Market update

Bitcoin has fallen further and faster than most pundits were expecting and is now trading at levels last seen in March. CryptoQuant’s Bull Score Index has declined to extreme bearish levels of 20/100, and the price is so far below the 365-day moving average of A$158K/US$102K that it’s slightly embarrassing. Part of the reason for this month’s price action now appears to be the possibility that digital asset treasuries like Strategy will be dropped from major indexes in January.

On a macro level, there’s fear over the “AI trade”, despite NVIDIA’s revenue exceeding expectations, and the uncertainty caused by the delay of October’s US jobs data until next month isn’t helping.

However, Bitcoin has trended upwards over the past two days, and prediction markets and pundits are growing increasingly confident of an early December US rate cut, which ARK Invest’s Cathie Wood says would be the catalyst for Bitcoin’s recovery. The tech-heavy Nasdaq also jumped 2.6% today after President Donald Trump announced he’s heading to China to meet with President Xi Jinping, suggesting the trade war may settle into a stalemate. After dipping below A$125K/US$81K, Bitcoin finishes the week down 3.9% to trade around A$136,427 (US$88,140) while Ethereum is down 2% to trade around A$4,556 (US$2,944). Solana gained 6.7% and Ripple gained 5.2% while Dogecoin was flat.

The Crypto Fear and Greed Index dropped to a level of 9, the lowest it has been since the FTX crash. Glassnode reported this week that 35% of Bitcoin, 40% of ETH, and 75% of Solana were being held at a loss, which likely helps explain the sentiment. The index has now recovered to 19, although that’s still Extreme Fear.

The crypto supercycle appears to have developed a flat tyre, with markets losing $1.84 trillion (US$1.2T) in value in just 42 days. Bitcoin dropped 13.3% this week and is currently trading at A$141,442 (US$91,782), while Ethereum lost 15.2% to trade around A$4,636 (US$3,006). Both are now negative year-to-date and are well below the level of the October 10 flash crash. Everything else is performing poorly as well, with Ripple losing 15.1% despite gaining an ETF, Solana falling 21.6%, Dogecoin down 15.7%, and Cardano pulling back 21.4%. Analysts note that Bitcoin’s 31% pullback since the all-time high of A$194,344 (US$126,198) in early October is fairly normal historically. We’ve seen two such dips already in this cycle. Traditional markets and tech stocks are also gripped with fear, as confidence drains from the AI trade — Peter Thiel sold off half a million Nvidia shares. There’s also great uncertainty over the actual state of the US economy, with the end of the shutdown meaning September’s jobs data is only finally being released this week. US Fed officials have also cast doubt on a December rate cut. The Crypto Fear and Greed Index is at 14, indicating Extreme Fear, and the TradFi Fear and Greed Index is at the same level. Outside of market collapses, the extreme fear reading is historically the best time to buy. Santiment also reports that the 30-day MVRV ratio for a number of the top coins is in deep negative territory, which again, is historically the best time to buy.

For reasons beyond our control, Uptober had to be cancelled this year – with Moonvember and the Santa Claus Rally now in doubt too. According to CoinDesk, Bitcoin finished the month of October down 8.5%, breaking a six-year-long streak of gains. Long-term hodlers dumped 400,000 Bitcoin across the month, perhaps in anticipation of the four-year cycle ending, as history suggests it might. It was a sad way to mark 17 years since the publication of the Bitcoin White Paper.

Ethereum fell 10% during the month as traders fled to safety, which helped bring about a record A$4.31 trillion (US$2.82T) in stablecoin volume. Even though the flash crash of October 10 was related to tariffs on China, this week’s “amazing meeting” with China and reported tariff deal has not restored confidence. Neither has a US interest rate cut or the news that the US Federal Reserve will end quantitative tightening. Fears over a stock market bubble, the US shutdown, the Balancer hack overnight and unverified rumours Wintermute is suing Binance over the flash crash (and may not be the only firm in trouble) have all contributed to the gloom.

Bitcoin finishes the week down 6.8% to trade around A$162,550 (US$106,194) while Ethereum lost 13% and is back down to A$5,4750 (US$3,578). The rest of the top 10 lost even more, apart from Tron, which only fell 5.4%. There is some hope on the horizon with stablecoin inflows to Binance more than double the usual amount and hitting US$11.2B (US$7.3B), and the HyperUnit whale, who made a killing during the flash crash, has just longed Bitcoin and ETH. The Crypto Fear and Greed Index is at 21 or Fear.

