In markets

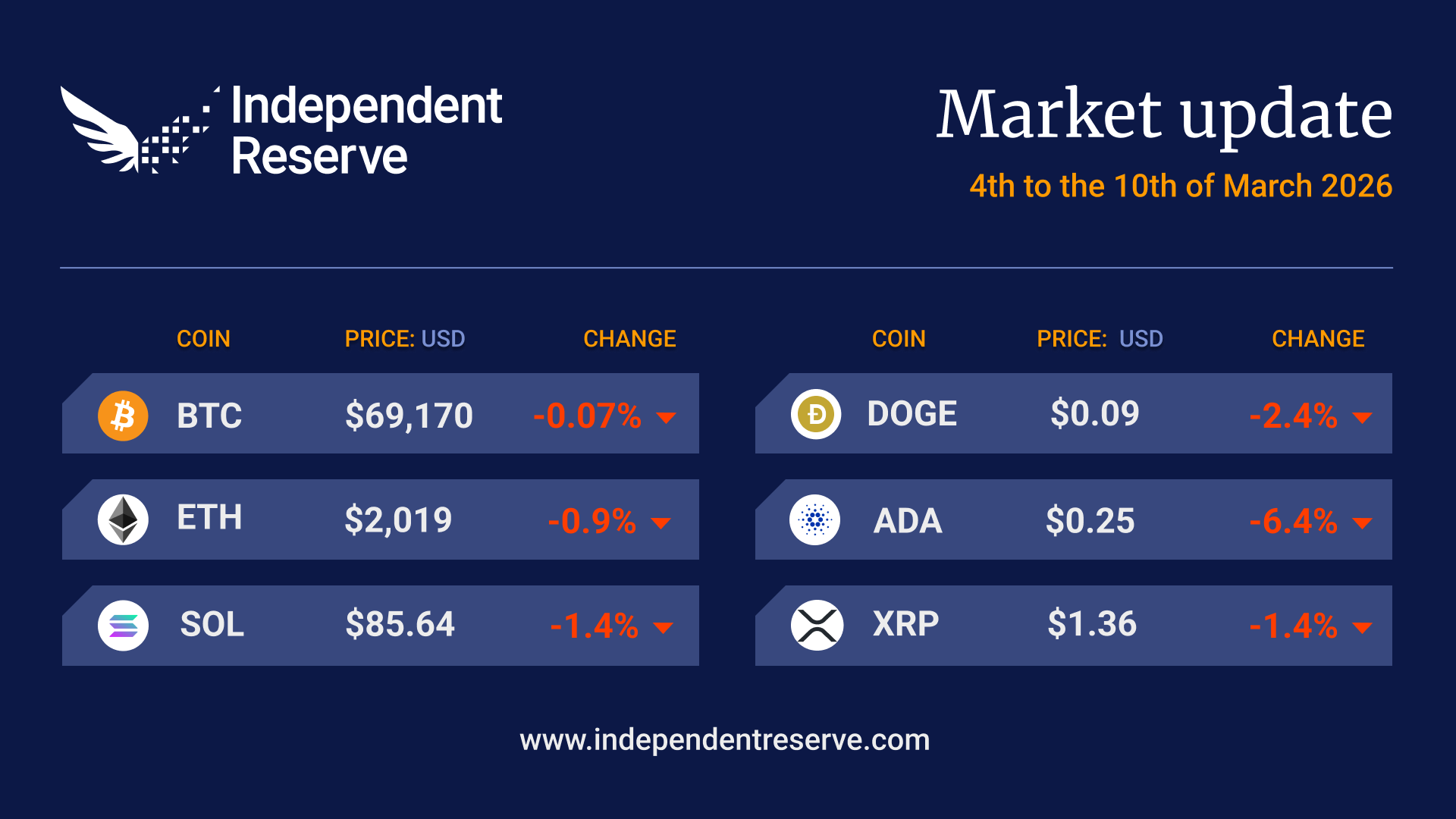

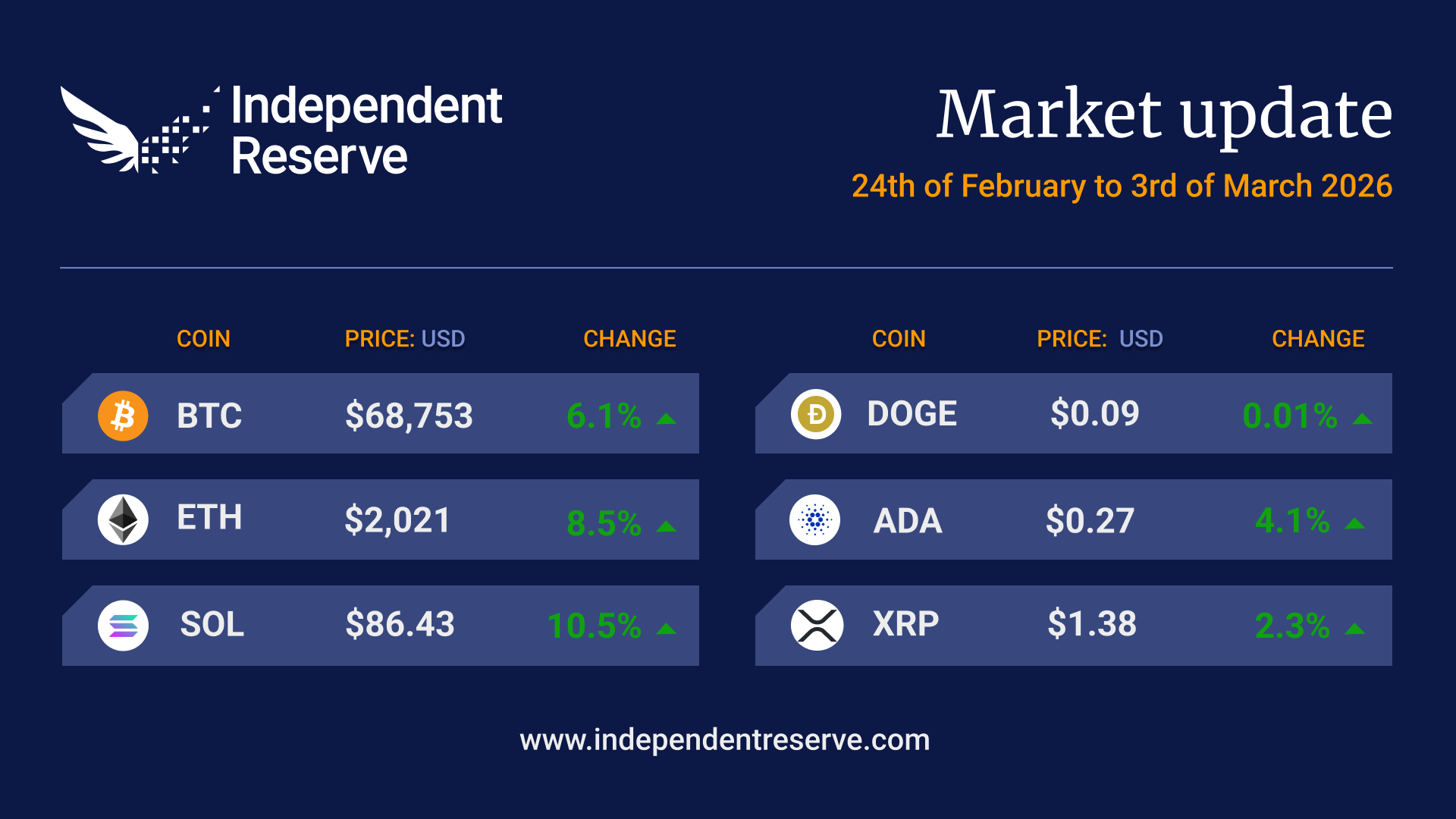

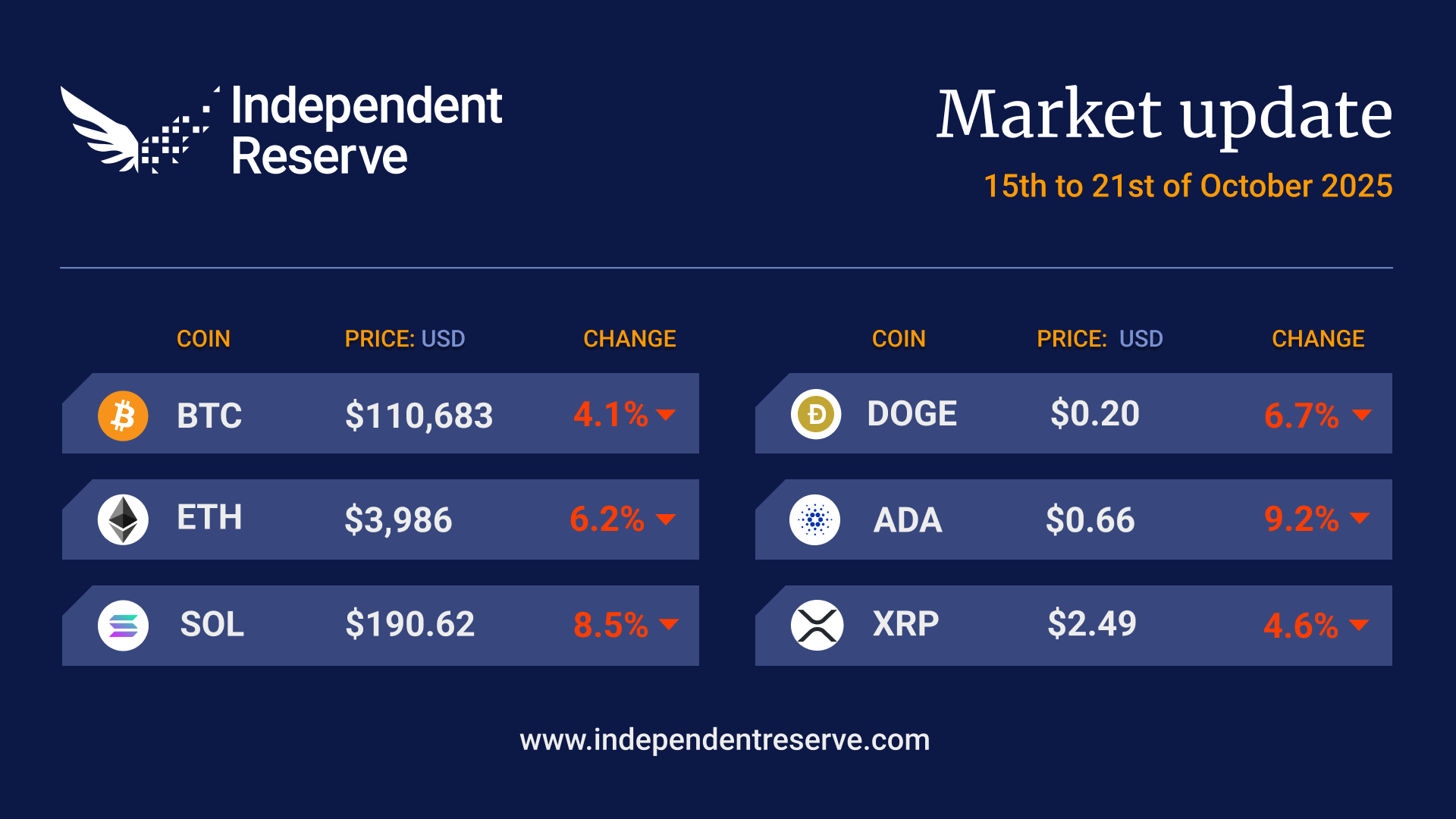

After leveraged traders got their fingers badly burnt in the October 10 flash crash, sentiment remained risk averse over the past week. Concerns over regional bank loans hit US stocks and crypto, while queues round the block to buy gold in Australia suggest many are seeking a safe haven. President Trump’s 100% tariff threat on China remains a live option, but Trump now says he expects to reach a “fantastic deal” with Chinese President Xi Jinping when the two leaders meet later this month. Meanwhile, Australia is now America’s best friend, signing a A$13.5 billion (US$8.5 billion) agreement on rare earths and minerals, to shore up supply chains outside of China. US Fed chair Jerome Powell suggested its quantitative tightening program is nearing an end. Bitcoin finishes the week down 4.1% on seven days ago to trade around A$169,844 (US$110,683) while Ethereum is down 6.2% to trade around A$6,115 (US$3,986). Solana was down 8.5% this week, Cardano lost 9.2% and Dogecoin fell 6.7%. Chartist John Bollinger highlighted “Potential ‘W’ bottoms in Bollinger Band terms in ETH/USD and SOL/USD but not in BTC/USD. Gonna be time to pay attention soon I think.” The Crypto Fear and Greed Index is at 34, or Fear.

