Market update

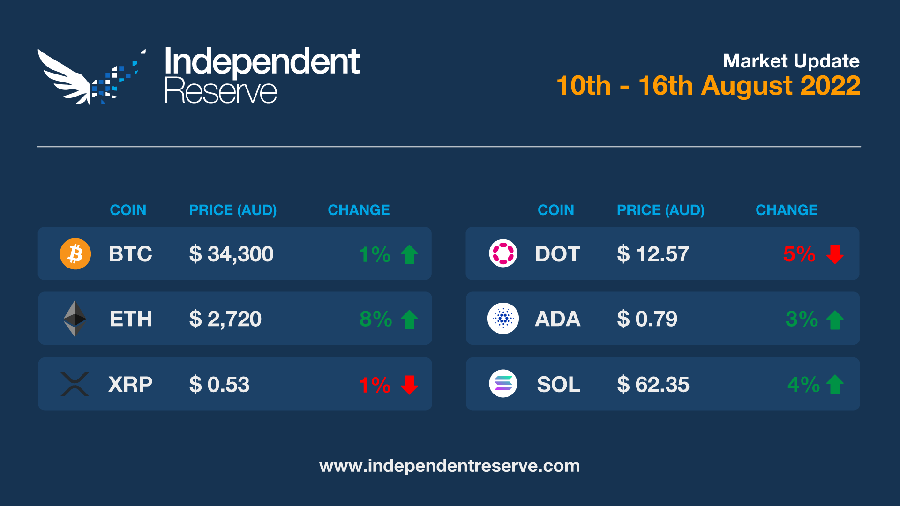

Ethereum reclaimed the US$2,000 (A$2,850) mark briefly on the weekend for the first time since May following news the Merge is just one month away. It’s currently trading around US$1,900 (A$2,720) marking a 7.7% gain for the week. Bitcoin is also up 1.1% on seven days ago to trade around US$24K (A$34.3K). Cardano increased 3.1%, with co-founder Charles Hoskinson insisting that testing on the delayed Vasil hard fork is going well. XRP lost 1.1%, Solana increased 3.8% and Dogecoin was up 10.4%. The Crypto Fear and Greed Index hit Neutral this week for the first time since April but is currently at 45 (Fear). Interestingly, the Bank of America’s Bull and Bear Indicator for traditional markets has been stuck at 0 or ‘extreme bearish’ for nine weeks in a row. Analyst Jack Dorman argued this week that while Bitcoin is still correlated with the Nasdaq, other digital assets including blue chip DeFi coins and Ethereum decoupled months ago.

