Market update

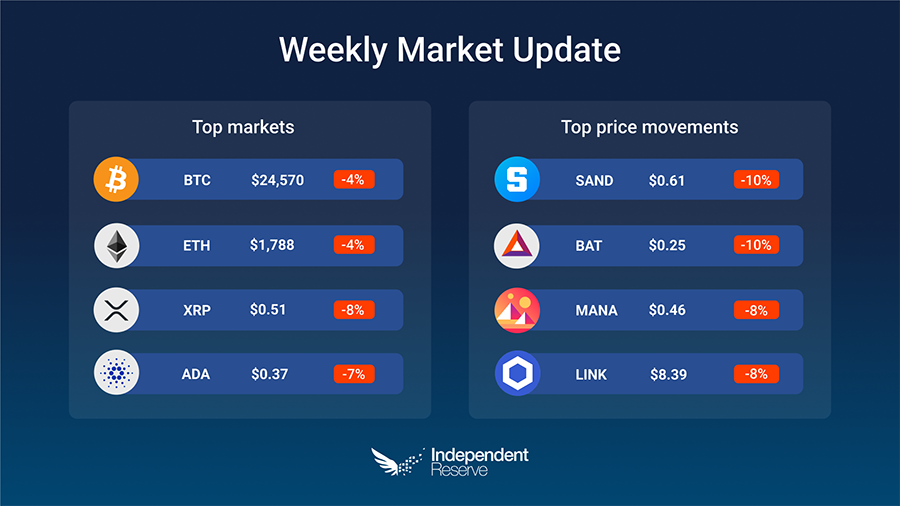

Crypto markets saw a boost earlier in the week after the US Federal Reserve raised rates by the expected quarter of a percent and officials started to talk about “disinflation”. Bitcoin poked its head above US$24K (A$34.6K) while ether traded above US$1,700 (A$2,450) for the first time since September. However, the good vibes came to a halt after unexpectedly strong job numbers on Friday raised fears that rates will continue to rise. Nonfarm payroll jobs jumped 517,000 in January, much higher than the 185,000 predicted and US unemployment is now at its lowest level since 1969. Closer to home the Reserve Bank is expected to raise interest rates again today. Bitcoin finishes the week down 4.1% to trade at A$32,760 (US$22,755) while ether was down 1% to A$2,333 (US$1,620). XRP lost 3.5%, Cardano was relatively flat, Doge gained 2.6% and Polygon was also up, by 2.2%. The Crypto Fear and Greed Index is at 56 and has been at ‘greed’ for the past week.