From the OTC desk

CPI data looms large as markets bet on rate cuts

Investors are eagerly awaiting the delayed CPI data release this Friday, which could significantly influence bond market movements. The cryptocurrency market continues to exhibit characteristics of a high-beta risk asset, as evidenced by its price swings this month. Amid these fluctuations, cryptocurrency investors are closely anticipating further interest rate cuts. Treasury futures currently indicate a 98% probability of a 25-basis-point rate cut at the upcoming FOMC meeting, suggesting it is nearly certain. Beyond October, however, market visibility remains limited. The FOMC statement will be critical, particularly in determining whether the rate cut decision, if it occurs, is unanimous or faces dissent. Any dissenting members could signal a more hawkish stance than the market expects.

Gold soars to record peaks amid Bitcoin buzz and rotation

Gold prices soared to an all-time high of US$4,381 last week. A noticeable risk rotation from Bitcoin to gold and silver has emerged, though opinions differ on Bitcoin’s trajectory. Some argue that current levels have historically provided strong support for Bitcoin, while others believe a support break is imminent, signaling a potential rotation opportunity. Binance founder CZ recently expressed confidence that Bitcoin’s market capitalisation will eventually surpass gold’s. This correlation remains a critical point of interest for cryptocurrency investors.

OTC desk activity

- The desk saw strong selling as concerns grew that the Bitcoin 4-year cycle might be over

- Large off-ramp flows for stablecoins

Key Economic Dates (AEDT)

- Wednesday, 22 Oct 2025, 10:50 AM: JP Balance of Trade (Consensus 22B Yen)

- Friday, 24 Oct 2025, 1:00 AM: US Existing Home Sales (Consensus 4.1M)

- Friday, 24 Oct 2025, 11:30 PM: US Core Inflation YoY (Consensus 3.1%)

In Headlines

US government shutdown

With the US Government shutdown about to enter its fourth week, pro-crypto Senate Democrats are due to meet with a Who’s Who from the crypto industry about the crypto market structure legislation, including the CEOs of Coinbase, Chainlink, Uniswap and others. The meeting comes after several Democrat senators released proposals that the industry claim will “kill DeFi.” The SEC has also been affected by the shutdown, with 16 ETFs due for final decisions on hold for now. VanEck has also just filed an S-1 form for a Lido Staked Ethereum ETF.

AWS outage exposes who was swimming naked

An AWS outage took down large parts of the internet last night and exposed crypto services that rely on centralised providers. Coinbase, Robinhood and Opensea were hit, but more worryingly Base (run by Coinbase) lost 25% of throughput and some Metamask users were greeted with zero balances. Both rely on Consensys’s Infura middleman service to connect to blockchains.

Developments in Ethereum scaling

Brevis has introduced Pico Prism, a new zkVM capable of proving 99.6% of Ethereum blocks in under 12 seconds. That is known as “real time proving” and it suggests the Ethereum L1s plan to scale to 10,000 TPS and beyond using a zkEVM while remaining decentralised looks credible. Meanwhile December’s Fusaka upgrade, which will help L2s scale, is rolling out Sepolia testnet, after a successful test on Holesky. And the Primev team released footage today they claim shows a new RPC for the Ethereum L1 that uses preconfirmations to allow for essentially instant transactions on mainnet.

