Market update

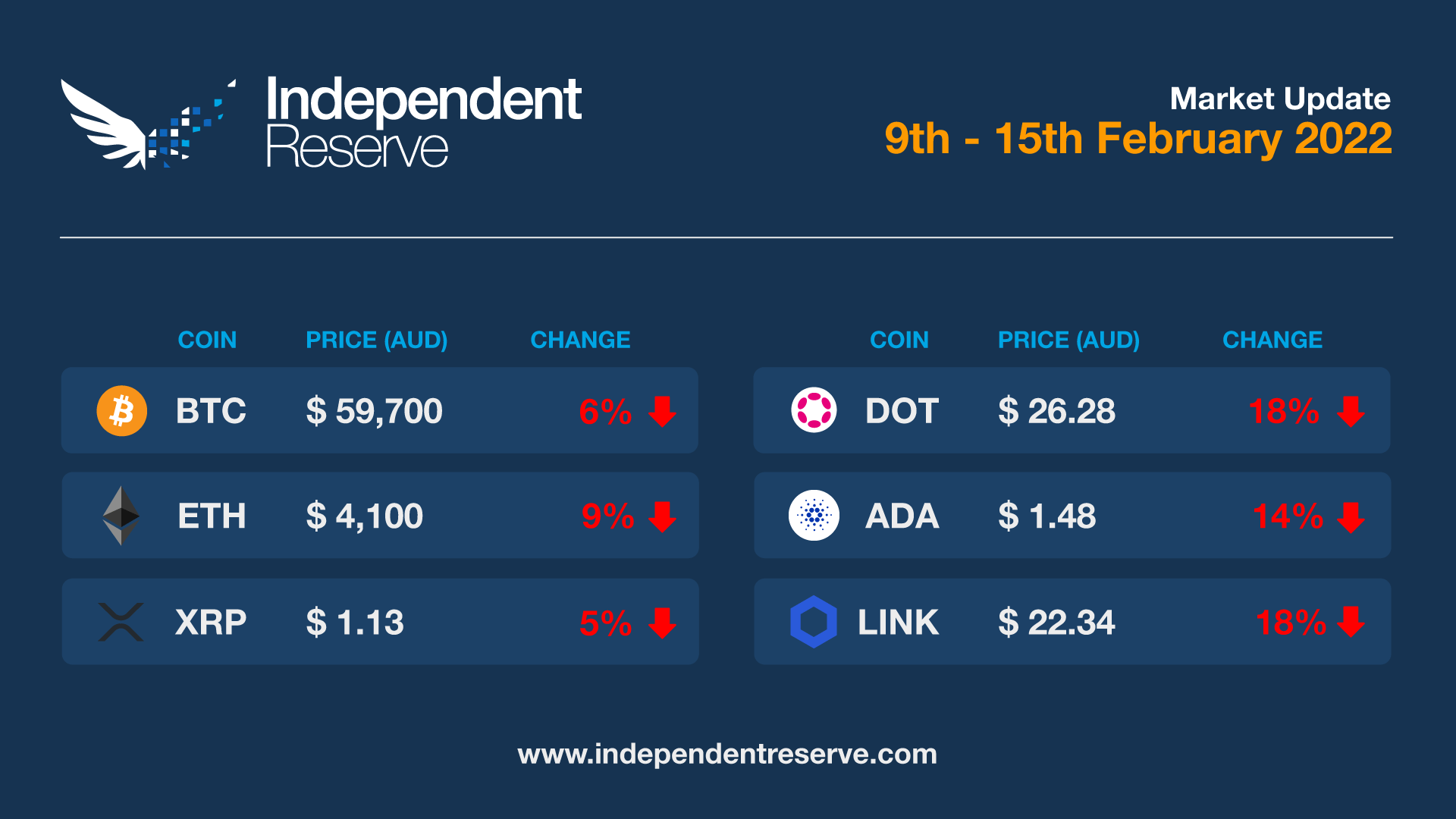

After an all too brief spell of fine weather last week, normal service has resumed, with Bitcoin falling 5.6% this week to trade around AU$59,700 (US$42.6K). Ethereum fell 9.2% to AU$4,100 (US$2.9K), while XRP was down 5.3%, Cardano (-14%), and Polkadot (-17.6%). The falls in crypto markets mirror falls in traditional markets which most blame on mounting fears of an imminent Russian attack on Ukraine. After hitting a local high of 54, the Crypto Fear and Greed Index has again fallen to 46 (Fear). In more promising news the Bitcoin hashrate has hit a new seven day average all time high of 201.3 terahashes per second (TH/s). It’s up 20% since the start of the year and peaked at 248 TH/s in the past 24 hours.

