Market update

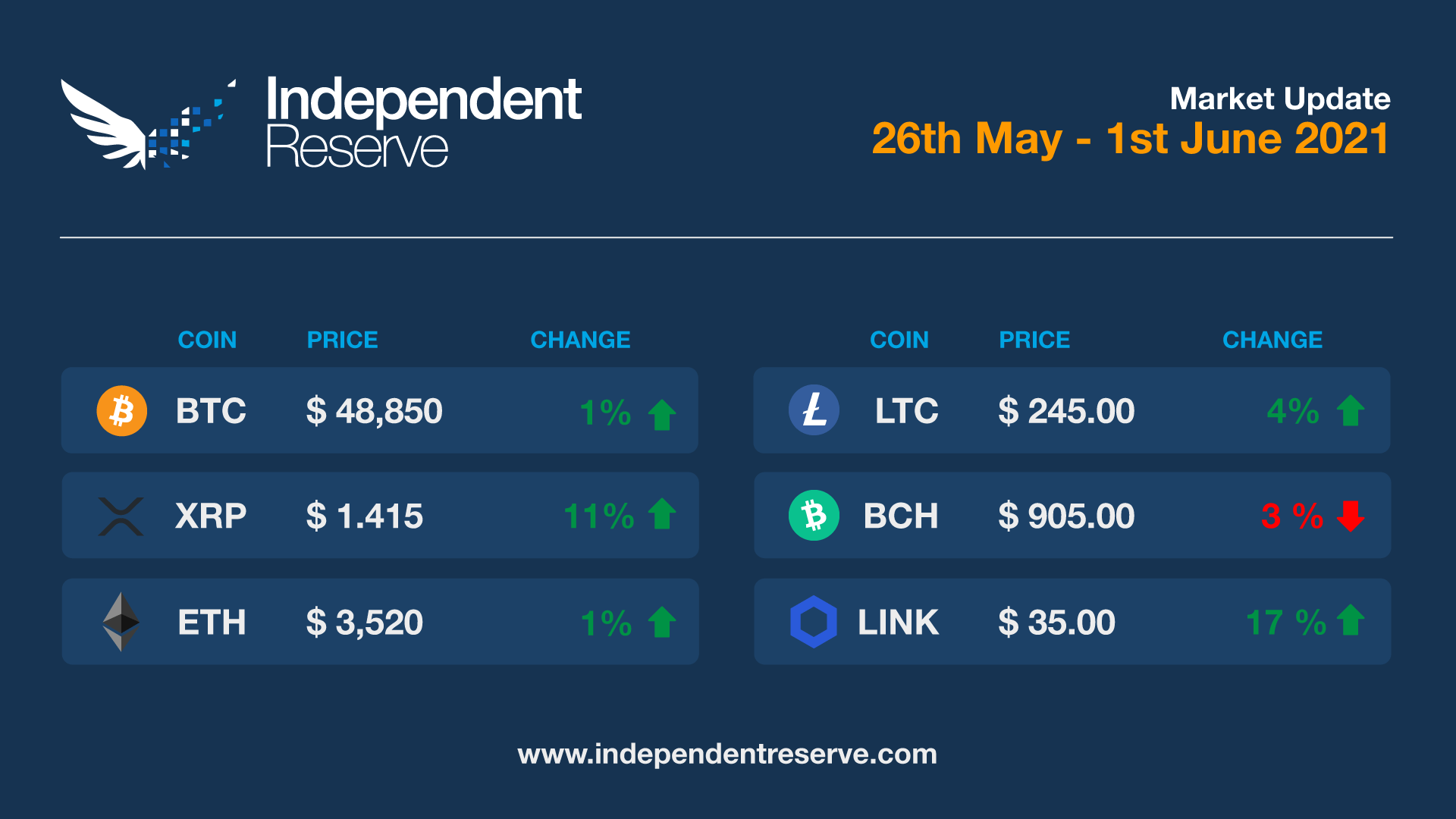

Bitcoin finished the month more than 36% down, in its worst performance since losing 37% in November 2018. The price is currently 3.9% below a week ago and it’s trading around A$48K (US$37K), which is around A$10K (US$7K) higher than it began the year. There are reports long term holders are buying the dip in preparation for a 2013 style double pump. Ethereum has seen a 9.3% pump in the past 24 hours and finishes the week 1.3% up. ETH volume has overtaken BTC volume on some days according to CoinGecko (which also counts DEX volume) and talk of the Flippening is once again doing the rounds. Polkadot was flat, XRP increased 9%, Chainlink was up 22.5%, Litecoin (2.8%) and EOS (17.8%). Bitcoin Cash fell 3.6%, Stellar (-7.4%), Aave (-2.6%) and Synthetix (-7.2%).

