Market update

Bitcoin edged closer to a new all-time high last week, amid positive news out of the US-China trade talks. While it dipped in the immediate aftermath of Israel attacking Iran’s nuclear facilities, Bitcoin held up well and has managed to notch up 38 days above $US100,000 (A$153,352) for the first time in its history.

The Crypto Fear and Greed Index also remained in “greed” throughout the week, with coins in the top ten mostly within a few percentage points of where they were a week ago, although Dogecoin and Cardano saw larger pullbacks. Ethereum sentiment is rising, thanks to a 19-day streak of ETF inflows and the revival of the ‘Digital Oil’ meme by Etherealize. Before the conflict, ETH had hit a 15-week high of US$2,879 (A$4,412). The Federal Reserve is due to meet to set interest rates mid-week.

Although crypto markets appeared to take a brief hit from the acrimonious end of the bromance between Donald Trump and Elon Musk, Bitcoin surged overnight and is again nearing an all-time high, which was last broken 18 days ago when the price topped US$111,970 (A$169,685). The S&P 500 and Nasdaq are both near record territory, too, despite lingering inflation and trade war concerns. The US economy added 139,000 jobs in May, beating expectations – although JPMorgan’s David Kelly has a different interpretation and is warning of a slowdown.

In other positive developments, the SEC chair Paul Atkins has endorsed DeFi and US lawmakers are closing in on stablecoin legislation. However, the seven-day moving average of transactions on the Bitcoin network has fallen to a 19-month low and Bloomberg Intelligence analyst Mike McGlone points out gold has outperformed Bitcoin since December, surging 26%. The Crypto Fear and Greed Index is at 71, or Greed.

President Trump’s tariff war has been roiling markets for months, and this week was no different. Markets rose mid-week as the Court of International Trade blocked the tariffs as an abuse of emergency powers. However, an appeals court put a temporary stay on the order, and the White House insists tariffs will remain, one way or another. Concerns about the Russia-Ukraine war and China’s military build-up also weighed on sentiment. June has been a bearish month for Bitcoin in four of the past six years. Nick Ruck, director at LVRG Research, says crypto investors remain hesitant. “Uncertainty around inflation, tariffs, and the US economy slowed bullish trends in crypto, while geopolitical risks have also pushed investors to pull some capital from assets.”

On the upside, Bitcoin is also being seen by some as a hedge against the trade war. The Australian Financial Review reports local investors tipped A$87.3 million (US$56.7M) into Australian Bitcoin ETFs last month, far exceeding the A$1.5 million (US$974K) into gold ETFs. And in other positive news, FTX has just distributed more than A$7.7B (US$5 billion) to creditors of the failed exchange. The Crypto Fear and Greed Index is at 64 or greed, after falling to 50 during the week.

Bitcoin hit a new all-time high of A$172,367 / US$111,970 on Bitcoin Pizza Day last Thursday. The day commemorates the first trade of 10,000 BTC for two pizzas in 2010, an amount now worth A$1.7B (US$1.1 billion). Unfortunately, President Donald Trump then killed any momentum with his threat to impose tariffs of 50% on goods coming out of the European Union. Shortly after that, he postponed the tariffs until July 9 to give the EU time to negotiate. The Crypto Fear and Greed Index is at 73, or Greed.

Bitcoin has just seen its highest ever USD weekly close at A$164,869/US$106,326 – less than 3% off a new all-time high – although markets are a long way from irrational exuberance. Moody’s caused some angst by downgrading US government bonds from AAA status, but only to the same level as the other two major ratings agencies. 21Shares has forecast Bitcoin will hit A$210,350/US$138,500 this year, driven mostly by institutional inflows rather than retail mania. Here in Australia, the RBA is expected to cut interest rates. Meanwhile, the Japanese economy is contracting. The Crypto Fear and Greed Index is at 74, or Greed.

