Market update

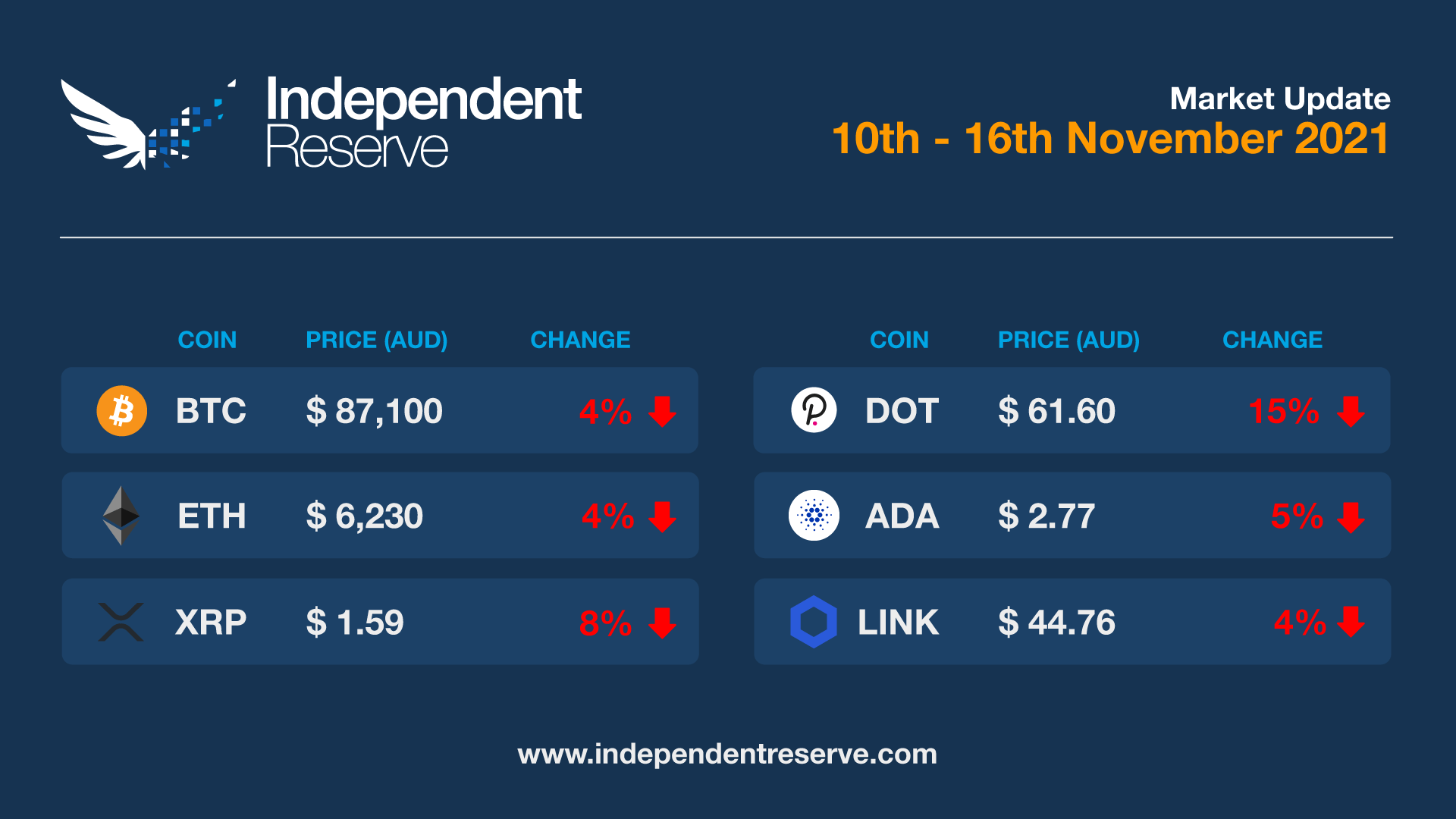

‘Moonvember‘ isn’t quite as catchy as ‘Uptober’ but Bitcoin and Ethereum have still been making new all time highs. On November 10, Bitcoin hit AU$93,450 (US$68,514) before plunging 10%. It’s currently 3.9% down for the week and is trading around AU$87,100 (US$64K). ETH’s new ATH that same day was AU$6,612 (US$4,834) and it is currently 4.3% down for the week at AU$6,238 / US$4,563. Cardano lost 4.8% during the past week, XRP lost 8% and Dogecoin (-7.2%). The Crypto Fear and Greed Index is at 72, or ‘Greed’. Onchain analyst Willy Woo thinks high expectations are holding back a bigger price run. “Whenever everyone’s bullish, it’s very difficult for the price to run upwards because you get a whole lot of speculative long positions in the markets and that makes it very, very profitable to take the other side and short it,” he said. “The majority is very seldom right.”

