Market update

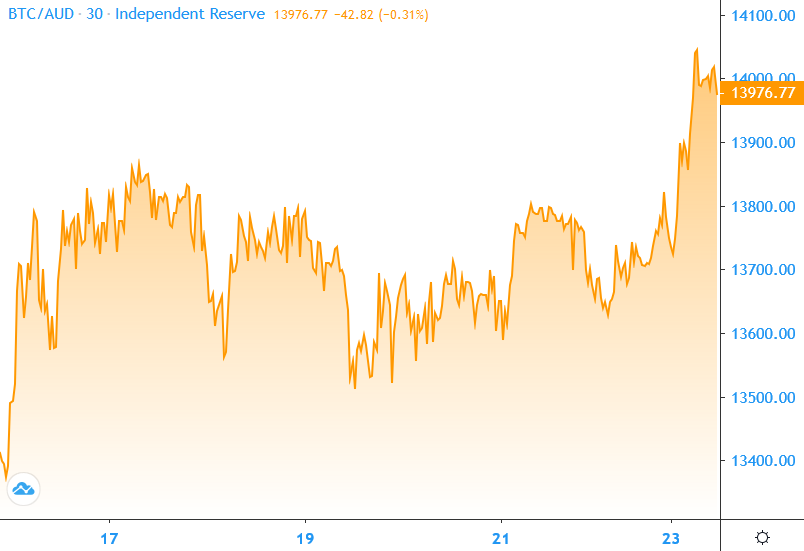

Bitcoin is currently trading just under $14,000 and is 1.9% up on seven days ago. Ether gained 4.8% this week, but the rest of the top ten remained fairly steady: XRP (-0.9%), Bitcoin Cash (2.4%), Bitcoin SV (0.5%), Litecoin (0.8%), EOS (1.4%) and Stellar (1.45%). Apart from a few flashes of volatility, Bitcoin has been trading in a 10% range for almost two months. Will today’s Paypal rumours help propel BTC above the psychological US $10,000 ($14,422) mark?

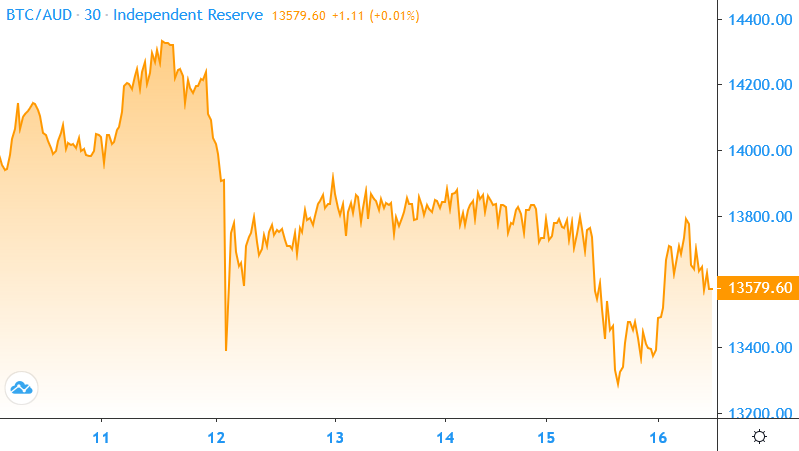

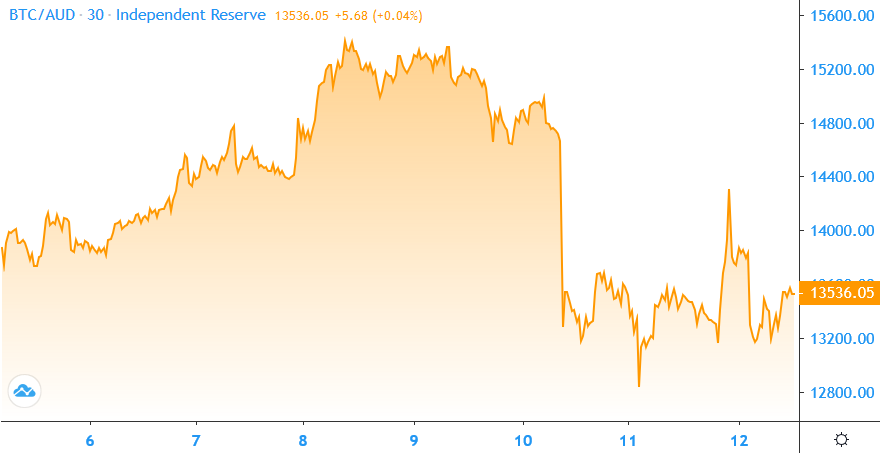

After yet another attempt to top the psychological US$10K mark – around A$14.4K – Bitcoin dove almost $1,000 in the early hours of Friday morning and then dropped below A$13,000 earlier today. The recovery has been just as swift though and the price is currently trading around $13,600, as it has done for much of the week. Bitcoin finished the week 2.7% down. Ethereum lost 5.6%, XRP was down 5.2%, Bitcoin Cash (-6.5%), Bitcoin SV (-7.9%), Litecoin (-5.1), EOS (-8.7%) and Stellar (-10.7%).