A 90-day ceasefire in the trade war between China and the US saw the tech-focused Nasdaq surge 4.4 per cent and the S&P 500 up 3.3 per cent overnight. The crypto market cap is also up A$660 billion (US$420B) in the past week. While the news helps alleviate one of the big macro factors weighing on markets, Bitcoin has been acting like a counter trade, so it didn’t get as big a boost as some may have been expecting. Gold futures also fell 3%.

Positive signs that there could be a resolution in the Ukraine/Russia war and India/Pakistan conflict have also buoyed markets. Meanwhile, Ethereum’s Pectra upgrade appears to have finally fixed its failing ‘Number Go Up’ technology, with ETH shooting up 44% in three days. Searches for the misspelled “etherium” have also surged, suggesting retail may be getting interested. Ethereum is now worth more than Coca-Cola or Alibaba, and is ranked the 39th largest asset by market cap.

In other market news, there’s growing speculation that Bitcoin dominance may have topped at 65% last week (it’s currently at 63%). Bitcoin finishes the week up 10% to trade around A$161,459 (US$102,929) while Ethereum is 39% higher than seven days ago and is trading around A$3,909 (US$2,491). XRP gained 20%, Solana gained 20%, Dogecoin (37%), and Cardano (25%) are also up. The Crypto Fear and Greed Index is at 70, or Greed.

Solid jobs data this week saw US stock markets recover the ground they’d lost since April 2’s ‘Liberation Day’ tariffs caused a major sell-off. And, after two down months in a row, Bitcoin finished up 14.2% in April. However, Bitcoin then took a dive on Monday, in a move some analysts linked to President Trump’s latest announcement of tariffs on non-US movies, though a direct relationship seems unclear. Bitcoin finishes the week flat at A$147,366 (US$95,025) while Ethereum gained 1%, ahead of this week’s Pectra upgrade, to trade around A$2,826 (US$1,826). CoinDesk reports the tightest Bollinger Band squeeze on the Ethereum/Bitcoin chart since 2020 (indicating low volatility and consolidation), suggesting ETH will experience a big move soon. Ripple, which reportedly failed in its bid to acquire USDC issuer Circle, saw XRP lose 7%. Solana fell 1%, Dogecoin is down 4%, and Cardano dipped 5%. The Bitcoin ETFs saw net inflows of A$2.8B (US$1.8B) last week while the Ethereum ETFs saw inflows on all but one day and took A$165M (US$107M) for the second positive week in a row. The Crypto Fear and Greed Index is at 59, or Greed.

Crypto and traditional markets came storming back this week after Donald Trump temporarily walked back some of his tariff proposals. But with new economic data rolling in and new hostilities between India and Pakistan, it’s not clear which direction markets will head. Interestingly, Vanguard says 97% of its retirement product clients haven’t made a trade this year, suggesting many hope the current volatility is merely temporary. Bitcoin has surpassed silver to become the seventh-largest asset globally by market cap, with its dominance against other cryptocurrencies surpassing 63%, the highest level since early 2021.

Bitcoin is up 8% this week to trade around A$148,106 (US$95,266), and Ethereum has seen some long-awaited glimmers of optimism about its future translate into a 15% gain to trade around $2,805 (US$1,801). A raft of XRP-related ETFs helped XRP to an 11% gain, Solana was up 9%, Dogecoin (13%) and Cardano (14%). The week’s most notable move was Facebook’s crypto project spinoff Sui’s 62.3% gain amid growing memecoin and stablecoin activity, and interest in its handheld gaming device SuiPlay0X1. The Crypto Fear and Greed Index is at 54 or Neutral.

Wall Street’s major indexes fell sharply on Monday, with the S&P 500 down 2.4%, the Nasdaq off 2.6%, and the USD falling to three-year lows. But Bitcoin actually increased 2.7% in the 24 hours to 9am Tuesday (alongside gold, which was up 2.9%), leading to speculation BTC is finally becoming the safe haven long promised. QCP Capital said the increase could just be “holiday-driven noise” but might also “mark a material change in how traditional finance views Bitcoin.” Strategy also announced it has bought another 6,556 BTC. Crypto markets remain weighed down by uncertainty due to the unpredictable twists in Donald Trump’s trade war and recent attacks on the Federal Reserve’s independence, with volumes on major crypto exchanges at six-month lows.

