Market update

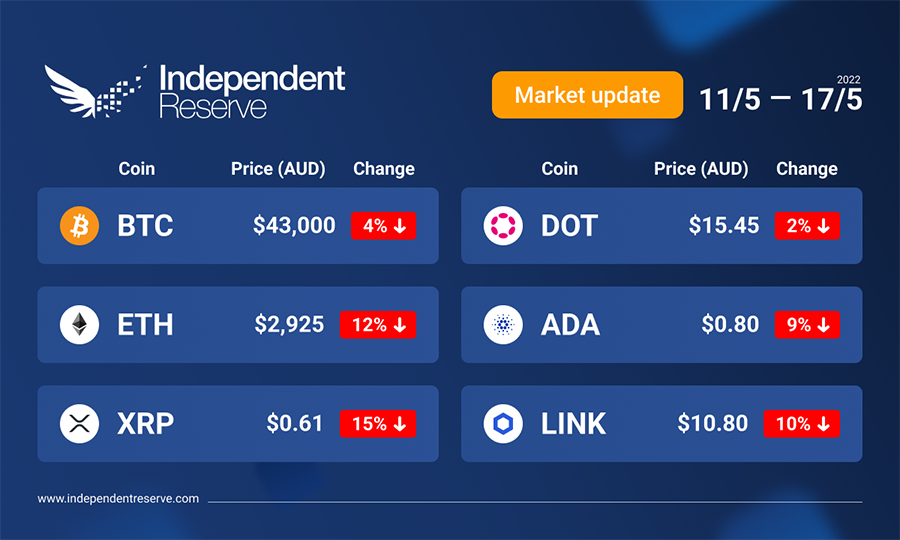

It’s been a historic week for all the wrong reasons, with Bitcoin notching up an unprecedented seventh weekly close in the red. The spectacular collapse of Terra and UST saw around AU$400B wiped off the total market cap of crypto mid-week, with Bitcoin and Ethereum crashing to lows not seen since 2020, Tesla, El Salvador, and MicroStrategy’s Bitcoin holdings all went into the red. After trading as low as AU$38K (US$26.5K) Bitcoin is back at AU$43K (US$30.1K) to cap the loss for the week at – 4%. Ethereum lost 12% to trade at just over AU$2,900 (US$2K). XRP lost 15%, Cardano (-9%), Solana (-16%) and Polkadot (-2%). The Crypto Fear and Greed Index improved, but is still at 14 or Extreme Fear.

