Market update

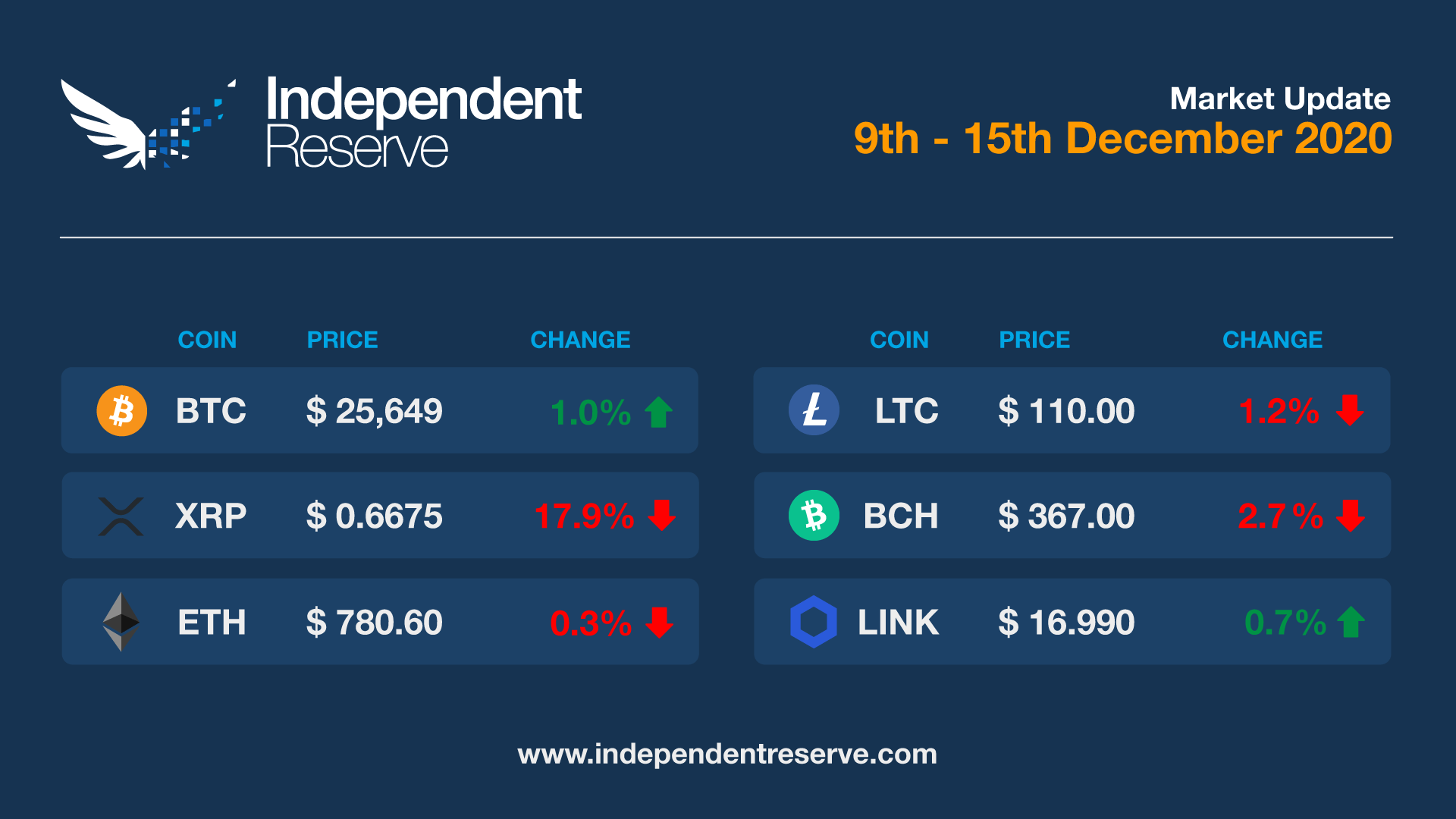

The Bitcoin price is once again in sight of the US $20,000 (A$26,550) mark, after dipping down to the mid $17,000s (A$23,425) on Saturday. At the time of writing Bitcoin was trading around $25,600 which is within 1% of where it was last week. Ethereum also finished flat, Stellar was up 1.2% and SNX gained 2%. Bitcoin Cash lost 2.7%, XRP was down 17.9%, Litecoin (-1.2%), Bitcoin SV (-7.2%), EOS (-3.5%) and AAVE (-6.5%).