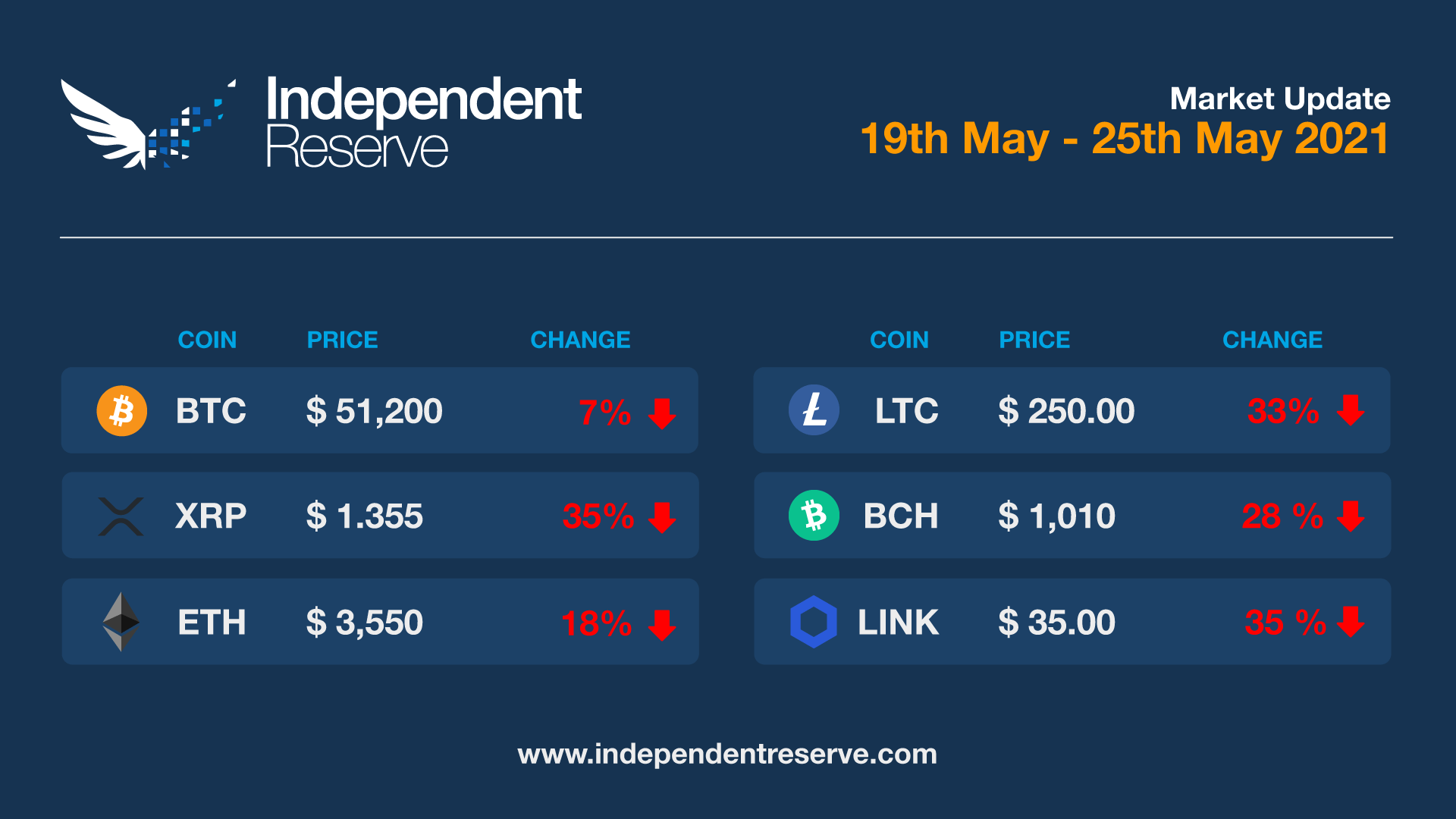

Congratulations, you’ve just survived “the largest capitulation event in Bitcoin’s history”. Since it peaked above A$76K (US$59K) on May 9, Bitcoin has taken the elevator down to around A$41K (US$32K) and has since recovered to around A$50,500 (US$38K). It’s still down 10.7% since last Tuesday and 22.7% for the month – although zooming out it’s almost 300% up on a year ago. Altcoins were hit harder and are recovering faster with many up 20-30% in the past day. Ethereum finishes the week 20.1% down at the time of writing, XRP (-34.1%), Bitcoin Cash (-29.7%), Litecoin (-35%), Chainlink (-29.6%), Stellar (-32.7%), Aave (-33.2%), Synthetix (-31.9%). The Bitcoin Hash Rate has fallen from a 7-day average of 180TH/s on May 14 to 145 TH/s currently. The Crypto Fear and Greed Index is at 10, the lowest level since April 2020 — but as analyst Mati Greenspan points out it may: “Just happen to have been the greatest buying opportunity in history”.