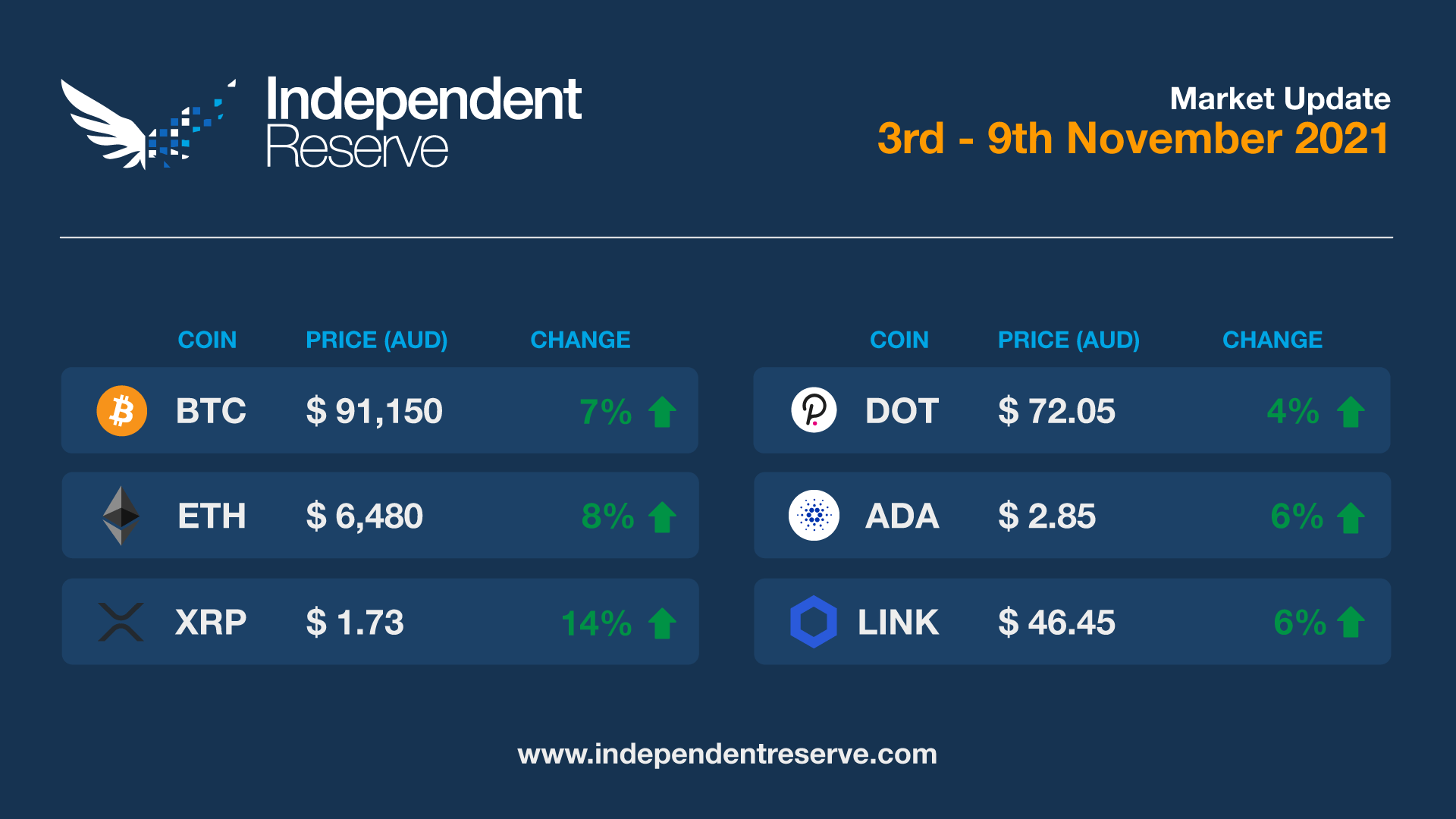

After a big surge yesterday, and another one this morning, Bitcoin is officially in all-time high territory again against USD, AUD, SGD, and NZD. The price is up 7% in 24 hours, and 9.5% on the week. Analyst Rekt Capital has just posted a chart suggesting a blistering end to the year: “One final resistance left before #BTC enters its parabolic phase of the cycle.” Ethereum cruised on through to hit a new all-time high of AU$6,503 (US$4,822) a few hours ago and is currently trading up 8% on the same time last week at AU$6,480 (US$4,800). Cardano was up 6%, XRP gained 14%, Polkadot (4%). The Crypto Fear and Greed Index is at 75 or Greed.

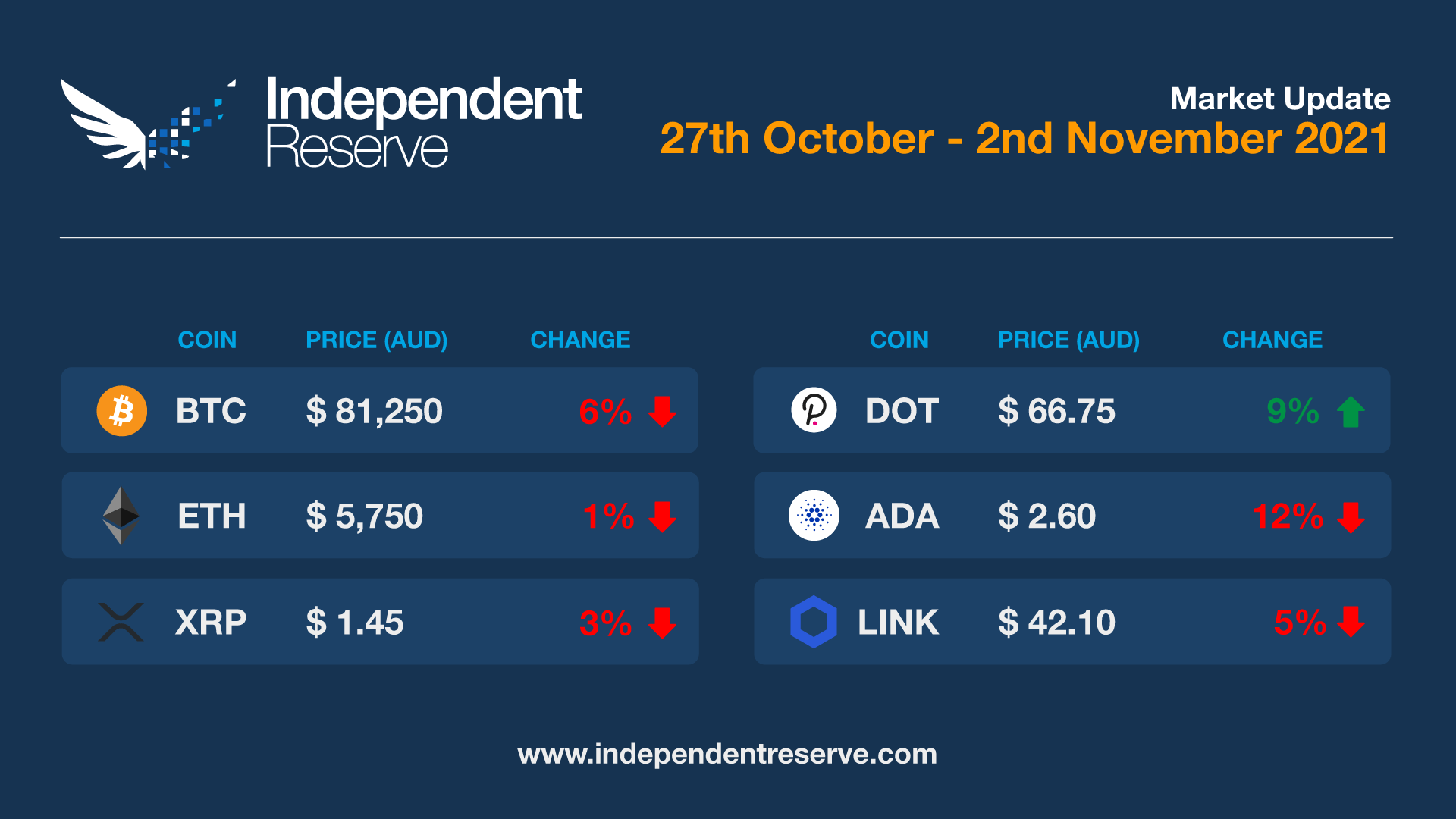

Uptober was a great month for investors, with Bitcoin up 39.9%, for the best result since December last year. Glassnode points out that in USD value, the total price range of the candle of $23,205 (AU$30,850) was larger than Bitcoin’s entire price range in the decade or so from genesis to December 2020. (Incidentally, October 31 marked 13 years since the release of the Bitcoin white paper). This week however the coin fell 6% and finished up around AU$81,250. Ethereum also pushed into price discovery on October 29 with a half trillion USD market cap (AU$676B) and is currently around AU$5,750. XRP was fairly flat, Polkadot gained 9%, Dogecoin was up 2.2% (but was pushed out of the top ten by meme clone Shiba Inu), Uniswap gained 2.2% and Cardano lost 12%. The Crypto Fear and Greed Index is at 74 or Greed.