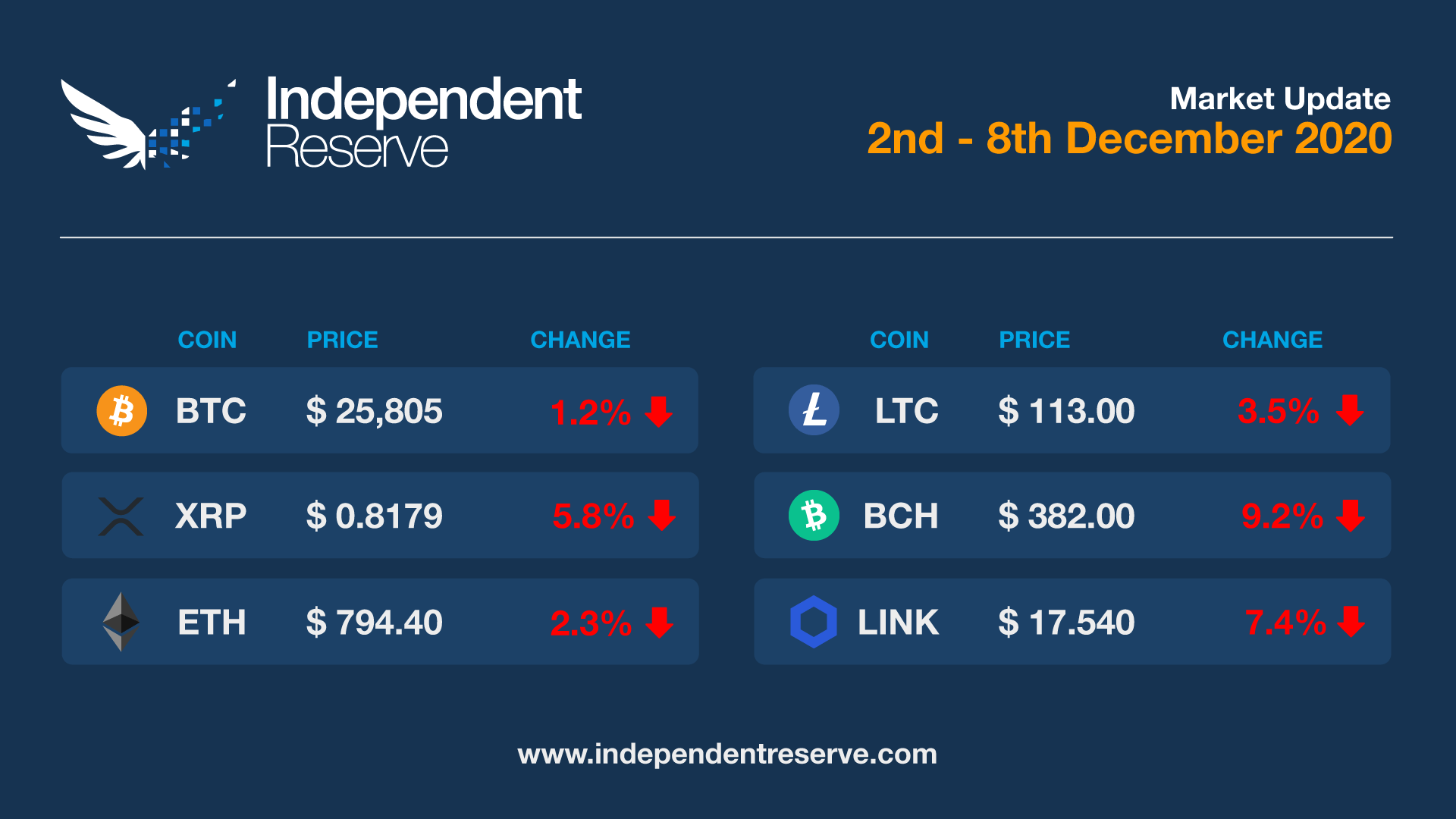

Bitcoin has spent much of the week consolidating at just under $26,000. At the time of writing Bitcoin was just 1.2% down on seven days ago to trade at $25,750. On-chain analyst Willy Woo says he has “never been so bullish” and his “top model” suggests that $270,500 by the end of 2021 “looks conservative“. If you’re a fan of the Stock to Flow model, it suggests Bitcoin will not fall below $16,000 after this point. Most other coins headed backwards including Ether, which was down 2.3%, XRP lost 5.8%, Litecoin (-3.5%), Bitcoin Cash (-9.2%), Chainlink (-7.4%), Stellar (-14.9%) and EOS (-8.3%). Bitcoin SV finished flat while DeFi ‘blue chips’ SNX (8.8%) and AAVE (18.6%) gained ground. The Fear and Greed index is at 95 or ‘Extreme Greed’.

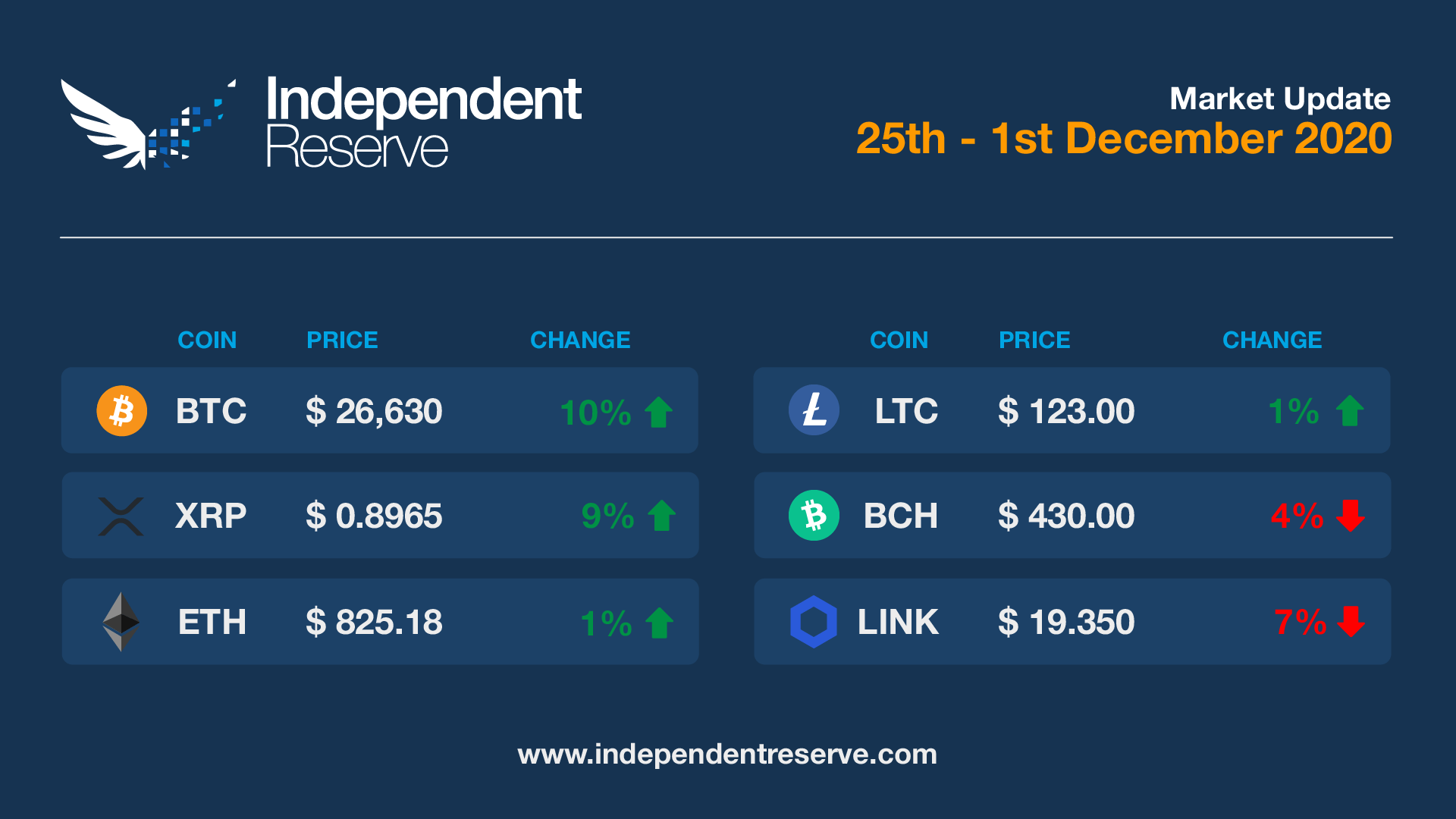

What a rollercoaster ride. After the euphoria reported in our last update, came a heavy reality check when the price plunged 16.4% in a matter of hours later in the week. But markets have since recovered all of that and more to reportedly top the USD all-time high price earlier today when it spiked as high as US $19,873. At the time of writing, BTC