In markets

Bitcoin has fallen further and faster than most pundits were expecting and is now trading at levels last seen in March. CryptoQuant’s Bull Score Index has declined to extreme bearish levels of 20/100, and the price is so far below the 365-day moving average of A$158K/US$102K that it’s slightly embarrassing. Part of the reason for this month’s price action now appears to be the possibility that digital asset treasuries like Strategy will be dropped from major indexes in January.

On a macro level, there’s fear over the “AI trade”, despite NVIDIA’s revenue exceeding expectations, and the uncertainty caused by the delay of October’s US jobs data until next month isn’t helping.

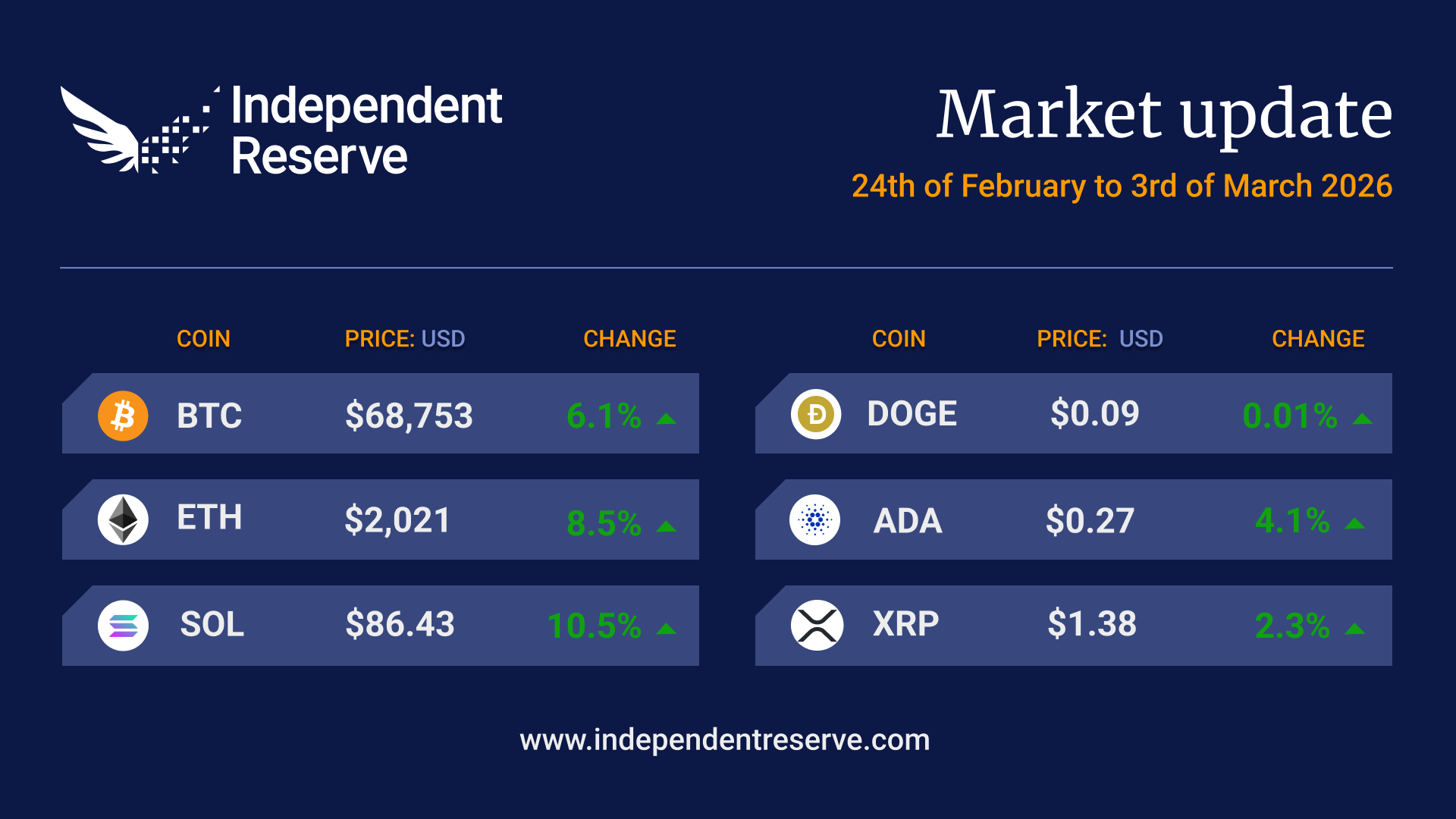

However, Bitcoin has trended upwards over the past two days, and prediction markets and pundits are growing increasingly confident of an early December US rate cut, which ARK Invest’s Cathie Wood says would be the catalyst for Bitcoin’s recovery. The tech-heavy Nasdaq also jumped 2.6% today after President Donald Trump announced he’s heading to China to meet with President Xi Jinping, suggesting the trade war may settle into a stalemate. After dipping below A$125K/US$81K, Bitcoin finishes the week down 3.9% to trade around A$136,427 (US$88,140) while Ethereum is down 2% to trade around A$4,556 (US$2,944). Solana gained 6.7% and Ripple gained 5.2% while Dogecoin was flat.