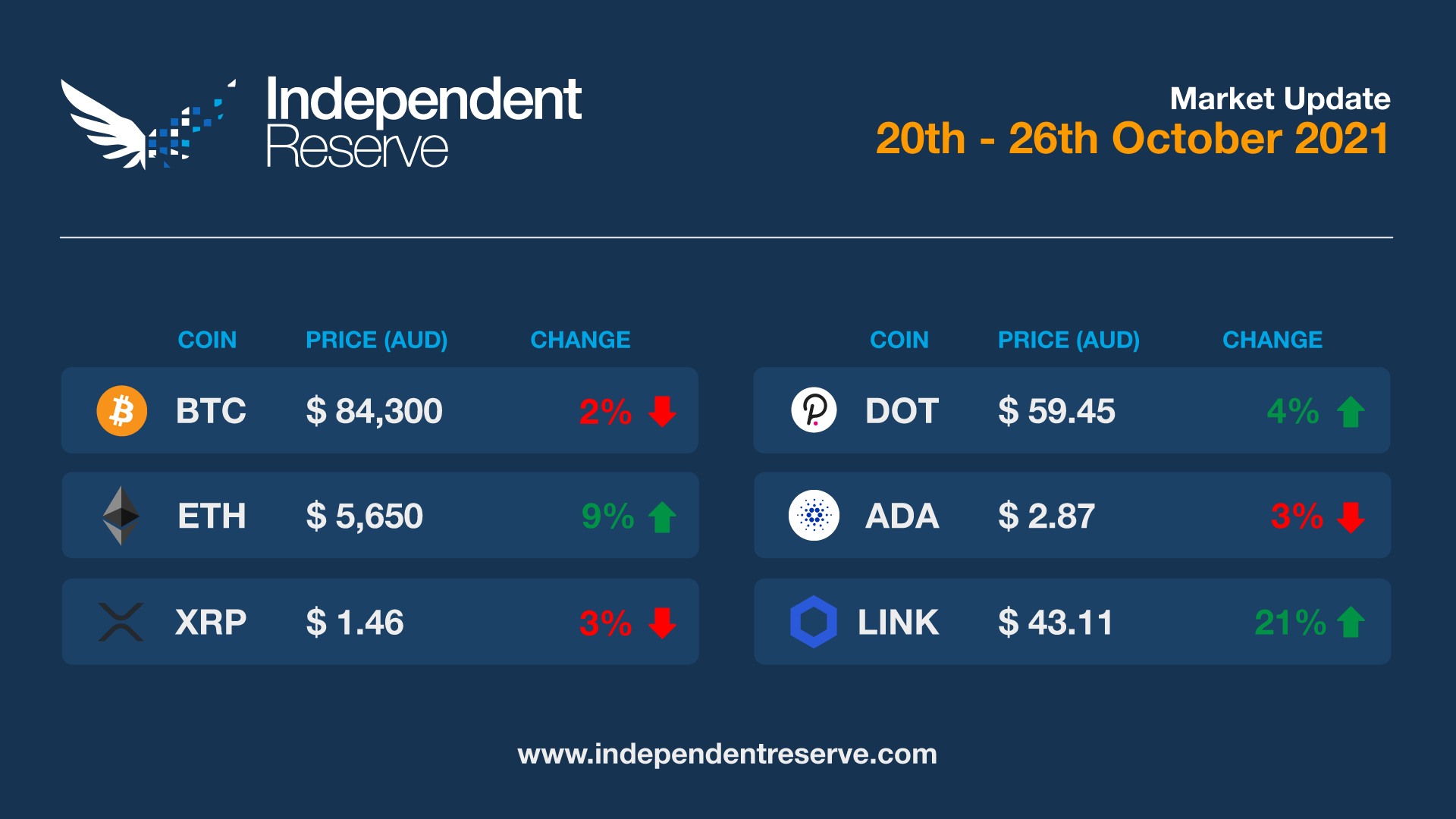

Congratulations team, we have notched up a new all-time high, with Bitcoin hitting AU$89,160 (US$66,234) on October 21. The market cap of all cryptocurrencies is currently at AU$3.491 trillion (US$2.62T). Ethereum made a push but faltered about $10 short of previous USD all time highs, hitting US$4,330) on October 21. Due to AUD/USD fx rate changes, the AUD price of ETH did hit a new all time high of $5,838. As Crypto Twitter likes to say WAGMI. Bitcoin is currently trading just around AU$84,300 and is down 2% for the week. Ethereum is trading at AU$5,650 and is up 9% for the week. Cardano and XRP were fairly flat this week, Polkadot gained 4%, Dogecoin (3%), and Chainlink (21%). The Crypto Fear and Greed Index is at 72, or Extreme Greed.