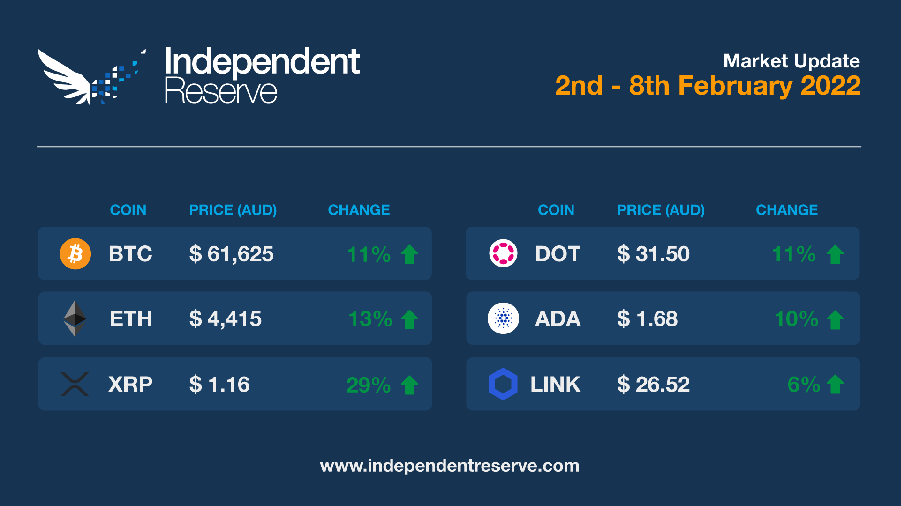

And just like that, ‘Crypto Winter 2022’ appears to have been just a couple of weeks of unseasonably cold weather. Of course, everything could still flip tomorrow, but the weather is fine and sunny this week with Bitcoin up 14.5% to trade around AU$62,000 ($US44K) and Ethereum up 13% to trade above AU$4400 (US$3.1K). Everything else was up by double figures, including Cardano (10%), XRP (29%), and Polkadot (11%). Influencer Lark Davis summed up the price action, tweeting yesterday: “Bitcoin has been in a downtrend since November, we have now broken out of that trend. Next stop? MOON.” The Fear and Greed Index has risen to 45 (Fear) – up from 26 last week – and the total market cap of all cryptocurrencies is up nearly half a trillion this week to AU$2.814T (US$2T).