The Crypto Fear and Greed Index dropped to a level of 9, the lowest it has been since the FTX crash. Glassnode reported this week that 35% of Bitcoin, 40% of ETH, and 75% of Solana were being held at a loss, which likely helps explain the sentiment. The index has now recovered to 19, although that’s still Extreme Fear.

From the OTC desk

Japan’s debt spiral accelerates: Stimulus panic sends yen and bonds reeling

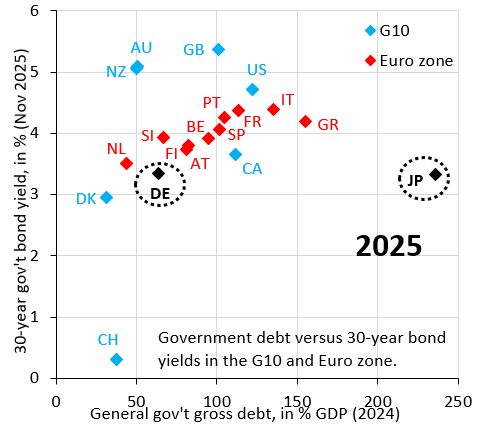

The yen and Japanese government bonds have continued to weaken sharply as confidence in Japan evaporates and negative sentiment snowballs. Markets are now bracing for a massive new stimulus package expected to be announced this Friday by the recently installed administration, a move that has only heightened anxiety. The yen has plunged to 158 against the USD, up from 147 in early September. Meanwhile, Japanese government bond yields have surged to multi-year highs, with the 30-year Japanese Government Bonds now yielding 3.3%. Investors are waking up to Japan’s deepening structural problems: consecutive quarters of GDP contraction, persistent inflation, and a public debt-to-GDP ratio exceeding 237%. For years, ultra-low interest rates were artificially sustained through the Bank of Japan’s yield curve control and massive bond-buying programmes. However, once global central banks aggressively hiked rates to combat inflation, the yen began a steady descent. Japan now faces an excruciating dilemma: allow market forces to push yields higher (which would trigger crippling borrowing costs given the country’s enormous debt load) or maintain yield caps and accept even faster yen depreciation. Either path risks further squeezing global liquidity, and rising Japanese yields tend to ripple into risk assets, including cryptocurrencies.

Digital asset treasury stocks crushed: From premium darling to discount

Digital Asset Treasury (DAT) companies, once celebrated as “buy-and-hold forever” vehicles, are under intense pressure. The poster child, MicroStrategy, has seen its Bitcoin premium collapse to levels last witnessed during the brutal 2021-2022 crypto winter. This week, its stock briefly traded below net asset value (NAV < 1) for the first time ever, a psychological blow that signals investors are no longer willing to pay any premium at all for indirect Bitcoin exposure. Competition from spot Bitcoin and Ethereum ETFs has been fierce, challenging the rationale for the corporate treasury plays. Adding to the pain, MicroStrategy now faces potential delisting from Nasdaq, further hammering sentiment. In a separate but related move, Ethereum-focused treasury firm FG Nexus liquidated nearly 11,000 ETH this week to fund aggressive share buybacks, highlighting that the cycle can spiral both ways.

OTC desk activity

- Predominantly seeing sell flows for the week, but starting to see some buyers at these levels

- Mixed stablecoin flows for the week

Key Economic Calendar Events (AEDT)

- Thursday, 27 Nov 2025, 12:30 AM: US Durable Goods Orders MoM (Consensus 0.2%)

- Friday, 28 Nov 2025, 11:00 PM: IN GDP Growth Rate YoY (Consensus 7.2%)

- Sunday, 30 Nov 2025, 12:30 PM: CN NBS Manufacturing PMI

- Tuesday, 2 Dec 2025, 2:00 AM: US ISM Manufacturing PMI

In headlines

Villain 1: MSCI

According to a new narrative about the October 10 flash crash, about 16 minutes before Trump’s China tariffs announcement, MSCI announced an investigation into whether DATs like MicroStrategy and BitMine should be included in indexes. Some say the news caused the crash; others say MSCI was trying to bury the announcement. Either way, it’s bad news for crypto, and the ruling on January 15 could see billions of forced sales from index funds. Complicating the story is the fact that MSCI actually announced it was consulting on excluding DATs from indexes back in September after Metaplanet announced a new public offering. Michael Saylor pointed out that Strategy is not a fund, but a US$500M (A$774M) software business with a unique treasury strategy that utilises Bitcoin as “productive capital.” MSTR’s banker, TD Cowen, agrees.