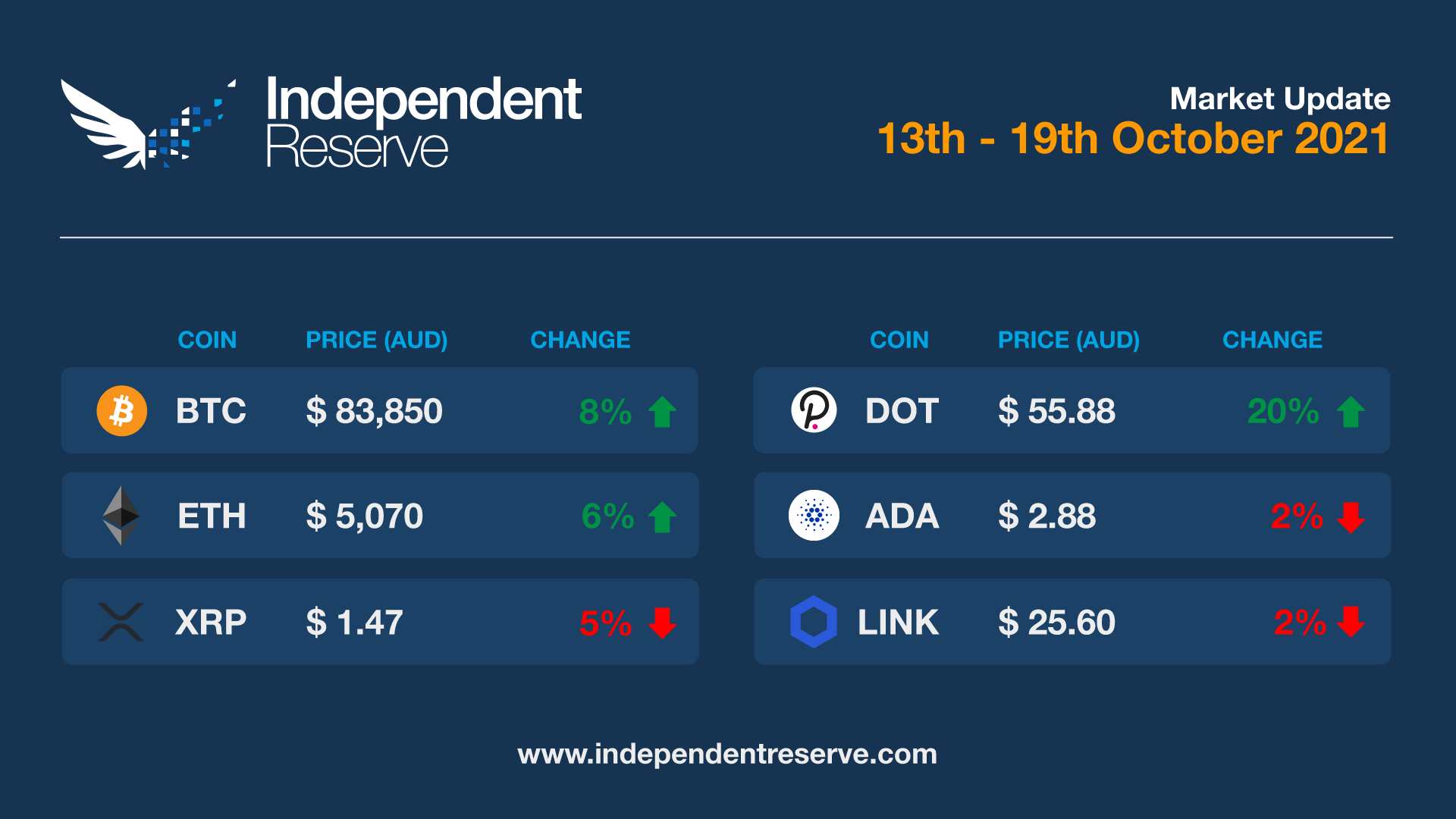

Bitcoin has blasted through the US$61K / AU$83K mark thanks to the arrival of Bitcoin futures ETFs. It’s just seen the highest ever weekly close and is not far off the all-time high price seen on April 14 when Bitcoin hit AU$84.7K. At the time of writing Bitcoin was trading just under AU$83.7K (US$62k, SG$83.7k), up 8% for the week and 28.2% for the month. The big question is whether the Bitcoin futures ETF will be a “sell the news” event? Ethereum gained 6.4% to trade just over AU$5,000, though it’s only up 9.2% for the month. Cardano was down 2% and XRP lost 5% however Polkadot gained 20%, Dogecoin (6%), Uniswap (7%), Litecoin (4%) and Chainlink lost 2.6%. The Crypto Fear and Greed Index is at 78, or Extreme Greed.

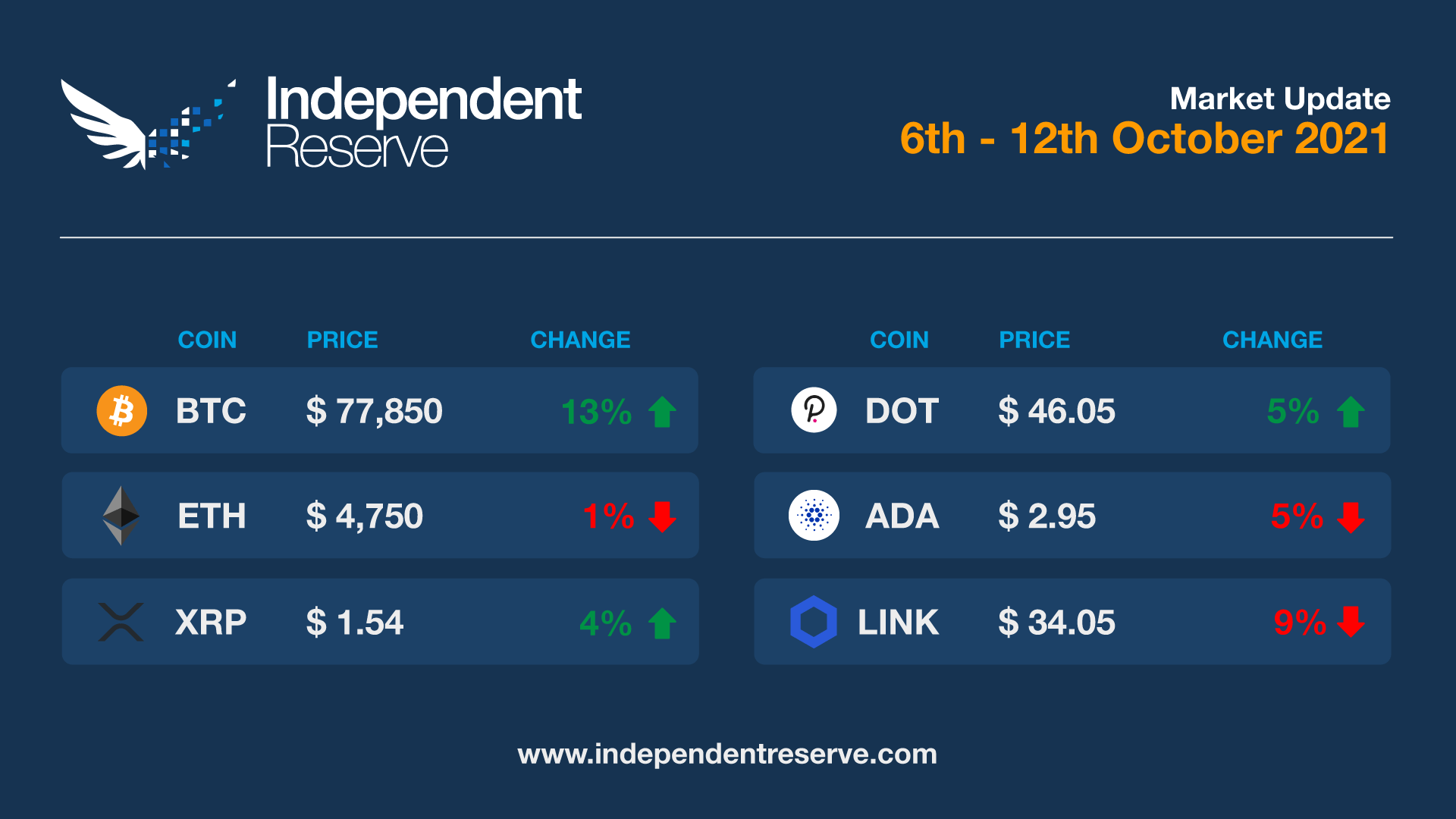

‘Uptober’ seems to be going well for Bitcoin in particular, with the price increasing 13% this week to around AU$78,000 (US$57.3K), its highest level in five months. Expectations are now high for a big fourth quarter, and with April’s ATH of AU$84.7K (US$64.9K) back in sight, “all data science models suggest that BTC will peak much higher than US$100,000 (AU$136K) in this cycle,” analyst Rekt Capital said. While alt season may be a little way off just yet according to trader Pentoshi, it is coming. Ethereum was up 4% to around AU$4,800 (US$3.5K), XRP (9.35%), Polkadot (9.1%). But Cardano fell 1.1%, Dogecoin (-3.8%), Chainlink (-5.6%). The Crypto Fear and Greed Index is at 71, or Greed.