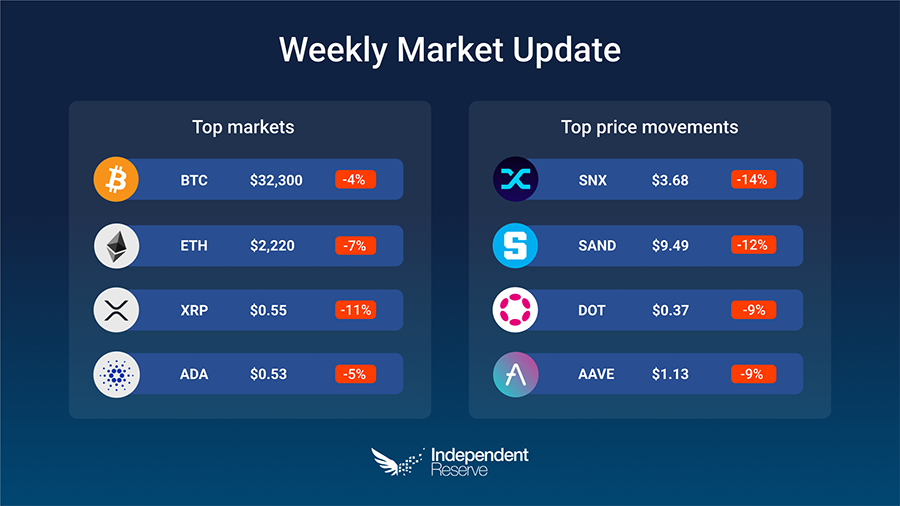

With the first four weeks of the year green, you’d be forgiven for thinking that Crypto Spring had sprung, but the Bitcoin price rise came to a shuddering halt today with a dip below US$23K (A$32.6K), perhaps on fears the Federal Reserve might throw a curveball with its interest rate decision this week. However most pundits seem to expect a soft quarter point hike. Earlier this week around 64% of Bitcoin holders were in profit, but that’s fallen below 50% today according to IntoTheBlock. Crypto stocks including Silvergate, Coinbase, MicroStrategy and Block all surged by double digit percentages earlier this week. Bitcoin finishes the week down 4% to trade at A$32,300 (US$22,775) while Ethereum lost 7% to trade at A$2,220 (US$1,565). XRP was down 11%, ADA lost 5%, MATIC increased 5%, and SOL was down 5%. At the time of writing the Fear and Greed Index was at 51 or Neutral.

