In Markets

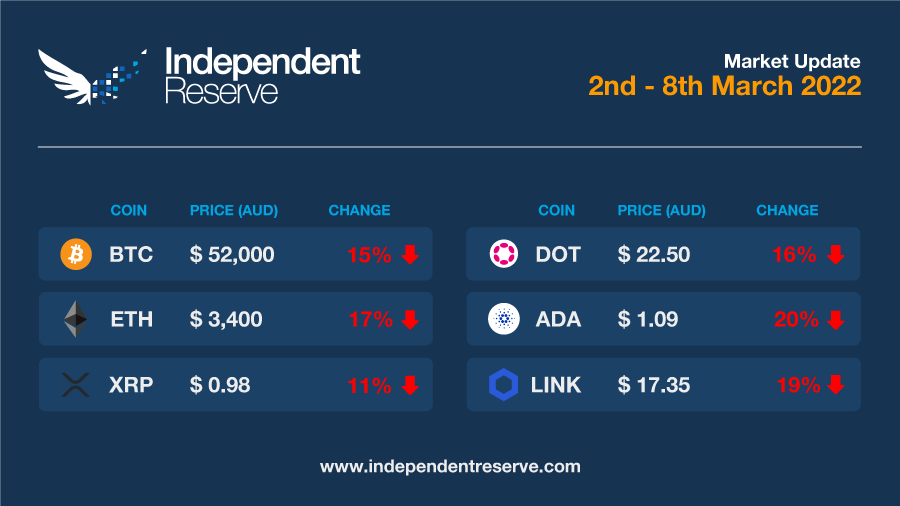

With the possibility of a nuclear exchange (relatively) high, a financial war ramping up, and increased regulatory pressure in the US and Europe, crypto markets are again under pressure. Bitcoin is down 15% for the week to trade just under AU$52K (US$38.3K) while Ethereum’s slide continues, losing another 17% to around AU$3,400 (US$2.5K). XRP lost 11%, Cardano (-20%) and Polkadot (-16%). The Crypto Fear and Greed Index moved above 50 earlier in the week but is now back around 23 or Extreme Fear.

From the IR OTC Desk

Following on from another week of Ukraine/Russia headlines, markets have remained volatile. In Australia, the Reserve Bank’s (RBA) March meeting addressed ‘uncertainty’, while maintaining ‘highly supportive monetary conditions to achieve its objectives’. The cash rate was unchanged at 0.10% with the meeting statement introducing a new requirement of ‘growth in labour costs consistent with inflation being sustainably at target’ as a condition of future monetary policy action. As commodity prices continue to surge higher, AUD/USD was the best performing currency pair in the G10 over the week – up circa 2%. Buoyed by surging global commodity prices, the Balance of Trade (Jan) came in at A$12.891B (the second highest print on record). Australian GDP Growth Rate Q4 YoY also increased 4.2% versus a 3.4% forecast.

In the US, Federal Reserve Chair Jerome Powell testified before the House Financial Services Committee (last Wednesday) about the Fed’s upcoming March 16th meeting. Confirming that he is ‘inclined to propose and support a 25bp rate hike’, Chair Powell added that the central bank is ‘prepared to move more aggressively by raising the federal funds rate by more than 25bps’ at future meetings if inflation does not move lower, as expected, later in the year. Interestingly for markets, it was also mentioned the neutral rate may currently sit around 2-2.5%. With Federal Funds futures pricing in a 24bp hike, all eyes will remain focused on US inflation data (February), scheduled for release on Thursday.

On the OTC desk, cryptocurrencies have now decoupled from the price action of precious metals and commodities to trade as a risk asset. For the time being, there is no obvious event that may look to change this correlation, as global markets continue to absorb the day-to-day developments of the Ukraine/Russia conflict. Across the OTC desk, risk reduction has remained a key theme: with last week’s rally delivering an opportunistic liquidity pocket for sell side flows. This ‘de-risking’ has brought about significant customer enquiry into staking coins – with DAI and UST (Terra) seeing the most enquiries on the week. For new readers, the OTC desk can provide pricing and liquidity in crypto/crypto pairs, as well as a long tail of cryptocurrencies in addition to what is listed on the order book. Market sentiment looks to be driven by Russia/Ukraine headlines and disruptions to global supply chains in the core commodities complex. Expect these headlines, and market dislocations to continue to drive short-dated volatility and cryptocurrency direction this week.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

Russia not using crypto to evade sanctions

There has been much discussion of Russia turning to crypto to evade sanctions, but experts say it’s unlikely to happen. While plenty of individual Russians might do so, the crypto market is not big enough, and is far too transparent for a country the size of Russia to use it to evade sanctions. Jake Chervinsky, head of policy at crypto policy promoter the Blockchain Association in the U.S, outlined his arguments in a lengthy Twitter thread.