was up 6.8% for the week to trade at A$26,800. It was a mixed bag for other coins however with Ethereum up 1%, XRP increasing 8.9%, Stellar (54.9%), YFI (5.4%), AAVE (6.8%). Coins going backwards include LINK (-6.9%), Bitcoin SV (-5.7%), EOS (-3.5%) and SNX (-13.4%). Litecoin and Bitcoin Cash were flat. The Fear and Greed Index is at 88 or “Extreme Greed’.

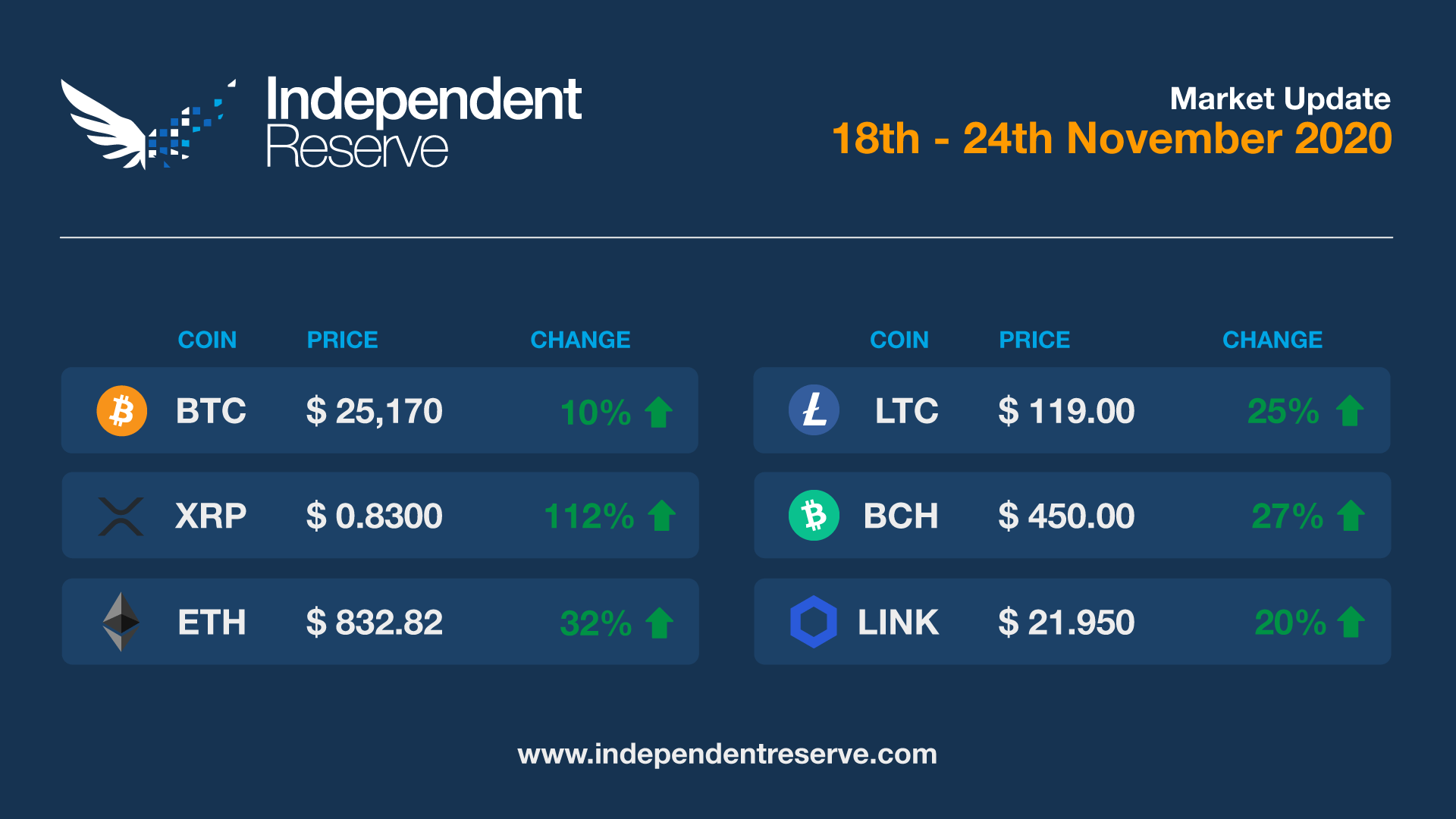

It’s been one of those weeks that allows true believers to dream that everyone is on the cusp of becoming hilariously rich. You would have been exceptionally hard-pressed to lose