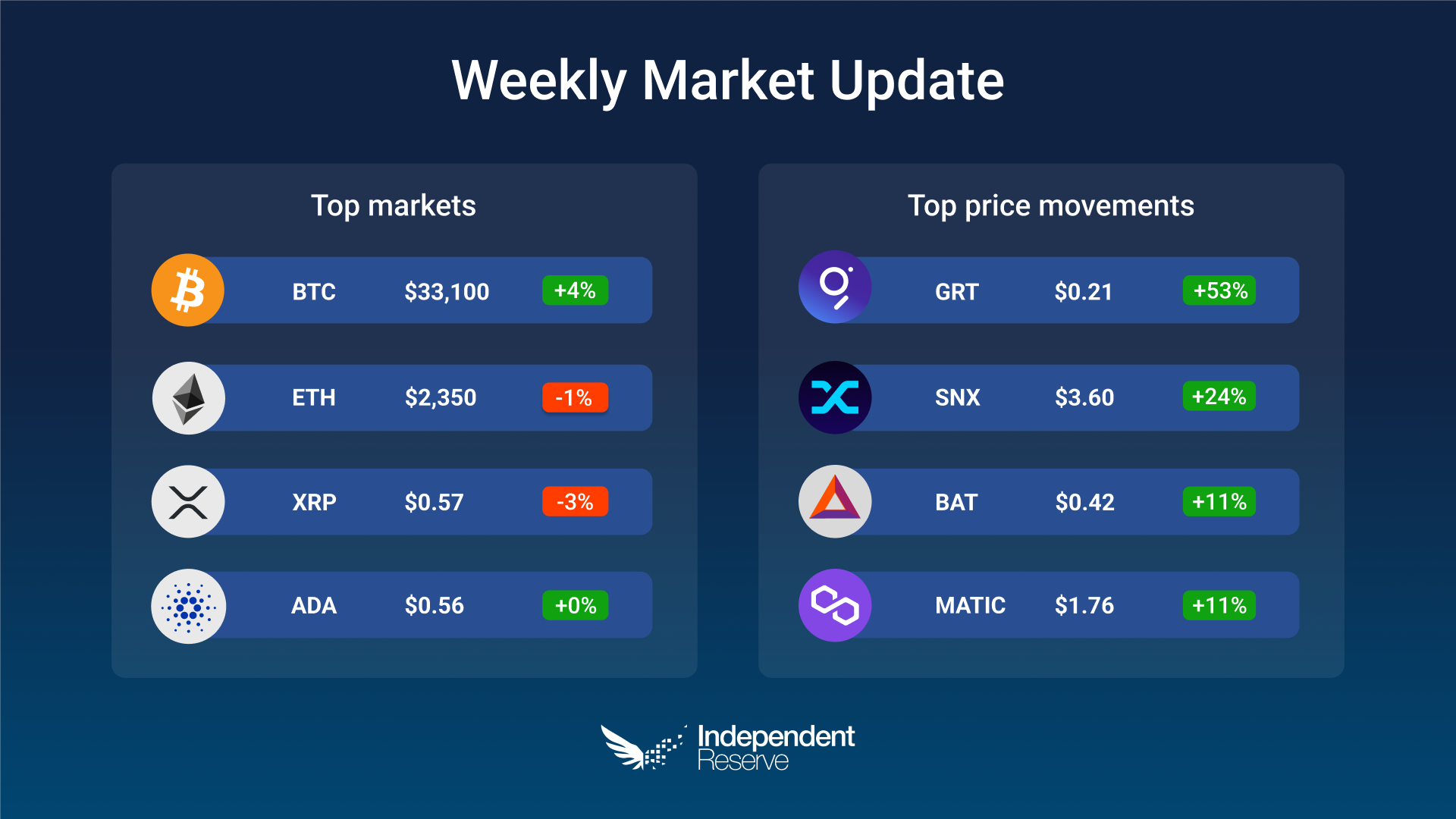

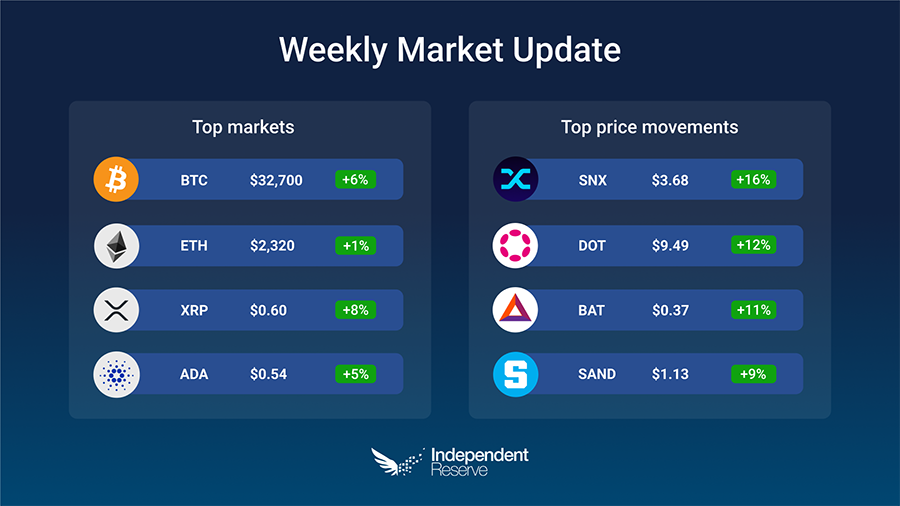

Back in early 2018 all of crypto was pinning its hopes on a post Lunar New Year recovery that never came. Well, in 2023 the markets keep going up and much of Crypto Twitter seems united in disbelief. Is this just a bull trap? Bitcoin is now up 38% in the year to date and hit US$23,230/A$33K on the weekend for the first time since August 2020. The total crypto market cap is once again above US$1 trillion – it’s currently A$1.5T – and Gold and the S&P 500 are also recovering, up 19% and 13% respectively. Bitcoin finished the week up 6% to trade around A$32,700 (US$22,980) while Ethereum gained 1% to trade at A$2,320 (US$1,630). Almost everything else was up including XRP (8%), ADA (5%), DOGE (4%), SOL (4%), but MATIC lost 4%. The Crypto Fear and Greed Index remains at 52 or ‘neutral’.