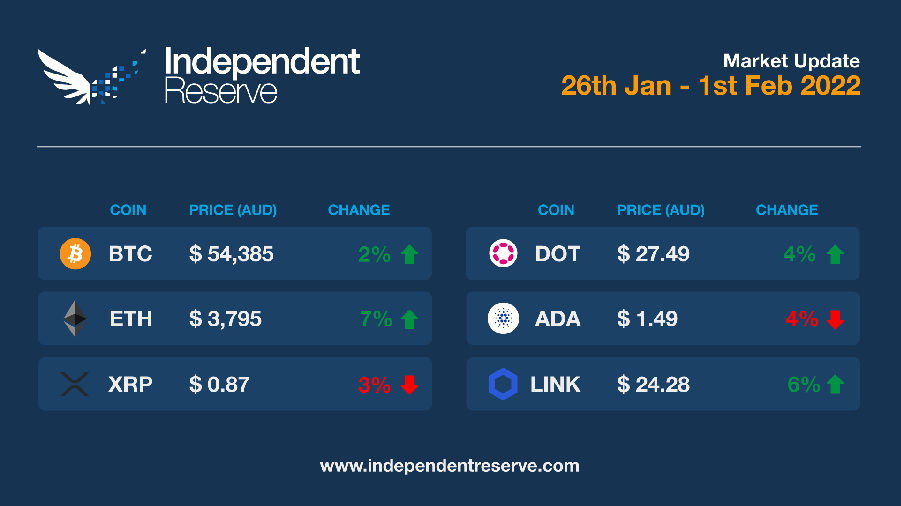

Let’s face it: January was not a great month for the crypto markets, with the market cap for all cryptocurrencies plunging from almost AU$3.2 trillion down to AU$2.47T today. It’s the worst start to a year since Crypto Winter began in 2018. There were only 11 green days this month and cryptocurrencies across the board lost double digits as prospective rate rises in the US spooked markets (here in Australia the RBA is expected to end the AU$4 billion a week bond buying program and open the door to interest rate rises after inflation reached the central bank’s target for the first time since 2014). Bitcoin is down 19.5% on a month ago, and Ethereum is down 29%. The good news is that February has started with a bounce and BTC is up 2% in the past week to AU$54,385 (US$38,475) and ETH is up 7% to almost $3,800. Cardano lost 4%, Ripple was flat and Polkadot increased 4%. The Crypto Fear and Greed Index is at 20, which is still ‘Extreme Fear’ but heading in the right direction after bottoming out last week around 11.

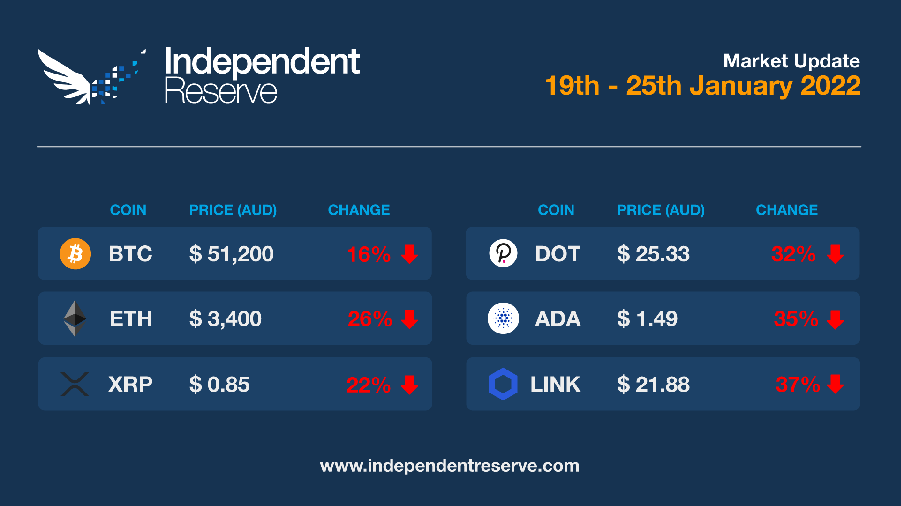

The party is over, the fluro lights are back on and what seemed a magical playground now looks more like a church hall strewn with empty beer cans. That’s the general feeling this week after crypto markets nuked, wiping half a trillion off the combined market cap. Bitcoin plunged to AU$46,560 overnight (US$32,970) – a 51.6% decline from the all time high in November – but bargain hunters have pushed that back up to AU$51,200, capping the loss at 16% this week. Various analysts have suggested that level may be the bottom, but nobody really knows for sure. The current correction is in the league of the 51% correction from April to May last year and the 60.8% correction from June 2019 to March 2020. We remain at levels last seen in July 2021. The Grayscale Bitcoin Trust Premium plummeted to an all time low of 30%, but El Salvador bought the dip, adding 410 BTC to its stack. Ethereum lost 26%, Cardano lost 35%, XRP (-22%) and Polkadot (-32%). The Crypto Fear and Greed Index is at 13, or Extreme Fear, after dipping to 11 yesterday.

