers and sellers), in BTC: while in ETH we have seen a greater proportion of sellers (profit taking). Flow into the alt coin space seems to have taken a breather this week – outside of some tactical switching between layer 1s. We continue to be highly active in stable coins – and in general have been better sellers of USDT and better buyers of USDC.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

Mixed regulatory news

SEC boss Gary Gensler revealed this week the SEC has no plans to ban Bitcoin … but as he pointed out, “That would be up to Congress.” Bloomberg reported the White House is weighing up an executive order on cryptocurrencies looking into financial regulation, economic innovation and national security. The most likely legislation in the short term is for stablecoins, which Shark Tank star Kevin O’Leary says will likely see the government “basically regulate issuers of stablecoins as banks.”

Infrastructure bill

About 3% of the US Senate turned up to the Texas Blockchain Summit late last week. While Senator Ted Cruz claimed that “there are not five members of the U.S. Senate who could tell you what Bitcoin is,” Senator Cynthia Lummis is now hopeful that the language in the controversial Infrastructure Bill will be amended in the House. The bill is subject to negotiations at present but contains language that defines everyone from miners to software developers as ‘brokers’ who need to comply with onerous reporting requirements. “I do think there will be some changes to that language,” Lummis said.

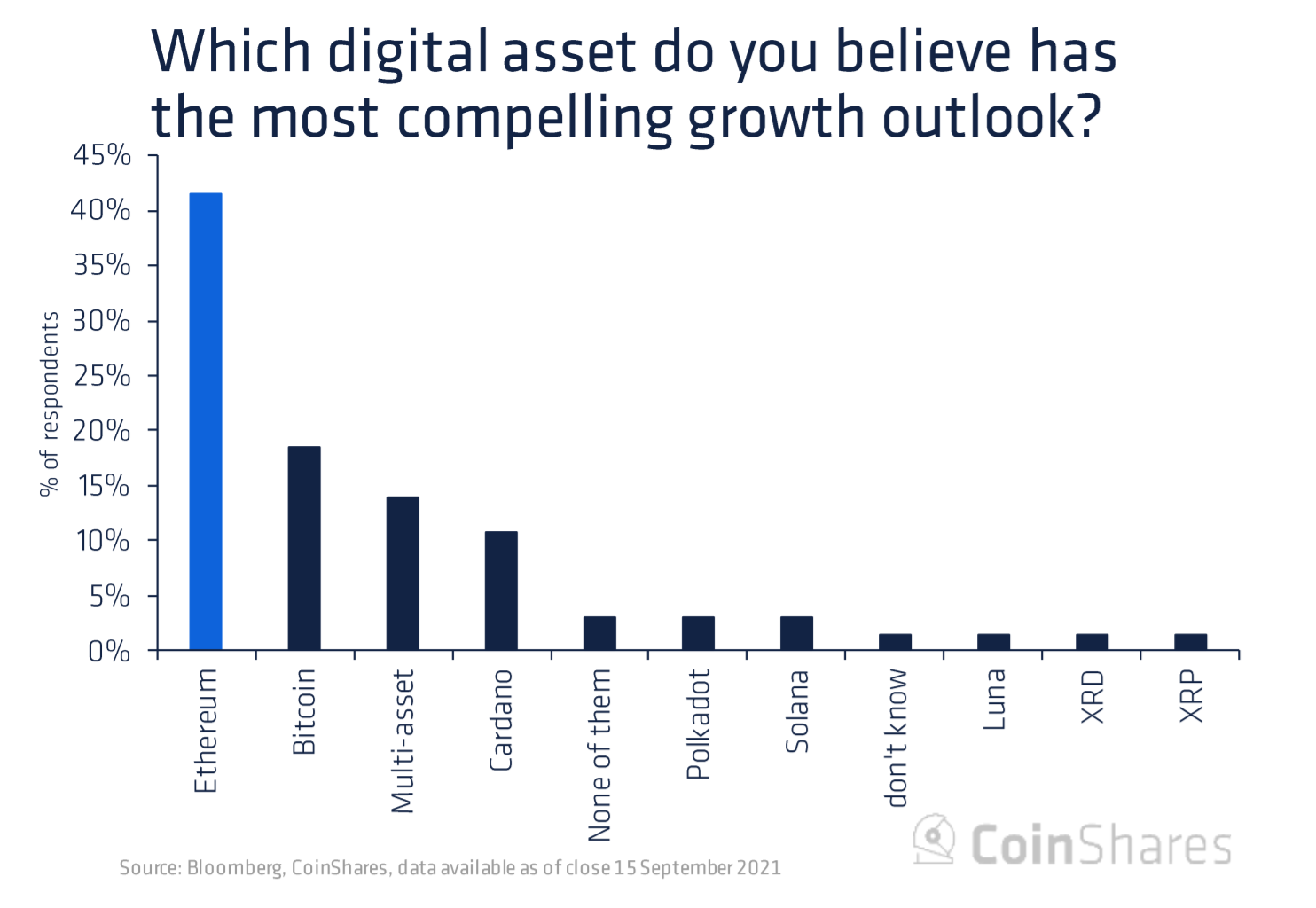

Ether price hopium

A new survey of crypto fund managers by Coinshares found that 42% think ETH has more potential to grow than BTC (18% thought the opposite). Ether represented about 11% of institutional AUM at the start of the year, but that has now grown to 26%. If you put a lot of faith in technical analysis you’ll be delighted to learn that a fractal indicator pattern (incorporating a relative strength index, stochastic RSI, bullish hammer and a Fibonacci retracement level) from 2017 has repeated. The pattern was closely followed by ETH surging by 7,000% that year …