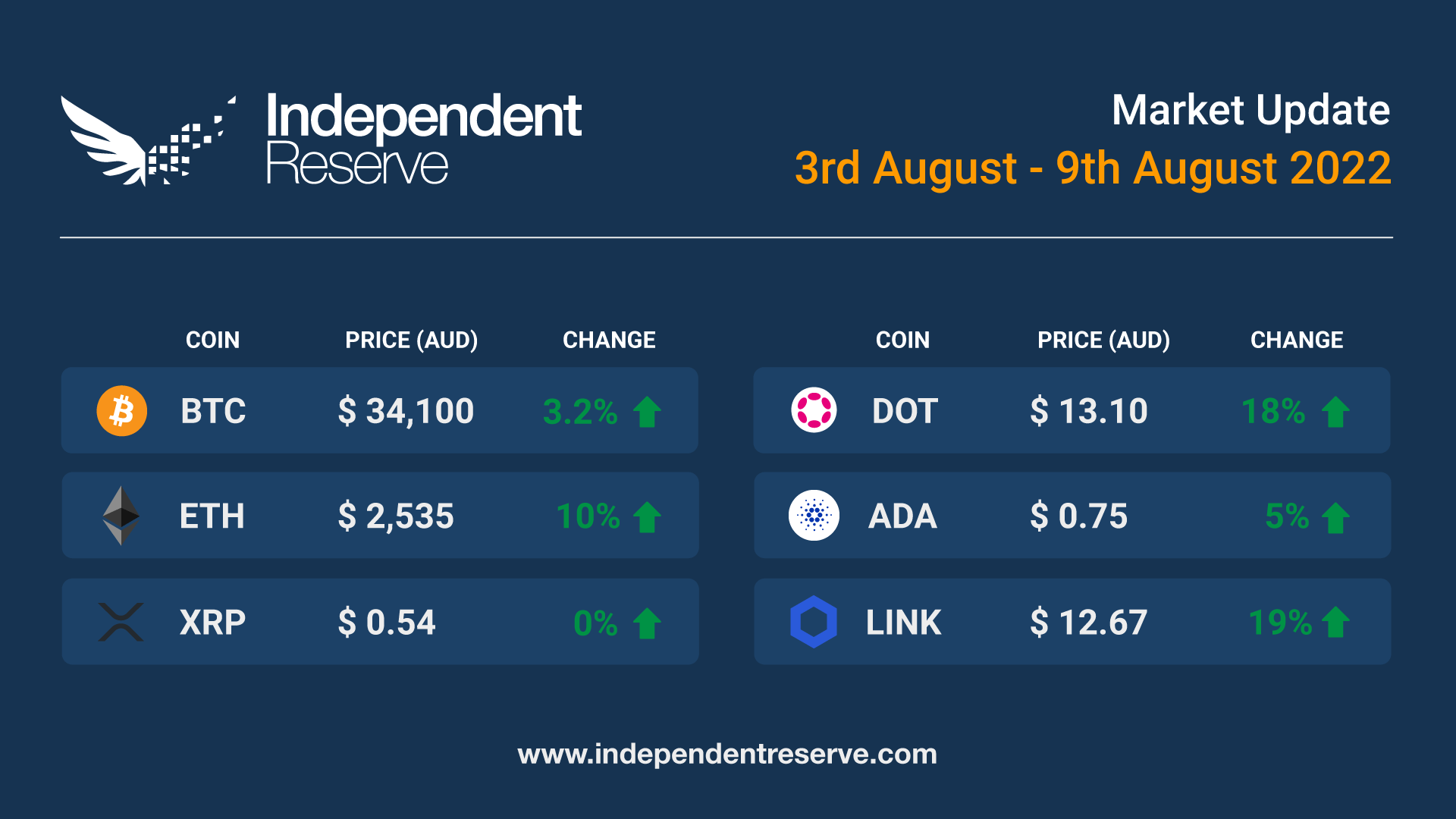

In the week just past, BTC has been range-bound – stuck in a channel 4% wide. Last night there was an attempt to break out to the upside, but as most of this has been given back, we resume the “crab” market. Bitcoin is currently up 3.2% to trade around A$34k (US$23.7k), Ethereum continues its merge exuberance and is trading 10% up – currently A$2,526 (US$ 1,765). XRP is flat, Cardano is up 5%, Solana (2.4%), Dogecoin (3.5%). The Crypto Fear and Greed Index is at 42, and while technically “Fear”, this is on equal footing with high on the 30th July, and the highest it’s been since April.