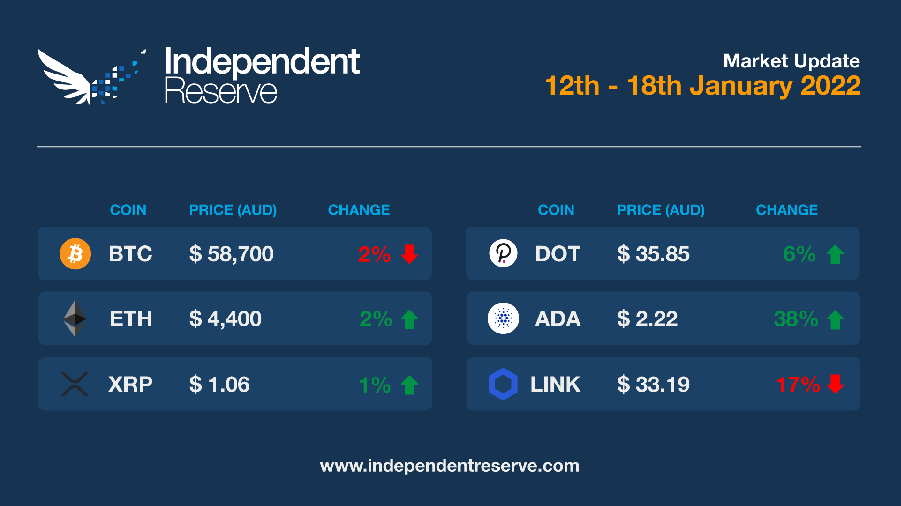

Although Bitcoin managed to break above AU$60K (US$43K) a few times, at the time of writing it had pulled back to around AU$58,700 (US$42.3K) for a -2% finish to the week. Ethereum gained 1.5% this week and is up around AU$4,400 (US$3.2K) while Cardano surged on positive network metrics and announcements and is up significantly by 38%. XRP was flat, Polkadot (4.5%) and Dogecoin (17%) both saw more significant gains. The Crypto Fear and Greed Index is at 22, or Extreme Fear which is pretty much where it’s been stuck so far in 2022.

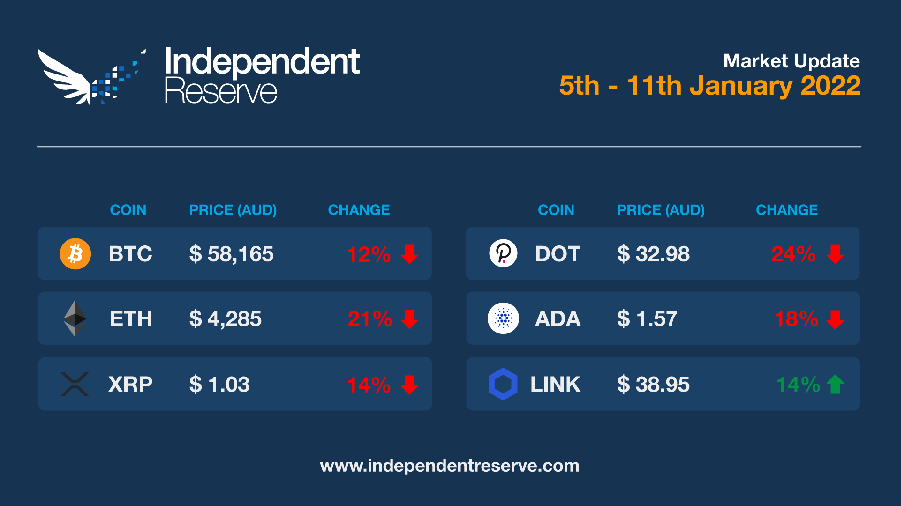

It hasn’t been a great start to 2022, with Bitcoin essentially reversing an entire year of gains to be back in similar territory to January 2021. Bitcoin plunged on the weekend following an internet outage in Kazakhstan and signs the Federal Reserve was becoming hawkish. It dipped below the psychological US$40K (AU$55.7K) mark earlier today, with Ethereum falling below US$3K (AU$4.18K). Overall crypto markets have lost US$1 trillion (AU$1.4T) since the all-time high in November. At the time of writing Bitcoin was down 12% for the week just above AU$58,100 and Ethereum had lost 21% and was trading just under AU$4,300. Cardano lost 18%, Ripple (-14%), Polkadot (-24%) and Dogecoin (-18%). Bitcoin’s RSI fell below the May 2021 crash, making it the most oversold since the March 2020 pandemic crash. The supply in profit is around 66%, similar to July last year. Some hope this means the bottom is in. After dipping to 10, the Crypto Fear and Greed Index is now at 23, or Extreme Fear.