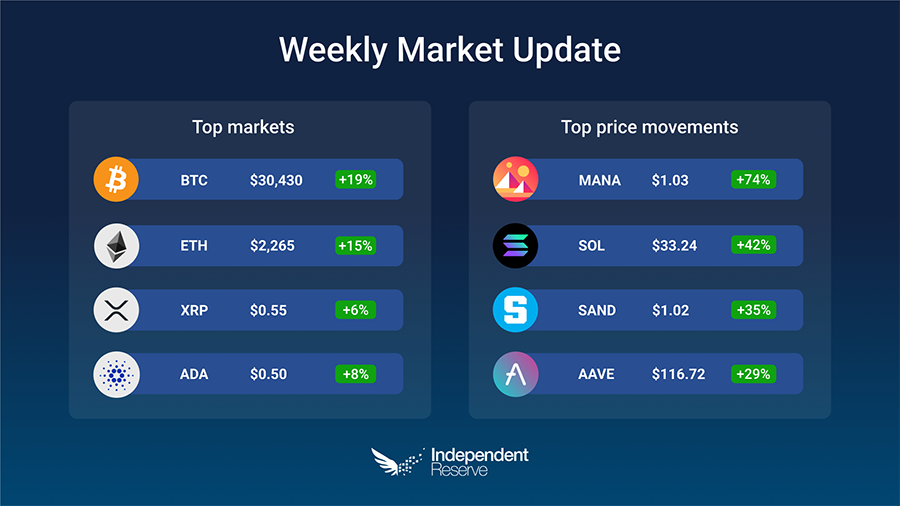

Is Crypto Winter over? Bitcoin suddenly broke through US$20K (A$28.7K) on Saturday and then US$21K (A$30.2K) on Sunday. Bears were rekt with US$500 million (A$718M) in liquidations. Bitcoin is again trading above the 2017 top and has recovered its losses from the FTX collapse. Pundits point to inflation moderating by 0.1% in December, FTX finding US$5B (A$7.18B) in assets, whales growing more confident and the Bitcoin halving in May 2024 as possible reasons for the rally. Bitcoin is currently trading at A$30,430 (US$21.2K), up 19% for the week, while Ethereum is at A$2,265 (US$1,577), up 15% on seven days ago. Everything else increased: XRP (7%), MATIC (17%) and SOL (39%). The overall crypto market cap is at $1.425 trillion (US$992B). After 10 months the Crypto Fear and Greed Index hit 52 or ‘neutral’ two days ago; it currently sits around the same at 51 at the time of writing.