Bitcoin recovered 4% over the weekend after Treasury Secretary Scott Bessent told NBC that China and the US have agreed to a “framework” for a trade deal to avoid the threatened 100% tariffs blamed for the flash crash on October 10. But nothing is confirmed until President Trump meets China’s President Xi this week. Softer-than-expected CPI figures in the US reinforced expectations that the US Federal Reserve will cut interest rates this week. Bitcoin is back in the green for the month, so the Uptober meme may well come true again. Bitcoin finishes the week up 3.1% on seven days ago to trade around A$173,782 (US$114,340), while Ethereum gained 3.6% to trade around A$6,275 (US$4,125). XRP gained 5.9% after it completed its acquisition of a prime brokerage, while Solana was up 4.8% and could see further gains on the news that Bitwise’s Solana Staking ETF is set to go live on the NYSE this week. After big falls earlier in the year, spot volumes on the top ten centralised exchanges surged by 30.6% in the third quarter, according to analytics platform TokenInsight. The Crypto Fear and Greed Index has increased to 50, or Neutral, after spending much of October in Fear territory.

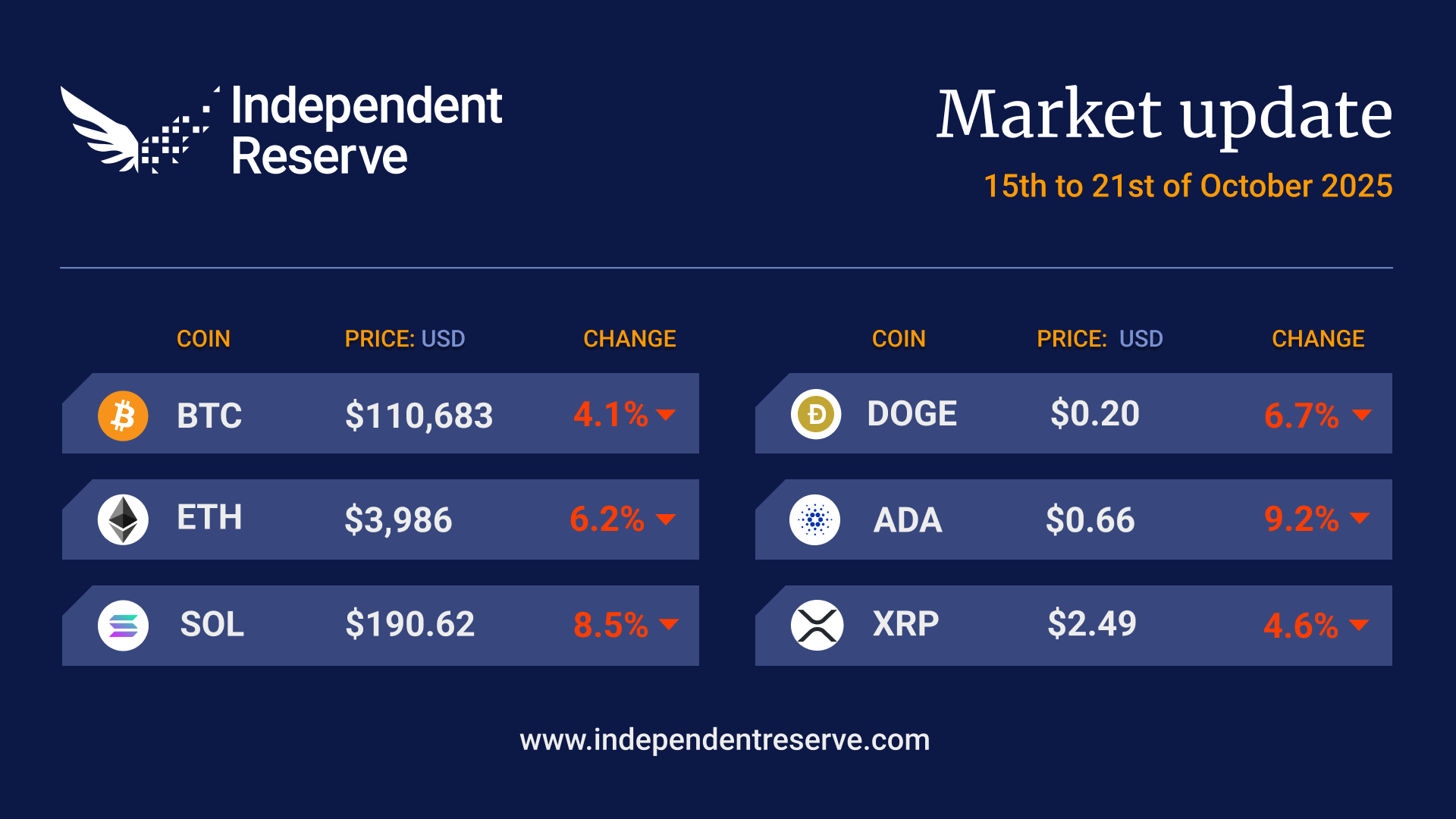

After leveraged traders got their fingers badly burnt in the October 10 flash crash, sentiment remained risk averse over the past week. Concerns over regional bank loans hit US stocks and crypto, while queues round the block to buy gold in Australia suggest many are seeking a safe haven. President Trump’s 100% tariff threat on China remains a live option, but Trump now says he expects to reach a “fantastic deal” with Chinese President Xi Jinping when the two leaders meet later this month. Meanwhile, Australia is now America’s best friend, signing a A$13.5 billion (US$8.5 billion) agreement on rare earths and minerals, to shore up supply chains outside of China. US Fed chair Jerome Powell suggested its quantitative tightening program is nearing an end. Bitcoin finishes the week down 4.1% on seven days ago to trade around A$169,844 (US$110,683) while Ethereum is down 6.2% to trade around A$6,115 (US$3,986). Solana was down 8.5% this week, Cardano lost 9.2% and Dogecoin fell 6.7%. Chartist John Bollinger highlighted “Potential ‘W’ bottoms in Bollinger Band terms in ETH/USD and SOL/USD but not in BTC/USD. Gonna be time to pay attention soon I think.” The Crypto Fear and Greed Index is at 34, or Fear.

