In markets

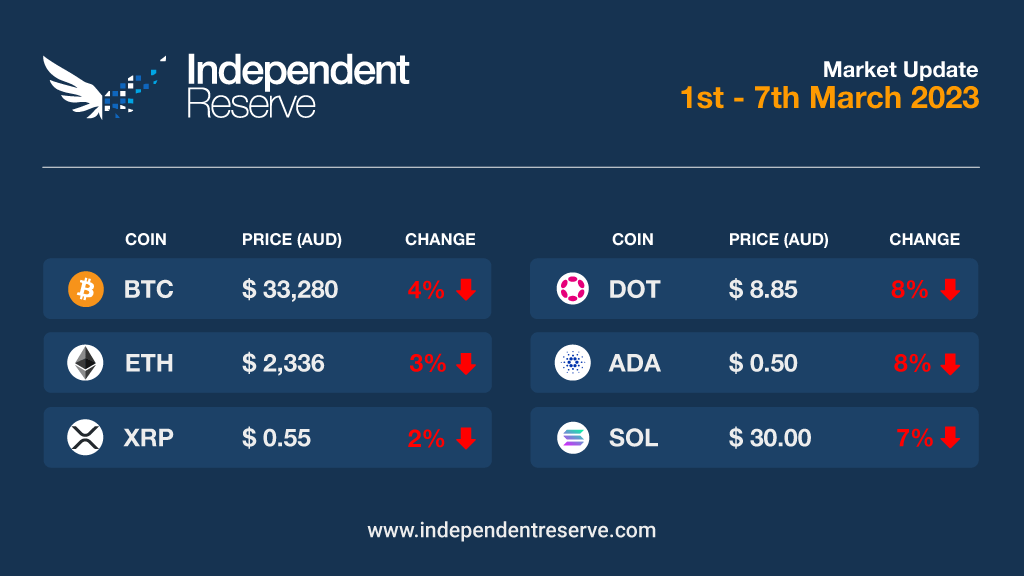

Despite storm clouds gathering around Silvergate and the SEC’s increasingly hostile attitude to the sector, Bitcoin’s price action has been fairly “boring” this week in the words of analyst Michaël van de Poppe. That could all change when the chair of the US Federal Reserve, Jerome Powell, testifies to Congress on the state of the economy this week. Over the last seven days, Bitcoin traded between A$35.2K (US$23.8K) and A$32.9K (US$22.2K) with the only sharp move in response to the Silvergate news. It finishes the week down 4.1% to trade around A$33.2K (US$22.4K) while Ethereum dropped 3.5% on a week ago to A$2,320 (US$1,570). Almost everything else fell: XRP (-1.8%), Cardano (-8.7%), Dogecoin (-7.6%) and Polygon (-7.8%). However, Synthetix gained 14.2% after the launch of its V3 and the news it has added 22 new tokens to its perpetual futures market. The Crypto Fear and Greed Index is at 48 or neutral.

From the OTC desk

This week has been all about Silvergate Capital (Silvergate) and the cancellation of the SEN network. Silvergate is one of the two primary US dollar native banks to service the cryptocurrency industry. Equity markets have raised questions of Silvergate’s solvency and their ability to remain a ‘going concern’. This has reflected a broad softening in cryptocurrency pricing. For the time being, however, pricing movements have been incredibly orderly and – outside of equity and fixed income holders – there doesn’t appear to be concern for depositors. Any change in Silvergate’s solvency should be carefully monitored.

Today the Reserve Bank of Australia (RBA) convened for their March meeting. As widely expected, the RBA increased the underlying cash rate by 25bps, to 3.60%. In the meeting Statement, RBA Governor Phillip Lowe highlighted:

The Board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target and that this period of high inflation is only temporary. In assessing when and how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market. The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.

The short-term interest rate futures market currently expects the Australian cash rate to peak at circa 4.15% in Q3, 2023.

In global economics, the past week has been relatively calm, with risk assets processing mixed indicators for US inflation. US ISM non-manufacturing data has remained resilient in February, coming in at 55.10 versus 55.20 in January. This positivity was somewhat balanced by the earlier release of US ISM manufacturing prices, which increased sharply in February (51.3) relative to 44.5 in January.

This week we receive critical US labour market data, with US JOLTS (job openings) due Thursday at 2:00am AEDT and US non-farm payrolls on Saturday at 12:30am AEDT. The US Federal Open Market Committee (FOMC) next meet on the 22 nd of March. The pulse of the US labour market will be critical to their policy direction.

On the OTC desk, front-end volatility has remained suppressed. Flow volumes have been light in the majors, with small sell side flow emerging in BTC. While the timing is unclear, discussion continues to develop on cryptocurrency regulation. It is unclear whether macroeconomic headwinds, regulatory headlines, or some light profit taking was the catalyst for the layer 1 tokens underperforming this week. Our volumes in stablecoins, particularly USDC and USDT remain high, and directionally well-balanced. Last week we mentioned that the market feels to be waiting for the next opportunity – this still seems current.