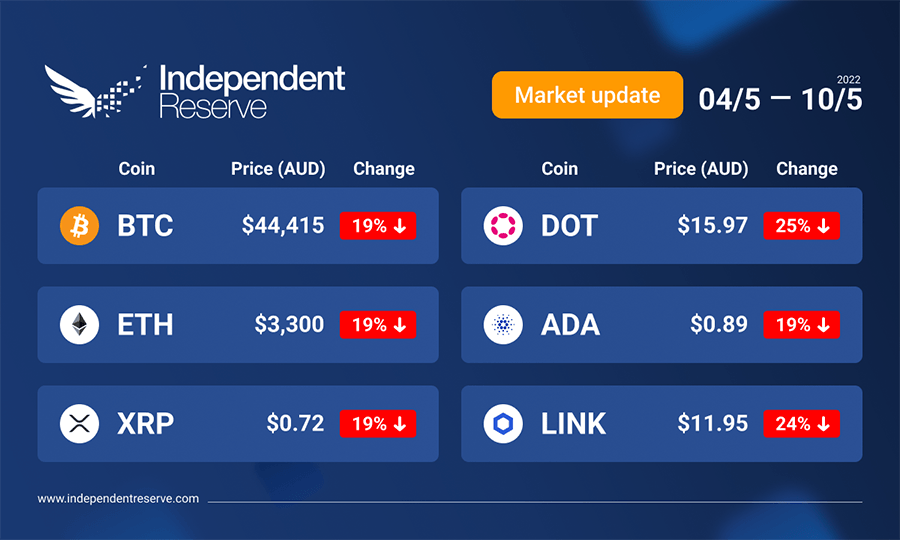

It looks like it’s time to fill out that McDonald’s job application with crypto falling off a cliff this week. Bitcoin tumbled around AU$12K four days ago from AU$55K down to AU$43K (the lowest prices since July 2021) alongside a major sell off in stocks, with the tech heavy Nasdaq in the US down another 4.3% on Monday and 26% year to date. Crypto’s market cap is down 35% in the same period and Bitcoin is now more than 50% off its all time high. The Future Fund LLC’s Gary Black tweeted today “BTC is nothing like gold, it’s Nasdaq on steroids“. Bitcoin has completed six red weekly candles in a row for the first time since 2014. Interest rates are rising along with the US dollar and the US CPI figures come out mid-week which will indicate how much more pain is to come. Crypto’s plunge was exacerbated by the UST stablecoin falling off its peg and deploying some of its BTC reserves. At the time of writing Bitcoin was down 19% for the week to trade at AU$44,415 (US$30.7K), Ethereum lost 19% for the week to trade around AU$3,300 (US$2.3K), XRP (-19%), Cardano (-19%), and Polkadot (-25%). The crypto fear and greed index bottomed out at 11, or Extreme Fear.

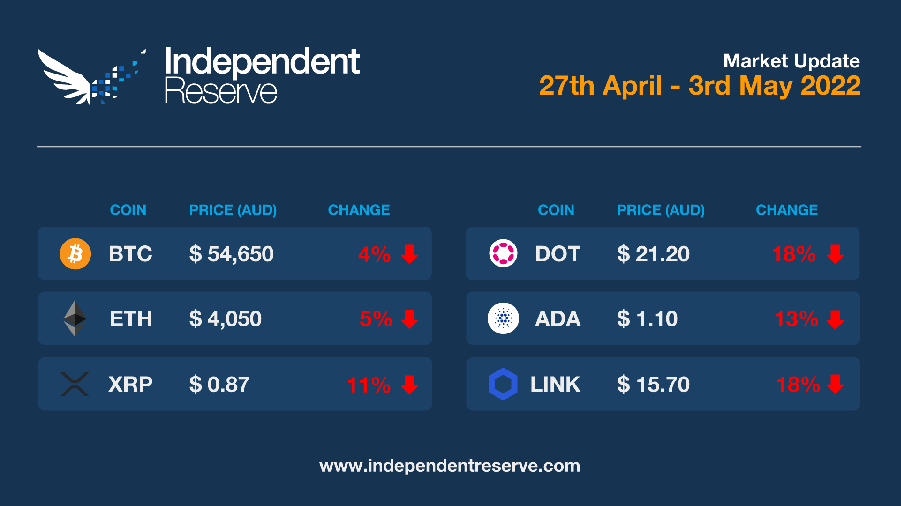

April wasn’t a great month and May isn’t looking too hot either. Traditional markets are tanking, the Federal Reserve is hiking rates in the US, and the RBA increased the cash rate by 25bps to 0.35% today. The tech-heavy Nasdaq (crypto’s closest proxy on traditional markets) plunged on Friday and lost 13% all up in April, its worst month since 2008 and its worst start to a year on record. By comparison, Bitcoin isn’t actually doing that badly, remaining above its year-to-date low of around US$33K (AU$47K). Bitcoin is currently trading at US$38.6K, or AU$54,650, which is 4% down for the week. Ethereum lost 5% to trade at US$2,865 (AU$4,050), XRP was down 11%, Cardano (-13%), and Polkadot (-18%). As a small sign of hope, the Crypto Fear and Greed Index is at 28, which is simply Fear, rather than Extreme Fear.

