In markets

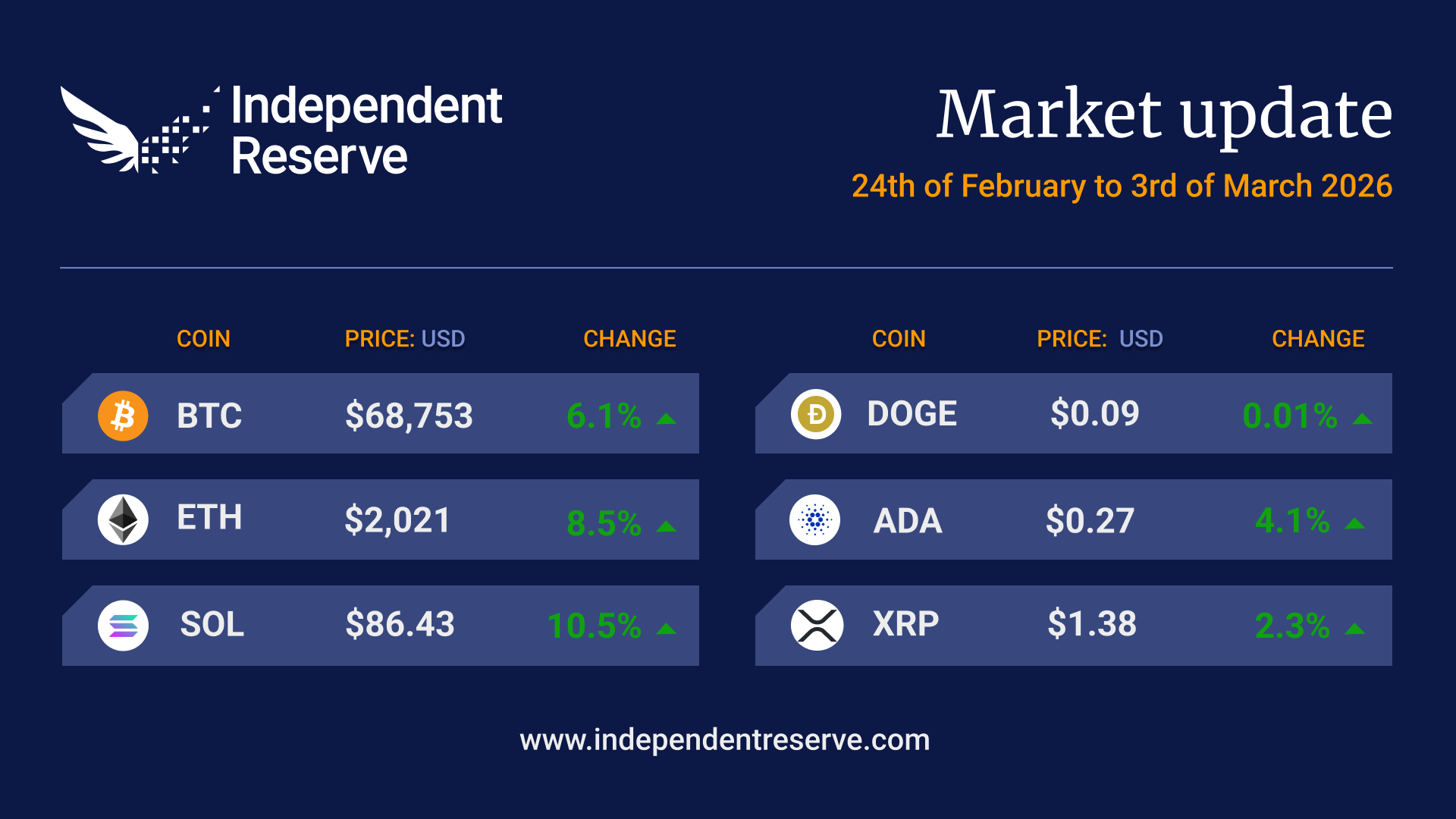

After trading above $73K on Monday, traders appear to have grown nervous that valuations were flying a little too close to the sun with Bitcoin suddenly plunging around 15%, liquidating $5B in leveraged positions this morning. Various pundits blamed Elon Musk who said on the weekend that BTC and ETH prices “do seem high” or US Treasury Secretary Janet Yellen who once again criticised BTC as “inefficient” and used for criminal activity. The Bitcoin price is still up 13.4% to trade just above $68,350. Ethereum traded above $2,500 for the first time this week but has fallen back to $2,250 which is where it was this time last week. Polkadot surged 35.9%, Ripple was up 3.6% and AAVE was flat, but everything else was down on seven days ago: Litecoin (-1.2%), Bitcoin Cash (-9.7%), LINK (-3.7%), Stellar (-5.3%) and Synthetix (-15.6%).

