Market update

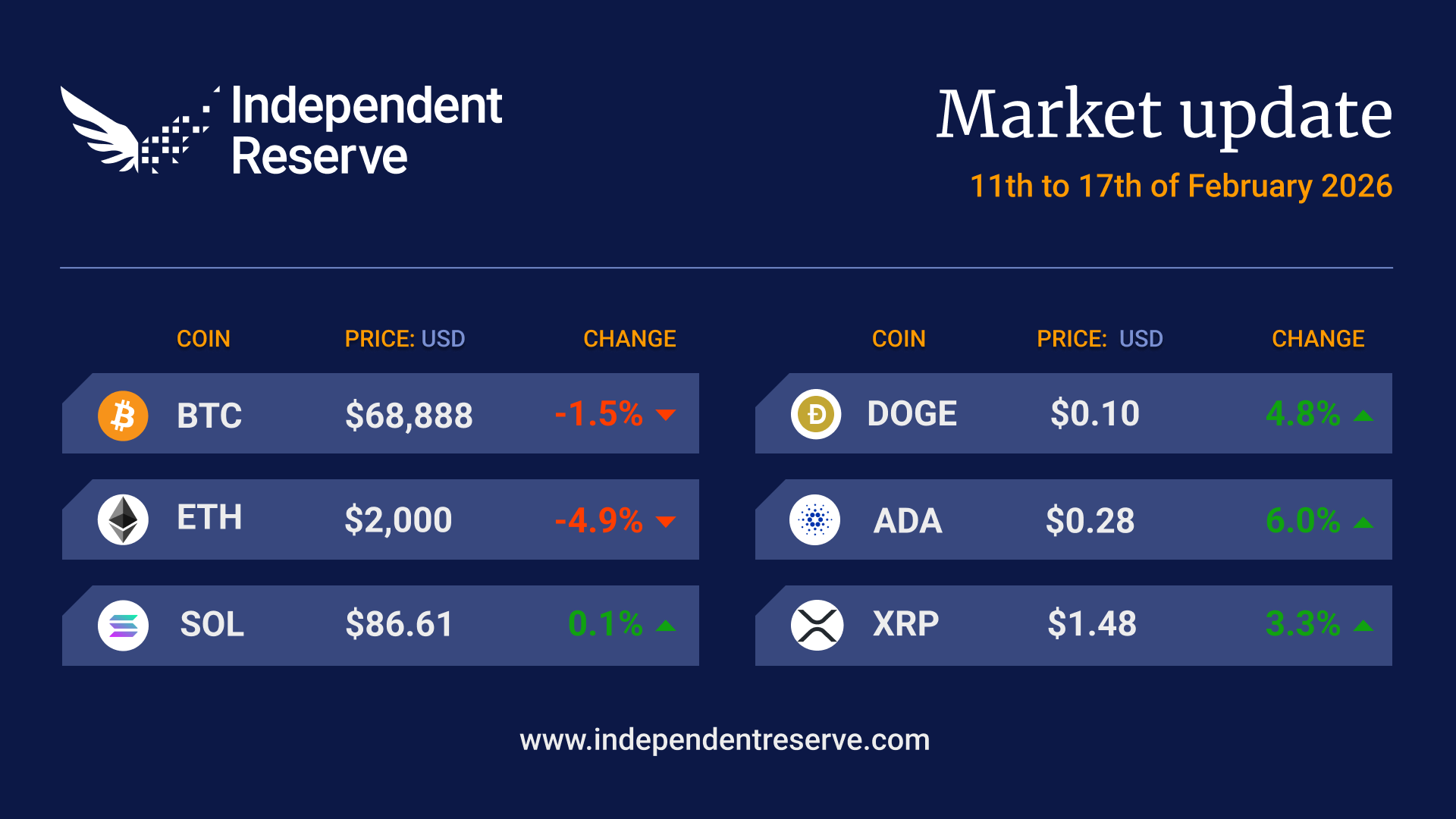

It’s been another grim week for Bitcoin hodlers, with the fourth weekly negative close below the 100-week moving average. Spare a thought for ETH hodlers who are on track for their sixth consecutive month in the red and are 60% down from the all-time high. The only other time that happened was a seven-month negative stretch in 2018 — though that was followed by six of the next seven months of price appreciation. Some green shoots have appeared, with Bitcoin’s three-month futures basis and funding rates ticking up, suggesting more traders are going long. Coinbase says its retail users in the US are “buying the dip” and long-term ETH accumulation addresses have seen significant inflows. Bitcoin is down 2.7% from seven days ago to trade around A$97,495 (US$68,769), which is below last cycle’s all-time high, while Ethereum has lost 6.3% over the same period to trade around A$2,830 (US$1,996). XRP gained 2.3%, Dogecoin 4.7%, and Cardano 5.8%, while Solana fell 1.8%. The Crypto Fear and Greed Index is at 12, or Extreme Fear.

With the blame game over the October 10 flash crash still ongoing — OKX CEO and Cathie Wood blame Binance, but CZ denies it — crypto markets saw the tenth biggest single day liquidation event on the weekend with A$3.74B (US$2.6B) wiped out. Over four days, around A$7.2B (US$5B) of leveraged trades were flushed from the system.

Bitcoin has now experienced four consecutive down months, which would be perfectly in keeping with the end of the four-year cycle. “So far, history is repeating,” said RektCapital. But this was far from a crypto-only crash, with the extraordinary precious-metals bubble popping on Friday US time, wiping 31.4% from silver and 9% from gold. The shock losses spooked crypto investors and global markets.

The common explanation for the metals crash was President Trump’s nomination of Kevin Warsh to chair the Federal Reserve. He’s seen as hawkish, inflation-focused and unlikely to aggressively cut interest rates or to fire up the money printer (some think this narrative is overblown, however). The US government is partially shut down, but a last-minute deal will reportedly see it reopen this week.