After a euphoria-inducing spike above US$ 10,000 at the time of our last market update, Bitcoin dropped sharply some hours later back to its previous US$ 9,500 – US$ 9,800 range, where it has remained since. The constant tests of the barrier are becoming routine, which analyst Keith Wareing believes signals that a fast break up to $12K ($17,100) could be on the cards. At the time of writing Bitcoin was trading just under $13,900 and was down 1.2% for the week. Bitcoin dominance has fallen from 67.5% a month ago to 64.8%. Ether held steady this week, while XRP lost 2.2%, BCH increased 1.25%, BSV (-4.1%), LTC (-2.6%) EOS (0.6%) and Stellar (4.2%).

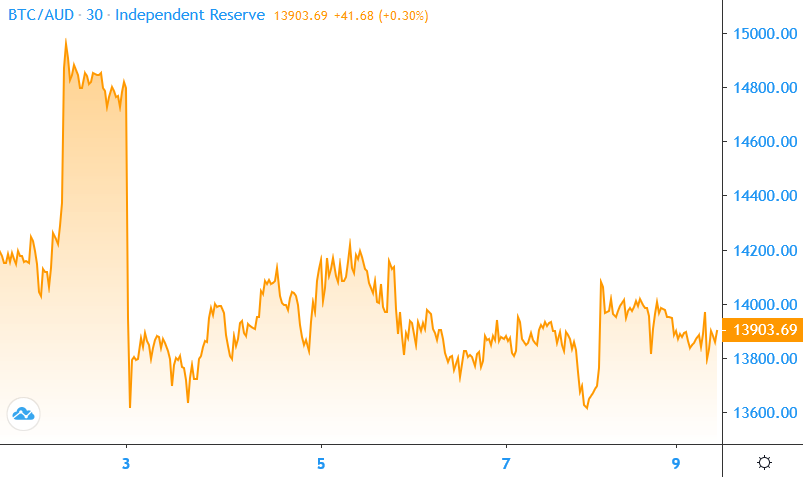

As President Trump was threatening a military crackdown this morning, Bitcoin was spiking above the psychological US$ 10,000 mark. Things are moving fast but at the time of writing Bitcoin was trading just over A$ 14,800 to be 14.1% up for the week. Ethereum finished the week up by 20.1%. The past week has also been positive for the rest of the top ten: XRP (7.2%), Bitcoin Cash (11.2%), Bitcoin SV (9.7%), Litecoin (12.4%), EOS (11.3%). Stellar was up 16.8%.

Bitcoin appears to have the post-halving blues, falling 7.6% this week. It’s trading just above $13,600 at the time of writing. Somewhat unusually, Bitcoin experienced a much bigger loss over the past seven days than any of the other coins in the top 10 (apart from BSV) but that’s probably because its gains for the month are still 18.4% – three times more than its closest competitor Ethereum (which only rose 5.5% this month). Ether is down 3.3% for the week, Bitcoin Cash (-6%), Bitcoin SV (-8%), Litecoin (-4%), EOS (-3.5%) and Stellar (-5.3%).