money in the past seven days, with almost everything up in double figures in percentage terms. Bitcoin gained 10% and is trading around $25,200, which is 40.2% up on just one month ago. The impending launch of ETH 2 helped Ether to increase 32%, though it was completely outshone by XRP which more than doubled in price this week. Everything else was up: Chainlink (20.6%), Bitcoin Cash (26.5%), Litecoin (24.5%), Bitcoin SV (21.0%), EOS (30.2%), Stellar (57.7%), and SNX (23.4%). The Crypto Fear and Greed Index is at 90, or extreme greed.

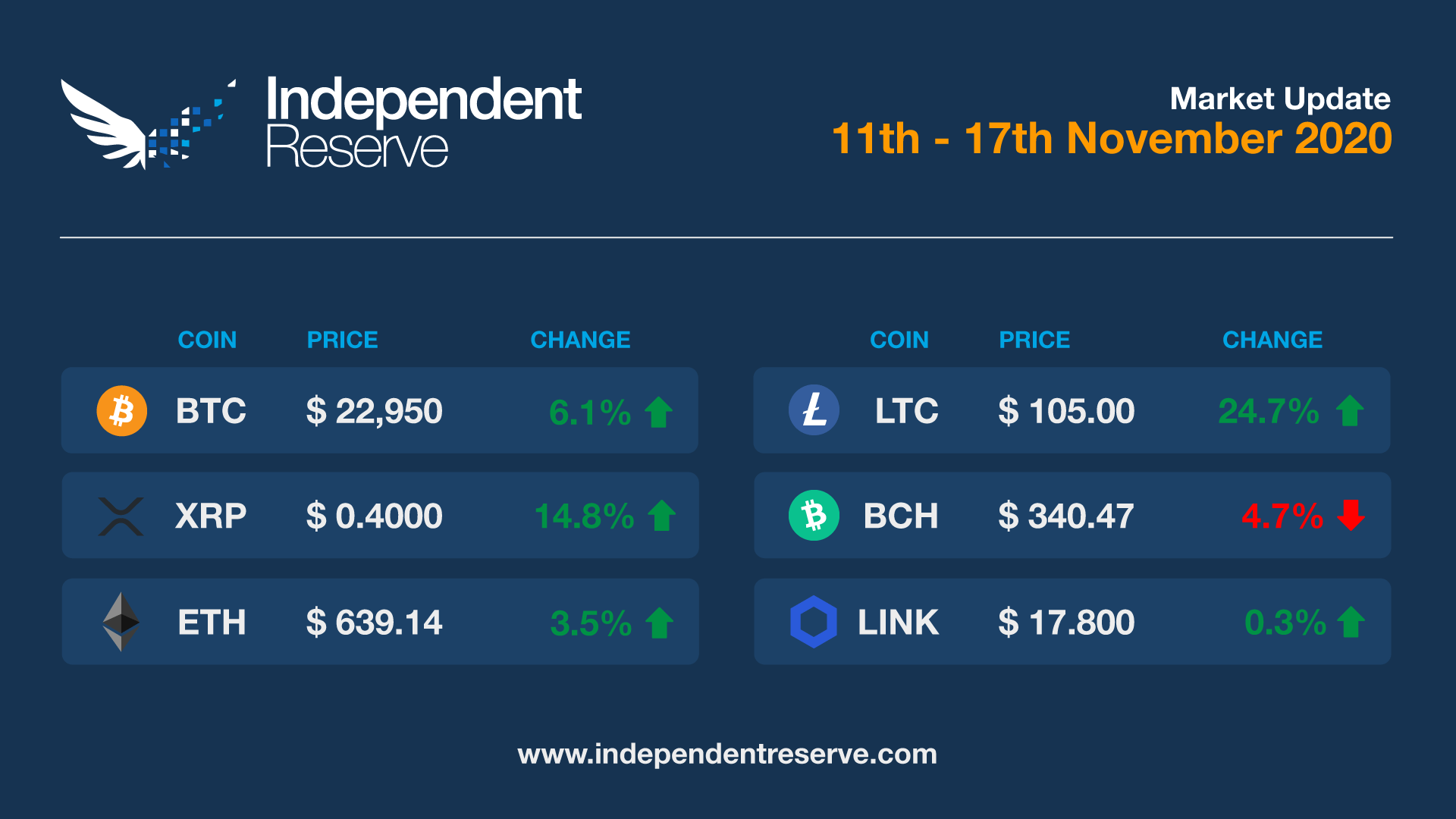

Claims that Moderna’s vaccine has 95% efficacy helped push crypto and stocks higher today, with Bitcoin increasing 6% in the past 24 hours to hit a new 2020 year to date high above $23,000. Bitcoin has only been higher than the current price for less than two weeks back during the all-time high. The price has currently pulled back a little to finish the week up 8.9% at just under $23k. Bitcoin Cash lost 4.7% due to the fork, while Bitcoin SV lost 1.5%. Everything else was up including Ethereum (3.5%), XRP (14.8%), Litecoin (24.75%), EOS (2.95%), SNX (5.4%), YFI (24.2%) and AAVE (36.1%).