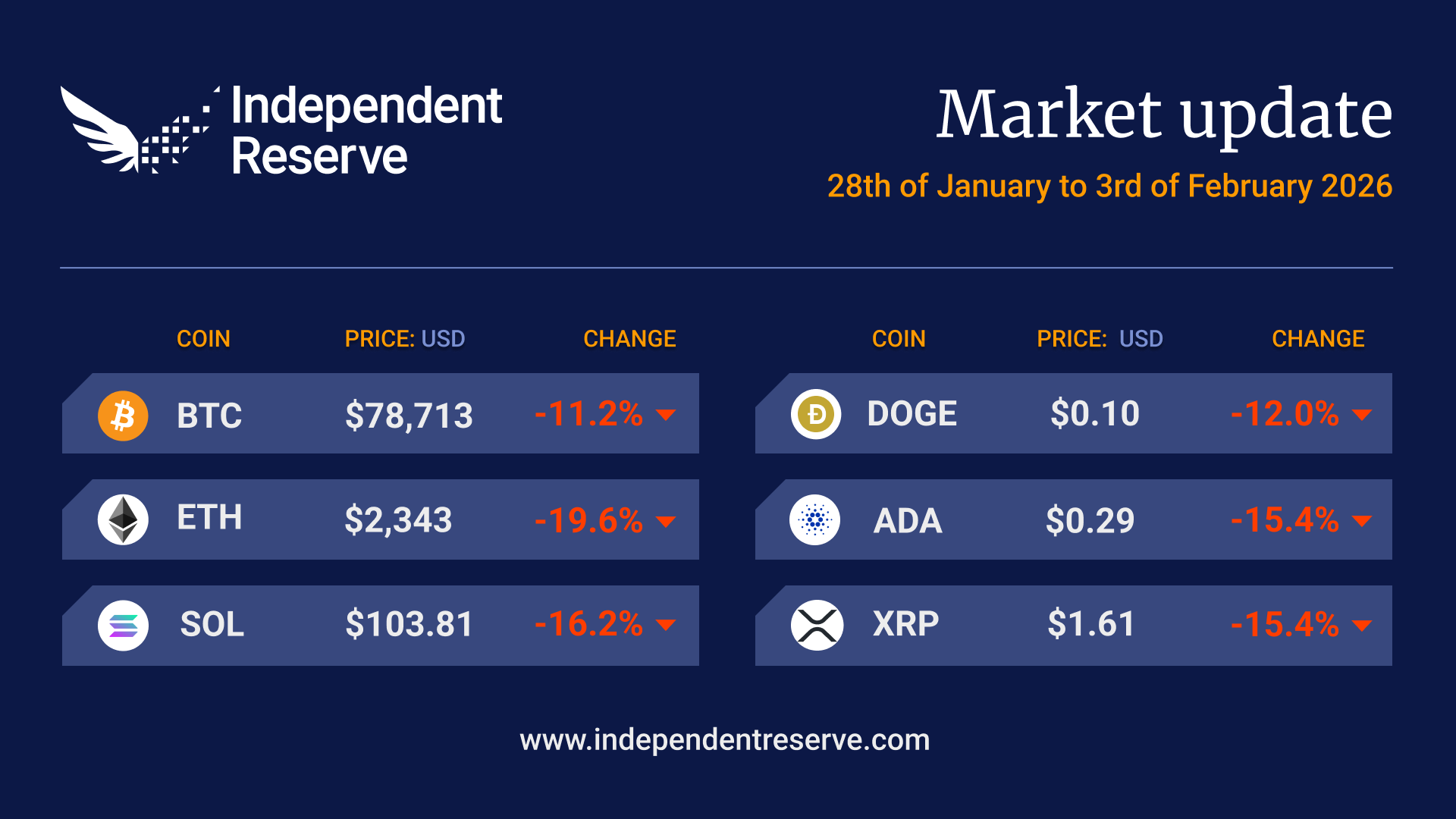

Bitcoin fell as low as A$107.4K (US$74.6K), but at the time of writing, it was trading at A$112,803 (US$78,713), down 11.2% on the same time last week. Ethereum lost 19.5% to trade around A$3,364 (US$2,343), but Goldman Sachs has just released a report saying the fundamentals remain stronger than during DeFi Summer. Solana lost 16.2%, Dogecoin lost 12% and both XRP and Cardano lost 15.4%. The Crypto Fear and Greed Index is at 17, or Extreme Fear.

President Trump’s dramatic reality series moves so fast that last week’s crisis over Greenland seems a distant memory. Trump reversed his threatened tariffs on a variety of European countries after reaching a deal, but the resulting breakdown in trust is set to upend international relations in unpredictable ways. The market mayhem continued with Trump subsequently floating 100% tariffs on Canada over a free trade deal with China that Canada says doesn’t exist. Meanwhile, the controversial ICE shootings in Minneapolis have seen Democrats vow to oppose further ICE and DHS funding, which has increased the odds of a government shutdown at the end of the week to 76%. The last shutdown saw Bitcoin draw down by around 25%. The US dollar is losing steam, and the Federal Reserve and the Japanese government are both reportedly considering intervening to support the Japanese yen.

Bitcoin came within sight of the US$100K/A$149K mark on January 15, as excitement grew about the potential for the CLARITY Act to sail through markup. But negotiations have stalled for now, and the markup has been delayed.

President Donald Trump’s latest tariff threats against European countries opposed to handing Greenland over to the US follow his usual playbook of delayed implementation (10% in February and 25% in June) to allow time for negotiation. That may be why crypto didn’t react much initially, but lost thousands in an hour on Monday after the EU signalled it is preparing punitive retaliatory measures. Gold and silver, meanwhile, surged to new highs.

Adding to the uncertainty, the US Supreme Court is due to rule any day now on the legality of his tariffs, with Polymarket estimating just a 30% chance they will be declared legal. Bitcoin finishes the week up 1.5% on seven days ago to trade around A$138,109 (US$92,675), while ETH is up 3.1% to trade around A$4,757 (US$3,192). XRP fell 3.1%, Solana lost 3.8%, and Dogecoin dipped 5.5%. The Crypto Fear and Greed Index is at 32, or Fear.

