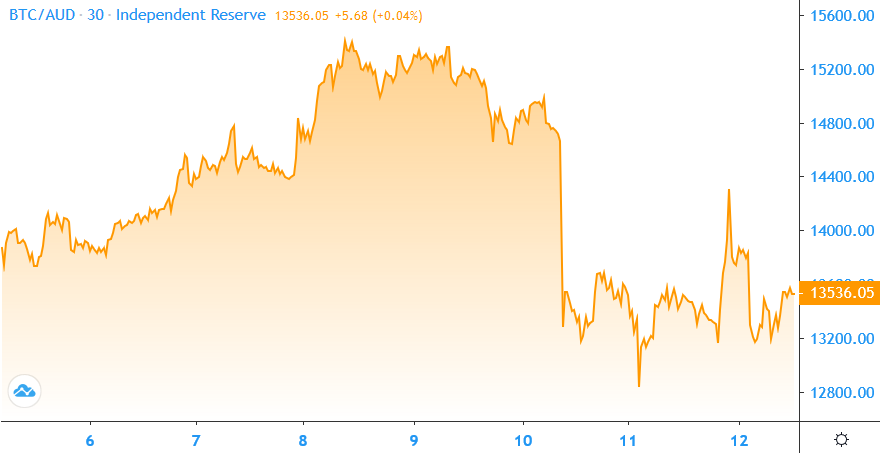

Market Update 6th – 12th May 2020

Despite a sharp fall on the weekend, Bitcoin finished the week just 3.24% down and was trading at just over $13,500 at the time of writing. It’s up 25% for the month. The Bitcoin Fear and Greed Index is at 40 or ‘neutral’ which suggests traders have quickly shrugged off the volatility. Still, it was a sea of red for the remainder of the top ten with Ethereum down 10.3%, XRP (-12.2%), Bitcoin Cash (-5.8%), Bitcoin SV (-11.2%), Litecoin (-12.5%), EOS (-13.5%). Stellar was down 15.2%.

Source: Independent Reserve Bitcoin/AUD chart

In Headlines

Through the looking glass

The Bitcoin block reward halved at the 630,000th block at 5.25am this morning (AEST), from 12.5 BTC to 6.25 BTC. The last block was mined by F2Pool and contained a headline from the New York Times on April 9: “With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue“. It’s a reference to Satoshi including the GFC headline ‘Chancellor on Brink of Second Bailout for Banks‘ in the BTC Genesis block.

Pre-halving crash

The widely anticipated post-halving Bitcoin price crash came early, when the price cratered by 15% in seven minutes on the weekend. Cryptometer reports that $455 million worth of long positions were liquidated on BitMEX alone, with Cointelegraph suggesting much of this was likely to be retail investors hoping to cash in on the halving hype, without considering that the price had already increased substantially in the past two months. The crash was reminiscent of 2016 when the Bitcoin price dropped 11% two days before the halving.

Where do we go from here?

With only two previous halving events to draw on – neither of which occurred during a global pandemic – experts are divided on what happens next. The amount of new Bitcoin created each day has fallen from 1800 BTC a day to 900 – making the annual ‘inflation’ rate 1.8%, below that of gold. Some believe Bitcoin’s increased scarcity will send the price to the moon, while others argue the amount miners sell each day is dwarfed by the daily trade in Bitcoin. Charles Edwards from Capriole digital asset managers said the cost of production was now US $14,000 (A$21,600) and without a big BTC price spike a third of miners will shut down. Miners with older equipment began turning them off before the halving itself.

Oh no, no FOMO

Larry Cermak from The Block says that Bitcoin Wikipedia page views, Google searches and growth in new followers for Coinbase and Binance have flatlined since mid-2018. He argued this meant the halving has not inspired any sort of retail FOMO. While Google searches for ‘Bitcoin Halving’ were up 300% since 2016, it was off a pretty low base.

All your Bitcoin are belong to us

So far this year, Cash App and Grayscale’s Bitcoin Trust have been buying 50% of all Bitcoin mined. That suggests that from here on in, they’ll be buying ALL of it. Bitcoin quarterly revenue on Square’s Cash App is up 367% on a year ago to $472 million. It’s also up 71% on the previous quarter.

Ethereum 2: Electric Boogaloo

Phase 0 of ETH 2.0 is on track for a July launch according to co-founder Vitalik Buterin. The first ETH 2.0 multi-client testnet called ‘Schlesi’ was released this week – meeting a hard pre-launch requirement. The devs are aiming to get ETH 2.0 up and running by July 30, which is the fifth anniversary of Ethereum. Buterin said scaling was already happening on Ethereum, with Aussie DeFi project Synthetix trialing Optimistic Rollup, a layer 2 solution that Buterin says can scale to more than 1000 transactions per second. That’s 50x faster than the current network.

The correlation is dead, long live the correlation

Good news: Mati Greenspan says the correlation between Bitcoin and the Dow Jones industrial average is over. Bad news, one of his followers pointed out that as an emerging technology, Bitcoin should be compared with the Nasdaq. So he had a look and concluded: “Sure, Bitcoin sold off harder and is making a stronger recovery, but directional wise and performance wise, they still seem pretty darn correlated at this time.”

In Bitcoin we trust

Despite leading the world in ICO scams in 2017, the citizens of China overwhelmingly trust cryptocurrency. The Edelman Trust Barometer surveyed 34,000 people in 26 markets and determined that overall 48% of respondents globally trust crypto, but in China that figure rises to 81%.

Billionaire backs Bitcoin

Legendary hedge fund investor Paul Tudor Jones II is investing part of his $4 billion hedge fund ‘Tudor BVI Global Portfolio LP’ in Bitcoin, as a hedge against inflation. Jones wrote that we’re witnessing “an unprecedented expansion of every form of money unlike anything the developed world has ever seen” and that after considering gold, bonds and commodities he decided Bitcoin was “the fastest horse in the race.” He later told CNBC he has “1-2%” of his net worth in Bitcoin – or around $150 million.

Until next week, happy trading!

Independent Reserve Trading Desk