ubank customers in Australia can securely buy Bitcoin and crypto by making transfers to crypto exchanges such as Independent Reserve, one of Australia’s longest-running and most trusted cryptocurrency exchanges.

This guide walks you through creating an account, depositing funds, and purchasing Bitcoin, along with ubank’s policies on crypto transactions, and tax considerations.

How to buy Bitcoin and crypto with ubank

Create your account

To buy Bitcoin and crypto with ubank, create a trading account with Independent Reserve or another trusted platform. You will need to verify your identity by providing:

- Your full name, email and date of birth

- Proof of address (e.g. utility bill, bank statement, or government notice)

- ID and selfie (e.g. passport or driver’s licence)

This is to meet Australian regulatory standards and keep your account secure.

Deposit funds from ubank

ubank customers can fund their Independent Reserve account using multiple payment options, including:

- Credit/debit card: Instant using Visa or Mastercard.

- PayID: Instant and free.

- EFT bank transfer: Free.

- PayPal.

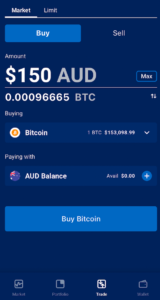

Buy Bitcoin

Once your funds have reached your account, buying Bitcoin is quick and straightforward.

- Log in to your account.

- Navigate to the Trade screen.

- Select Bitcoin or your preferred crypto from the list of available cryptocurrencies.

- Enter the AUD amount you want to purchase.

- Click Buy Bitcoin.

- Review transaction details and confirm your order.

Your Bitcoin will appear in your Independent Reserve account after the trade is complete. Below is an example of the mobile app interface.

ubank’s crypto policies

ubank is a digital-only bank (i.e., no branches) and part of the NAB, which itself is generally considered crypto-friendly when depositing to AUSTRAC-registered crypto exchanges. ubank customers generally report smooth transactions, though high-risker exchanges and suspicious transactions will be blocked.

As of writing, Independent Reserve has not received significant customer reports of failed deposits made to our platform.

Crypto tax obligations in Australia

According to the Australian Tax Office (ATO), cryptocurrency is considered an asset for capital gains tax (CGT) purposes. Most everyday investors are taxed on crypto similarly to shares, with a CGT event occurring when you sell or trade crypto, including swapping one crypto for another. If you made a profit, it may be taxed.

The rules differ depending on whether you bought the cryptocurrency as an investment or acquired it to use in the same way as fiat money to pay for goods and services. If you’re carrying on a business in cryptocurrency, or you’re a professional trader, there are different rules again, and we suggest speaking to a qualified accountant.

Learn more about crypto tax obligations and reporting tools.

Create your Independent Reserve account

Frequently asked questions

Are there deposit limits for ubank transfers?

- Independent Reserve’s daily deposit limit can be accessed via your deposit screen.

- For higher daily deposit limits, please contact customer support via the support screen. Our over-the-counter (OTC) crypto trading desk is available for transactions above $50,000.

Can I withdraw AUD to my ubank account?

- Yes, you can easily send AUD to your linked bank account.

Are there any fees for bank transfers with Independent Reserve?

- AUD deposits using bank transfers are free.

- EFT bank withdrawals back into your nominated bank account are also free.

- See our complete list of fees here.

Are there any limitations when it comes to using ubank?

- ubank may delay your first deposit by 1 to 2 business days.

- Osko and PayID deposits are typically instant. EFT transfers can take up to 2 business days to process.

How much does it cost to buy Bitcoin in Australia?

At the time of writing, a single Bitcoin is currently trading at $175,674. A lot of beginner investors might not know this, but you don’t have to buy one “whole Bitcoin”. You can always purchase a fraction of a Bitcoin.