Crypto has held up reasonably well, considering the ongoing unrest in Iran, a politically tinged investigation into the US Fed chair, and regime change in Latin America. Adding some extra spice to the coming week, the US Supreme Court is set to rule on President Donald Trump’s tariffs on January 17, with considerable uncertainty surrounding the ruling and its potential market reaction.

After a disappointing 2025, in which the Bitcoin price declined for the first time in a post-halving year, 2026 is already looking more promising. Bitcoin is up 7.5% from the same time last week, trading around A$139,529 (US$93,693), while Ethereum gained 9.5% to trade around A$4,781 ($3,210). Ripple surged by a whopping 26.5% while Solana (11.7%), Dogecoin (22.5% and Cardano (18.9%) all saw significant gains. Geopolitical strife typically weighs heavily on markets, but the US military operation in Venezuela has seen both crypto and traditional markets rise in its aftermath. One theory suggests that President Trump’s promises of increased oil production will result in lower energy prices. Crude oil has already fallen, which will, in turn, result in lower inflation and, consequently, boost asset prices. While the end of sanctions could lead to a bump in near-term oil production, analysts say that getting Venezuela back up to full production will likely take years and US$100 billion (A$149B) in infrastructure. Another bright spot for crypto was the fact that end-of-year crypto tax loss harvesting in the US (AKA wash trading that pushes down prices) stopped on December 31. Sentiment has risen, and after three weeks of extreme fear, the Crypto Fear and Greed Index is finally back to just 26 or Fear today. Santiment analyst Brian Quinlivan said its social media analysis showed sentiment is even better than that and is actually “very positive at the moment.”

The S&P 500 and the Dow Jones hit new all-time highs this week, but despite bullish crypto developments almost every day recently, Bitcoin fell 4.6% over the past seven days to trade around A$130,189 (US$86,471). Ethereum lost 5% to trade around A$4,473 (US$2,969), XRP lost 8.8%, Solana (-4%), Dogecoin (-8.8%) and Cardano (-10.3%). One catalyst for the negative sentiment was Bloomberg’s report that the Bank of Japan plans to raise rates at its December 19 meeting, with more rises expected in 2026. Previous BoJ rate hikes have seen Bitcoin fall around 20% — although given it’s already widely expected, the news may already be priced in.

The US Federal Reserve cut interest rates, but Jerome Powell suggested further cuts are unlikely for now. The Fed also announced A$60B/US$40 billion short-term treasury purchases from this month, sparking a debate as to whether it was “real” quantitative easing or not. US jobs and inflation data are scheduled for release this week and may spark volatility.

Unusual trading patterns in the recent week have led to speculation about manipulation, and there are unverified rumours about Wintermute dumping billions, as well as Hyperliquid market makers ABC and CyantArb and hedge fund Selini Capital sustaining heavy losses from the October 10 flash crash. Crypto trading volumes have fallen by two-thirds since the start of the year, but Bitfinex notes that this has historically preceded the next leg up. DeFi Llama reports that the correlation between the largest crypto assets has been unusually high over the past week, with many pairs having coefficients over 0.9. The Crypto Fear and Greed Index has been stuck at Extreme Fear since November and is currently at 16.

After last week’s plunge, crypto markets rose sharply on a trifecta of positive news: Vanguard is now offering crypto ETFs, Charles Schwab plans to launch spot crypto trading in 2026, and the US CFTC will enable spot crypto products to trade on futures markets. Some wild price swings over the weekend suggest leveraged trading is best kept to weekdays. Partly due to the US government shutdown, the economic picture over there isn’t particularly clear, with conflicting data on the health of the jobs market and inflation. Despite all this, the S&P 500 is near record highs. Polymarket puts the odds of a US interest rate cut this week at 94% and some pundits are tipping the Fed will announce up to A$68B/US$45B in monthly T-bill purchases this week, which would improve liquidity (but not match the money printing of the past). Meanwhile, Japan is stimulating its economy with A$203B/US$135B even though the Central Bank is expected to hike rates, which the Kobeissi Letter described as “contradictory”.