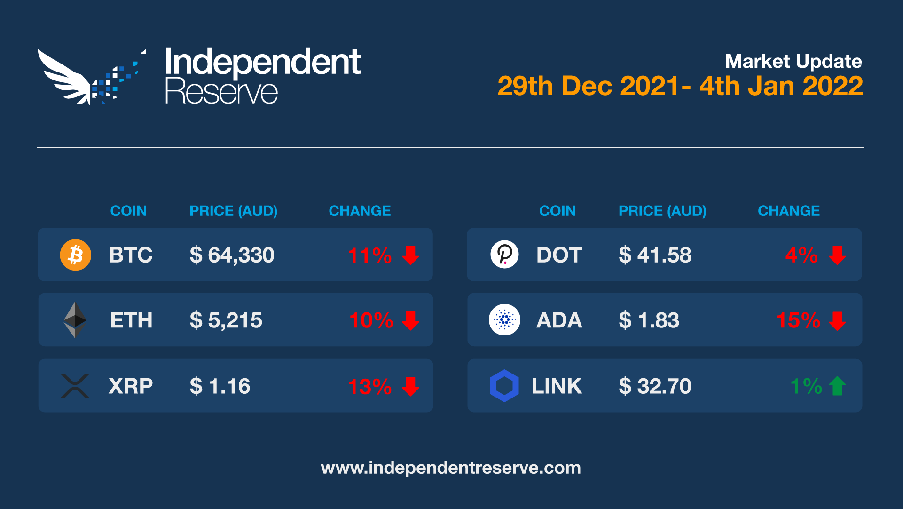

Bitcoin may have pulled back one third from its all-time high of AU$95.7K (US$68.9K) in November, but it’s still up by almost 50% from a year ago, beating out the S&P 500 which was up 27% in 2021. Bitcoin’s performance was better than 2019’s 75% drop but didn’t hit the heights of other annual gains since 2016, which ranged between 81% to 1390%. Bitcoin dipped to around AU$63,000 (US$46.2K) on New Year’s Day and is currently trading around AU$64,300 (US$46.2K) for a loss of 11% this week. A survey of 110K CoinMarketCap traders tips we’ll hit AU$73K (US$52.6K) by the end of the month. Ethereum was down 10%, Cardano (-15%), XRP (-13%) and Dogecoin (-11%). Synthetix turned a corner, up 11% this week. The total crypto market cap is currently just over AU$3 trillion. The Crypto Fear and Greed Index is at 29 or ‘Fear’.