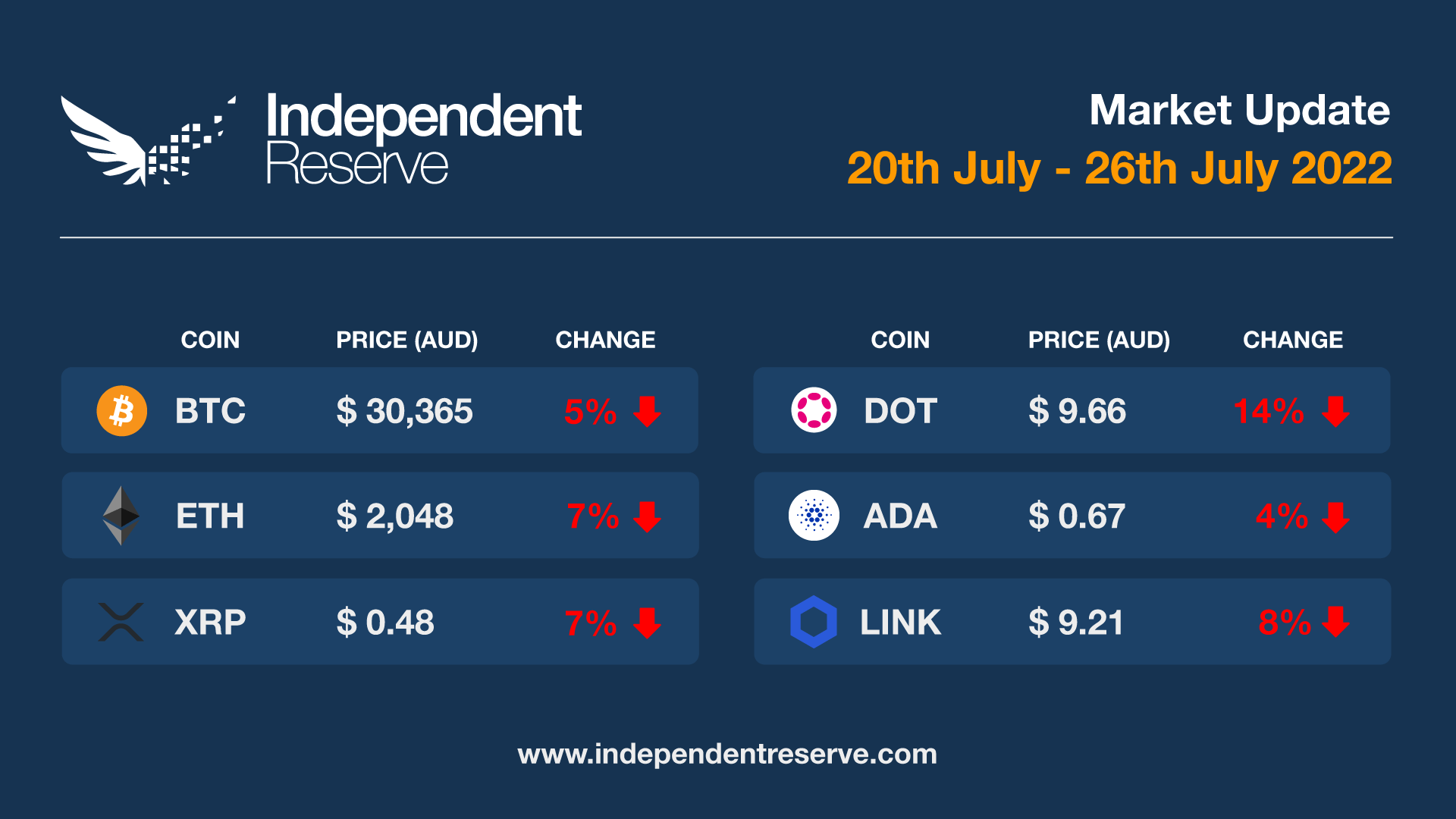

Brace yourself for a potentially bumpy week with the US Federal Reserve expected to hike interest rates by 75 basis points, and the release of the Q2 US Gross Domestic Product figures potentially showing a recession (two quarters of negative growth). Australia’s inflation rate figures also come out and are expected to be awful, and a bunch of big tech company earnings reports are coming out too. Perhaps in expectation of possible bad news, everything has fallen considerably in the past 24 hours. Bitcoin finished the week flat at just over A$31,000 (US$21.5K), while Ethereum was down 1.1% to around A$2,120 (US$1.5K). The imminent Vasil hard fork saw Cardano gain a modest 1.8% while Ripple fell 4%, and Dogecoin lost 3.1%. After a record 73 days at Extreme Fear, the Crypto Fear and Greed Index returned to simply Fear this week, and it’s currently at 30 (Fear).