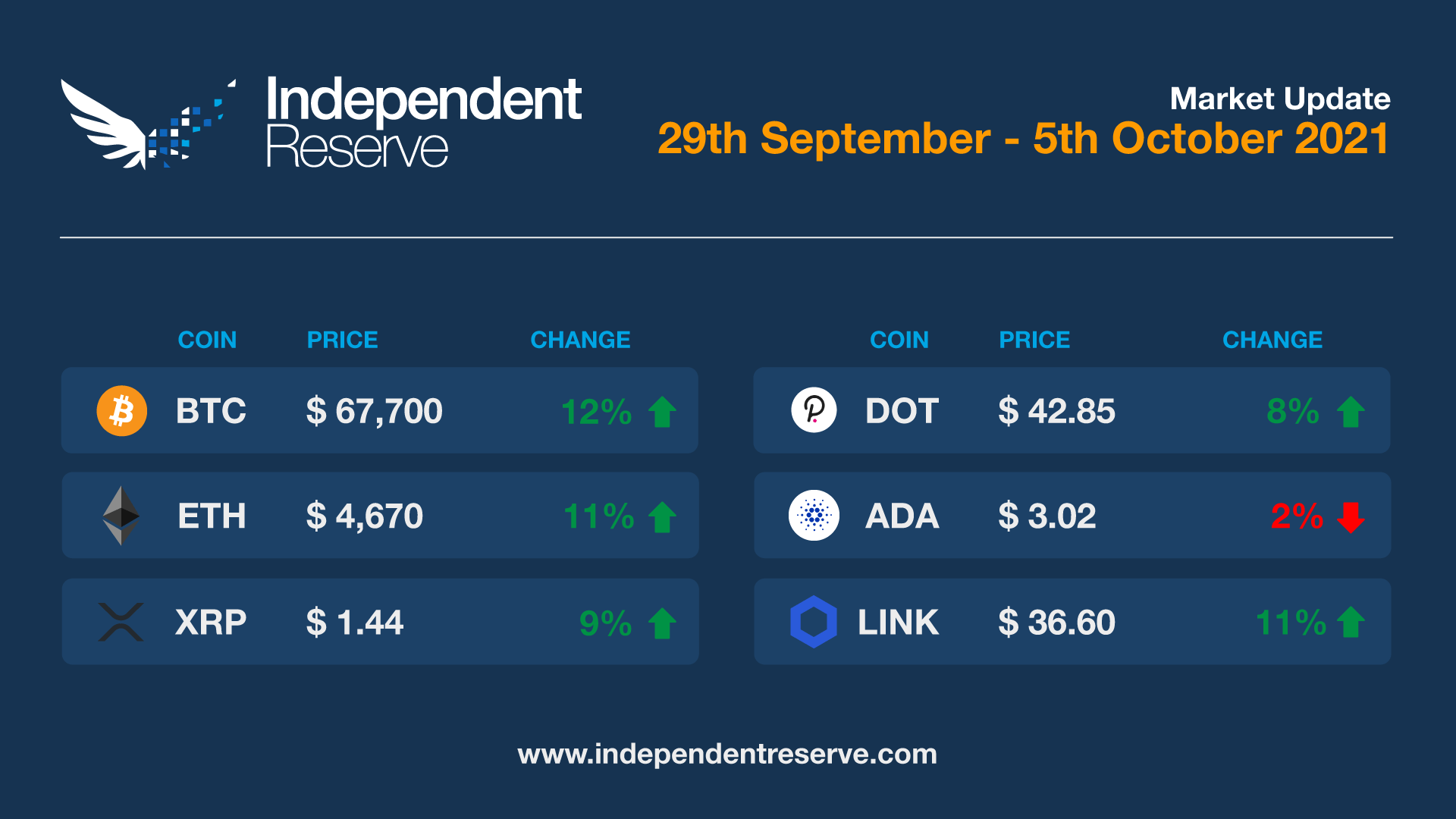

September is historically the worst month for Bitcoin and the price was hit by fears over Evergrande and the latest China crackdown … but we have now entered what Crypto Twitter optimistically calls ‘Uptober’. The global crypto market cap is back at US$2.1 trillion (AU$2.9T) – more than the US junk bond market – and around 86% of the supply is currently in profit. Bitcoin is up 12% on the same time last week to trade just under the US$50K mark, at around AU$67K. Ethereum also jumped 12.3%, Ripple (9%), Polkadot (8%), Chainlink (11%). Cardano was flat. The Crypto Fear and Greed Index is at 54 or neutral. Despite the recent market rebranding of October, it’s also the month that saw the 1929 Stock Market Crash and Black Monday in 1987…