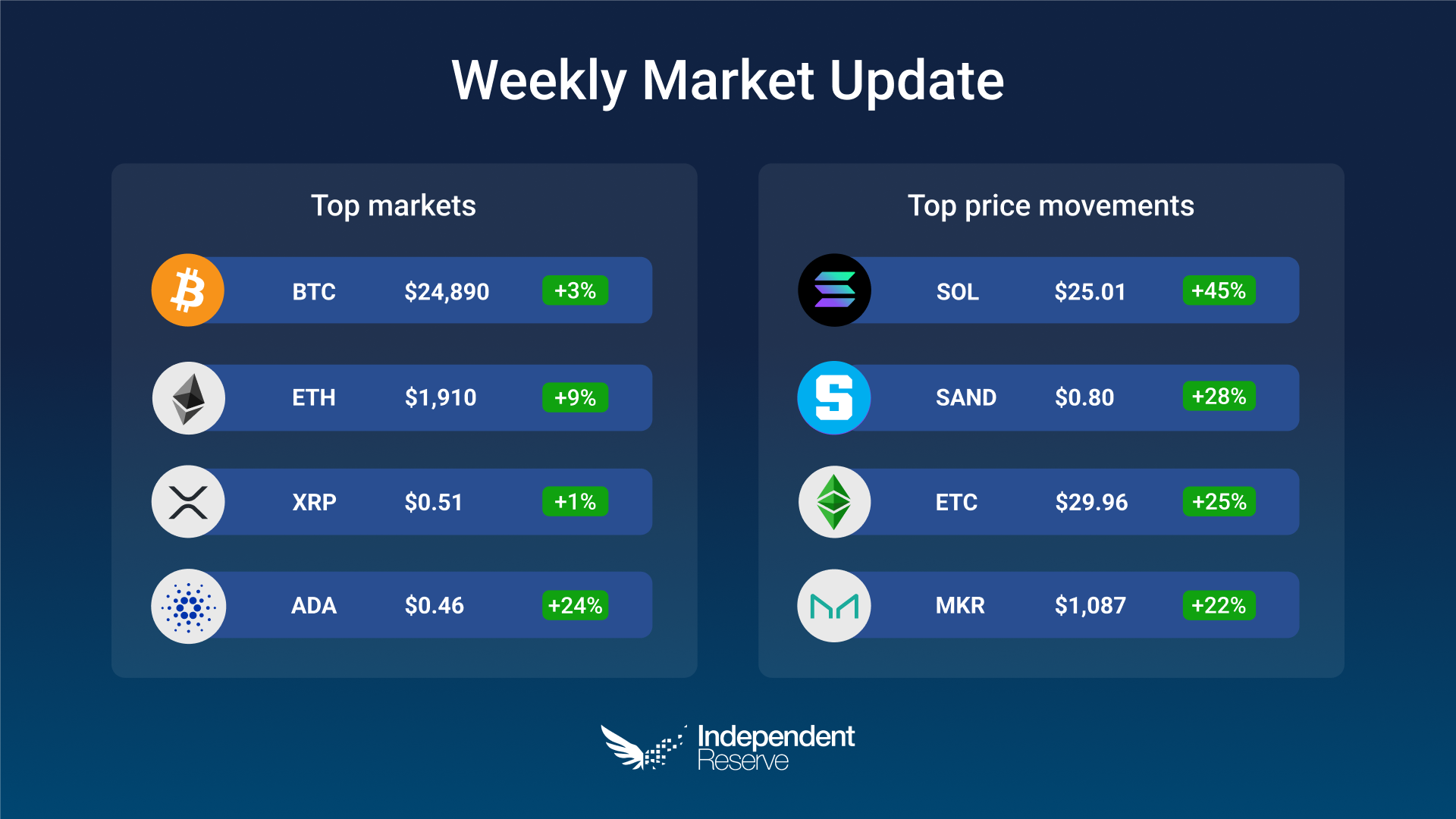

Crypto markets appeared to have finally turned a corner this week after grinding along with low volatility since the collapse of FTX in November. It’s too early however to call the bottom or work out if this is just a bull trap. Pundits linked the rise to markets expecting a lower US inflation figure this week and for interest rates to peak around 5%, but in truth it’s just as likely to be the fact that no major exchange or crypto firm has collapsed in the past couple of weeks. Bitcoin has broken through the US$17K (A$24.6K) mark and is up 3% from a week ago to trade at A$17,220 (US$24,885). Ethereum gained 8.6% to trade at A$1,910 (US$1,322). Everything else was up, including Cardano (24%), Dogecoin (6%) and Polygon (7.8%). Solana gained 46% and has more than doubled in price since its lows two weeks ago. Crypto mining companies and other blockchain-linked stocks, including Riot Blockchain, Marathon Digital, Coinbase and Silvergate have all rallied by double-digit percentages on share markets.