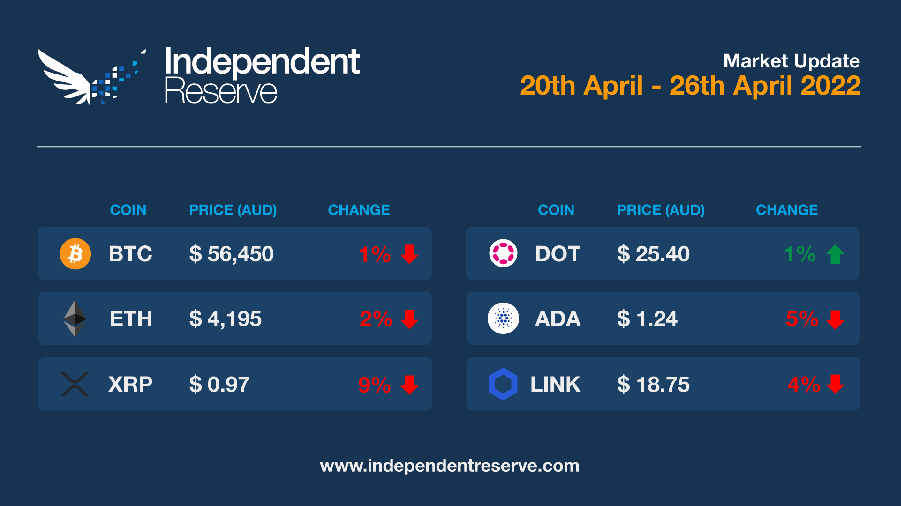

Bitcoin has seen four red candles in a row on the weekly chart for the first time since June 2020. Traders seem unsure of how crypto markets will react to heavy losses in Asian stocks over lockdowns spreading in China and the US Federal Reserve signalling a half point rise in interest rates is likely at its next meeting to tame inflation. A looming death cross on the three-day chart could also send prices tumbling 40% according to CoinDesk — but on two previous occasions it notes that marked the end of bear markets and the start of bulls. Despite the gloom, HODLers keep HODLing, with the percentage of Bitcoin supply that hasn’t moved for more than a year crossing 64% for the first time ever. Bitcoin dipped again below US$40K (AU$55.7K) on the weekend and was as low as US$38.5K (AU$53.5K) earlier today but it finishes the week at US$40.5K (AU$56,450), which is down 1% on seven days ago. Ethereum is down 2% to trade around US$3K (AU$4.2K), XRP lost 9%, Cardano was down 5% but Dogecoin was up 10%. The Crypto Fear and Greed Index is stuck on Extreme Fear, at 23.

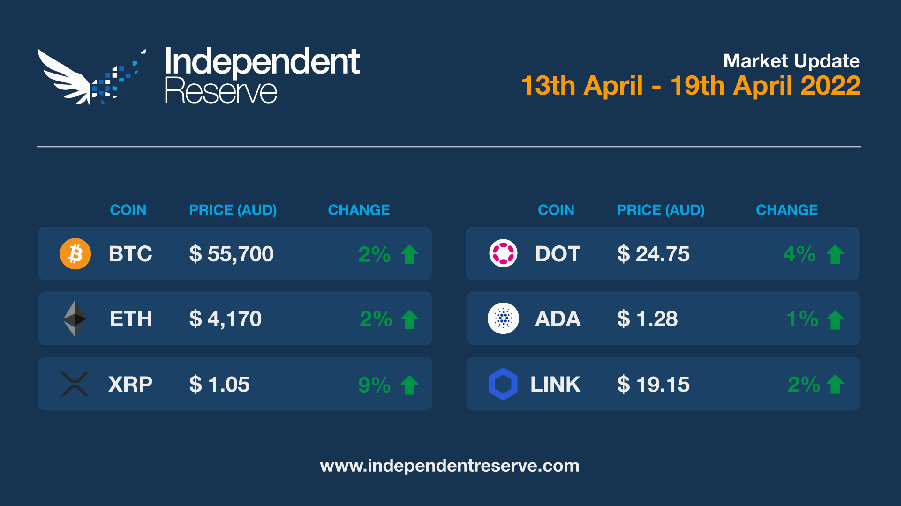

In the absence of a clear overall bullish or bearish narrative driving the Bitcoin price firmly up or down, the price has been meandering above and below the US$40K mark (AU$54.4K) for most of 2022. Bitcoin dropped below that level a few times this week, but finished up 2% to US$41K (AU$55.7K). Ethereum was up 2% to just over US$3K (AU$4,100). Promising signs in the SEC case against Ripple helped XRP to gain 9%, Cardano was flat and Polkadot gained 4%. The Fear and Greed Index is at 24, or Extreme Fear.