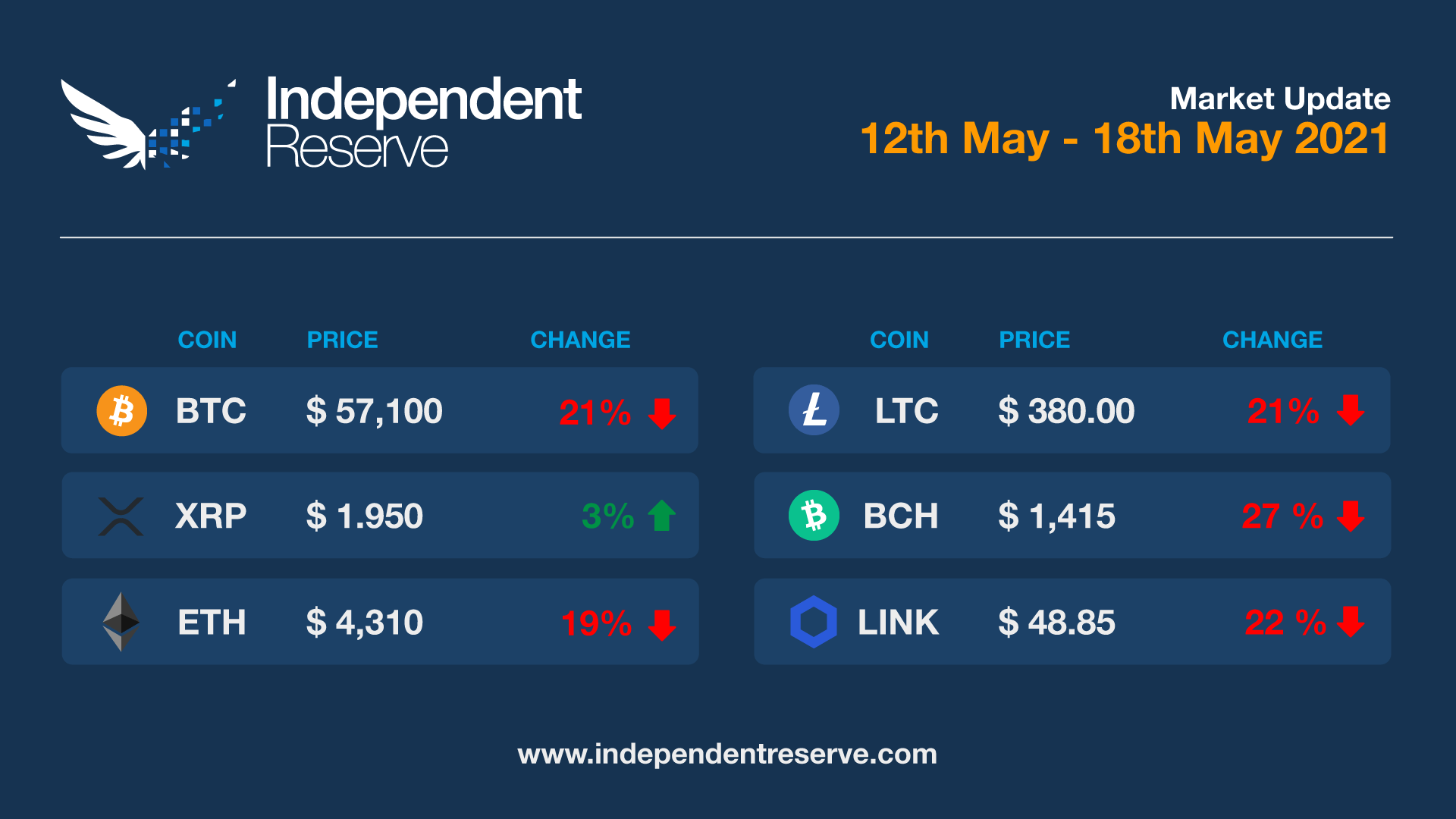

It hasn’t been a great week, with Bitcoin currently 22.6% down on last Tuesday to trade just above A$55K (US$42.8K). It’s corrected around 30% in a month for its worst performance since Black Thursday (still, there were seven larger corrections between 2015 and 2017.) It wasn’t all bad – while ETH corrected 18.2%, it’s still up 38.4% this month and the market cap topped half a trillion US for the first time this week. XRP was up 4.3%, Polkadot was up 4.7%, AAVE increased 28.7% and Synthetix was up 20.1% apparently on rumours something big is happening this week. Bitcoin Cash lost 22%, Litecoin was down 23.6%, Chainlink -22.4%, Stellar lost 4.8%, EOS lost 4.7%. Last week The Fear and Greed Index was around 68 (greed) but it took a dive to 20 (extreme fear) yesterday, the lowest point since April 2020. It’s since recovered to 27 (fear). Glassnode attributes the dip mainly to 1.1 million noobs panic selling.

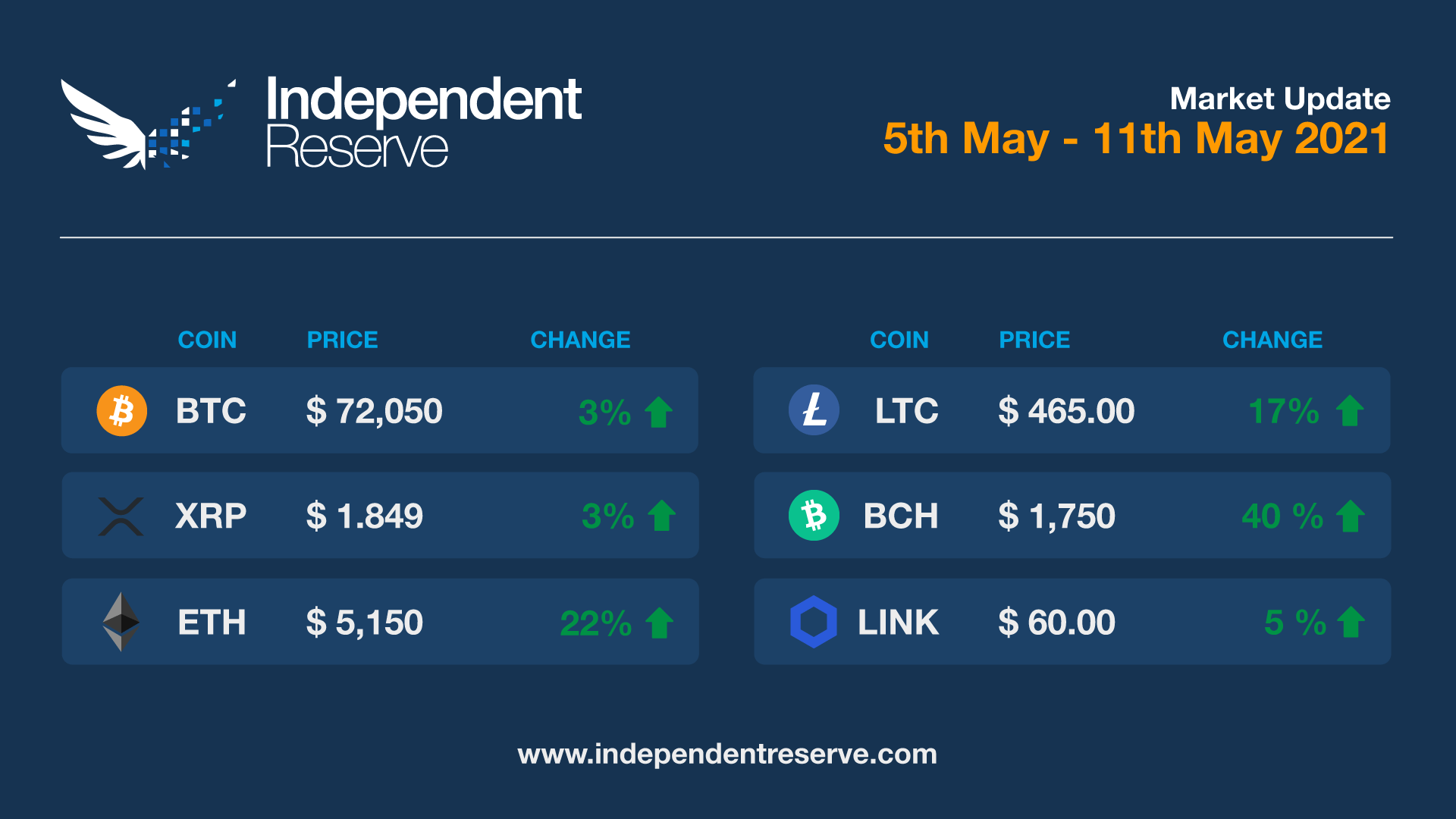

Bitcoin is down 2.2% this week to trade at just under A$71,600. But Ethereum has been hogging the spotlight again, peaking at a new all-time high a few hours ago of A$5,359. It’s since pulled back to finish the week up 16.5% at $5,089. The record price came within 24 hours of the highest day of address activity in ETH’s six-year history. “Generally, when active addresses grow, prices will follow,” notes Santiment. New retail interest appears to be flowing to classic, more established names with Bitcoin Cash up 32.3%, Litecoin up 23.5%, Chainlink (12.5%), Stellar (21%), Ethereum Classic (106%) and EOS (38%). XRP lost 9.9%, Polkadot (-1.9%), AAVE (-14.9%) and Synthetix (-12.7%). There are unconfirmed rumours that Synthetix, Chainlink and UniSwap v3 are all set to launch layer 2 scaling within weeks, which if true could help usher in a new DeFi boom.