Villain 2: JPMorgan

JPMorgan sold 772,000 Strategy shares last quarter and has more recently released a bearish note about the ramifications of MSCI removing Strategy from its indexes. In addition, JPMorgan has debanked Strike’s Jack Mallers, having previously refused service to the Trumps. Social media is now speculating that JPMorgan has a massive (unconfirmed) short position in MSTR, and is calling for a boycott and/or a GameStop-like short squeeze. However, total short interest across all holders is only 9.74% of the float of MSTR compared to 140% of GameStop during the famed squeeze.

Market maker(s) blew up

BitMine’s Tom Lee says he knows which market maker blew up on October 10, but he’s not willing to “name names”. However, he believes the current price action is due to a market maker selling everything and chasing prices lower in an attempt to fill a hole in its balance sheet. “I think that this drip that’s been taking place for the last few weeks in crypto reflects this market maker’s crippling,” he said. Lee said that in 2022, it took eight weeks for a similar situation to resolve, meaning the current situation likely has at least two more weeks to go. BitMine is reportedly sitting on more than US$3 billion (A$4.6B) in unrealised losses, but bought another 69,822 ETH in the past few days and has US$800 million (A$1.24B) in cash to buy even more.

Jane ditches BTC for ETH

Quant trading firm Jane Street Capital has sold 10.8 million shares in BlackRock’s IBIT Bitcoin ETF and bought 21.8 million shares of BlackRock’s ETHA Ethereum ETF. It’s now the third-largest holder of ETHA. Meanwhile, BlackRock registered the iShares Staked Ethereum Trust ETF in the state of Delaware on November 19. Registration is required before the firm can proceed with filing for regulatory approval.

Cardano vs the vibe coder

The Cardano network suffered a temporary chain split late last week, due to a malformed transaction that exploited a code bug from 2022. About 30% to 40% of the nodes followed the poisoned chain, but the network recovered pretty quickly. Details are a little hazy due to claims and counterclaims, but the exploit was caused by an ADA staking pool operator using AI-generated code (vibe coding). Cardano founder Charles Hoskinson classed it as an attack and said the FBI had been called in and decried what he calls “FUD” around the incident.

ZK tech takes big strides

EthProofs Day at DevConnect suggests that Ethereum’s ZK scaling plan for the L1 is starting to solidify, with a target of 10,000 TPS. The idea is to switch the network over from every computer re-executing all the same transactions to having validators verify tiny proofs, which is so easy that you can do it on a smartwatch. Researcher Justin Drake demonstrated the process live on stage. To date, generating the proofs in the first place has required expensive equipment and dozens of GPUs; however, the zkSync Airbender team has demonstrated that it is now possible using just two gaming GPUs. “The L1 gas limit is going higher. So much higher,” said Drake. Around 10% of validators are expected to switch to verifying ZK proofs by the end of 2026, before a wider switch-over in 2027.

SOL and XRP ETFs are positive

To date, the Solana ETFs have accumulated nearly US$500M (A$774M) in net inflows, and the XRP ETFs have seen US$410M (A$634M) without any net outflow days. However, November is on track to be the worst month for Bitcoin ETF outflows, with US$3.79 billion (A$5.86B) withdrawn so far. DAT inflows remain positive, but fell from US$10.89 billion (A$16.85B) in September down to just US$505 million (A$781M) in November. Five spot crypto ETFs (XRP, Chainlink, and Dogecoin) are expected to launch within the next six days, with potentially 100 more in the next six months.

India’s stablecoin proposal

India’s government is considering adopting a regulatory framework for stablecoins and will present its case in an annual report for the Ministry of Finance. However, the Reserve Bank of India urges a “cautious” approach and is pushing for a CBDC.

The Moonshot Dispatch – Live Crypto Market Update

Join us every Tuesday at 3 pm (AEDT) for a live market update. Hosted by Lee Eaton and Nick Fletcher, we cover the latest crypto news and price movements. Tune in weekly on Twitter/X, LinkedIn, YouTube, Facebook & TikTok.

Until next week, happy trading!