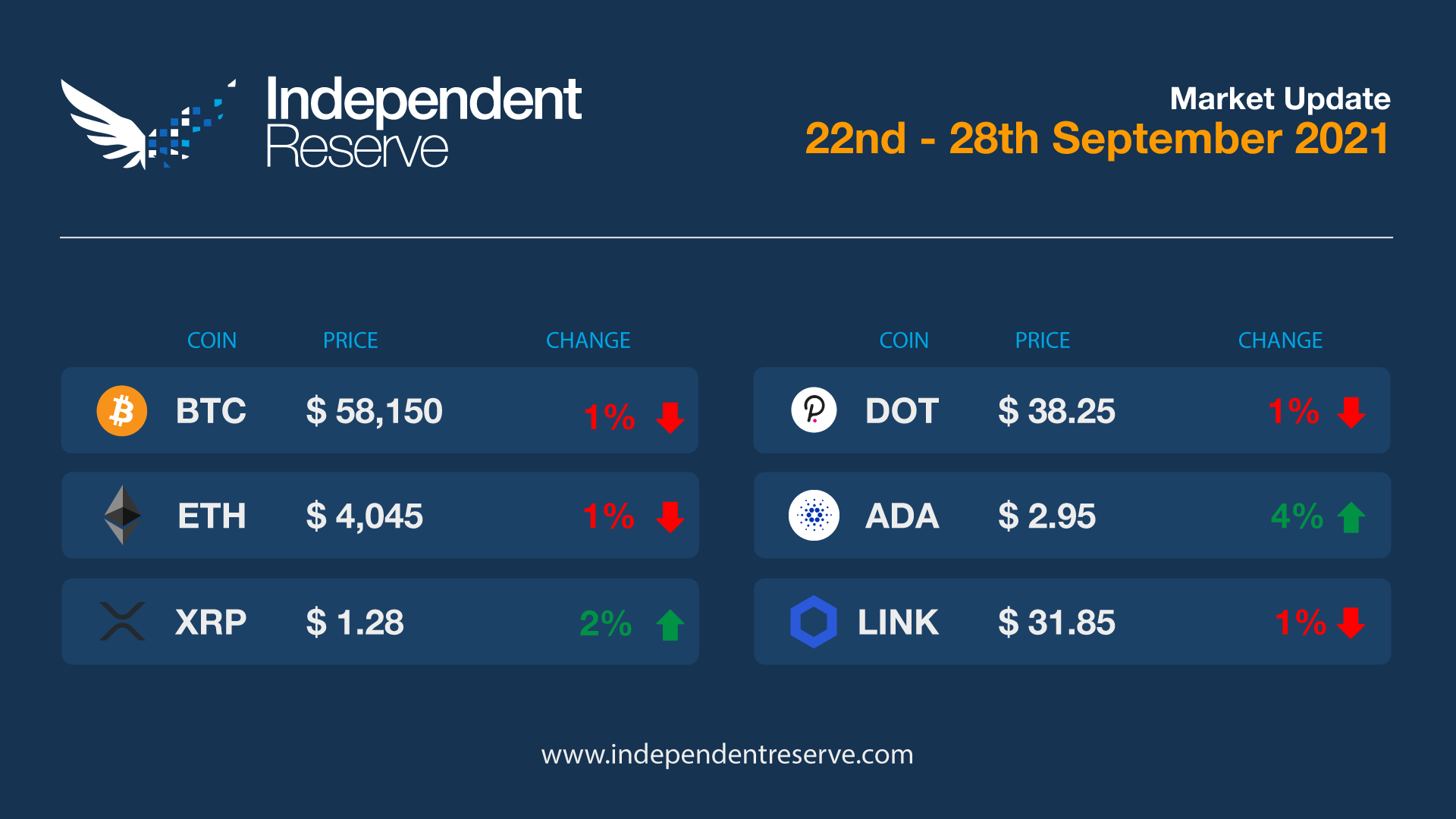

Despite new China ban FUD, the existing FUD about Evergrande, and the looming passage of the Infrastructure bill in the US Senate, Bitcoin has held up remarkably well (compared to where it started) and finished flat this week to trade around AU$58,150 (US$42.6K). BTC is also about 13.8% down on 30 days ago, but September is historically a poor month for returns. Ethereum was also flat, while Polkadot was down 1%, Ripple was up 1.6%, Cardano increased 3.5% and Uniswap was up 10.5%. The Crypto Fear and Greed Index is at 26, or Fear.

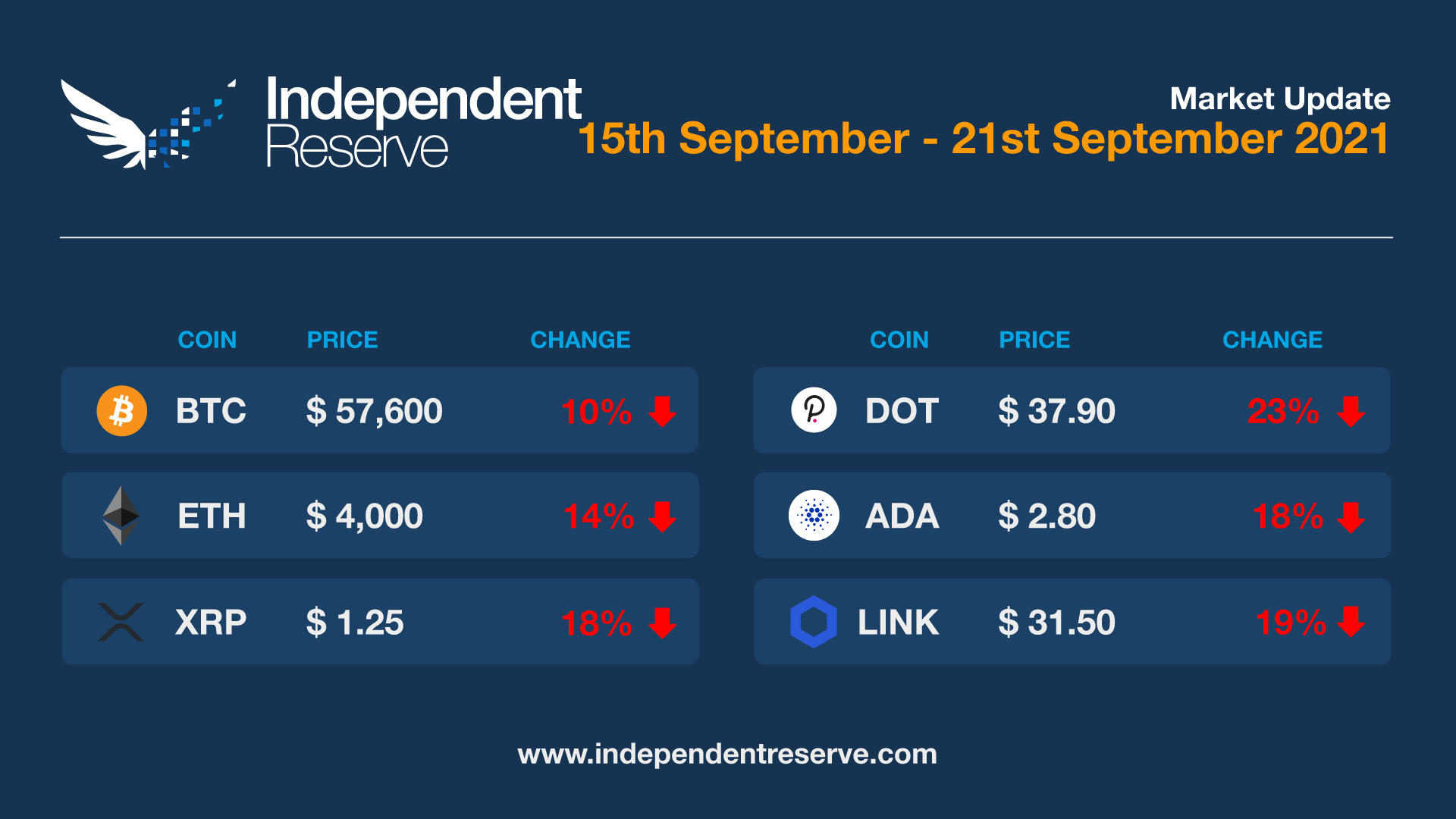

Crypto markets fell this week alongside traditional markets over mounting concerns Beijing will allow Chinese property giant Evergrande to default on its massive AU$400 billion (US$300 billion) debts. Bitcoin finishes the week down 10% to AU$57,600 (US$ 41.9K) while Ethereum lost 14% and is trading around AU$4,000 (US$ 2,950). Everything else lost ground: Cardano (-18%), Ripple (-18%), Polkadot (-23%), Dogecoin (-17%), Chainlink (-19%). In more positive news crypto assets held by institutional managers rose for a fifth straight week and El Salvador bought the dip, adding another 150 BTC to its stash.