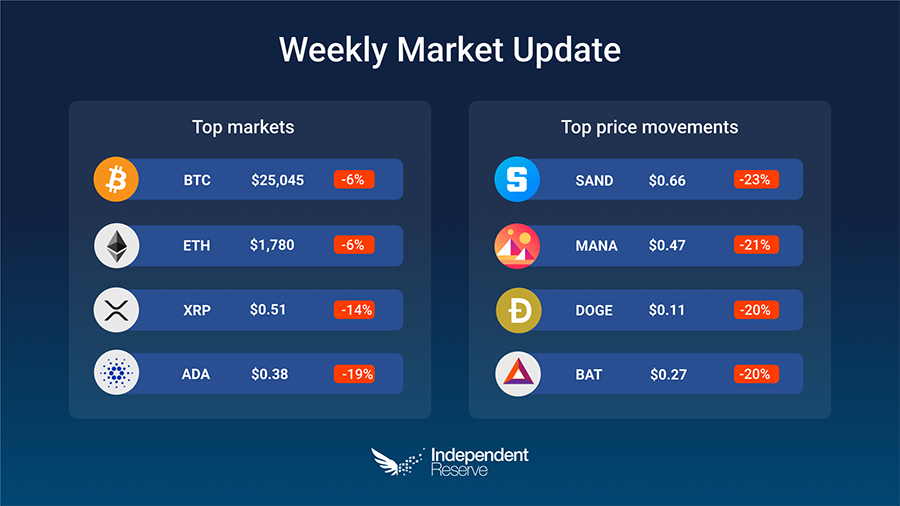

Crypto markets rose mid-week in expectation of a more positive outlook from the Federal Reserve, and Bitcoin peaked above US$18,000 (A$26.4K) for the first time since FTX collapsed. Then everything crashed after the Fed hiked rates by 50 basis points and said it will continue to raise rates into 2023. The good news is that US inflation came in at 7.1%, better than expected, and the slowest pace in nearly a year. Bitcoin finishes the week 5.5% down at A$25,045 (US$16,750) while Ethereum lost 6% to trade around A$1,780 (US$1,160). Everything else was down including XRP (-14%), Cardano (-19%) and Dogecoin (-20%). The Crypto Fear and Greed Index is at 29 or Fear.

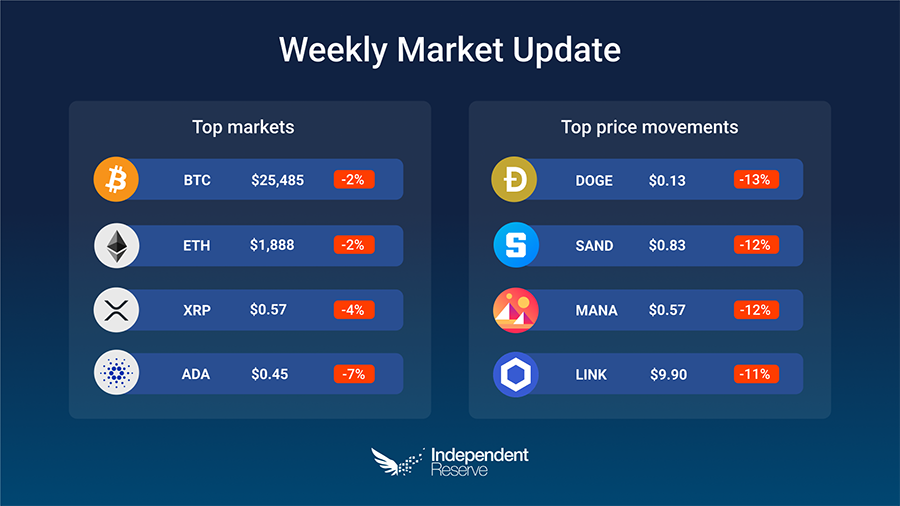

With all the paper hands and retail tourists gone long ago, crypto markets aren’t making any dramatic moves despite fresh bad news coming out daily. Bitcoin was down 2% on seven days ago to trade at A$25,485 (US$17,190) and Ethereum also lost 2% to trade at A$1,888 (US$1,273). XRP lost 4% (there are unconfirmed rumours of a settlement in the SEC case), Dogecoin fell 13% while Cardano lost 7%. November’s US inflation data comes out in the next 24 hours and markets expect the next rate rise will be 50 basis points.

