Market update

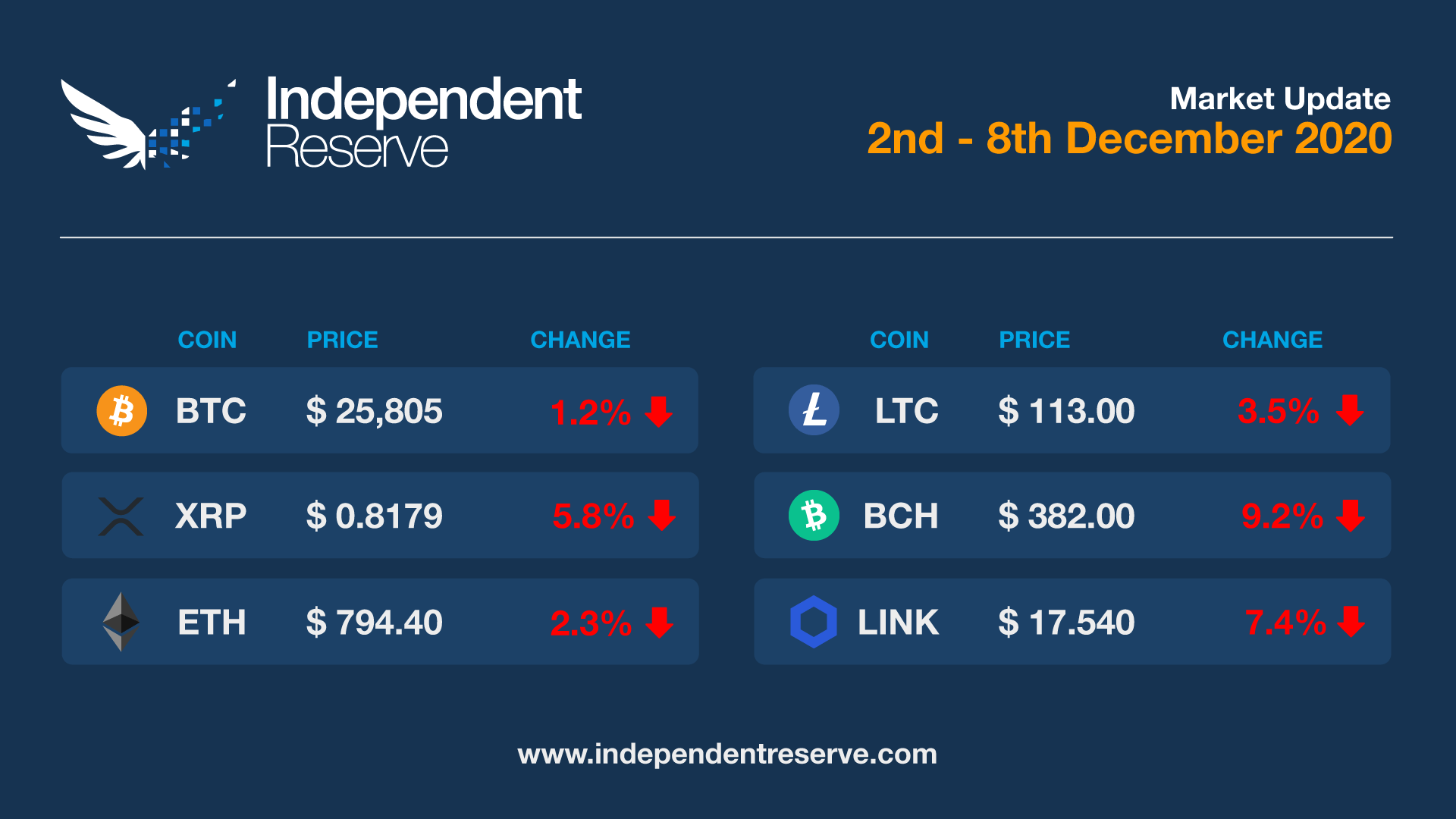

Bitcoin has spent much of the week consolidating at just under $26,000. At the time of writing Bitcoin was just 1.2% down on seven days ago to trade at $25,750. On-chain analyst Willy Woo says he has “never been so bullish” and his “top model” suggests that $270,500 by the end of 2021 “looks conservative“. If you’re a fan of the Stock to Flow model, it suggests Bitcoin will not fall below $16,000 after this point. Most other coins headed backwards including Ether, which was down 2.3%, XRP lost 5.8%, Litecoin (-3.5%), Bitcoin Cash (-9.2%), Chainlink (-7.4%), Stellar (-14.9%) and EOS (-8.3%). Bitcoin SV finished flat while DeFi ‘blue chips’ SNX (8.8%) and AAVE (18.6%) gained ground. The Fear and Greed index is at 95 or ‘Extreme Greed’.

What a rollercoaster ride. After the euphoria reported in our last update, came a heavy reality check when the price plunged 16.4% in a matter of hours later in the week. But markets have since recovered all of that and more to reportedly top the USD all-time high price earlier today when it spiked as high as US $19,873. At the time of writing, BTC was up 6.8% for the week to trade at A$26,800. It was a mixed bag for other coins however with Ethereum up 1%, XRP increasing 8.9%, Stellar (54.9%), YFI (5.4%), AAVE (6.8%). Coins going backwards include LINK (-6.9%), Bitcoin SV (-5.7%), EOS (-3.5%) and SNX (-13.4%). Litecoin and Bitcoin Cash were flat. The Fear and Greed Index is at 88 or “Extreme Greed’.