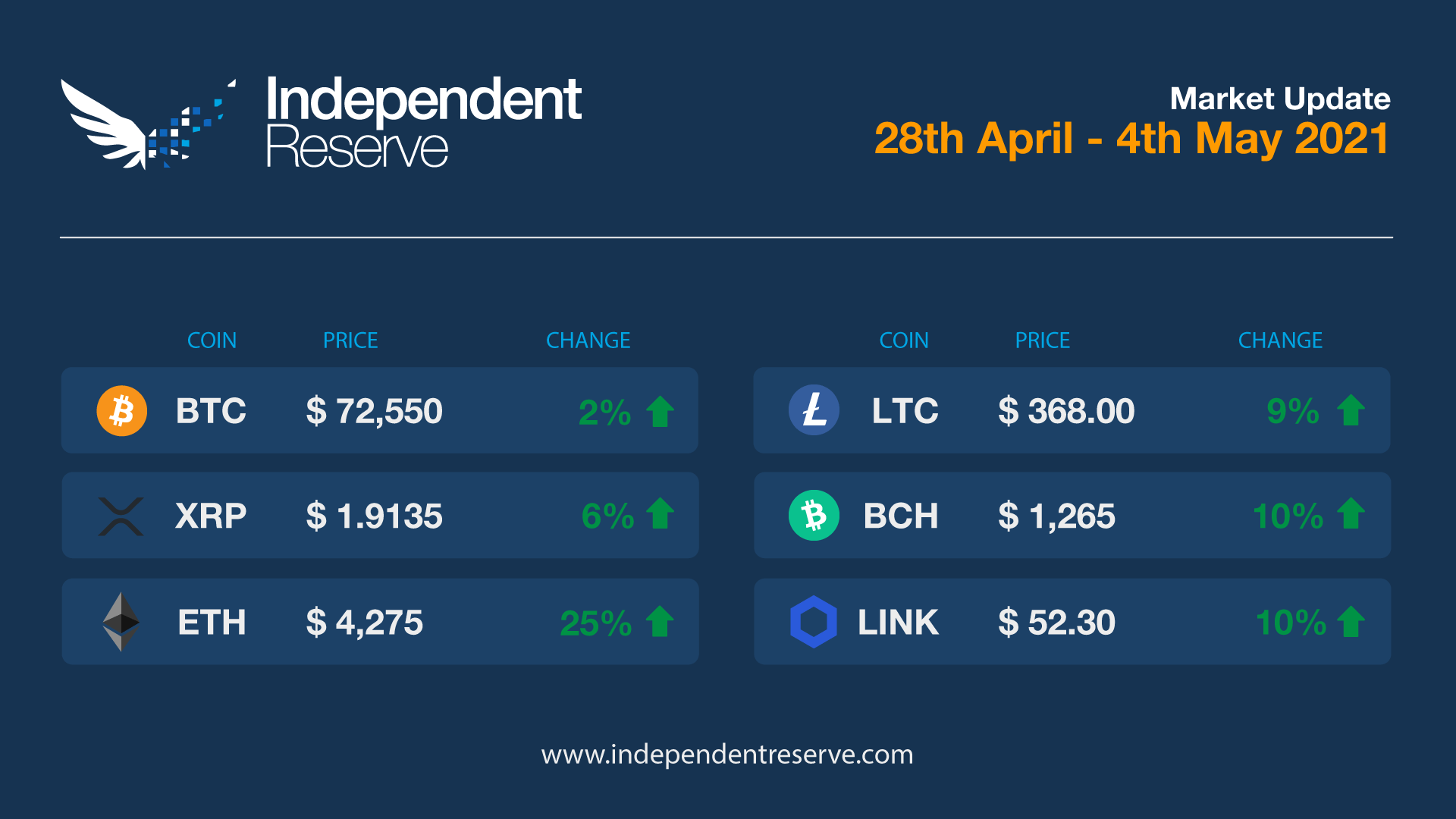

The two-week bear market is now just a memory, with Bitcoin up 5.5% on last Tuesday to trade above A$73,400 (US$56,850). But it’s Ether that’s been attracting all the attention, up by 12.4% in the past day and more than a third since last week to trade at A$4,360 (US$3,375) at the time of writing. Ether prices have quadrupled this year and appreciated roughly twice as fast as Bitcoin. Everything else was up substantially: Ripple (10.4%), Polkadot (8.2%), Litecoin (16.9%), Bitcoin Cash (19.3%), Chainlink (18.8%), Stellar (12.5%), EOS (17.1%) — which is on the verge of being flipped by AAVE (26.3%) — and Synthetix (14%). Bitcoin dominance has fallen to 46.4% (in the last bull market dominance fell all the way to 32%). The Fear and Greed Index has recovered from 27 (fear) last week to 61 (greed) today.

