Licensed, secure, and trusted cryptocurrency exchange

Helping you securely invest in crypto since 2013.

Access to top cryptocurrencies

Buy and sell the world's most liquid and traded cryptocurrencies.

- XRP (XRP)Usd 1 .38195−0.38%

- Bitcoin (BTC)Usd 70,486 .290.00%

- Ethereum (ETH)Usd 2,043 .51−0.21%

- USD Coin (USDC)Usd 1 .00706+1.03%

- Dogecoin (DOGE)Usd 0 .09530+2.59%

- Tether USD (USDT)Usd 0 .99461+0.59%

- Solana (SOL)Usd 86 .8000−0.57%

- Cardano (ADA)Usd 0 .26465+1.47%

We keep your assets safe, that is our promise

Audited

Secure

Segregated funds

ISO 27001 certified

24/7 support

Gold certified

Trusted by global partners

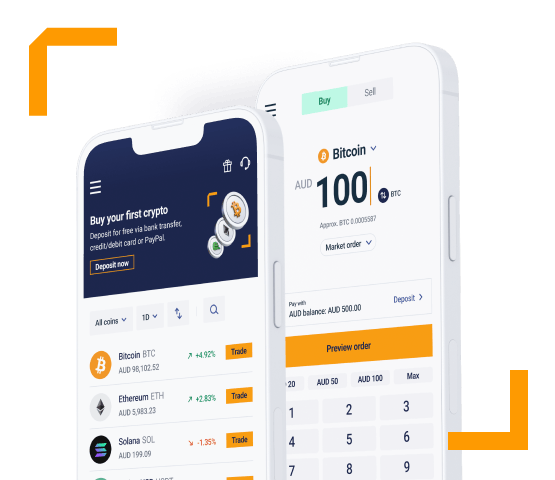

How to invest in crypto

It takes just a few minutes to start.

-

1. Create account

Securely create your personal or business account and verify your identity.

-

2. Deposit funds

Deposit USD, AUD or NZD using SWIFT, PayID or NPP.

-

3. Start investing

Buy, sell and track your crypto portfolio on your desktop or mobile device.

Explore our features

-

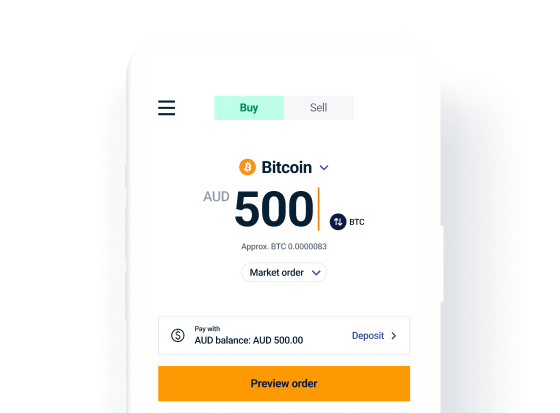

Buy and sell crypto

There are simple and advanced ways for you to buy and sell crypto. Available order types include simple, market, limit, and advanced “stop buy” and “stop sell”.

-

Portfolio tracking

View real-time market updates with our simple tracking interface.

-

AutoTrader (DCA)

Automate your crypto investments with strategies that allow you to dollar-cost average (DCA).

-

Multi-currency trading

Buy and sell crypto with AUD, NZD, SGD or USD. We offer instant deposits in Australia.

Awards & Recognition

Official Crypto Exchange of the Sydney Swans

Featured on

Manage your portfolio on the go

Buy, sell and manage your crypto safely anywhere, anytime with the Independent Reserve app.

Get started today

Register, deposit and trade in 5 minutes.