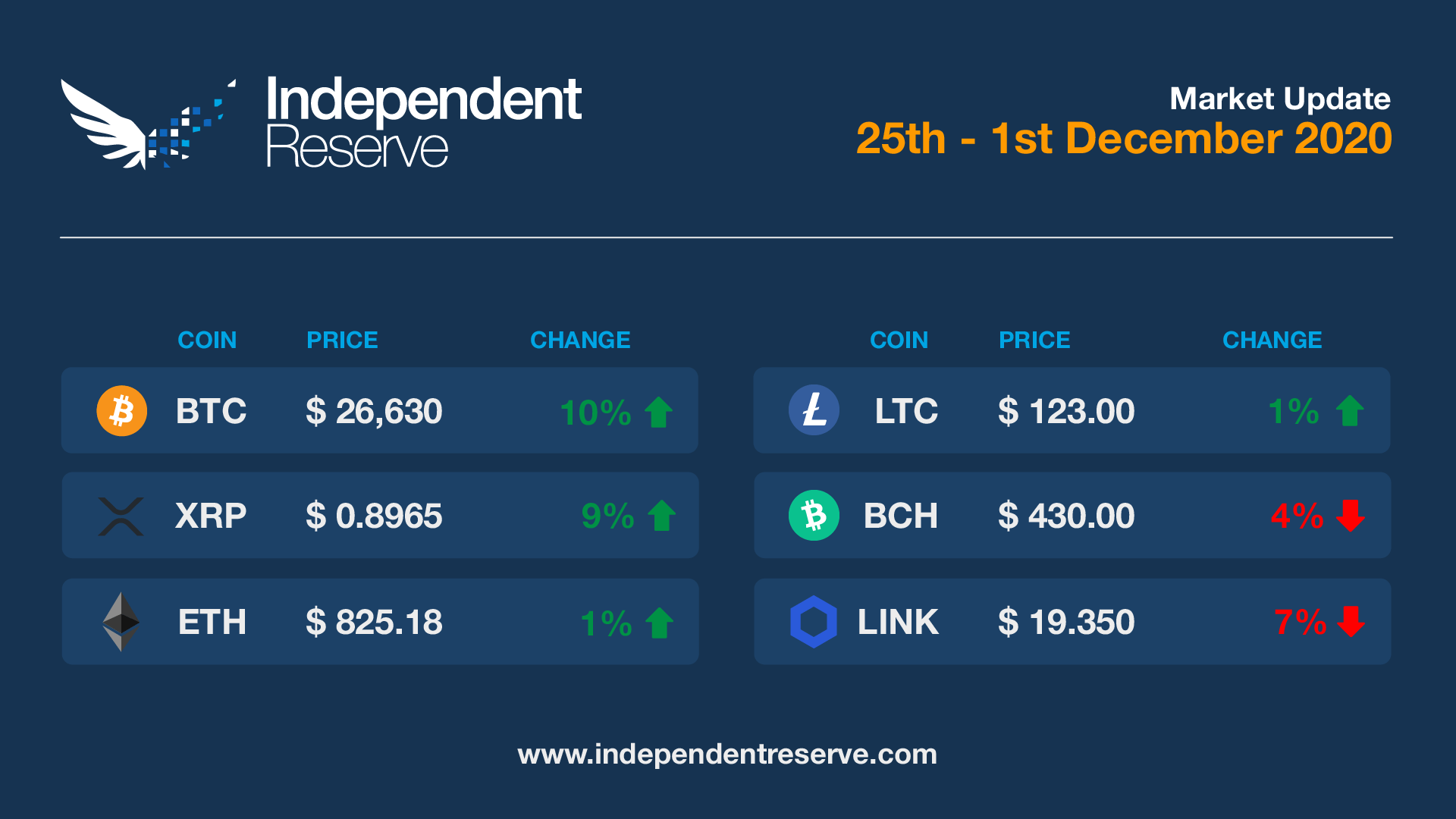

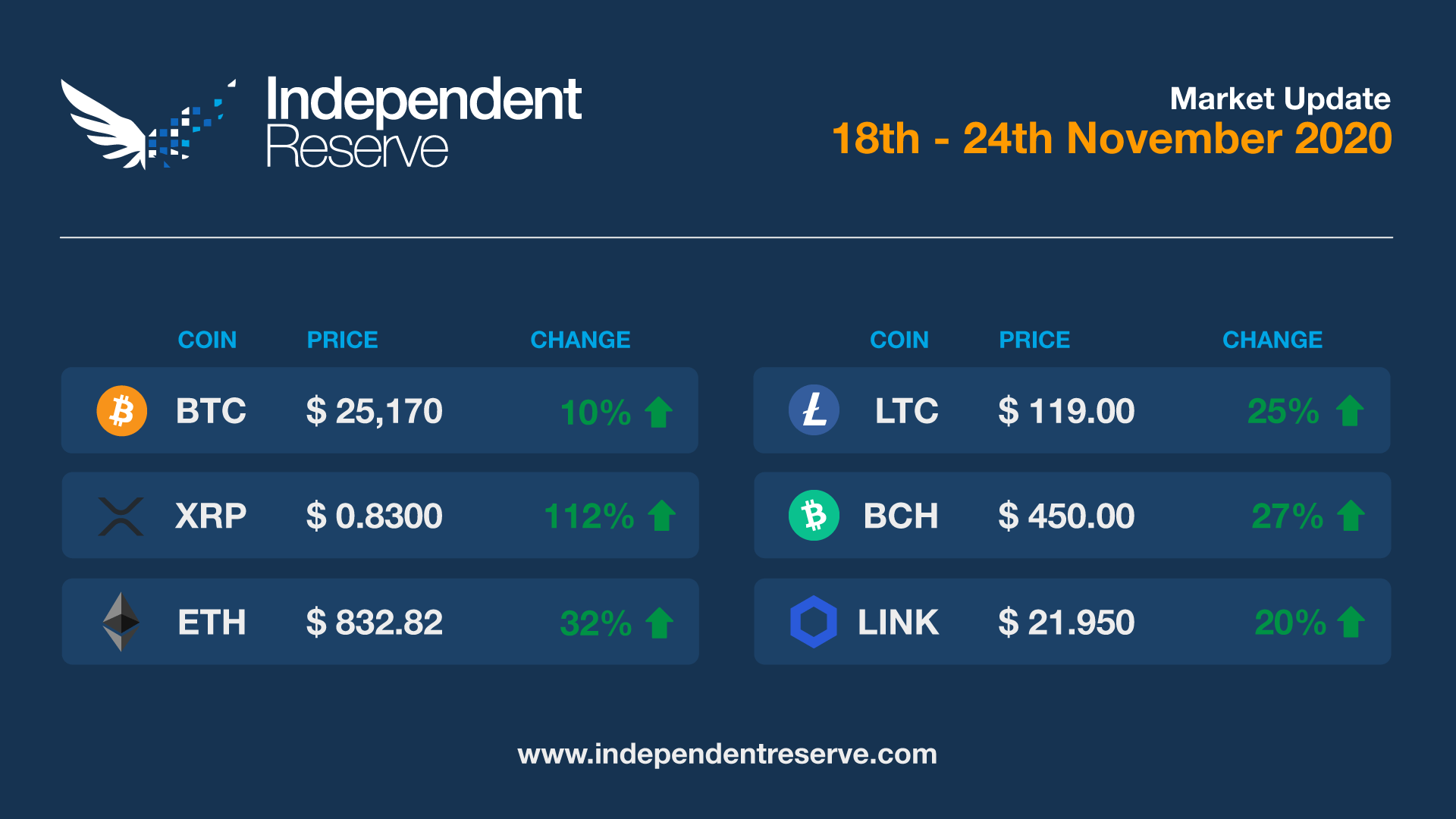

It’s been one of those weeks that allows true believers to dream that everyone is on the cusp of becoming hilariously rich. You would have been exceptionally hard-pressed to lose money in the past seven days, with almost everything up in double figures in percentage terms. Bitcoin gained 10% and is trading around $25,200, which is 40.2% up on just one month ago. The impending launch of ETH 2 helped Ether to increase 32%, though it was completely outshone by XRP which more than doubled in price this week. Everything else was up: Chainlink (20.6%), Bitcoin Cash (26.5%), Litecoin (24.5%), Bitcoin SV (21.0%), EOS (30.2%), Stellar (57.7%), and SNX (23.4%). The Crypto Fear and Greed Index is at 90, or extreme greed.