For any further information, please feel free to reach out.

Silvergate wobbly

Silvergate, one of the two major banks that deals with the crypto industry in the US, is looking decidedly wobbly after it postponed the filing of its annual financial report, suspended its crypto payments network, and expressed doubt over its own viability. About 90% of its deposits are from the crypto sector, but Circle, Coinbase, Gemini, Galaxy Digital and others have all announced they will wind up their partnerships with the bank. Silvergate was damaged by the collapse of FTX, asset price falls and increased regulatory scrutiny. The stock plummeted by 55% the day the news broke and there are fears it may end up declaring bankruptcy. Fortunately, the other major crypto bank, Signature, seems OK for now despite losing 64% of its share price this year.

Independent Reserve has no exposure to Silvergate bank.

Aussie crypto laws next year… or the year after

The Australian Financial Review reports that proposed new crypto laws are unlikely to happen until 2024 or possibly even 2025. Treasury, which now has a “crypto policy unit”, will publish consultation papers in the second quarter, and conduct stakeholder roundtables regarding licensing and custody in Q3.

Smart accounts arrive

Nine years ago, before Ethereum even launched, Vitalik Buterin blogged about something called “account abstraction.” This week the new ERC-4337 contract was launched, finally bringing account abstraction to the network. The standard introduces “smart accounts” and means new users won’t have to learn about complicated seed phrases or the technical process of setting up a wallet to get into crypto. It also enables smartphone security modules to be used as defacto hardware wallets, the use of two-factor authentication, signing transactions on a phone using a fingerprint or face-scan, setting monthly spending limits, subscription payments, and much more. It’s also available on EVM chains Polygon, Optimism, Arbitrum, BNB Smart Chain, Avalanche and Gnosis Chain and it’ll work better on them due to lower gas costs. Learn all about it with this dummies guide.

Warren: Show me the money

Senator Elizabeth Warren and two colleagues fired a letter to Binance demanding its financial records back to 2017 and claiming the exchange has reportedly “facilitated theft, money laundering and terrorist financing.” Binance raised eyebrows by protesting its innocence without directly addressing any of the claims. Forbes also reported that the company “spirited away US$1.8 billion (A$2.67B) of collateral meant to back customers’ stablecoins and transferring the funds to several large investors.”

Scroll on

Ethereum scaling solution Scroll has raised US $50 million (A$74,3M) at a valuation of US$1.8 billion (A$2.67B). Scroll is a Ethereum Virtual Machine compatible zero-knowledge proof rollup, which is a fancy way of saying it brings much faster and cheaper transactions to Ethereum DApps. It launched its zkEVM on the Goerli test last week. Competitors zkSync and the Consensys zkEVM are due to launch soon too.

Voyage into the unknown

It appears as if Voyager went broke due to a reckless disregard for due diligence. A single unsecured loan to 3AC accounted for more than a quarter of its loan book and the loan was approved in under an hour based on a one sentence letter from 3AC claiming it had US$3.7B (A$5.5B) in assets under management. As reporter Amy Castor points out, Celsius and Alameda have also borrowed up to 25% of Voyager’s total assets at various points, meaning if 3AC hadn’t caused it to collapse, something else would have. Voyager is being sued by the SEC, which claims its native token VGX is a security. In response Voyager is suing the SEC stating the regulator’s objections to Binance.US purchasing it is costing the company US$10M (A$14.8M) every month.

RBA to trial CBDC

The Reserve Bank of Australia will trial out a CBDC and it has the Commonwealth Bank and ANZ on board. The RBA has 14 pilot projects aimed at testing use cases for a digital Aussie dollar – and one of the companies involved is Canvas Digital which uses Ethereum scaling solution StarkWare to provide private, fast and gas fee transactions.

Singapore police investigate Terraform

Singapore Police have opened an investigation into Terraform Labs, which was co-founded by crypto fugitive Do Kwon. The US SEC last month accused Kwon and Terraform of fraud, while the founder also faces charges in South Korea over the US$60 billion (A$89B) wipeout the collapse of Terra Luna ecosystem caused.

Beacon chain withdrawals next month

The testnet shadow fork of Ethereum’s Shapella upgrade (which introduces withdrawals from the beacon chain) went off pretty smoothly. The devs even tried to stress test the fork by taking a mock relay offline to trigger circuit breaker conditions, but the fail-safes kicked in and the network ploughed on. The latest All Core Devs call decided the next shadow fork will occur on the Goerli testnet on March 14, and if there are no issues, the real fork on Ethereum will occur four weeks later.

Until next week, happy trading!