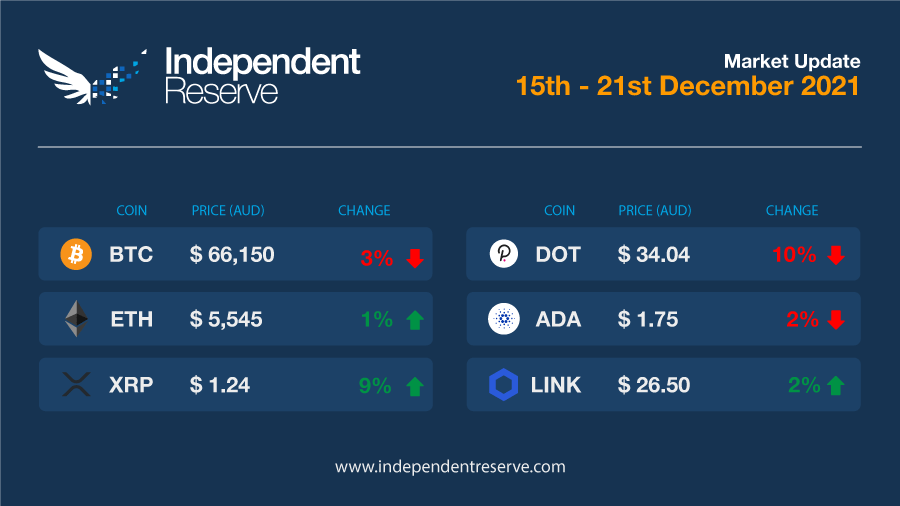

The Bitcoin price is around one third down from its all-time high price a little over a month ago. But while sentiment is bearish, on chain metrics remain strong and miners are holding on to their coins, with outflows halving in the last month and unspent supply about to hit a new ATH. Bitcoin spent most of the week trading between AU$64K and AU$69K (US$46K to $50K) and finished the week roughly where it began, around AU$66,000. Ethereum gained 1% and is trading around AU$5,550, Cardano was flat, XRP was up 9% and Dogecoin gained 3%. The Crypto Fear and Greed Index spent the week in the ‘Fear’ zone, but fell today down to 25 or Extreme Fear.

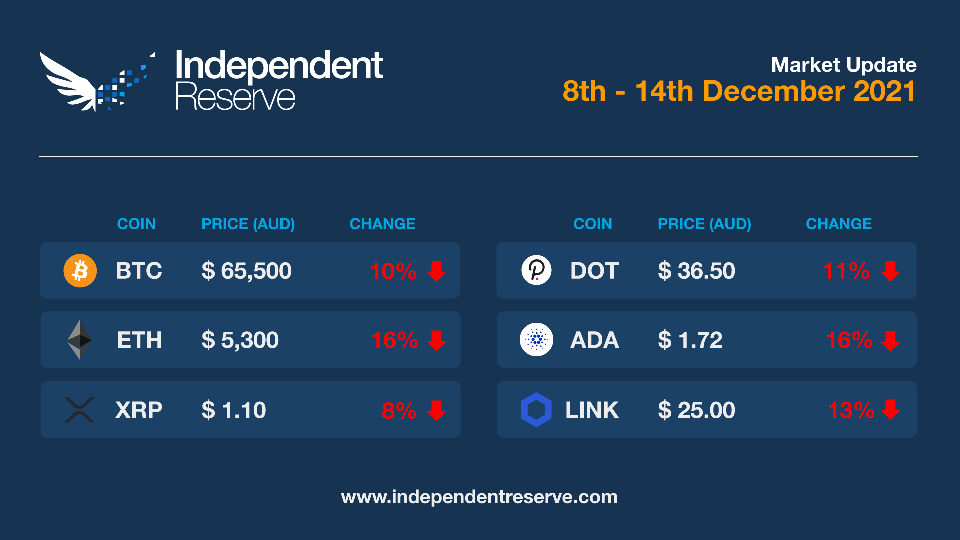

Crypto markets are seeing a price correction with many altcoins down by double digits this week. As usual, there are plenty of potential contributing factors, with inflation hitting a 40 year high in the US potentially forcing the Federal Reserve to accelerate its tapering plan and Chinese real estate giant Evergrande being declared in restricted default after failing to repay overseas bond holders. Bitcoin has also dipped below the 200-day moving average, which is never a good sign and finishes the week down 10% to trade around AU$65,500 (US$46,800). Ethereum lost 16% and is trading just above AU$5,300 (US$3,800). Cardano (-16%), XRP (-8%) and Dogecoin (-14%) all lost ground. The Crypto Fear and Greed Index is at 28, or ‘Fear’.