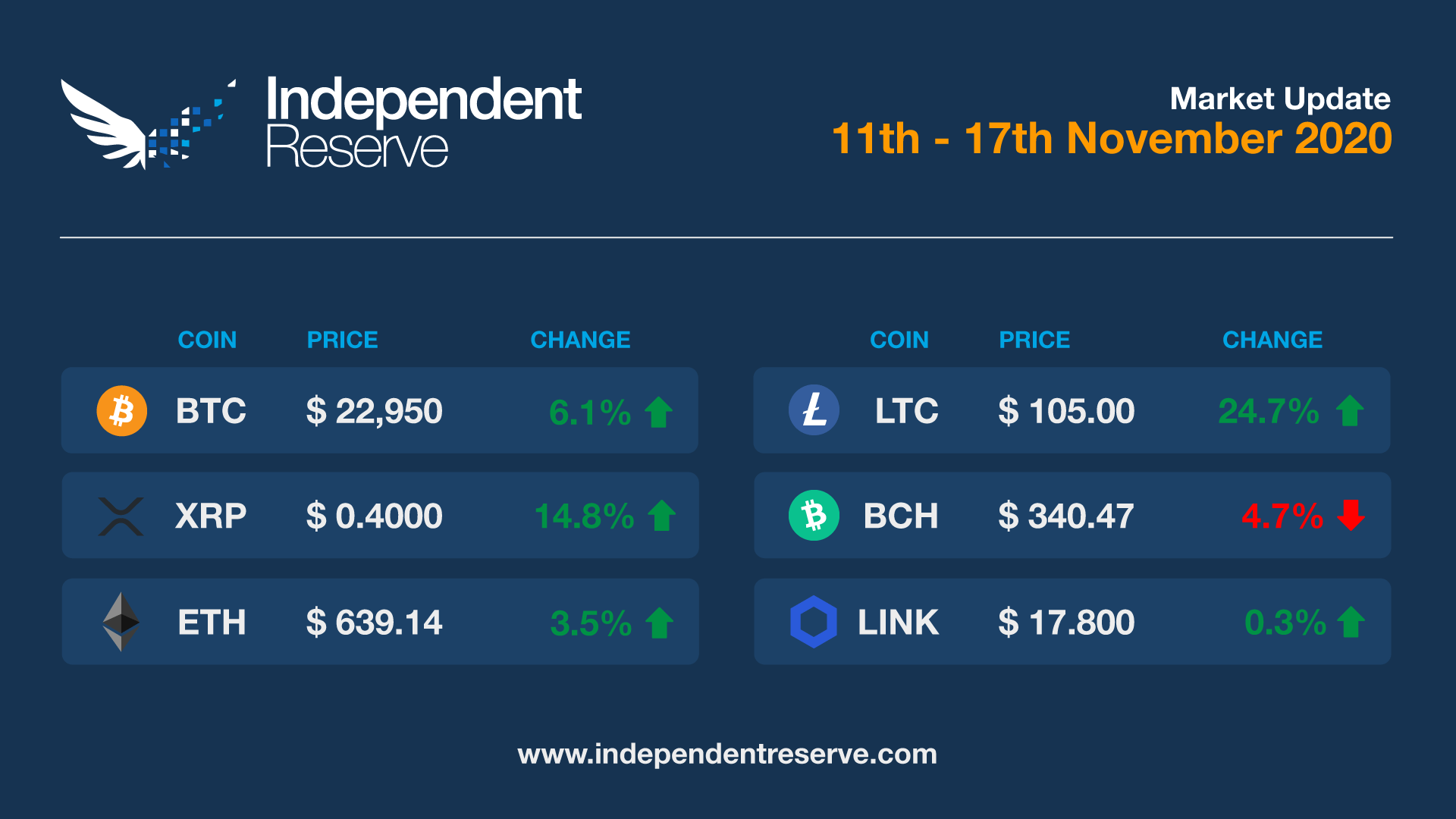

Claims that Moderna’s vaccine has 95% efficacy helped push crypto and stocks higher today, with Bitcoin increasing 6% in the past 24 hours to hit a new 2020 year to date high above $23,000. Bitcoin has only been higher than the current price for less than two weeks back during the all-time high. The price has currently pulled back a little to finish the week up 8.9% at just under $23k. Bitcoin Cash lost 4.7% due to the fork, while Bitcoin SV lost 1.5%. Everything else was up including Ethereum (3.5%), XRP (14.8%), Litecoin (24.75%), EOS (2.95%), SNX (5.4%), YFI (24.2%) and AAVE (36.1%).