Crypto just experienced one of the craziest weekends in its history, with cascading liquidations of leveraged positions worth A$29.3 billion (US$19.13 billion), according to CoinGlass. That’s an order of magnitude larger than the A$2.45B/US$1.6B in liquidations seen during the FTX collapse in 2022. Bitcoin plunged by around A$16k (US$10.4k) in a few hours (more on some venues) and Ethereum briefly dropped A$1,200 (US$780), but both were the standout safe performers in crypto, thanks to ample liquidity and dip buyers. Altcoins with thin liquidity lost 40%-80% and some, like ATOM, appeared to plunge by 99.5% briefly (although this may have been a display issue). Some market makers, who typically prop up trading, reportedly pulled out during the flash crash, exacerbating the problems. Traditional markets plunged too, after President Donald Trump responded to China’s rare earth export controls by threatening to resume the trade war with 100% tariffs – a threat he later appeared to walk back. Many perp traders were unhappy to discover that Auto Deleveraging can close out their positions without warning. Bitcoin finishes the week down 7.6% to trade around A$177,004 (US$115,252) while Ethereum was down 9.4% to trade around A$6,520 (US$4,245). Many other altcoins remain down by double digits, but the situation is improving, and the Crypto Fear and Greed Index has recovered from a low of 24 (Extreme Fear) on the weekend to 38 (Fear) now.

Despite the US government shutdown, Uptober has lived up to its name so far, with Bitcoin seeing its second-best start to the month ever, climbing to a new all-time high on October 5, and bettering it the following day by reaching A$189,637 (US$125,989).

Fabian Dori, Chief Investment Officer at Sygnum Bank, believes the political dysfunction behind the shutdown actually encouraged investors to turn to BTC as a store of value as their faith in traditional institutions faltered. The shutdown also helped avoid one potential landmine, with the Bureau of Labor Statistics unable to release its September jobs report. Meanwhile, Jeff Bezos became the latest high-profile figure to worry publicly about an AI bubble, with one breathless report claiming the bubble was 17x larger than the Dotcom one.

Nobody outside of crypto appears to have paid much attention to Bitcoin’s new all-time high, with Google search interest for Bitcoin remaining low. This is arguably a good thing, as retail FOMO to new ATHs is often followed by a crash. Bitcoin finishes the week up 8.6% to trade around A$188,700 (US$124,847).

Ethereum is also within sight of a new all-time high, following a surge overnight after Grayscale announced staking for its Ether ETF. It finishes the week up 10.8% to trade around A$7,108 (US$4,702). Dogecoin and BNB also hit double-digit percentage increases. The Crypto Fear and Greed Index is at 71, or Greed.