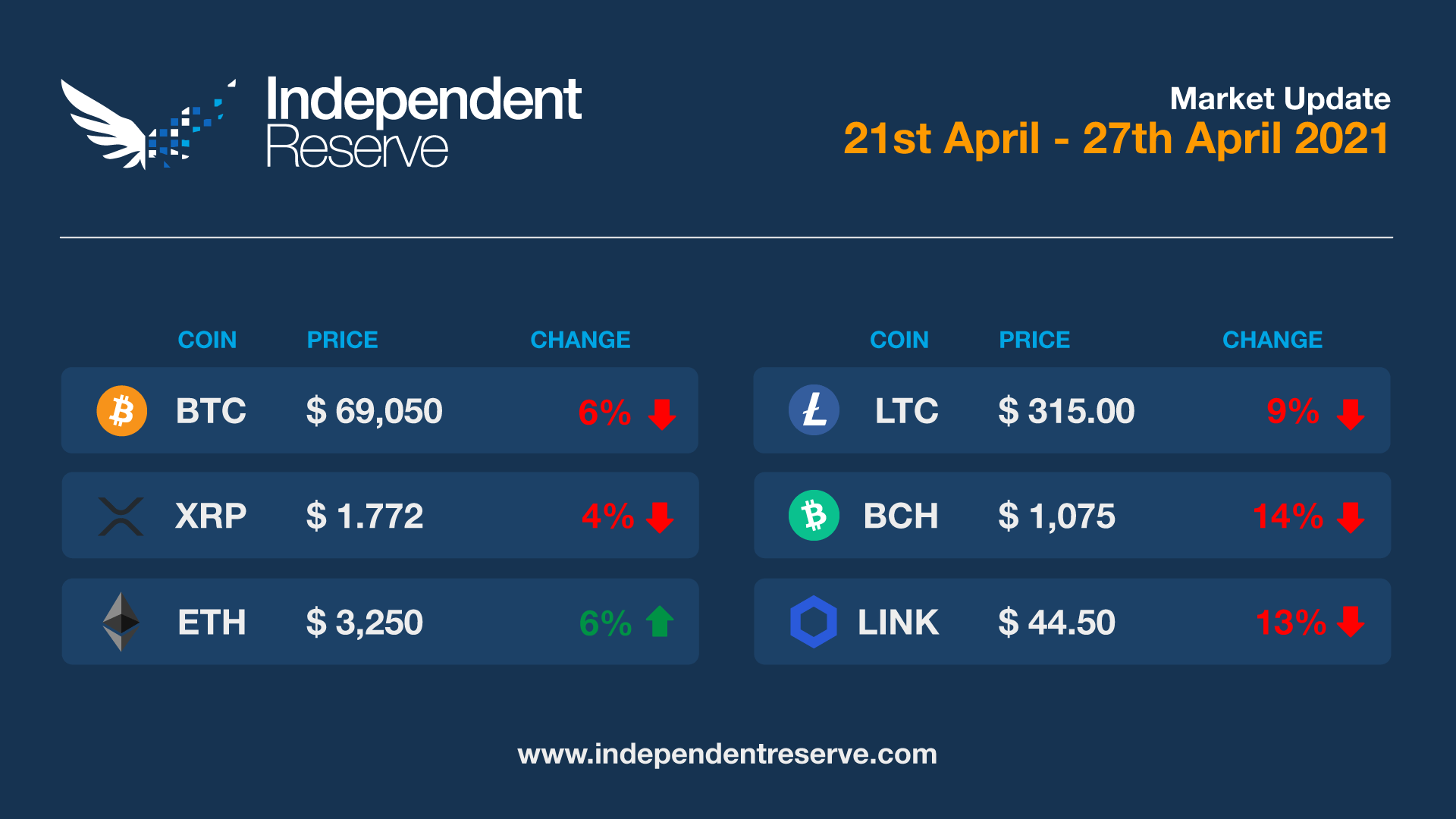

Bitcoin has been on a wild ride this week falling from almost A$73K to below A$61K, before staging a 13.5% recovery in the past 24 hours. BTC finishes the week down 5.1% and is trading at A$68,800 at the time of writing. Ethereum meanwhile broke into new all-time highs around A$3,386 on April 22 and finished the week up 13.6% at A$3,233. It’s up 50% against BTC in the past month and there’s much speculation it’s poised for an even bigger move — Real Vision CEO Raoul Pal is thinking of selling all his BTC for ETH. Bitcoin’s rocky ride saw a wider pullback with XRP down 4.4%, Polkadot (-8.4%), Litecoin (-9.4%), Bitcoin Cash (-10.1%), Chainlink (-7.4%), Stellar (-7.4%) and Synthetix (-4.4%). Most altcoins are substantially in the green today however and Aave finishes the week up 10.3%.

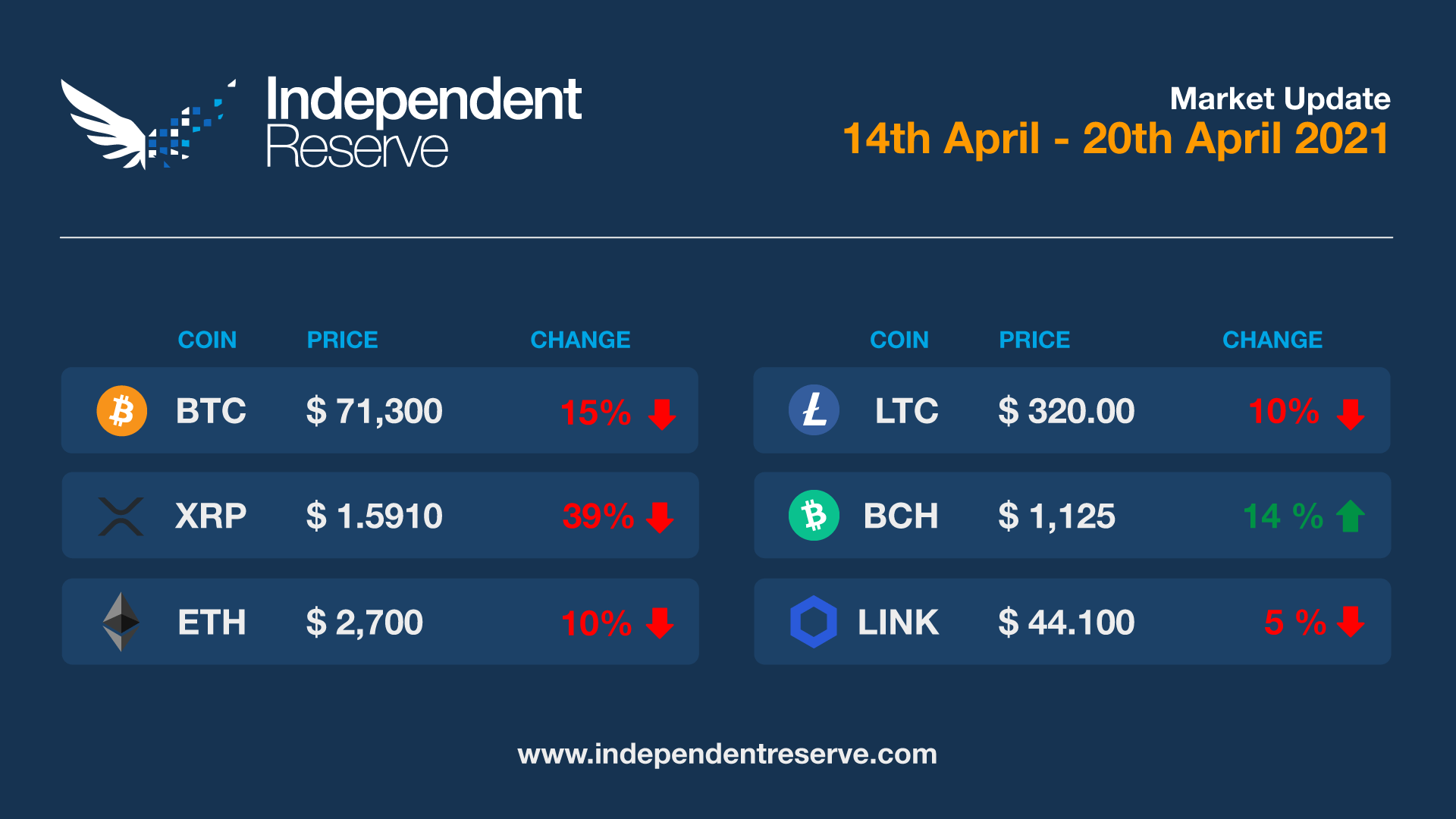

Bull runs don’t always see the price rise smoothly upwards, and we saw a brutal 16.6% drop in the price on the weekend liquidating around US$10B of positions. Bitcoin finishes the week 7.2% down to trade around A$72,500. Pullbacks of between 20-40% are common during bull markets historically speaking. Despite the fall, many coins are up this week including Litecoin (5.8%), Bitcoin Cash (31.5%), Chainlink (7.1%), EOS (1.7%). Ethereum was flat while others lost ground including Ripple (-5%), Polkadot (-14.5%), Stellar (-12.8%) AAVE (-14%), Synthetix (-18.6%). The Fear and Greed index is at 74, or ‘greed’. Monthly adjusted on chain volume for Bitcoin hit a record US$366.27 billion in March, up 14.7% from the previous ATH in February.