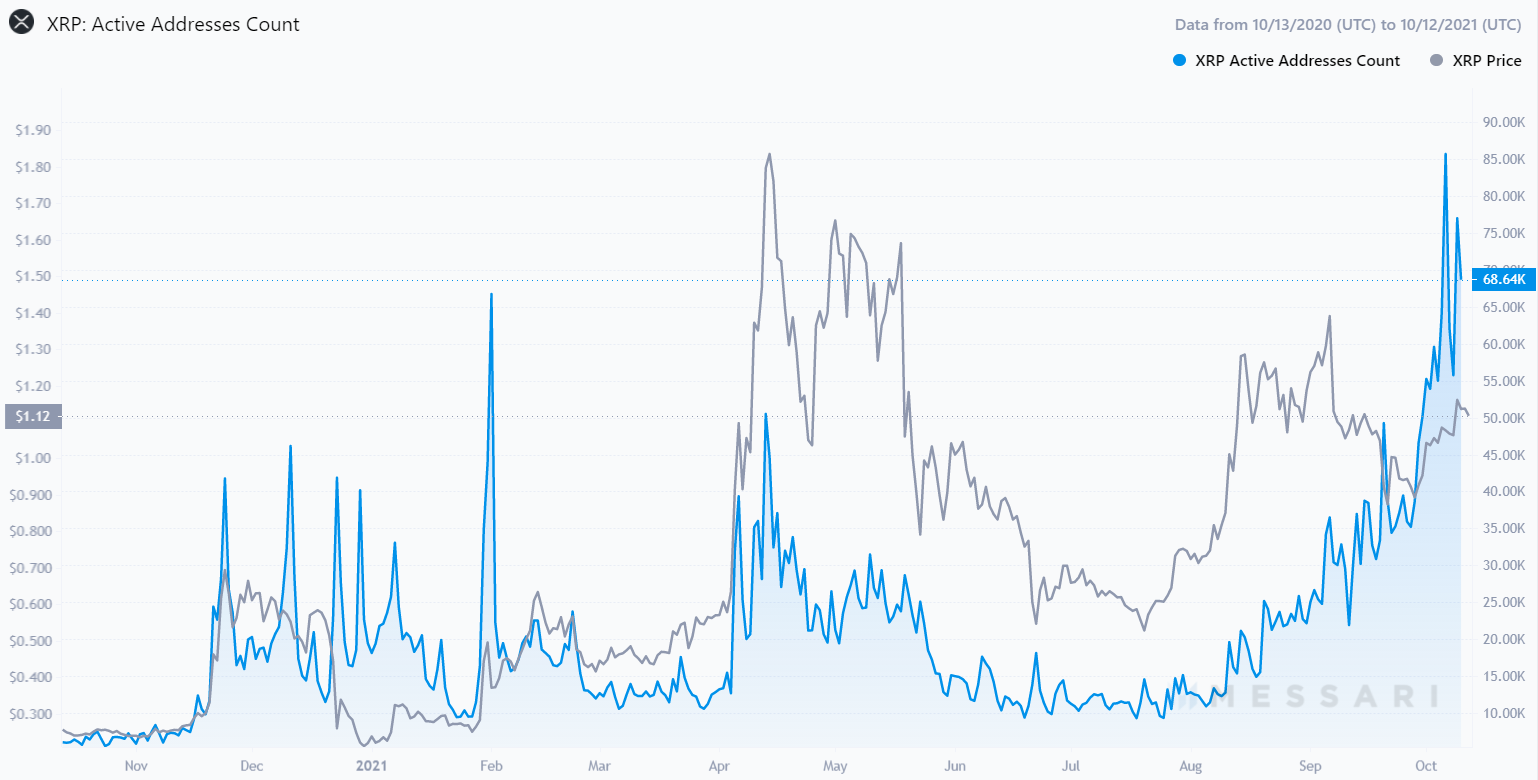

XRP’s record addresses

The number of active addresses on the XRP network has hit an all time high. The news comes amid partnerships between Ripple and banks in Qatar and Bhutan, along with a US$250M (AU$340M) creator fund to help bring about NFT adoption on the blockchain. And, while no one knows how the SEC case against Ripple for selling unregistered securities will turn out, many believe XRP will get a boost if the matter is resolved in Ripple’s favour.

XRP Active wallet address count. Source: Messari

Beacon chain upgrade

Ethereum’s Altair upgrade is set for October 27 and if you’re staking on Eth2 you must upgrade your client before that date. The upgrade to the Beacon chain (not the main network) includes patches, slashing changes and cleanups to validator rewards … but more importantly it’s the last upgrade before the merge and if it goes badly the merge will be delayed. Ethereum devs met in person last week to work on the transition.

Bank of America is bullish

A bullish 140 page report into the crypto sector from Bank of America concluded that $US17B (AU$23.1B) had been invested in the markets in the first half of 2021, a massive increase on the US$5.5B (AU$7.5B) in the same period in 2020. The analysts also see “significant value in the intermediate-term for DeFi DApps.” “Our view is that it’s unlikely DeFi will replace the traditional financial infrastructure soon, but its application technologies are likely to provide near-term efficiencies and increased transparency to existing firms especially in the areas of tokenization,” the report stated.

Venture funding hits record

According to market intelligence firm Blockdata, blockchain companies secured a record US$6.68B (AU$9.1B) in venture funding during the third quarter. That’s double the amount raised in all of 2020 and brings the year to date figure to US$15.54B (AU$21.1B).

Big fourth quarter