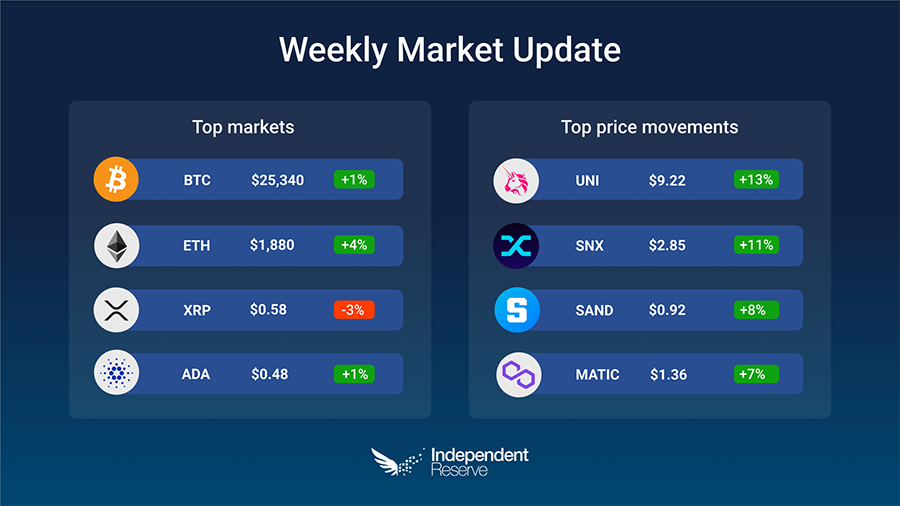

There were some green shoots this week with monthly inflation data showing a slight easing to 6.9% and pundits tipping the next interest rate rise will be 0.25%. There’s also the slim chance of a Santa Claus Rally (even if there’s not a lot of evidence of any consistent December rise over the years). Bitcoin finished the week up 1% to trade at A$25,340 (US$16,940) while Ethereum increased 4% to A$1,880 (US$1,260). XRP is down 3%, Dogecoin increased 4% (related: rumours of a Twitter Coin) and Cardano was up 1%. The Crypto Fear and Greed Index is at 25 or Extreme Fear.

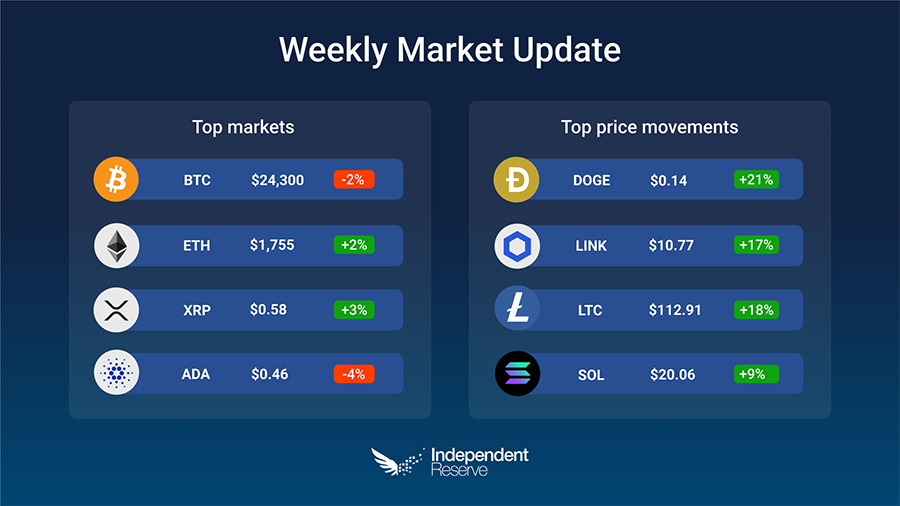

Despite acres of bad news, markets have been mostly in a holding pattern this week. Bitcoin finishes the week down 2% to trade at A$24,300 (US$16.1K), while Ethereum increased 2% to A$1,755 (US$1,167). XRP gained 3% and Dogecoin surged 21% after Twitter boss Elon Musk mentioned payments in a tweet about his new ‘everything app’. Decentrader’s Filbfilb said this week “[the] fact that we haven’t dumped harder than we actually really could have done is a good sign for the bulls,” but he also said Bitcoin could fall below A$15K (US$10K). The Crypto Fear and Greed Index increased to 26 or simply ‘Fear’.