Another historic week for Bitcoin kicks off with the leading cryptocurrency again within sight of breaking the all-time high of A$80,924, set on March 13. It’s currently up 1.8% for the week to trade at just over A$79,000, with Bitcoin dominance at 53.9%. Bitcoin was again the best performing institutional grade asset of the first quarter, gaining 103%, followed by oil which was up 26%. Gold meanwhile lost 10%. Ethereum has just ploughed into a new all time high of A$2,885 and finishes the week up 1.4% at A$2,820. Court victories saw Ripple rediscover its mojo, up 59.3%, Litecoin increased 12.3%, Chainlink (3%), Stellar (10.8%) and Bitcoin Cash (8.8%). Aave was flat, Polkadot fell by 8.1%, EOS dropped 4.6% and SNX lost 5.4%.

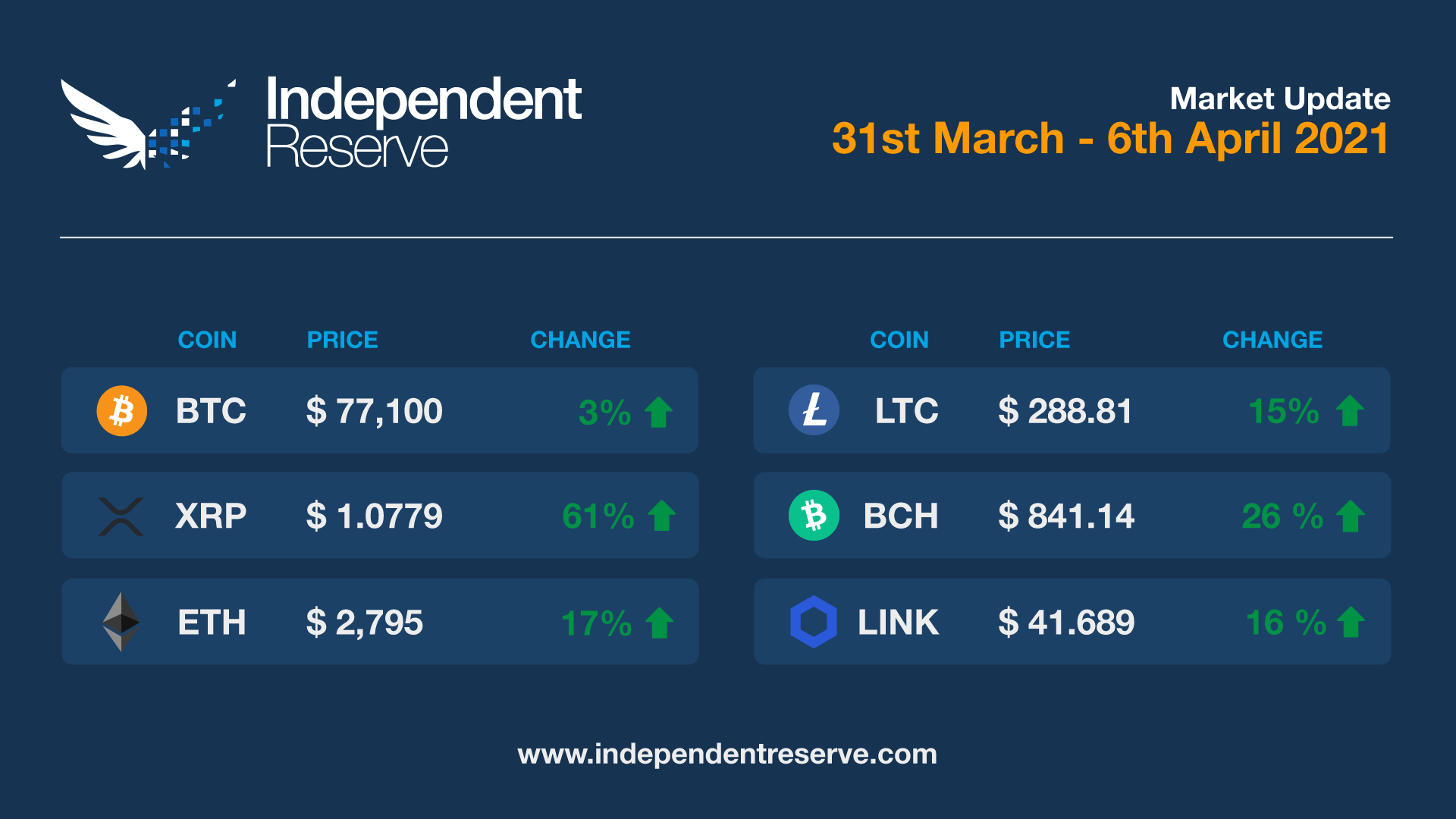

March has historically been a terrible month for Bitcoin, but not this year with the price increasing by almost a third. Bitcoin is up 2.9% on a week ago to trade just under A$77,000. However, Bitcoin dominance has fallen from 72% at the turn of the year to 55.7% today. The reason is that altcoins have gone nuts: in the past two months, the number of crypto unicorns has doubled. There are now 100 projects with a market cap above US$1 billion. Ethereum has broken into new highs and is currently up 17.8% to trade around A$2,760. Everything else saw double-figure percentage increases with Polkadot up 33.6%, XRP/Ripple (61.5%), Litecoin (14.8%), LINK (16.2%), Stellar (30.7%), Bitcoin Cash (26.7%), EOS (58.5%), AAVE (11.2%) and Synthetix (19.8%).