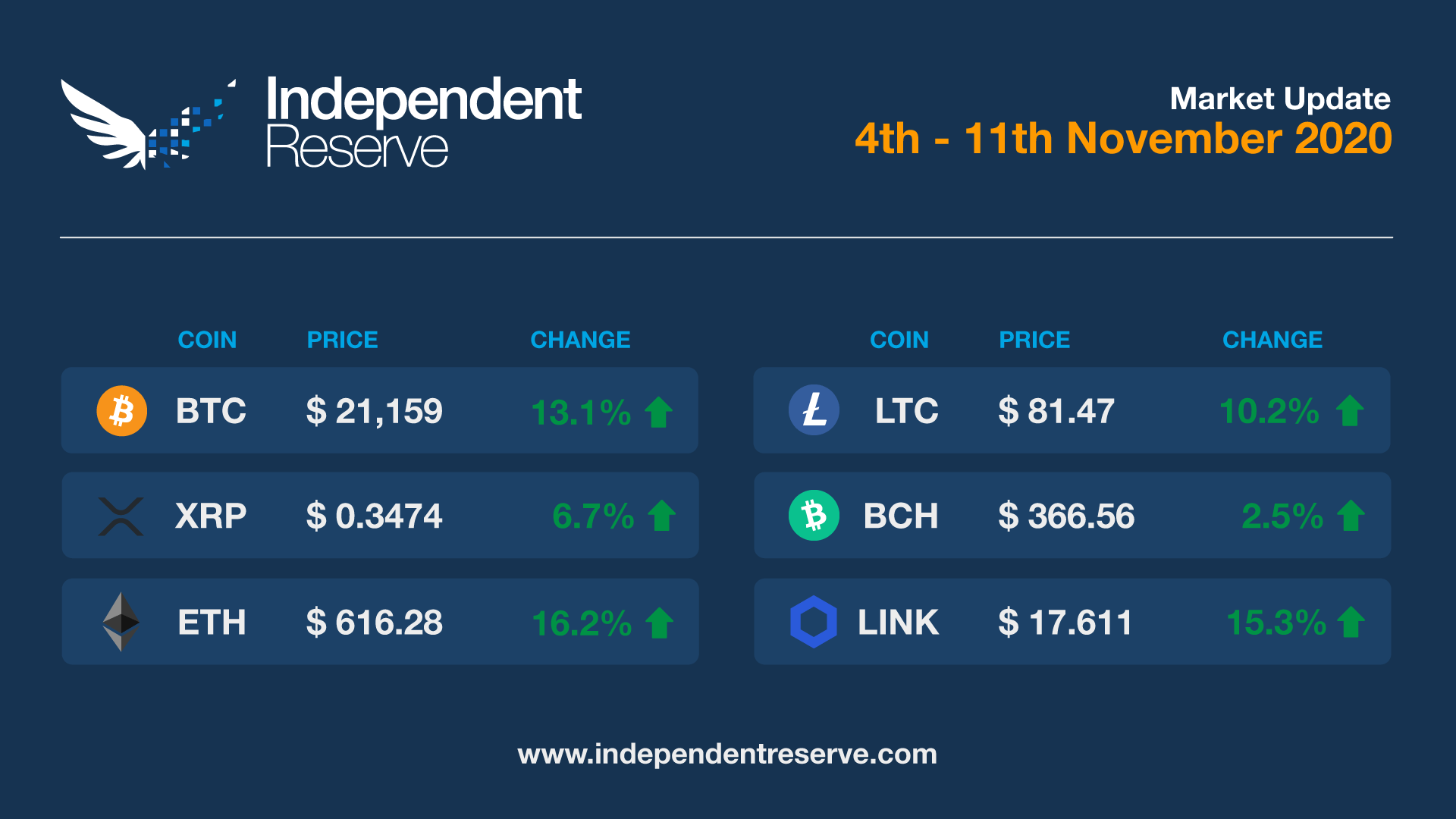

US stocks are back at all-time high levels after Joe Biden became President-Elect and Pfizer unveiled a hugely successful vaccine trial. Bitcoin was also making history, nudging the US$16,000 (A$22K) mark, which is the best price since the all-time high. At the time of writing it was 13.1% up on last week around $21,100. Ethereum performed even better, gaining 16.2% off the back of ETH 2 launch news. It’s currently at the highest point since mid-2018, around $610. DeFi came storming back with it, with Synthetix up 57.4% and Chainlink up 15.3%. Everything else was up: XRP (6.7%), Bitcoin Cash (2.5%) Litecoin (10.2%), EOS (3.1%), Stellar (5.3%), although Bitcoin SV was flat. The Fear and Greed Index is at 90 or Extreme Greed.