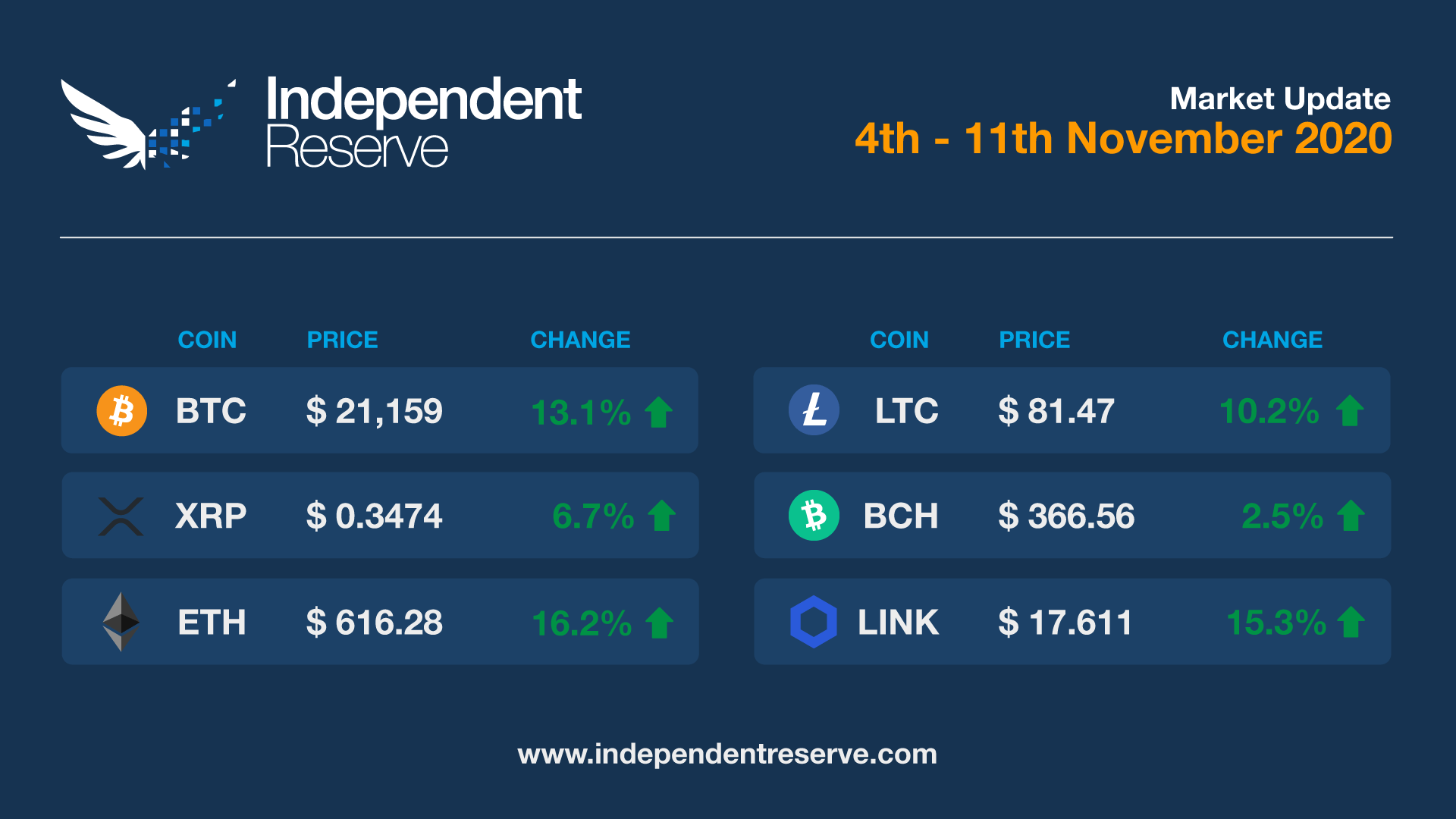

US stocks are back at all-time high levels after Joe Biden became President-Elect and Pfizer unveiled a hugely successful vaccine trial. Bitcoin was also making history, nudging the US$16,000 (A$22K) mark, which is the best price since the all-time high. At the time of writing it was 13.1% up on last week around $21,100. Ethereum performed even better, gaining 16.2% off the back of ETH 2 launch news. It’s currently at the highest point since mid-2018, around $610. DeFi came storming back with it, with Synthetix up 57.4% and Chainlink up 15.3%. Everything else was up: XRP (6.7%), Bitcoin Cash (2.5%) Litecoin (10.2%), EOS (3.1%), Stellar (5.3%), although Bitcoin SV was flat. The Fear and Greed Index is at 90 or Extreme Greed.