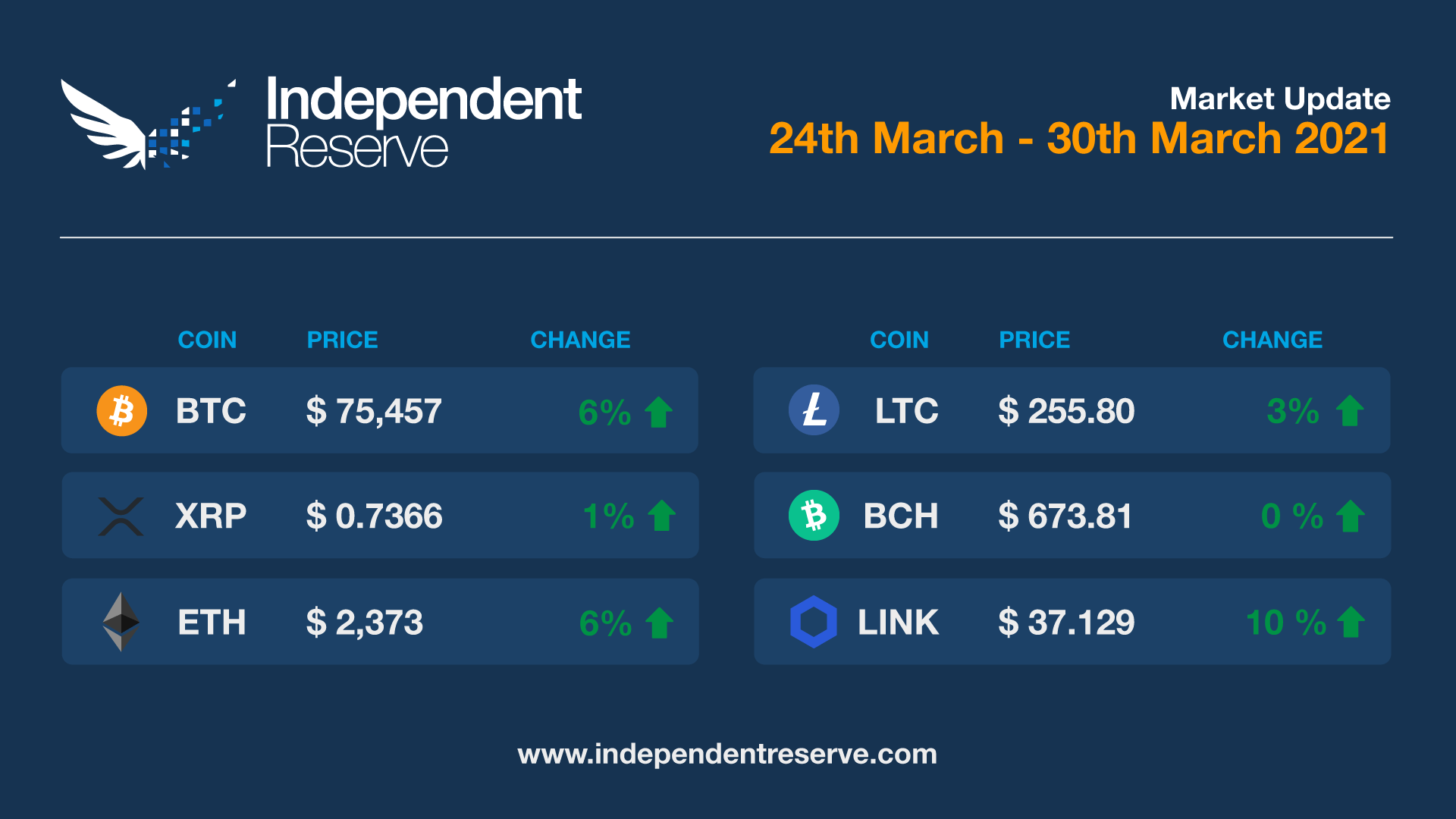

After taking a tumble to the A$67,000 mark on Friday following the expiration of a record $6B in options contracts, Bitcoin has recovered to trade above A$75,000. It finishes the week up 5.4%. Ethereum was up even more (6.5%) on this time last week after Visa announced it was settling some transactions on the network. Litecoin was up 3.1%, Stellar (1.6%) Aave (3.5%) and EOS (3.2%). Ripple, Chainlink, and Bitcoin Cash were all flat, Polkadot lost 4.3% and Synthetix lost 3.3%. Analyst Filbfilb, co-founder of Decentrader, believes alt season has arrived, pointing to Bitcoin dominance falling below 60%, the lowest point since October 2020. The Crypto Fear and Greed Index is at 72 or Greed.