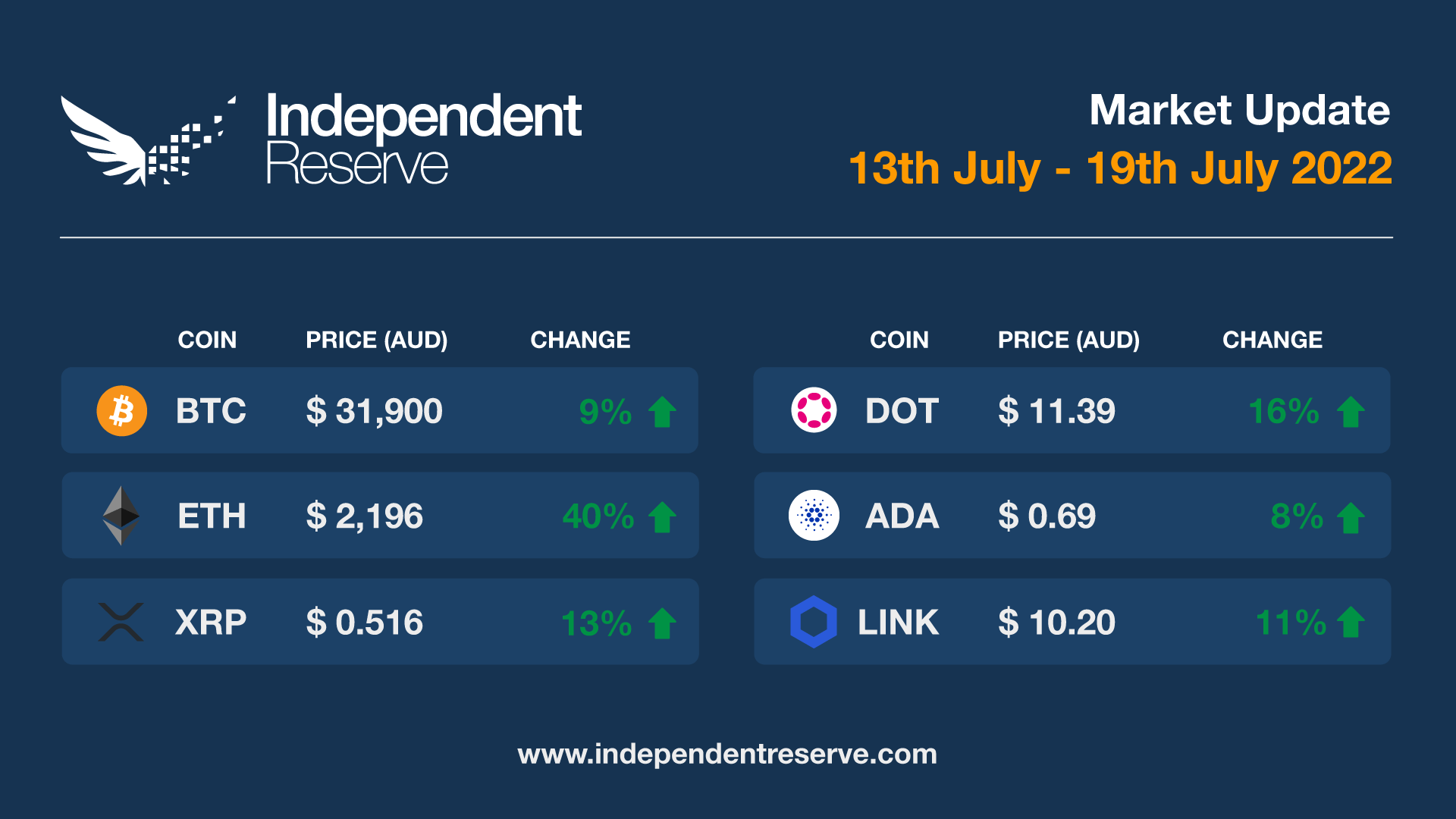

Crypto markets turned around this week, thanks to a bullish narrative that the Ethereum Merge will actually happen in September, and perhaps guarded optimism from some in traditional markets that inflation may have peaked in the US at 9.1% due to falling commodity prices and supply chains clearing up (plenty of others think that idea is totally wrong, however.) The overall crypto market cap has returned above the US$1 trillion mark (A$1.47T), leading to loose talk about a new bull market. It’s worth noting that the market is still down US$2T (A$2.93T) from November’s peak, and Glassnode points out that the average time Bitcoin normally trades below the realised price during a bear market is 197 days. The current bear has just 35 days on the clock. Still green is good, and Bitcoin finishes the week up 9% at A$32,070 (US$21.7K), while Ethereum has shot up 40% to A$2,200 (US$1,500). Ripple (XRP) was up 13%, Solana jumped 28%, and Dogecoin increased 6.6%. The Crypto Fear and Greed Index is at 20 – that’s still Extreme Fear but a lot higher than one month ago when it was 6.

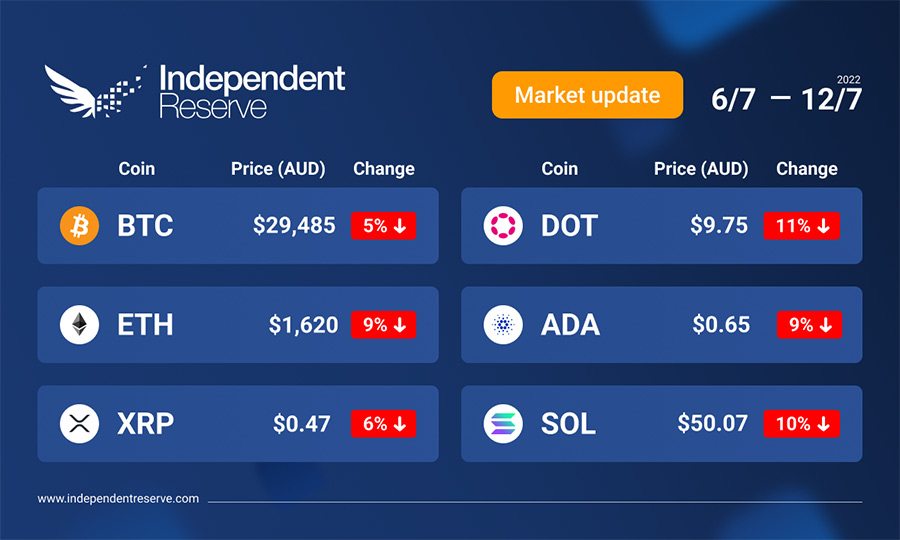

Although crypto has been dealing with its own issues, macro factors appear to be having the biggest impact. The White House expects this week’s June CPI figures to be “highly elevated” and analysts are tipping 8.8%. The Euro has also fallen to parity with the US dollar for the first time in 20 years. Noelle Acheson, head of market insights at Genesis Global Trading said: “This could negatively impact the price of Bitcoin in dollar terms, which for the past couple of years has been negatively correlated with the dollar index.” Bitcoin traded as high as A$32.5K (US$22.1K) this week but is currently around A$29,485 (US$19.8K) which is pretty much where it was seven days ago. Ethereum fell 8.6% to A$1,620 (US$1.1K), XRP lost 6.2%, Cardano (-8.9%) and Polkadot (-10.8%). The Crypto Fear & Greed Index is at 16, or Extreme Fear.