Bitcoin finishes the week up 3% to trade around A$136,077 (US$87,162) while Ethereum fell 3% this week to trade around A$2,454 (US$1,574). Almost 60% of ETH holders are now underwater, which is worse than during the last bear market bottom for ETH. XRP lost 3%, Solana gained 5%, Dogecoin was flat, and Cardano lost 2%. The Crypto Fear and Greed Index is at 39, or Fear.

While crypto markets remain approximately A$1.6 trillion (US$1T) down from December’s peak, things are certainly looking more positive than last week — Donald Trump’s erratic trade war remains the prime mover. Markets saw big gains after he suspended tariffs above 10% on everyone but China for 90 days and later exempted big tech products from China, too (though how long for remains up in the air). Trump was left with no choice after investors began dumping US bonds — one of the clearest warning signs of an approaching full-blown financial crisis. The Wall Street Journal says there are now worrying signs investors are starting to lose faith in American economic management. Many analysts anticipate a range-bound pattern for Bitcoin until the tariff picture becomes clearer. “BTC continues to consolidate within the US$80K-$90K (A$126K to $142K) range and could continue trading sideways, adopting a ‘wait and see’ approach to the tariff situation,’ said QCP Capital on Telegram. Bitcoin has held up incredibly well throughout the crisis and finishes the week up 6% to trade around A$133,784 (US$84,891), while Ethereum is up 3% to trade around A$2,565 (US$1,612). XRP gained 14%, Solana surged 20%, Dogecoin was up 8%, and Cardano gained 9%. The Crypto Fear and Greed Index is at 31, or Fear.

The great “Trump Dump” of 2025 has seen carnage in markets around the world, after the US President launched a more dramatic global trade war on “Liberation Day” than expected. US markets seem particularly volatile, with an unfounded rumour of a tariff pause overnight, seeing markets jump trillions before quickly reversing when the story was denied. However, crypto analysts said the event highlighted the fact Trump can stop the turmoil at any moment (though he shows no sign of wanting to). The worst three days of damage appear to have abated temporarily, with Trump’s threat of an additional 50% tariff on China not moving the dial much lower. Crypto markets actually front ran a lot of the plunge, and Bitcoin held up well on Friday, leading to talk of “decoupling”, which dried up during Monday’s plunge. The S&P 500 is down more than 20% since February, putting it in a bear market, but the worst fears of a Black Monday style crash were not realised. Bitcoin dipped to A$123,708 (US$74.41K) yesterday but has since recovered to A$132,141 (US$79,216) to finish the week flat. Ethereum finishes the week down 11% and is trading at two-year lows around A$2,595 (US$1,557). Almost everything else was down, including XRP (-5%), Solana (-11%), Dogecoin (-6%) and Cardano (-7%), but Fartcoin somehow gained 22.3%. The Crypto Fear and Greed Index is at 24 or Fear.