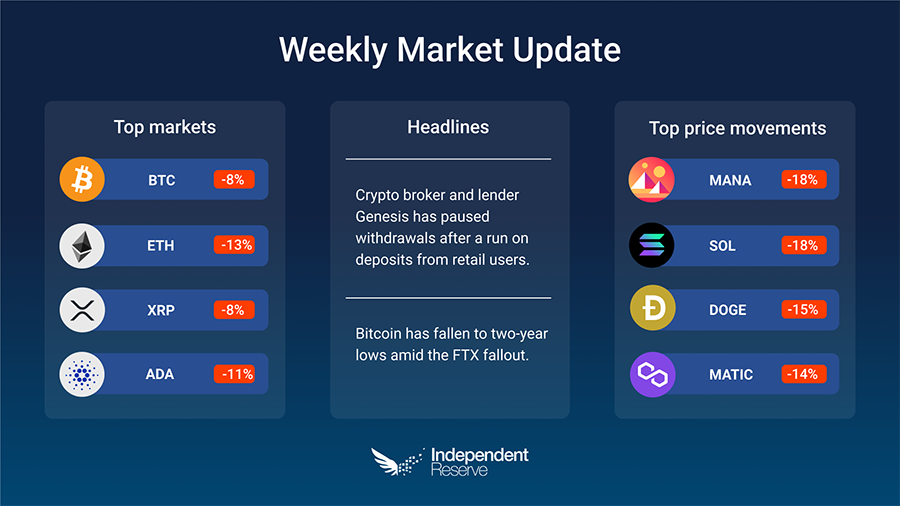

Bitcoin has fallen to two-year lows amid the FTX fallout, with just over 51% of addresses at a loss, which compares to 55% at the bottom of the previous crypto winter in January 2019, and 62% in 2015.

However, the price crash from the collapse of the world’s second largest exchange hasn’t been as severe as may have been expected, with Bitcoin down another 8% for the week to trade around A$23,990 (US$15.8K) and Ethereum down 13% to hit A$1,670 (US$1.1K). Everything else was down including XRP (-8%), Cardano (-11%), Dogecoin (-15%) and Solana (-18%). Some true believers are still buying, with Pantera Capital reportedly snapping up A$212M (US$140M) in BTC to once again demonstrate its belief in halving cycles (which will theoretically see a turnaround early in 2023). El Salvador President Nayib Bukele plans to dollar cost average in from now on, buying one Bitcoin a day. The Crypto Fear and Greed Index is at 22 or Extreme Fear.

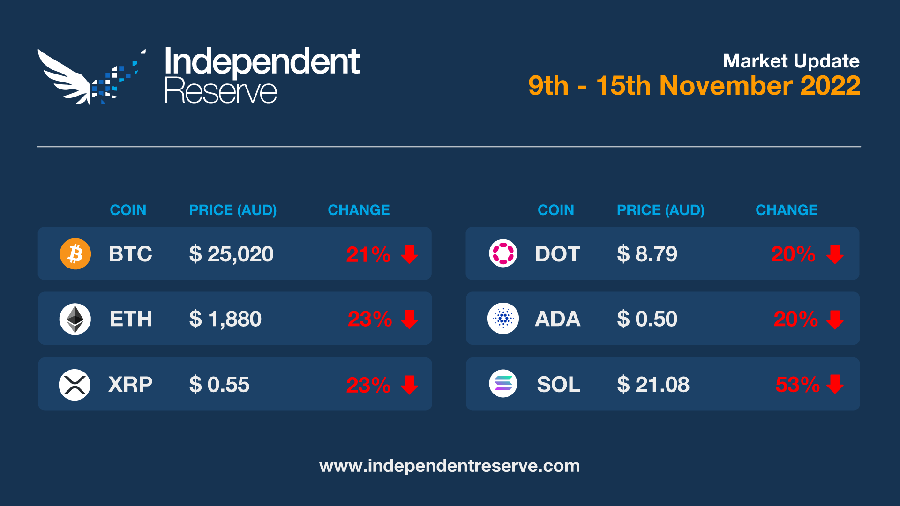

Normally, crypto markets would likely be heading upwards following the news that US inflation had come in below expectations by falling to 7.7%. The Nasdaq and S&P 500 certainly had their best week in six months! However, the FTX/Alameda collapse saw the overall crypto market plunge from A$1.52 trillion (US$1.02T) to A$1.235T (US$827 billion) in the space of a week. Bitcoin fell from A$32K (US$20.8K) to hit the lowest point for the year below A$24.4K/US$16K with more pain expected. Bitcoin’s relative strength index (RSI) reached an all-time monthly low of 40.5 on November 10. Bitcoin finishes the week 21% down to A$25K (US$16.7K) while Ethereum lost 23% to trade at A$1,880 (US$1,260). Everything else crashed too including XRP (-23%), Cardano (-20%), Dogecoin (-25%) and Solana plunged 53%. The Crypto Fear and Greed Index is at 24 or Extreme Fear. In some good news though, the extremely low prices mean that the number of people who own one whole Bitcoin is fast approaching 1 million.