In Markets

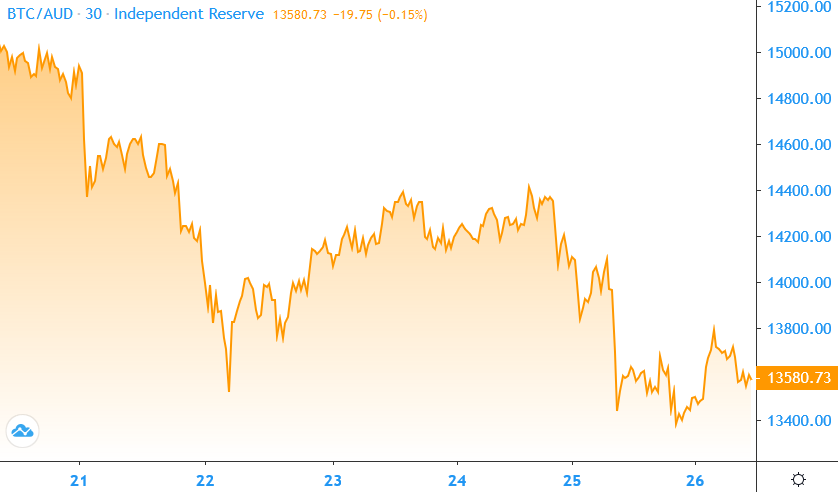

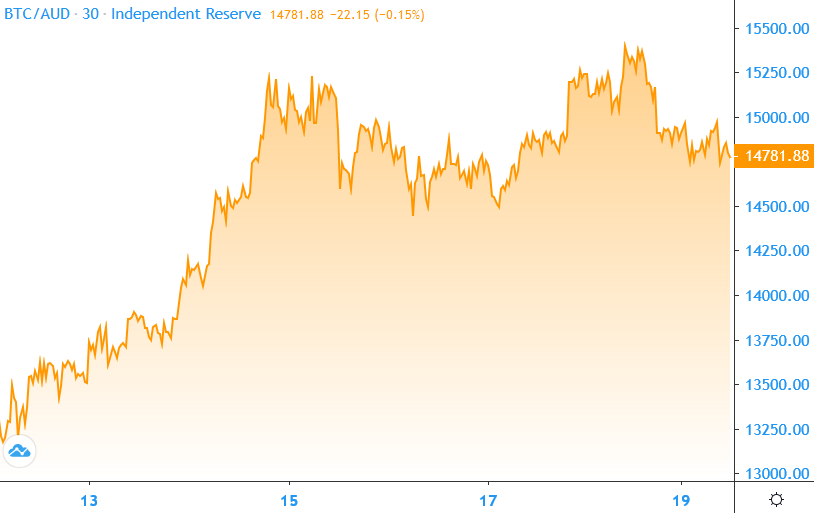

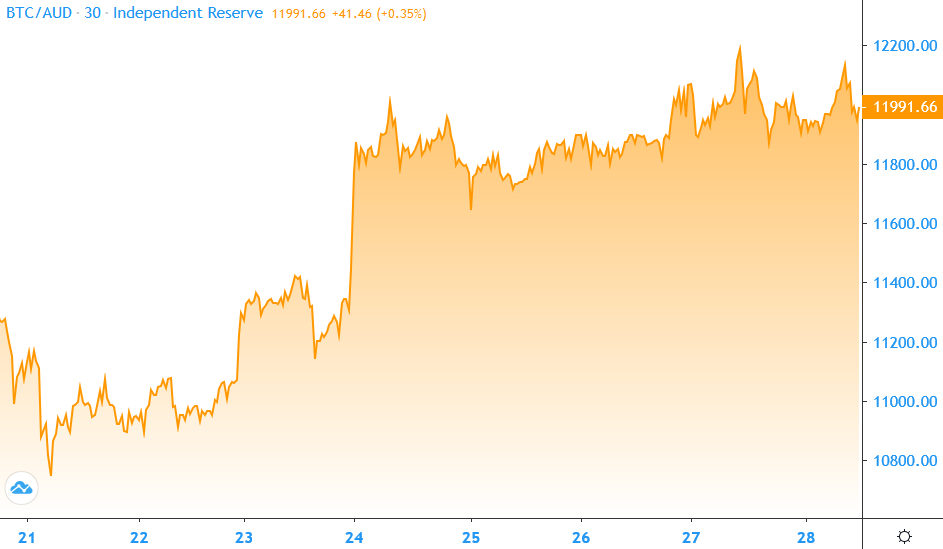

Bitcoin is up 12.8% on this time last week to trade at just under $14,800 at the time of writing. However, BTC seems very reluctant to make a sustained break above the psychological US$10,000 mark (A$15,331). The overall trend is very positive with BTC up by a third in the past month. Ryan Selkis from Messari noted that what he’s calling the ‘Pomp Trade’ – “Long Bitcoin Short the Bankers” – has paid off in spades this year, with BTC up 38% YTD while the major US banks have lost 37% or more. Ether was up 15.2% on seven days ago, XRP was up 6.2%, Bitcoin Cash (6.9%), LTC (9.3%), EOS (10.5%) and Stellar (12%).

In Markets

Despite a sharp fall on the weekend, Bitcoin finished the week just 3.24% down and was trading at just over $13,500 at the time of writing. It’s up 25% for the month. The Bitcoin Fear and Greed Index is at 40 or ‘neutral’ which suggests traders have quickly shrugged off the volatility. Still, it was a sea of red for the remainder of the top ten with Ethereum down 10.3%, XRP (-12.2%), Bitcoin Cash (-5.8%), Bitcoin SV (-11.2%), Litecoin (-12.5%), EOS (-13.5%). Stellar was down 15.2%.