Weaponising finance

The Financial Times calls the harshest sanctions regime seen so far “financial warfare”, and it’s still ramping up with moves to block the sale of Russian oil sending oil prices skyrocketing, and the Ruble tumbling. The flight to safety has pushed up the US dollar to a near two year high and gold topped US$2,000 (AU$2,728) per ounce for the first time since August 2020. But Former Federal Reserve trader Joseph Wang cautioned that weaponising the financial system with recent moves such as seizing the deposits of the Central Bank of Russia and blocking the bank accounts of Canadian Freedom Convoy protesters lessens trust in the system and means, “Risk free assets are no longer risk free.” He says actors like China and India, along with substantial parts of the public will instead opt for gold, real estate, crypto and cash.

Perth Mint Gold Token / Australian Dollar chart (Independent Reserve)

EU Oh

The European Parliament is now considering a proposal to apply the Travel Rule to every single crypto transaction. The rule means banks, exchanges and other actors need to record the sender and receiver of each transaction and keep the information for years. In more positive news the EU’s Markets in Crypto-Assets Directive (MiCA), which is scheduled for a vote on March 14, won’t contain a ban on Bitcoin’s Proof of Work mining system. Over in the US, President Joe Biden is reportedly ready to sign an executive order on crypto this week that “will direct federal agencies to examine potential regulatory changes, as well as the national security and economic impact of digital assets” according to Bloomberg.

Billionaire wrong about Bitcoin

Billionaire Ken Griffin, the founder of Citadel Securities, has admitted he was wrong about Bitcoin. Griffing compared Bitcoin to Tulips back in 2017 and suggested the bubble was about to burst. But this week he told Bloomberg Wealth that crypto had been one of the biggest success stories in finance in the last 15 years. “I’ll be clear, I’ve been in the naysayer camp over that period of time. But the crypto market today has a market capitalization of about $2 trillion (AU$2.73T) in round numbers, which tells you that I haven’t been right on this call.” He said Citadel was looking at becoming a market maker in crypto.

SEC NFT investigation

The SEC has launched an investigation into NFT owners and markets, in particular the process of fractionalising NFTs, which ‘Crypto Mom’ commissioner Hester Peirce warned last year was likely to fall under the definition of a security. In other NFT news, searches for NFTs on google have collapsed by 70% since last month, while the number of monthly users is below 800,000 for the first time since last October.

War, what is it good for?

Following in the footsteps of Grayscale’s bad taste ‘buy the invasion’ report last week, Bloomberg Intelligence also thinks the war could drive up crypto prices. In the March edition of Crypto Outlook, the research outfit theorises that energy price increases caused by the crisis could help Bitcoin evolve as a new asset class. Meanwhile Peter Berezin, chief global strategist at BCA Research Inc. released a note to clients suggesting that investors should push thoughts of the 10% chance of a nuclear apocalypse to one side as it was impossible to do anything about: “The risk of Armageddon has risen dramatically. Stay bullish on stocks over a 12-month horizon,” he concluded.

Signs of life

Institutional crypto investment funds saw their highest weekly inflows since December of US$127M (AU$173M). Bitcoin fund flows have increased for seven consecutive weeks now, while Ether funds took in $25M (AU$34M) last week, which is the highest level for 13 weeks. The number of retail investors – those with balances between 0.1 and 1 BTC – has hit an all time high according to Santiment. “The aggregate balance held by addresses with 0.1 to 1 BTC reached a record of over 780,000 Bitcoin. The group holding between $4,000 to $40,000 (AU$5.5K to AU$55K) roughly worth of Bitcoin was the fastest grower over the past month,” it said, adding that, “Retail interest in BTC is returning to the market.” Bitcoin miners are also reportedly accumulating.

All-time high holdings for 0.1 -1 BTC | Source: IntoTheBlock

City of Lugano to accept Bitcoin as ‘de facto’ legal tender

The Swiss city of Lugano has partnered with Tether, making plans to allow local businesses to accept Bitcoin and USDT as ‘de facto’ legal tender. Residents of the city will have the ability to pay taxes, parking tickets, public services and tuition fees using the select cryptocurrencies. Tether’s CTO Paolo Ardoino spoke during the city’s ‘Plan B’ event and stated that the firm had set up a fund worth 3 million Swiss francs in collaboration with Lugano officials to encourage adoption of BTC, USDT and the LVGA token for shops and businesses across the city. He said the project goals are to attract talent from the crypto space into Lugano, making the city a major blockchain hub in Europe. Ardoino also cited the work of El Salvador lawmakers for the adoption of cryptocurrencies.

Until next week, Happy Trading!