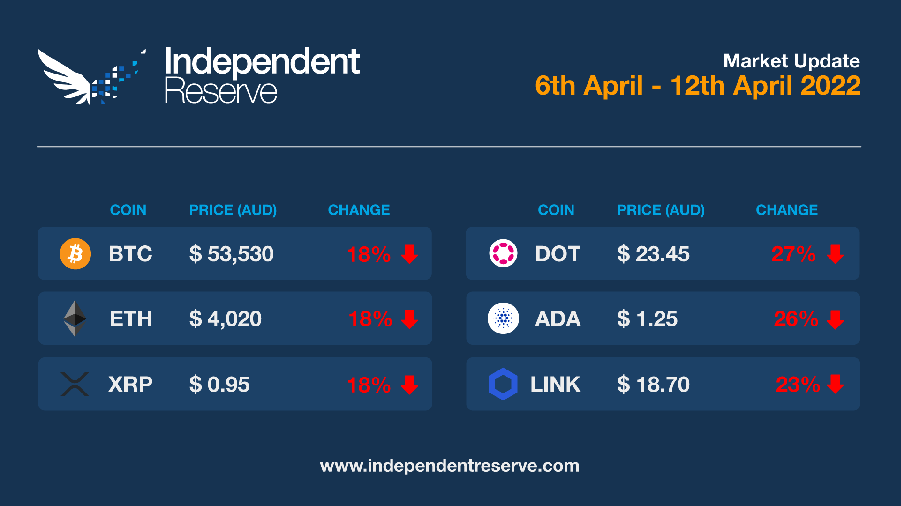

In crypto’s ongoing game of snakes and ladders, we’ve just hit a ladder, with Bitcoin down 8% in the past 24 hours and 18% down for the week to trade around AU$53,500 (US$39,600). The overall crypto market cap is down to AU$2.46T (US$1.82T). Pundits point to Bitcoin’s increasing correlation with equities markets as a possible explanation – the correlation is at the highest point since October 2020 and all the major US markets were down on Monday, with the tech heavy Nasdaq losing 2.2%. The Ukraine war, interest rates, and inflation are weighing heavily and former BitMEX CEO Arthur Hayes thinks it’ll get worse before it gets better, tipping BTC will test US$30K (AU$40.4K) and ETH US$2,500 (AU$3,370) before the end of June. Ethereum lost 18% this week to trade just over AU$4,000 (US$2,960) and everything else lost ground including XRP (-16.7%), Polkadot (-27%), Cardano (-26%) and LINK (-23%). The Crypto Fear and Greed Index is at 32, or Fear, though expect that to dip further today.