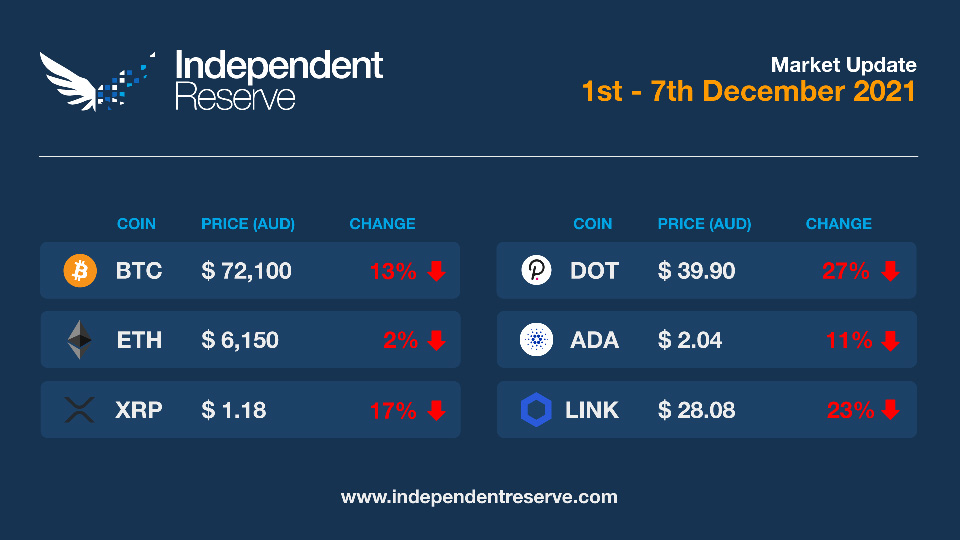

After its big weekend plunge, Bitcoin has been trundling along mostly below AU$70K/US$50K until today when it poked its head above. It’s still down 12.6% for the week and is trading at just above AU$72,100 (US$50.9K). Ethereum has performed considerably better and is now just 2.4% on this time last week to trade around AU$6,150. Everything else was down including Cardano (-10.7%), Ripple (-16.6%) and Dogecoin (-17.5%). The Crypto Fear and Greed Index is at 16, or Extreme Fear, the lowest reading since July.

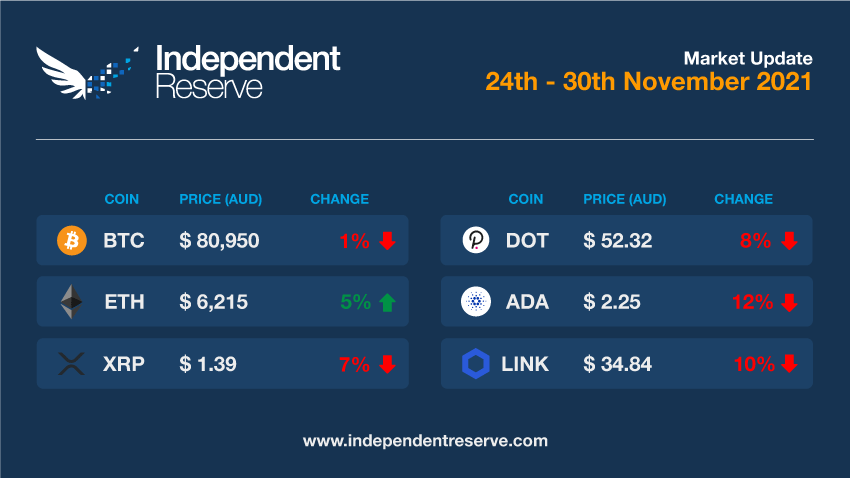

Crypto markets held a Black Friday sale when they tanked AU$280B (US$200B) late last week along with share markets on fears of a scary new variant from Omicron Persei 8. Crypto Twitter immediately flipped the switch to suicidal and the Crypto Fear and Greed Index plunged to Extreme Fear, even as an obscure ‘Omicron’ token gained 900% (before crashing of course). Markets have since recovered with Bitcoin finishing the week flat at just under AU$81,000 (US$57.8K). Ethereum’s up 5% on seven days ago to just above AU$6,200 (US$4.4K) but Cardano fell 12%, Ripple lost 7%. And it wouldn’t be a BTC price dip without news that Microstrategy had bought an additional 7,002 Bitcoin at an average price of AU$82,821 (US$59,187), bringing its total stash to 121,044 BTC. Quantum Economics founder Mati Greenspan warns the volatility likely isn’t over just yet: “The over-exuberant recovery Bitcoin experienced once that fear subsided is of little consolation, as we can now see that the digital currency is clearly vulnerable to a stock market panic.”