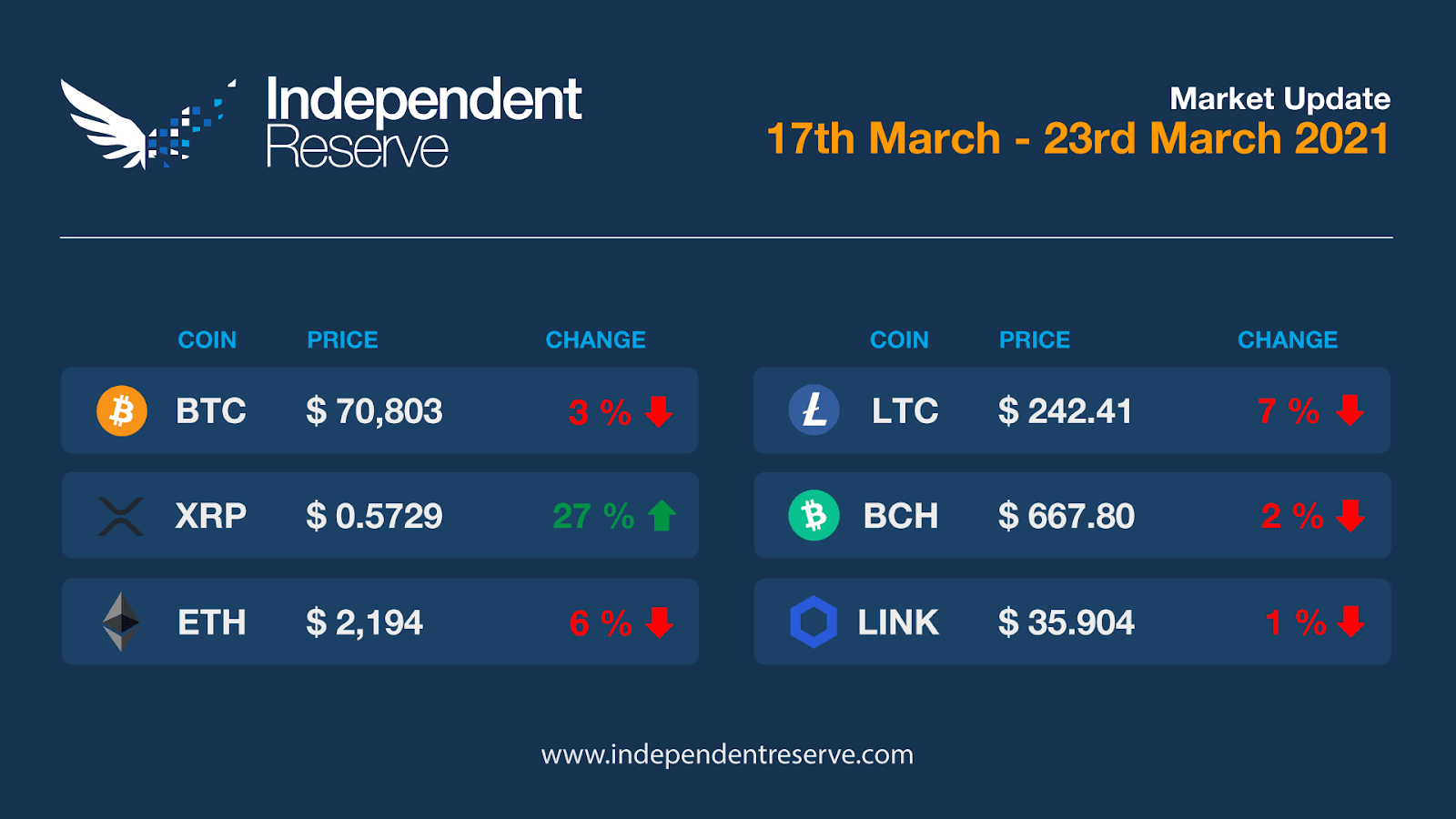

Bitcoin was trading as high as A$77,000 earlier this week, but took a tumble over the past couple of days and is currently trading around $71K. That’s 3.1% down on seven days ago. Ethereum lost 5.7%, Litecoin dropped 6.9%, BCH (-2.5%), AAVE (-6.6%) and SNX (-3.8%). However, Polkadot increased 3.4%, XRP/Ripple was up a whopping 27.2% amid a new push to get it relisted on exchanges, LINK was flat and Stellar was up 4%. Sentiment has eased and the Fear and Greed Index is currently at 70, or Greed.

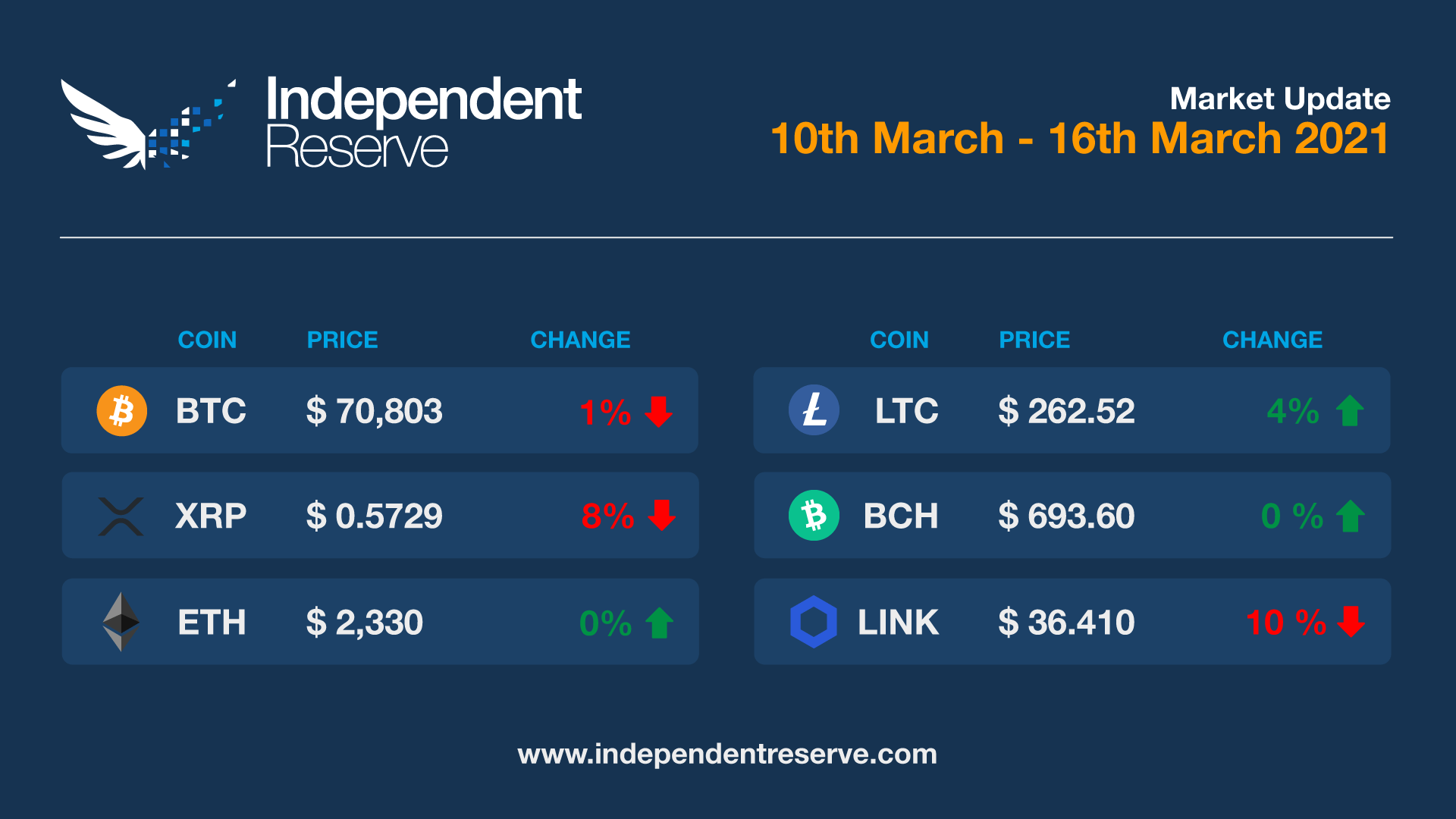

Bitcoin was closing in on the A$80,000 mark over the weekend before it fell almost ten grand on Monday and another three grand today. Various theories have been advanced for the correction: the usual weekend retail shenanigans, conflicting reports over the severity of a crypto ban in India, incorrect reports of $1.3B in BTC being deposited on Gemini. At the time of writing, we have ended about flat from a week ago at A$70k. Bitcoin futures open interest hit a record US$29B a few days ago suggesting bulls expect the uptrend to continue. Elsewhere it was a mixed bag: Ethereum and EOS were flat, Polkadot was up 1%, along with Litecoin (4%) and Bitcoin Cash (0.3%). Chainlink lost 10%, Stellar (-6.1%), AAVE (-11.5%) and Synthetix (-10.8%).