Market Update 29th April – 5th May 2020

In Markets

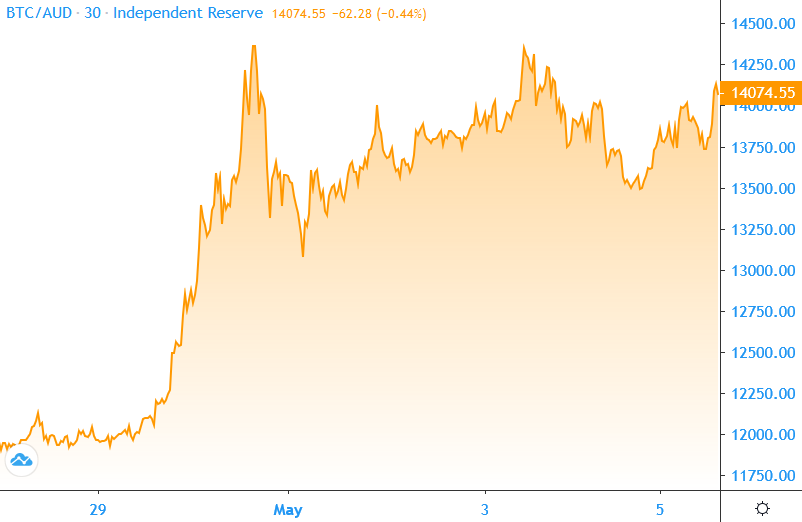

The Bitcoin price has been on the move in the lead up to next week’s halving, with BTC up 15.1% on a week ago to trade just over $14,000. Altcoins have increased to a lesser extent: Ethereum was up 6.6%, XRP (11.4%), Bitcoin Cash (2%), Bitcoin SV (6.8%), Litecoin (7.1%), EOS (2%). Stellar increased another 10.6%, bringing its gains for the month to a hefty 68%.

Market Update 22nd – 28th April 2020

In Markets

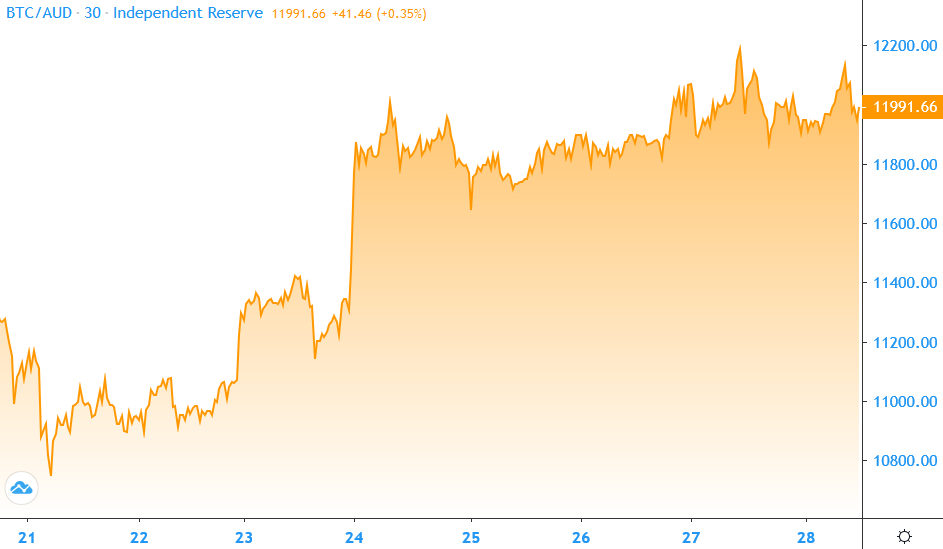

Lockdowns are easing, searches for the ‘Bitcoin halving’ have surged past their 2016 peak and the Crypto Fear and Greed Index has finally emerged from ‘extreme fear after seven weeks’ (it hit 28/100 yesterday which is just ‘fear’). Bitcoin is up 12.7 percent this week and was trading under $12,000 at the time of writing. That’s 100% up on the price it crashed to on Black Thursday… but is it showing signs of a classic bull trap? It’s happy days too for Ethereum, which gained 13.6%, XRP (7.24%), Bitcoin Cash (9.3%), Bitcoin SV (4.4%), Litecoin (9.2%) and EOS (8.3%). Stellar outperformed the lot, up 34% on a week ago.