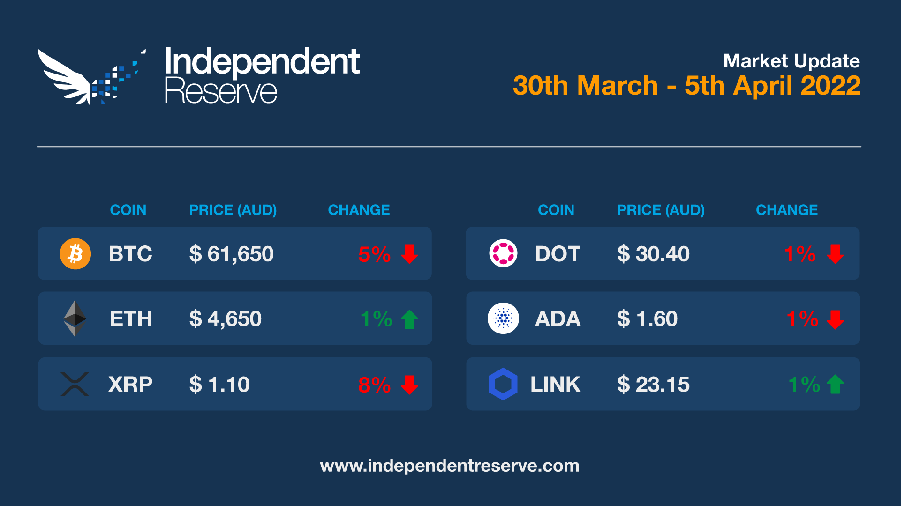

After a shaky first quarter, Bitcoin hit a new high for the year on March 29 around AU$65.6K. Glassnode reports that over the past week a net US$1.5 billion (AU$2B) worth of Bitcoin and US$1.7B (AU$2.25B) of Ethereum departed exchanges, while a net US$451.8M (AU$599M) of USDT flowed in. The Bitcoin price however finished the week down 5% at AU$61,650 (US$46.5K), while Ethereum increased 1% to AU$4,650 (US$3.5K). Cardano was down 2%, XRP lost 8% and Dogecoin also finished flat despite a spike in the aftermath of Elon Musk buying a slice of Twitter. The Crypto Fear and Greed Index is at 52, or Neutral.

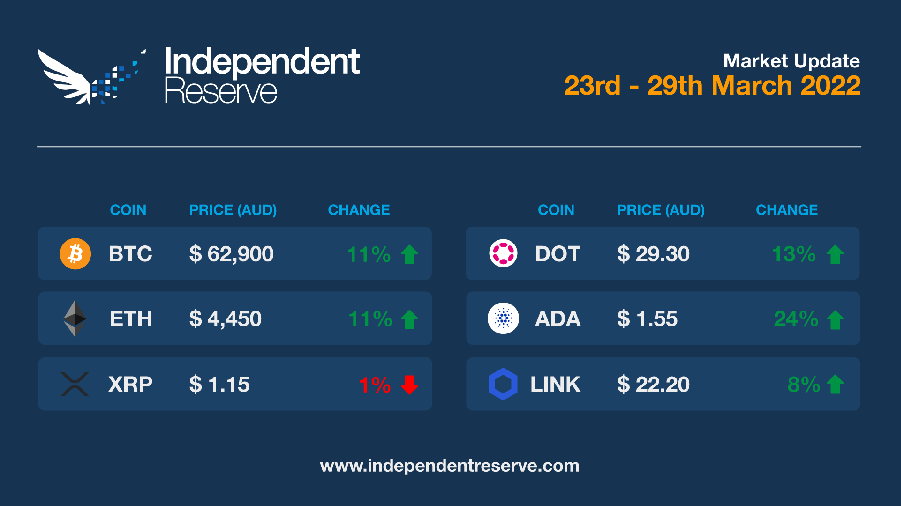

Normal service has resumed, with Bitcoin now up by 35% since Russia’s invasion of Ukraine tanked markets in February. Analyst Will Clemente observed: “Bitcoin has closed above short term holder cost basis for the first time since Dec. 3. Hard to be bearish as long as BTC is above.” Tether just printed 1 billion USDT in four days, Ethereum gas fees for DeFi transactions are back around US$20 (AU$27) and memecoin insanity has returned because of course there’s already a Will Smith slap token and a DAO. The BTC price is up a whopping 11% since this time last week and currently sits at around AU$63,000 (US$47,100). Analysts who were bearish recently, are now talking about a new all time high. Ethereum gained 11% and is trading around AU$4,500 (US$3.3K), XRP was flat, Cardano added 24% and Polkadot was up 13%. The Crypto Fear and Greed Index is at 60, or Greed, for the first time in March.