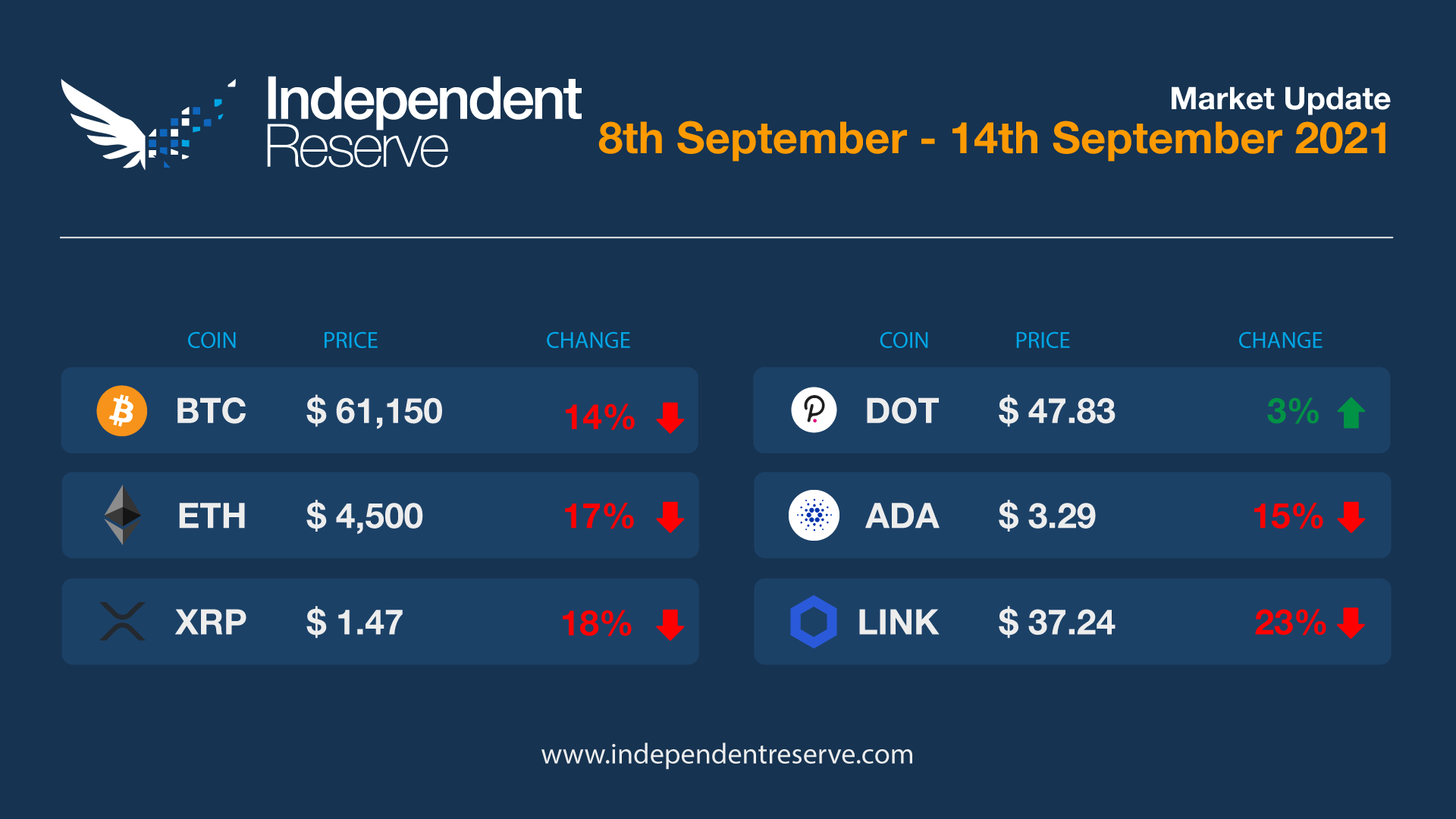

Bitcoin has had a rocky week, with US$400 billion (AU$544B) wiped off markets on the day the Bitcoin Law went into effect in El Salvador. It finishes the week down 13.6% to trade around US$45.1K or AU$61,150. That’s also 4.5% down on a month ago. TVL locked in DeFi protocols has dropped from US$98.26B (AU$133.3B) to US$85.85B (AU$116.5B). Polkadot was a rare green shot, increasing by 3.4% but everything else lost ground including Ether (-17.2%), Cardano (-14.7%), Ripple (-17.9%), Chainlink (-23.2%). The Fear and Greed Index has pulled back to 44 (fear) which is down from 79 (extreme greed) last week. In more promising news, MicroStrategy has just bought 5,050 Bitcoin for an average price of US$48,099 (AU$65.3K) bringing its total to 114,042 BTC.