Altcoins are at 2022 levels

A viral post by Luke Martin, host of Stacks Podcast, highlighted one reason crypto sentiment remains depressed; it’s because a basket of the top 50 altcoins is still trading around the same level as just after the FTX collapse in 2022. But analyst Ted Pillows points out that Bitcoin Open Interest is currently 70% higher than altcoins (excluding ETH), which he says has only happened four times since the final quarter of 2023. “In all these instances, alts bottomed out and then rallied,” he said.

Mr Beast enters the crypto space

BeastHoldings, the company behind YouTube star Jimmy “MrBeast” Donaldson, has filed a U.S. trademark for “MrBeast Financial,” outlining potential crypto-linked services including payment processing, a cryptocurrency exchange and trading via decentralised exchanges, plus downloadable software and SaaS tools for managing financial services. While the filing signals a possible push into fintech/Web3 that could on-ramp MrBeast’s vast audience, it’s still early and trademark applications don’t guarantee a product launch.

Hong Kong crypto news

Officials at the People’s Bank of China have warned Alibaba’s Ant Group and JD.com away from issuing stablecoins in Hong Kong, stressing that only the state and not private firms should have the authority to issue money. Meanwhile, a Hong Kong-based subsidiary of China Merchants Bank (CMB) has tokenised its US$3.8 billion (A$5.8B) money market fund on BNB Chain. Launched early last year, the CMB International USD Money Market Fund invests in US dollar denominated deposits and state backed market instruments around the world.

Tempo raises $500M, steals Dankrad

High-profile Ethereum researcher Dankrad Feist has bowed out of leading the project to join Stripe-backed stablecoin payment Tempo blockchain. This is a big blow to Ethereum as he was so integral to the project, they named Danksharding after him. The Fusaka fork in December is actually the critical step to enable Full Danksharding. Tempo itself has amassed a veritable supergroup of crypto people, and just raised US$500 million (A$767M) at a US$5 billion (A$7.67B) valuation. Feist said Tempo aligns with Ethereum’s “permissionless ideals” while pushing the boundaries on scale and speed.

Ethereum Treasury from Huobi founder

Huobi founder Li Lin is setting up a US$1 billion (A$1.53B) Ethereum treasury company that’s backed by top investors in Asia. It will focus on liquidity reserves, strategic staking, and treasury yield optimisation. But will there be any ETH left to buy when Tom Lee is finished? Since the October 10 flash crash, Bitmine has scooped up 379,271 ETH in three massive buys worth a total of US$1.48 billion (A$2.27B).

Ripple sets up $1 billion DAT

Ripple Labs is also setting up a US$1 billion (A$1.53B) treasury company to accumulate XRP. The funds will be raised through a Special Purpose Acquisition company. Interestingly, Ripple already owns 42% of the XRP supply and reportedly sells more than $3 billion (A$4.6B) of it per year.

SEC chair says crypto is “job one”

Securities and Exchange Commission Chair Paul Atkins told DC Fintech Week that crypto and tokenization is “job one” for the SEC. “We want to make sure that we build a strong framework to actually attract people back into the United States who may have fled, but then also be able to build a framework that makes sense for the future, so that innovation can thrive,” he said. “I’d like to say that we’re the Securities and Innovation Commission.”

US now owns additional 127K BTC

The US Bitcoin Reserve just got a bit bigger, after the Department of Justice seized 127,271 Bitcoin from an industrial “pig butchering” scam allegedly being run by Prince Holding Group out of Cambodia.

ICYMI – Crypto tax webinar

Last week, Independent Reserve’s Tim Tyndale hosted a captivating webinar with David Fam from Consensus Layer titled “Structuring for crypto tax efficiency”. This hour-long discussion covers various account structures, including individuals, discretionary (family) trusts, private companies, and self-managed super funds (SMSFs), with detailed explanations of the pros, cons, scenarios, and tax implications for each. If you’re a savvy crypto investor, this webinar will teach you the fundamentals of optimising your tax strategies effectively.

You can rewatch the webinar here.

The Moonshot Dispatch

Join us every Tuesday at 3 pm (AEDT) for a live market update. Hosted by Lee Eaton and Nick Fletcher, we cover the latest crypto news and price movements. Tune in weekly on Twitter/X, LinkedIn, YouTube, Facebook & TikTok.

Until next week, happy trading!