The total crypto market cap plunged from A$6.15 trillion (US$4.03T) down to A$5.64T (US$3.7T) this week, before recovering over the past couple of days to A$5.98T (US$3.93T). There didn’t appear to be any one single catalyst, but concerns over interest rates, insider trading among DATS, plus President Trump’s latest 100% tariffs on pharmaceuticals and foreign films, as well as geopolitical instability, aren’t helping. The US government also looks headed for yet another shutdown, and given Trump presided over a 35-day shutdown back in 2018, the game of chicken could last for some time. US labour market figures come out this week, which could shake things up too.

The Ethereum ETFs lost A$1.21 billion (US$795.8M) to outflows, and the Bitcoin ETFs lost A$1.36 billion (US$897.6M). However, Bitcoin finishes the week up 1.5% on seven days ago to trade around A$173,813 (US$114,376), and Ethereum was up 0.9% to trade around A$6,416 (US$4,216). The Crypto Fear and Greed Index is at 50 or neutral. The good news is that Uptober averages a 21.89% return historically.

Despite a brief sugar rush from the US Federal Reserve cutting interest rates, crypto markets were wiped clean yesterday with the biggest flush of cascading liquidations in a year. A$2.6 billion (US$1.7 billion) of leveraged positions, mostly longs, were wiped out in 24 hours as Bitcoin and Ether corrected. Analysts suggest the Fed’s cautious approach to further cuts, US inflation fears and a weak jobs market contributed to a lack of confidence. Others believe history shows the four-year Bitcoin price cycle is due to end in October — but with a wave of new ETFs on the horizon and treasury companies still in acquisition mode, commentator Kaleo asked: “Does anyone truly believe this is a typical four-year cycle?” Economist Timothy Peterson pointed out last week that September 21 is historically Bitcoin’s single worst day of the year, after which it tends to finish higher 70% of the time, with a median gain of 50%. History is also promising for Ether, according to CoinGlass, which reports that ETH has historically delivered an average return of 23.85% in the fourth quarter. Bitcoin finishes the week down 2.1% to trade around A$170,684 (US$112,540) while Ethereum is down 6.9% to A$6,360 (US$4,195). Most of the other majors were down in a range between Cardano’s and Dogecoin’s 4.3% to 9.6% decline. The Crypto Fear and Greed Index is at 45, or Fear.

The Bitcoin bull market isn’t over, but it’s not looking as healthy as it could be, with eight of the ten indicators on the CryptoQuant Bull Score Index flashing bearish. “Momentum is clearly cooling,” CryptoQuant analyst JA Maartun said. However, the Altcoin Season Index is at 78, with the metric climbing from 25 (Bitcoin season) in June. Expected interest rate cuts in the US could support crypto markets, with FundStrat’s Tom Lee telling CNBC that monetary policy combined with the usually strong fourth quarter means Bitcoin “can easily get to US$200,000 (A$299K) before the end of the year.” Bitcoin has traded up and down in an A$15K/US$10K range this week, and it finished up 3.5% from seven days ago to trade around A$172,939 (US$115,320). Ethereum finishes the week up 5.6% to trade around A$6,799 (US$4,535), Solana gained 10.5%, and Dogecoin surged 13.5%. The Bitcoin ETFs hauled in A$3.5B/US$2.32 billion while the Ethereum ETFs took in A$955M/US$637.6 million. The Crypto Fear and Greed Index is at 53, or Neutral.

If Donald Trump thought firing the Statistics Commissioner last month would result in improved numbers, he would have been disappointed, as only 22,000 US jobs were added in August, which was well below the 75,000 expected. Unemployment ticked up and wage growth slowed; however, that increased expectations of US interest rate cuts and the Nasdaq hit a fresh all-time high overnight. New US inflation figures come out mid-week. Ethereum flipped Bitcoin for spot market trading volume for the first time in seven years, but still finished the week flat at A$6,510 (US$4,297), while Bitcoin gained 3.9% to trade around A$169,420 (US$111,645). Analyst Ted Pillows believes ETH may be following Bitcoin’s 2020 price action when it pulled back 25% – 30% after it hit a new all-time high. If ETH mirrors that move, Pillows says it could bottom around US$3,500 to US$3,700 (A$5,305 to A$5,607) before a “parabolic rally in Q4”. Solana surged 7.7% as Forward Industry announced a US$1.6 billion (A$2.4B) SOL treasury. Ripple gained 6.9% and Dogecoin shot up 13.9%. Bitcoin mining difficultly also climbed to a new all-time high of 134.7 trillion on Friday. Stock and crypto trading platform Robinhood surged 15% after being added to the S&P 500, but Strategy was snubbed, despite qualifying for inclusion. The Crypto Fear and Greed Index is at 51, or Neutral.