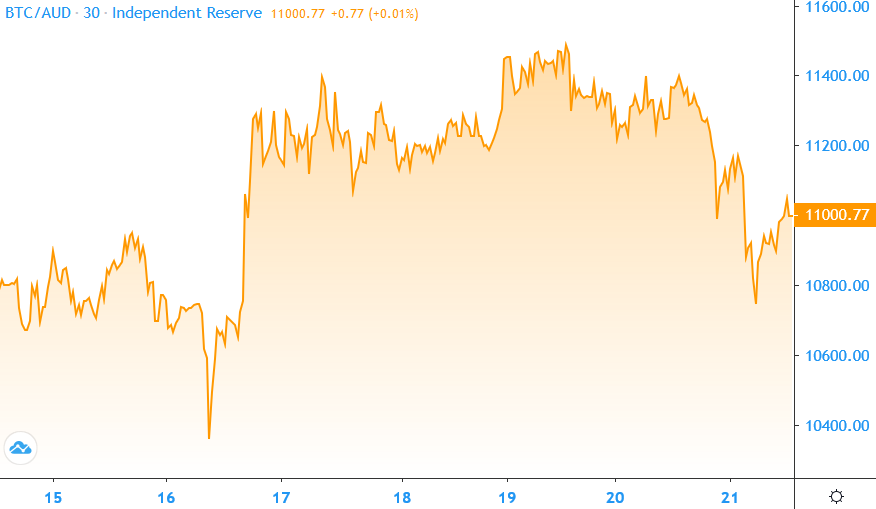

Market Update 15th – 21st April 2020

In Markets

Bitcoin has been trading between $10,400 and $11,500 this week. It fell 4.5% in the past 24 hours following losses on Wall Street. Overall Bitcoin is up 1.1% for the week and is trading around $11,000 at the time of writing. Today’s plunge wasn’t enough to erase Ether’s gains for the week, which are currently 10.7%. XRP (-2.3%), Bitcoin Cash (-0.6%), Bitcoin SV (-1%) all suffered minor losses for the week, Litecoin broke even while EOS (3.5%) and Stellar (3.9%) made up ground.

Market Update 8th – 14th April 2020

In Markets

After the best week since 1974, US stocks fell on Monday, with the Dow closing 1.4% down and the S&P 500 down 1%. Bitcoin fell 4.5% in tandem and it’s currently trading at just under $10,800, which is 5.8% down on a week ago. Everything else was in the red: Ethereum (-6.4%), XRP (-3.75%), Bitcoin Cash (-11.3%), Bitcoin SV (-0.75%), Litecoin (-7.6%), EOS (-9.4%) and Stellar (-2.1%). With the correlation to stocks appearing to hold, it’ll be interesting to see what happens as quarterly earnings reports are released from today. Quantum Economics founder Mati Greenspan predicts the earnings season will be “probably the worst in history”.

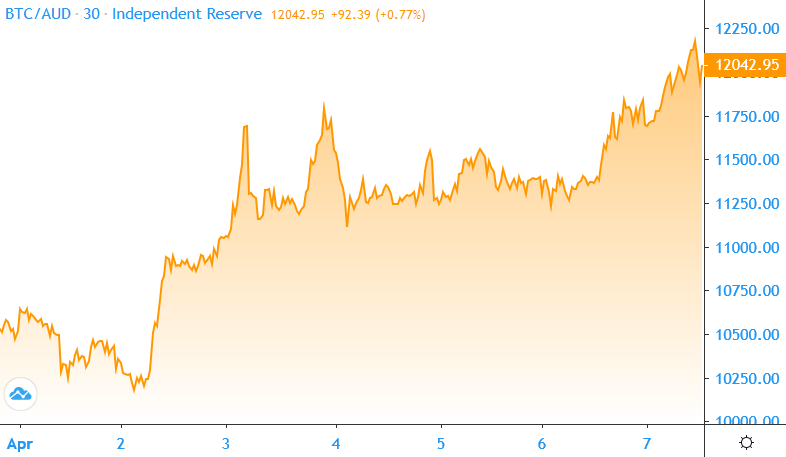

Market Update 1st – 7th April 2020

In Markets

It’s been a positive week in crypto markets with Bitcoin up 14% on seven days ago to trade above $12,000 at the time of writing. It remains 8.1% down for the month. Ethereum surged 20% in the past day and is up 30% for the week. Everything else was green including EOS (24%), XRP (14.9%), Bitcoin Cash (16.6%), Bitcoin SV (15.3%), Litecoin (15.8%) and Stellar (24.9%). The rise in the past day coincided with a 7% increase in the S&P 500. While JP Morgan thinks the worst is over for markets, Guggenheim predicts a 40% slide for stocks when unemployment, growth, and earnings data comes out. Let’s hope Bitcoin treads its own path.