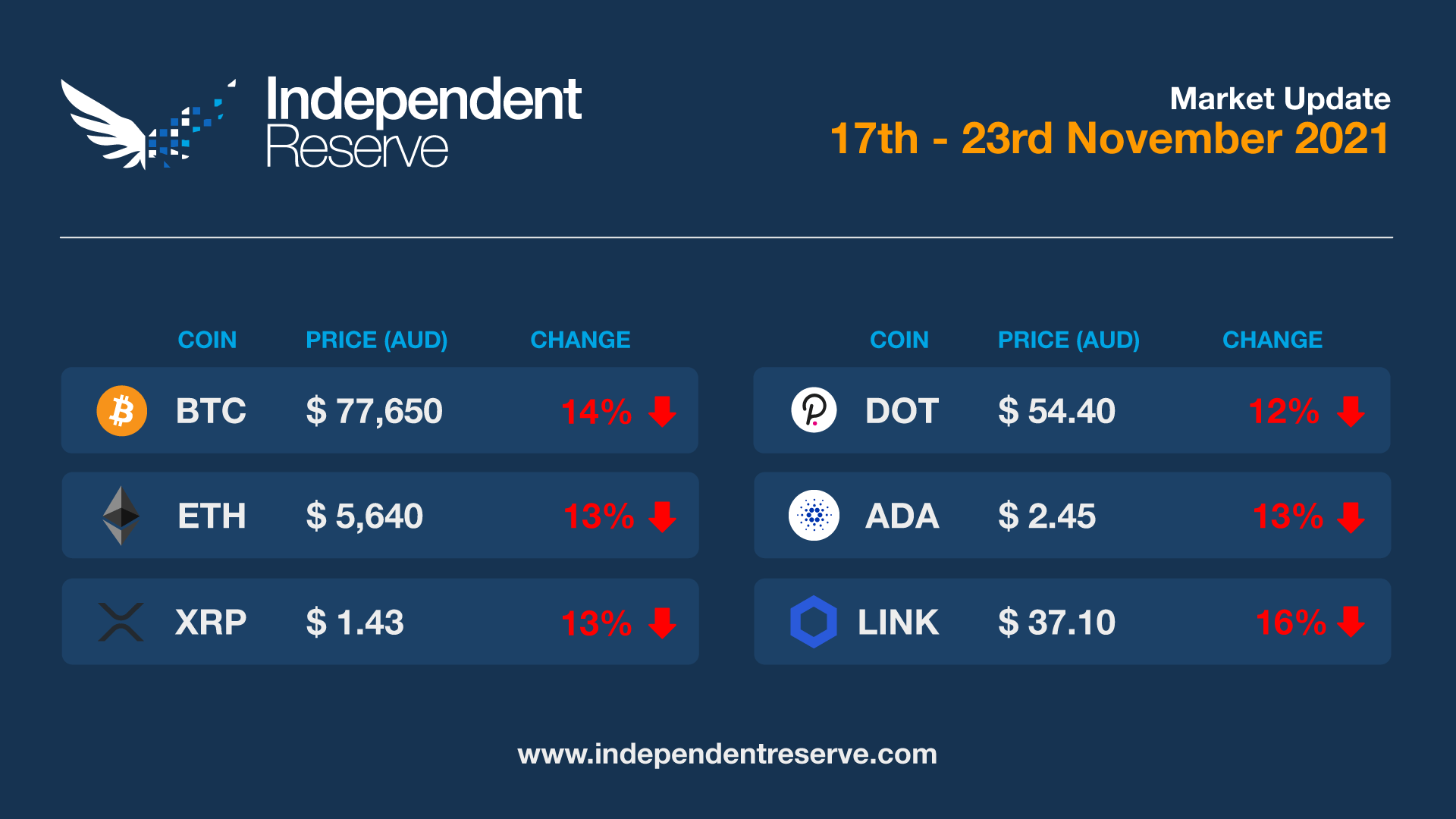

After reaching new highs earlier in the month, crypto markets have pulled back across the board, with Bitcoin losing 14% on seven days ago to trade around AU$77,650 (US$56,500). Ethereum is trading around AU$5,650 (US$4,100) which is down 10.2% on seven days ago. Most other coins pulled back too: Cardano (-13%), Ripple (-13%) and Polkadot (-12.3%). Interestingly Dogecoin (-15.8%) was pushed out of the top ten by Avalanche which gained 42% this week. As you might expect sentiment took a dive from 72 last week (greed) down to 50 (neutral) this week according to the Crypto Fear and Greed Index.