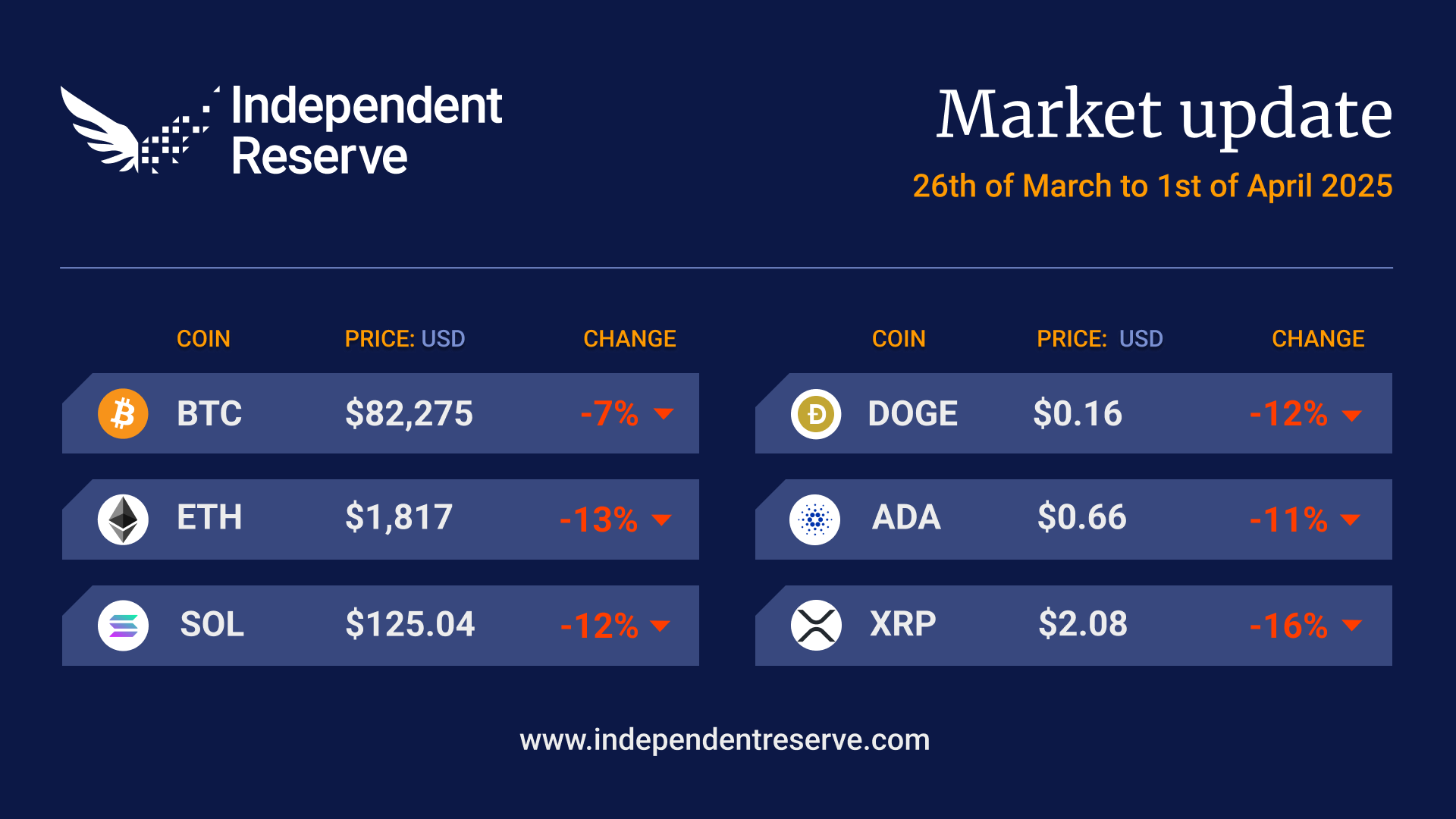

It’s April 1, meaning we can finally say goodbye to the worst quarter for the Bitcoin price since 2018, and the worst quarter for Ethereum since 2018. The price plunge seems mostly due to macroeconomic factors, with the Tesla chart mirroring Ethereum’s and US stocks recording their worst quarter relative to the rest of the world in 23 years. The ASX is also down 4% this year. February’s US core inflation came in above expectations at 2.8%, and consumer spending is growing by just 0.4%. The big worry is President Donald Trump’s looming ‘Liberation Day’ tariff announcements, which The Kobeissi Letter claims “will be the biggest escalation of the trade war to date. Markets are in for a wild week.” Crypto trading volumes are down 70% from the peak, and the total market cap has declined from A$5.94 trillion (US$3.9T) to A$4.26T (US $2.67T). One potential bright spot is that FTX has begun to repay creditors it owes more than A$80K (US$50K) this week. Bitcoin finishes the week down 6% to trade around A$131,763 (US$82,275), while Ethereum lost another 12% to trade around A$2,910 (US$1,817). Everything else was down, including XRP (-15%), Solana (-11%), Dogecoin (-11%) and Cardano (-10%). The Crypto Fear and Greed Index is at 34 or Fear.