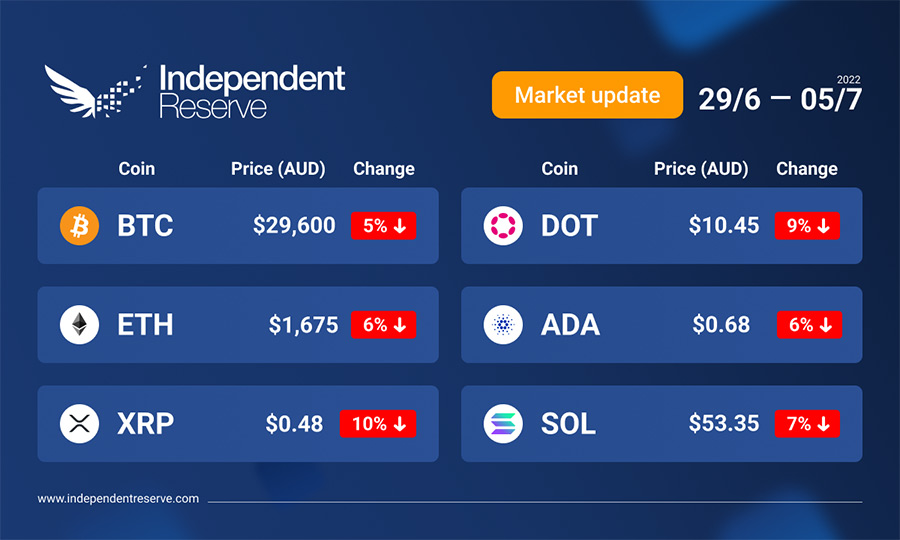

Bitcoin saw its worst month on record in June with a 38% fall, while Ether lost 47%. Contagion continues among crypto lenders and economists increasingly believe the US may already be in a recession. Adding to the fun, the Reserve Bank of Australia has raised interest rates by 0.5% today and in Turkey, inflation is at an eye watering 79%. But there’s a sense things may finally be stabilising in crypto after an extremely volatile few weeks. “Overall caution is still the name of the game,” Susannah Streeter, a markets analyst at Hargreaves Lansdown, told CoinDesk. Bitcoin is down 4.9% to trade around AU$29,600 (US$20.3K) and Ethereum is down 5.7% to trade around AU$1,675 (US$1,155). XRP lost 9.5%, Cardano (-9.5%) and Solana (-7%). The Crypto Fear and Greed Index is at 14, or Extreme Fear.