In headlines

$1 trillion market cap

Bitcoin smashed through the US$1 trillion mark (A$1.26T) on the weekend, where it remains despite the ‘dip’. The market cap has doubled so far in 2021 … and it’s only February. Breaking the barrier could encourage asset managers to take a serious look at Bitcoin says Cory Klippsten, CEO of Swan Bitcoin. “It will trigger many asset managers to take a closer look, but with Bitcoin’s total addressable market in the $200 trillion to $400 trillion range it’s still just a drop in the bucket,” he added.

Dots and Graphs

Independent Reserve has launched trading in Polkadot and The Graph today. Polkadot is the most hyped ‘Ethereum Killer’ on the market: an interoperable Proof of Stake blockchain project founded by former Ethereum CTO Gavin Wood that is the fourth-largest cryptocurrency by market cap. The Graph (GRT) meanwhile is an indexing protocol that makes it easy for Web3 developers to build decentralised apps. Node operators stake and earn GRT for processing API queries.

Ethereum rally

Ethereum has topped US$ 2,000 (A$2,526) for the first time, after increasing by a third since ETH reached $1,500 (A$1,894) for the first time on Feb 2. Analyst Joseph Young said there were three reasons behind the rally: “The rapid growth of DeFi, the hype around ETH after the CME futures trading listing, and the decreasing amount of BTC and ETH on exchanges.” Gas fees on ETH went from expensive to ludicrous during the volatility yesterday (influencer Anthony Sassano says bots will pay any gas price as long as the overall trade is profitable) topping out at 1,450 Gwei. That’s about 10 to 15 times the cost of the already expensive gas fees.

Fools rush in

The Motley Fool investment advisory service has recommended Bitcoin to members and will add the cryptocurrency to its 10X portfolio, in expectation of the price rising to half a million. It’s also converting $6.31M of the company’s reserves to Bitcoin. “While Bitcoin may very well continue to be volatile in the short term, we think it has 10x potential from today’s levels over the long term as part of a diversified portfolio. We plan to hold this Bitcoin investment for many years.” Not all of its analysts are convinced: In the days since it has published articles saying “Forget Bitcoin” and “Why I’ll never buy Bitcoin”.

A more sober assessment

A new survey from Gartner found that only 5% of finance executives surveyed planned to invest in BTC this year. And The Wall Street Journal reported that J.P. Morgan analyst Nikolaos Panigirtzoglou found that “since September only about $11 billion [A$13.9B] of professional money has entered the Bitcoin markets” suggesting that “the attention given to institutional investors has drawn in more retail investors” and that contrary to perceptions “retail-driven momentum trading” is driving the rally.

XRP and MoneyGram part ways

MoneyGram will no longer be using Ripple’s payment protocol to complete cross border settlements. The company announced that: “Due to the uncertainty concerning their ongoing litigation with the SEC, the Company has suspended trading on Ripple’s platform.” Ripple has also become a Wyoming based company to take advantage of the state’s crypto-friendly laws.

Canada’s Bitcoin ETF rocketing to one billion

Canada’s first Bitcoin ETF rocked up to $533M asset under management in the first two days, with experts tipping it will hit $758M by the end of today and $1.26 billion in a week. Bloomberg ETF analysts Eric Balchunas pointed out the biggest Canadian ETF only has $10B AUM and the second biggest has $6.3B. “I wouldn’t be surprised if this passes one or both of them in the next couple of months,” he said.

Macro Strategy

Meanwhile, unofficial US-based Bitcoin ETF, MicroStrategy set off to raise US$600M to buy more BTC last week, upped their sights to $900M and then settled on a little over US$1 billion (A$1.26B) for the purchase. Various reports suggest the company will use Coinbase Pro and buy in $2000 lots per second over about ten days … but coincidentally $1 billion dollars of BTC was withdrawn from Coinbase just prior to yesterday’s plunge. Could it be related?

Fun stuff

- Tesla’s US $1 billion unrealised profit from its recent Bitcoin buy is greater than all the profit it made selling cars last year.

- There are now 100,000 Bitcoin addresses holding more than US $1M.

- Half of Crypto Twitter, and two members of US congress, changed their profile pics to feature laser eyes in a meme that looks set to be with us until BTC tops US $100K.

- You’d need one million Antminer S19 pros (Bitmain’s most powerful mining rig) to reach the current Bitcoin hash rate of 110M TH/s.

Until next week, Happy Trading!