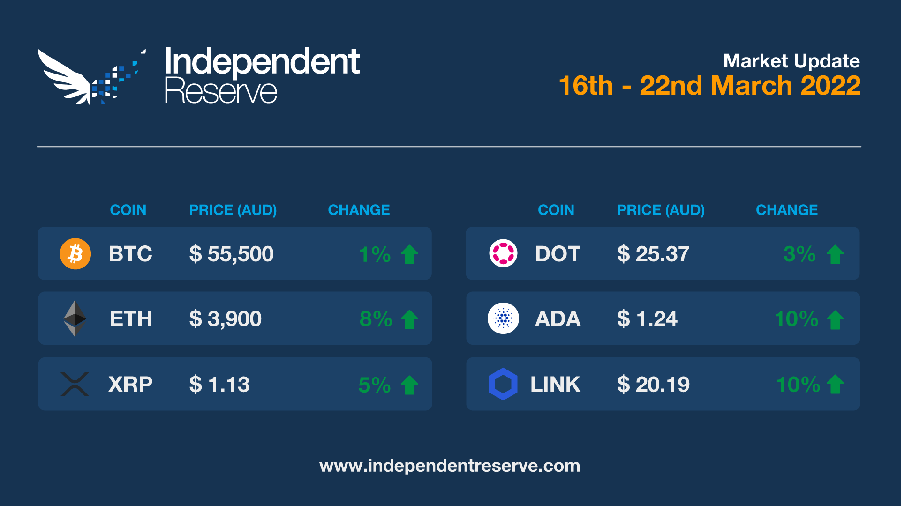

With the market growing more accustomed to the Ukraine war, and inflation and interest rate rises, the Crypto Fear and Greed Index has recovered slightly to 30, or simply ‘Fear’. Bitcoin has spent most of the week in the mid AU$50Ks, and it’s currently 1% up on seven days ago to trade around AU$55,500 (US$41K). With signs the years-in-the-making Merge is finally coming closer to reality Ethereum jumped 8% to trade at AU$3,900 (US$2.8K). Separately, XRP increased 5% and Cardano and LINK are up 10%.

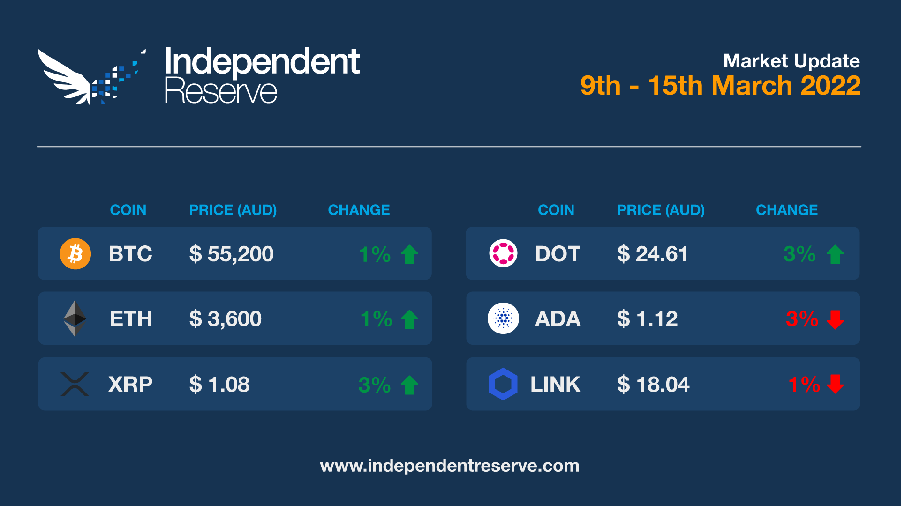

With inflation at a 40 year high in the US, and the Federal Reserve expected to start raising interest rates this week, Bitcoin’s ‘inflation hedge’ narrative is being put to the test. After a short-lived sugar rush from President Biden’s Executive Order, Bitcoin spent most of the week trundling along under US$40K (AU$55.6K), and it is currently flat on the last seven days, trading just around AU$55,200. Ethereum was up 1% to around AU$3,600 (US$2.5K), XRP gained 3%, Cardano is down 3% and Polkadot is up 3%. The Crypto Fear and Greed Index is at 23, or Extreme Fear, the same as last week.