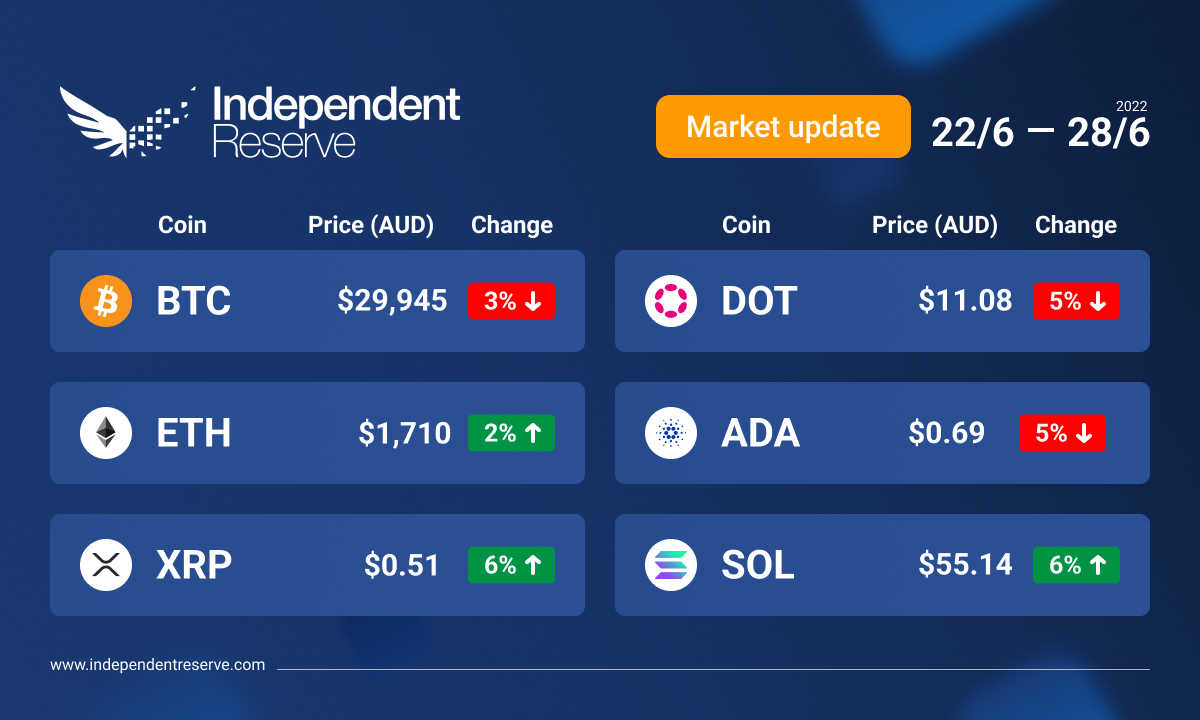

Things are starting to settle down, but with the effects of various collapses, bad loans and forced selling still working its way through the system, anything could happen. Bitcoin finished down 3% to AU$29,945 (US$20.7K) on a week ago, while Ethereum also managed to close the weekly in the green for the first time in 12 weeks, and is currently up 2% to AU$1,710 (US$1,180). XRP was up 6%, Solana (6%) and Polkadot (-5%). Documenting Bitcoin points out that in December 2020 when Bitcoin was at the same price it is now the Fear and Greed Index was at 92 or Extreme Greed. It’s currently at 12 or Extreme Fear.

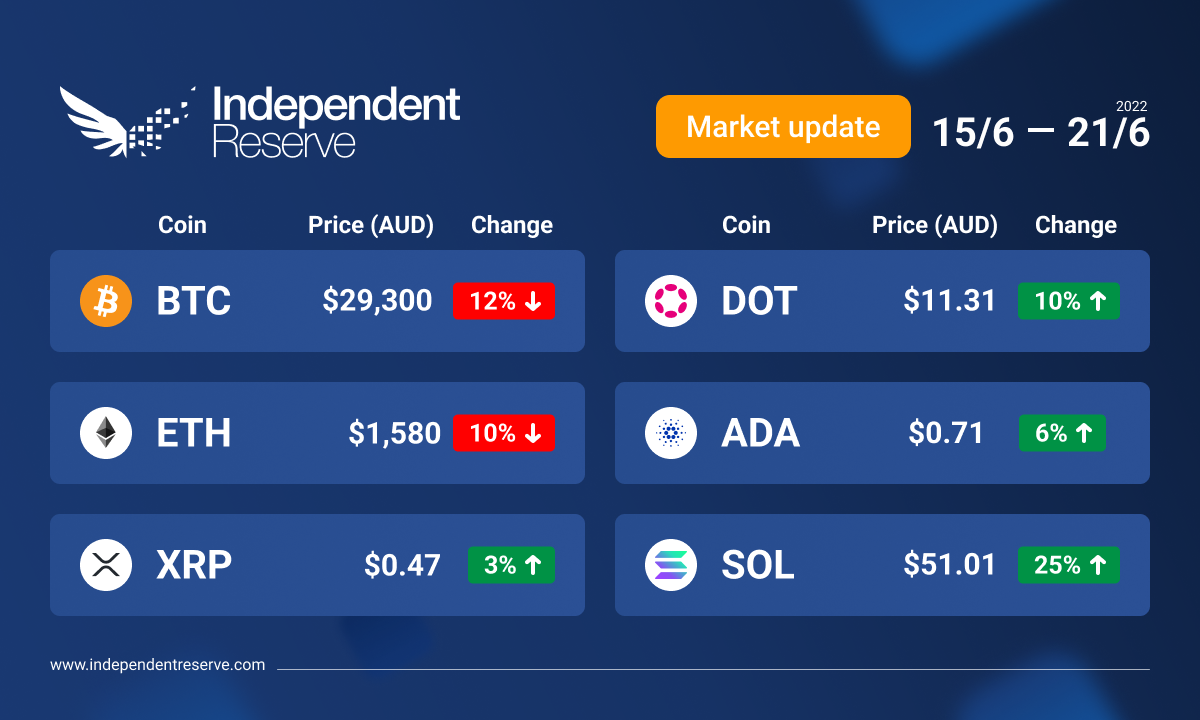

Sad news this week after Bitcoin died for the 455th time. This time it’s serious however with Google searches for ‘Bitcoin dead’ hitting a new record. It’s certainly been a historic week with BTC dropping well below the 2017 former all-time high, plunging to AU$25,640 (US$17,744) on June 19th (ETH fell to AU$1,293/US$896). The unprecedented drop calls into question various cycle halving theories and invalidates the maxim that “no one who invested in Bitcoin and waited four years has lost money.” Over the weekend Glassnode reported AU$10.5B/US$7.325B in onchain BTC losses had been “locked in by investors spending coins that were accumulated at higher prices.” Bitcoin finishes the week down 11.5% to trade around AU$29,300 (US$20.4K) while Ethereum is down 10.4% to trade around AU$1,580 (US$1,100). However: Cardano was up 6%, Solana jumped 25% and Polkadot increased 9.8%. Various analysts suggest that relative altcoin strength means much of the BTC and ETH fall was due to forced selling and liquidations. After dipping to 6 out of 100 over the weekend, the Fear and Greed Index is now at 9 or Extreme Fear.