Strategy has just bought 10,624 Bitcoin in its most significant buy for months, and Bitcoin finishes the week up 4.8% to trade around A$136,805 (US$90,695). Bernstein analysts now believe that Bitcoin has broken the four-year cycle and have moved their 2026 target to A$226K/US$150K. BitMine purchased an additional 138,452 ETH, and Ethereum has increased by 11.2% to trade around A$4,719 (US$3,125). Analyst Michael van de Poppe notes that for the first time in three months, ETH is holding above the 20-day moving average against Bitcoin and tips it will outperform in the near term. The rest of the top 10 made smaller gains under 10%, apart from Cardano, which surged by 11.6%. It’s been a terrible year for the top altcoins, with only Bitcoin Cash, BNB, Hype and Tron making gains year to date. The Crypto Fear and Greed Index is at 20, or Extreme Fear.

Bitcoin has fallen further and faster than most pundits were expecting and is now trading at levels last seen in March. CryptoQuant’s Bull Score Index has declined to extreme bearish levels of 20/100, and the price is so far below the 365-day moving average of A$158K/US$102K that it’s slightly embarrassing. Part of the reason for this month’s price action now appears to be the possibility that digital asset treasuries like Strategy will be dropped from major indexes in January.

On a macro level, there’s fear over the “AI trade”, despite NVIDIA’s revenue exceeding expectations, and the uncertainty caused by the delay of October’s US jobs data until next month isn’t helping.

However, Bitcoin has trended upwards over the past two days, and prediction markets and pundits are growing increasingly confident of an early December US rate cut, which ARK Invest’s Cathie Wood says would be the catalyst for Bitcoin’s recovery. The tech-heavy Nasdaq also jumped 2.6% today after President Donald Trump announced he’s heading to China to meet with President Xi Jinping, suggesting the trade war may settle into a stalemate. After dipping below A$125K/US$81K, Bitcoin finishes the week down 3.9% to trade around A$136,427 (US$88,140) while Ethereum is down 2% to trade around A$4,556 (US$2,944). Solana gained 6.7% and Ripple gained 5.2% while Dogecoin was flat.

The Crypto Fear and Greed Index dropped to a level of 9, the lowest it has been since the FTX crash. Glassnode reported this week that 35% of Bitcoin, 40% of ETH, and 75% of Solana were being held at a loss, which likely helps explain the sentiment. The index has now recovered to 19, although that’s still Extreme Fear.

The crypto supercycle appears to have developed a flat tyre, with markets losing $1.84 trillion (US$1.2T) in value in just 42 days. Bitcoin dropped 13.3% this week and is currently trading at A$141,442 (US$91,782), while Ethereum lost 15.2% to trade around A$4,636 (US$3,006). Both are now negative year-to-date and are well below the level of the October 10 flash crash. Everything else is performing poorly as well, with Ripple losing 15.1% despite gaining an ETF, Solana falling 21.6%, Dogecoin down 15.7%, and Cardano pulling back 21.4%. Analysts note that Bitcoin’s 31% pullback since the all-time high of A$194,344 (US$126,198) in early October is fairly normal historically. We’ve seen two such dips already in this cycle. Traditional markets and tech stocks are also gripped with fear, as confidence drains from the AI trade — Peter Thiel sold off half a million Nvidia shares. There’s also great uncertainty over the actual state of the US economy, with the end of the shutdown meaning September’s jobs data is only finally being released this week. US Fed officials have also cast doubt on a December rate cut. The Crypto Fear and Greed Index is at 14, indicating Extreme Fear, and the TradFi Fear and Greed Index is at the same level. Outside of market collapses, the extreme fear reading is historically the best time to buy. Santiment also reports that the 30-day MVRV ratio for a number of the top coins is in deep negative territory, which again, is historically the best time to buy.