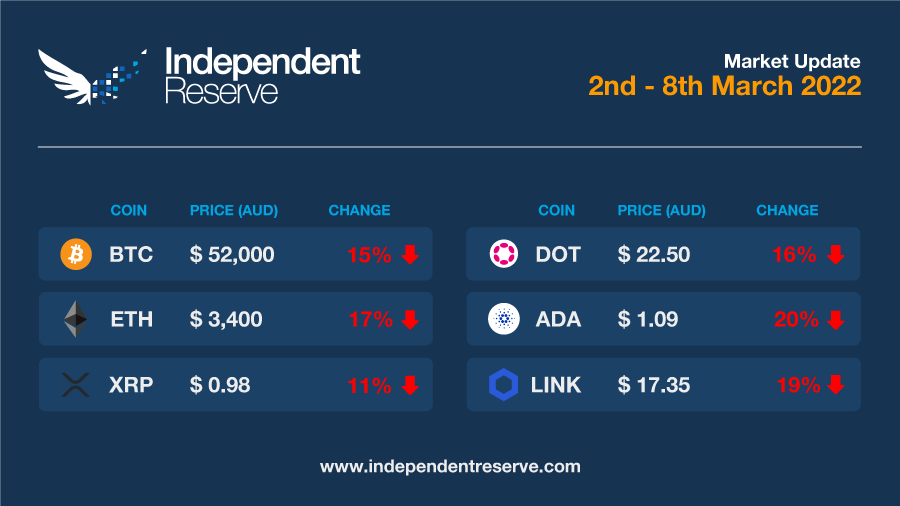

With the possibility of a nuclear exchange (relatively) high, a financial war ramping up, and increased regulatory pressure in the US and Europe, crypto markets are again under pressure. Bitcoin is down 15% for the week to trade just under AU$52K (US$38.3K) while Ethereum’s slide continues, losing another 17% to around AU$3,400 (US$2.5K). XRP lost 11%, Cardano (-20%) and Polkadot (-16%). The Crypto Fear and Greed Index moved above 50 earlier in the week but is now back around 23 or Extreme Fear.

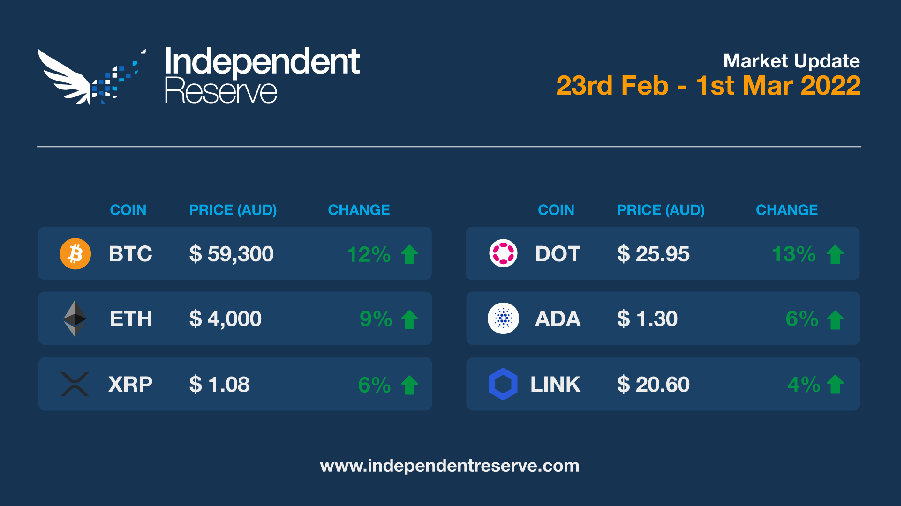

Bitcoin went on a rollercoaster ride this week, plunging more than 10% on the news that Russia had invaded Ukraine. It bottomed out below AU$48,000 (US$34K), recovered a little bit as markets digested the implications, and then suddenly jumped almost 15% in the past 24 hours to AU$59,300 (US$43K). As usual, the reasons aren’t exactly clear but there are reports Russians are buying up crypto as the country’s financial system gets hit hard by sanctions. Markets also seem to prefer certainty to uncertainty and news emerged today that eBay is looking at adding crypto payments. Bitcoin is up 12% for the week at the time of writing, with everything else up too including Ethereum (9%), XRP (6%), Cardano (6%), and Polkadot (13%). The Crypto Fear and Greed Index is at 20, or Extreme Fear. Bitcoin dominance is edging back towards 44%, the highest it’s been since November, and there are now 800K wallets with at least one whole Bitcoin, and non-zero addresses are at an all-time high above 40 million.