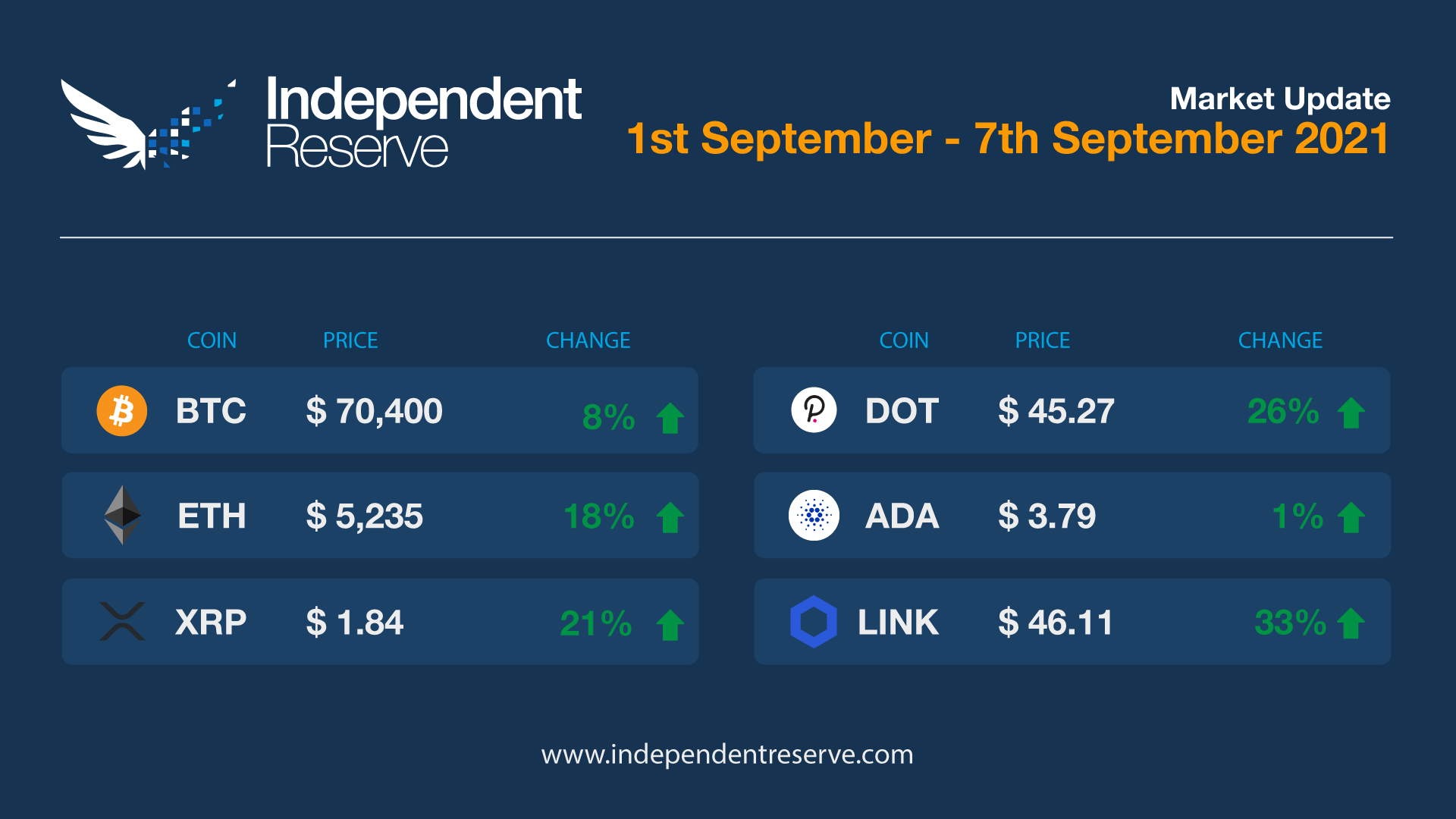

Bitcoin put in a strong showing this week and is up 8.3% to trade around A$70,400 (US$52.5K). According to Glassnode, the total amount of Bitcoin held on exchanges has hit a 2021 low. Ethereum did twice as well and is up 17.7% to trade just below A$5,300 (US$4K). It’s now within 10% of its all time high price of approximately A$5,645 (US$4.4K) set on May 12. To flip Bitcoin in market cap the price would need to double from here. Everything else was up: Cardano (0.7%), Ripple (20.6%), Dogecoin (9.3%), Polkadot (26%). The Crypto Fear and Greed Index is at 79, or extreme greed.

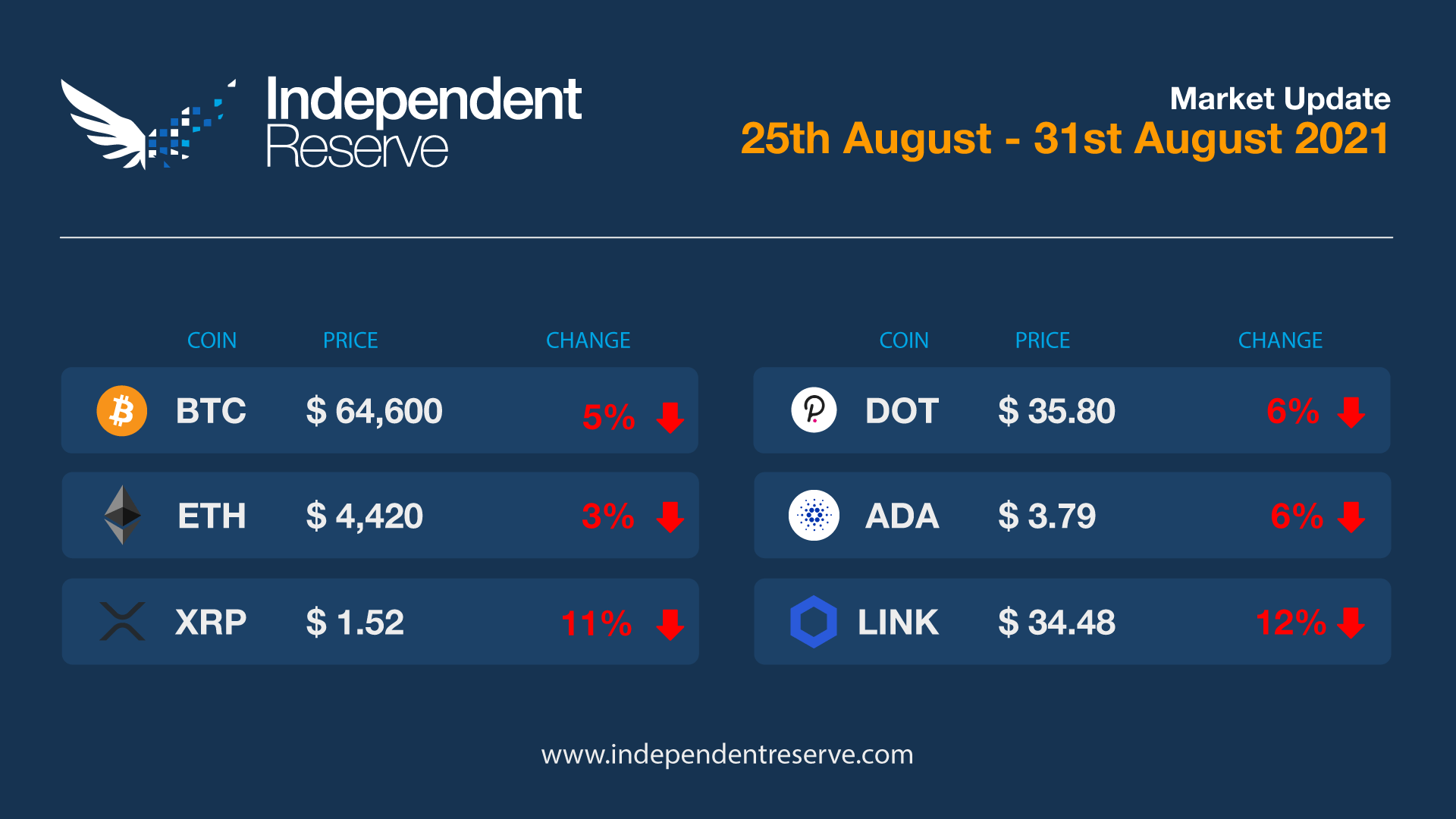

It was a week of consolidation for Bitcoin as it held on to most of the gains made over the month and traded in a range from A$64K (US$46.6K) to A$69K (US$50.3K). It’s currently down 5.1% from seven days ago to trade around A$64,600 (US$47.5K). Elsewhere prices eased across the board: Ethereum lost 3%, Cardano (-6.1%), Ripple (-11.3%), Dogecoin (-14.6%), Polkadot (-6.2%). The Crypto Fear and Greed Index is at 73, or greed.