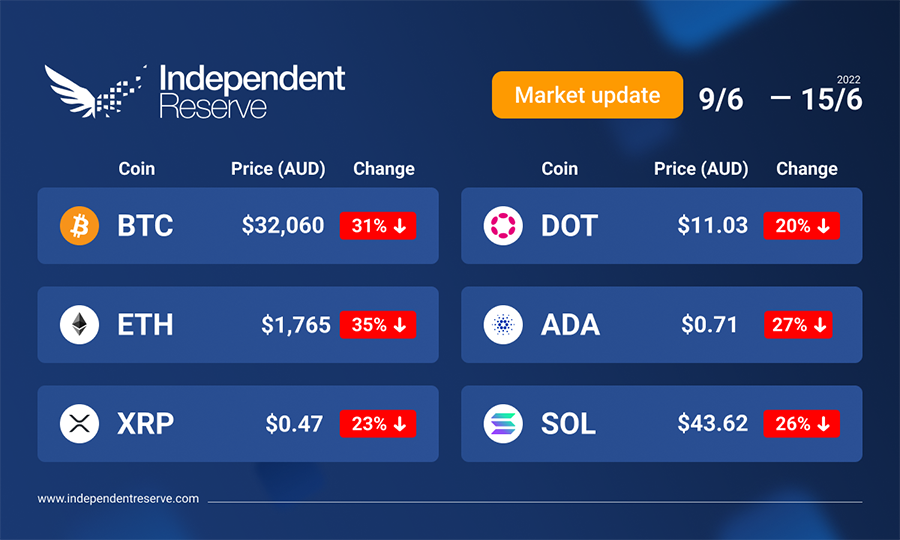

Bitcoin has stabilised by 4% in the past 24 hours, and finishes the week down 31% at US$22,150, or AU$32,060, which is roughly the lowest pricing since December 2020. ETH is down 35% this week and is trading around US$1,220 (AU$1,765). The macro picture looks bleak: May’s inflation rate in the US topped 8.6% and there’s speculation the Fed may hike interest rates by a whopping 0.75%. The S&P 500 is in a bear market, having lost more than 20% this year, and as a riskier asset class crypto has been hit even harder. The effects have been multiplied by the potential for lending platform Celsius to collapse and the possibility the ETH Merge may be delayed again. Everything has lost double digits: Cardano (-27%), XRP (-23%) and Polkadot (-20%). The Crypto Fear and Greed Index is at 7 or Extreme Fear. The overall market cap is at US$932 billion (AU$1.353T). With two weeks to go, this is shaping up as either the worst, or second worst quarter in Bitcoin’s history.

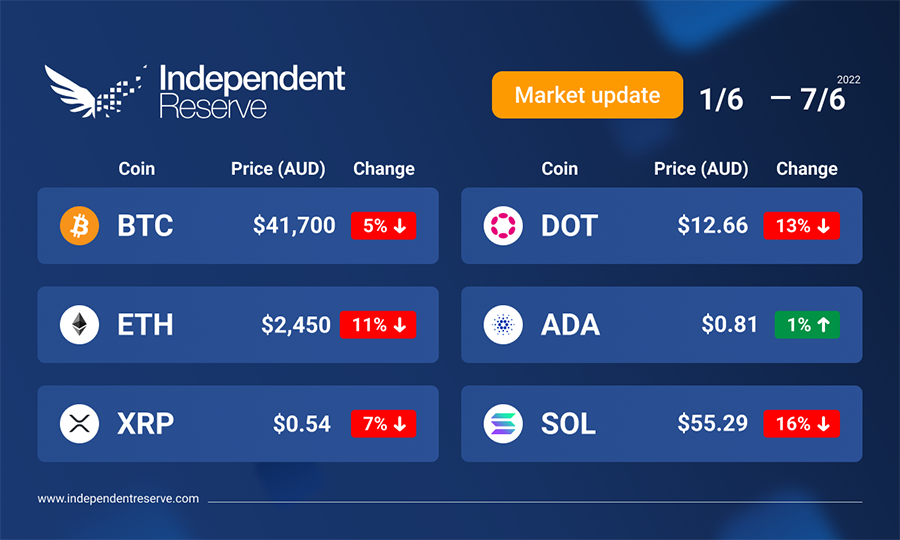

Bitcoin’s longest ever losing streak ended on Sunday with the cryptocurrency finally printing its first weekly green candle in 10 weeks. There’s now hope among traders that we’ve found the bottom and JPMorgan’s suggestion of a 30% upside for Bitcoin following the recent washout is right. However, Josh Olszewicz, head of research at Valkyrie Investments, thinks overall conditions aren’t favourable. “Uncertainty in the global economy due to high inflation and the likelihood we are in a recession, paired with the prevalence of central bankers raising rates, is likely going to force all assets downward at least through the end of the summer,” he said. The Reserve Bank of Australia is also widely expected to raise interest rates today. Bitcoin finished the week at AU$41,700 (US$29.9K) while Ethereum lost 11% to AU$2,450 (US$1,750). Cardano increased 1%, XRP fell 7%, Solana (-16%) and Polkadot was down 13%. The Crypto Fear and Greed Index is at 13, or Extreme Fear, up from 10 last week.