As mentioned above, Bloomberg Intelligence’s senior commodity strategist Mike McGlone is tipping a big fourth quarter for Bitcoin. “Relative to rising US debt and tensions over a potential default, Bitcoin may be entering a unique phase for a 4Q price rise as markets gain trust in the coding that defines the crypto’s supply,” he wrote. “Bitcoin looks like a rested and discounted bull market.” McGlone also thinks ETH is in a “consolidating and discounted bull market” and believes the supply squeeze will see further price appreciation. “It’s likely still the early price discovery days for Ethereum,” he added. Meanwhile, everyone’s favourite pastry themed crypto account Croissant cited Lightning adoption, Bitcoin’s Taproot upgrade, rumours of a Bitcoin ETF and the historically good returns for the final quarter each year as reasons to be extremely bullish right now.

Latest in billionaire funds

News surfacing last Wednesday revealed that mega investor George Soros’ family office has invested in cryptocurrency, stating that the asset class has gone “mainstream”. The family office was established in 1970 by billionaire investor George Soros, and the fund’s CEO and CIO Dawn Fitzpatrick revealed the news in an interview with Bloomberg. Fitzpatrick shared that the Soros Fund is showing interest in cryptocurrencies beyond the “inflation hedge” narrative, although mentioning that Bitcoin could’ve stayed a “fringe asset”, despite money supply surging over 25% in the last 12 months. The fund has also invested in several cryptocurrency infrastructure companies, including Lukka and NYDIG.

McNFT

Global fast-food giant McDonald’s will release a set of 188 NFTs on October 8 to celebrate its 31st anniversary in China. The “Big Mac Rubik’s Cube” will be handed out amongst employees and customers, and the NFT design is based on the three-dimensional structure of McDonald’s China’s new office headquarters. Whilst a progressive move for the company, it seemingly goes against the authority’s intent to ban all crypto operations. Impacts of this ban have resulted in the likes of crypto mining equipment manufacturer Bitmain, stopping the shipment of mining rigs to China as well as many other industry curveballs. As continually witnessed, despite China’s ongoing resistance, the crypto ecosystem continues its path of growth.

Until next week, happy trading!