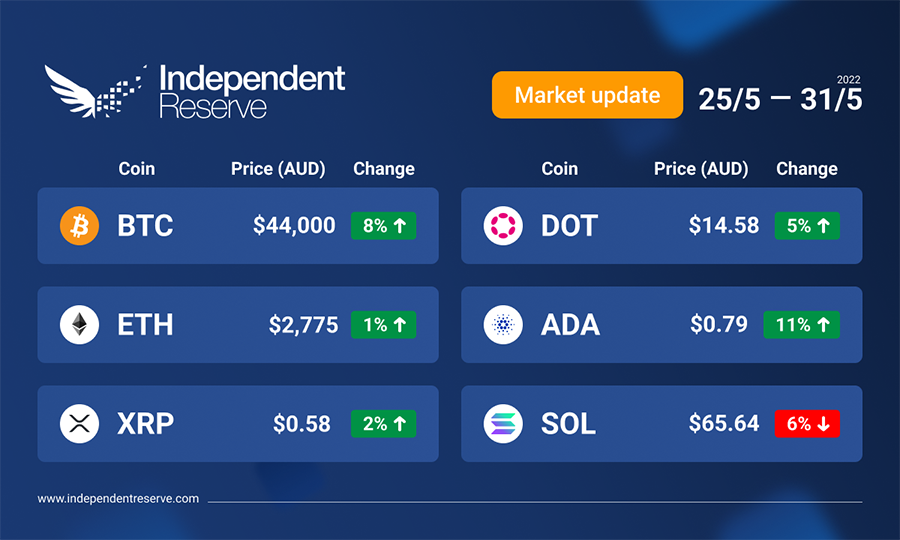

The good news is that the bad news has stopped, but is it a dead cat bounce or a trend reversal? Bitcoin is up 8% from a week ago to trade around AU$44,000 (US$31.7K) at the time of writing. Glassnode’s latest report says Bitcoin true believers have been snapping up BTC at discount prices and swallowed up all of the 80K Bitcoin liquidated by the LUNA Foundation Guard. The Bitcoin Accumulation Trend score is at 0.9% which Glassnode says indicates “investor psychology shifts from uncertainty to value accumulation.” Ethereum finished the week up 1% at AU$2,775 (US$1,990), XRP gained 2%, Cardano was up 11% and Solana lost 6%. The Crypto Fear and Greed Index is at 16 or Extreme Fear.

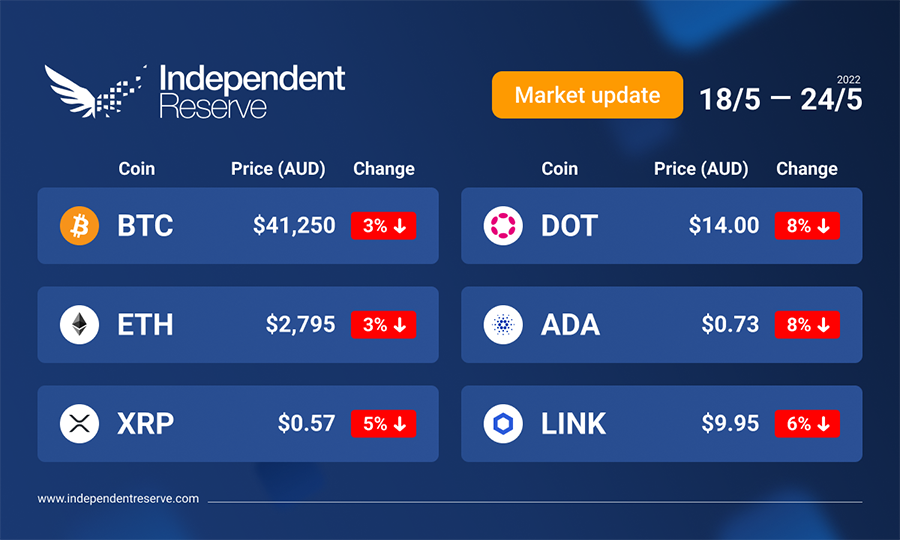

As the apocryphal Chinese curse goes: ‘May you live in interesting times’. Well, markets have rarely been more interesting with a record eight weeks in the red for Bitcoin which slid another 2.9% this week to trade around AU$41,100 (US$29.2K). In traditional markets the S&P 500 dipped briefly into bear market territory on Friday with a 20% drop from its January high before a small turnaround on Monday. Ethereum fell 2.9% this week and is trading at AU$2790 (US$1984), XRP lost 5%, Cardano (-8%), Solana (-9.6%) and Polkadot (-8%). The Crypto Fear and Greed Index is at 10 or Extreme Fear.