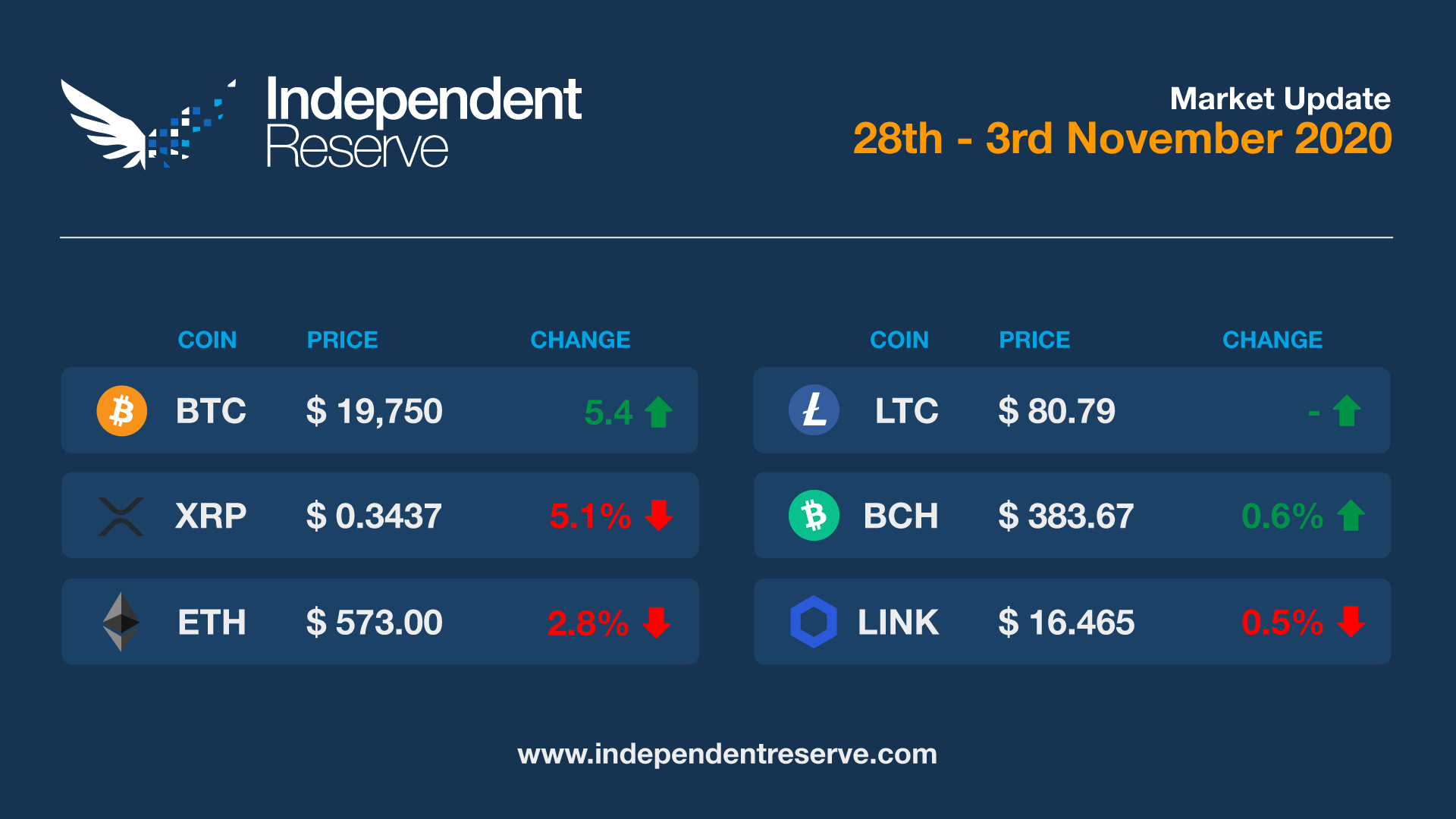

After increasing in price by a third in October, Bitcoin marked its second-highest monthly close ever. And to celebrate 12 years since the release of the Bitcoin whitepaper on October 31, 2008, it briefly topped US$14,000 (A$20,000) on the weekend – the highest price since January 2018. The price was unwinding back then, but this time it’s making higher highs and higher lows. Are we due a pullback, entering a period of consolidation, or headed to a new record high? The Bitcoin price is up 5.4% for the week and is currently trading at just over $19,600. Everything else headed in the opposite direction though. Ethereum lost 2.8%, XRP (-5.1%), Bitcoin Cash (-1.2%) Chainlink (-5%), Litecoin (-5.2%), Bitcoin SV (-9.6%), EOS (-6.6%), Stellar (-5.2%) and Synthetix (-20.1%).

Bitcoin blasted through the US $13,000 ($18,250) level this week for only the third time since the all-time high. It also saw its sixth-highest weekly close ever. This week will be critical for Bitcoin as it’s never held at these levels for long. With US stock markets falling on Monday on worsening infection numbers and concerns over the delayed stimulus, there are headwinds, however sentiment is extremely strong. The Fear and Greed Index is at 75 or ‘Greed’ and Bitcoin is once again getting coverage in the mainstream media. BTC finishes the week up 11.3% and is above $18,400 at the time of writing. Almost everything else is up including Ethereum (3.9%), Bitcoin Cash (3.7%), Chainlink (8.2%), Litecoin (17.9%), Bitcoin SV (8.2%), EOS (1.5%). XRP was flat however and Stellar lost 4.7%.

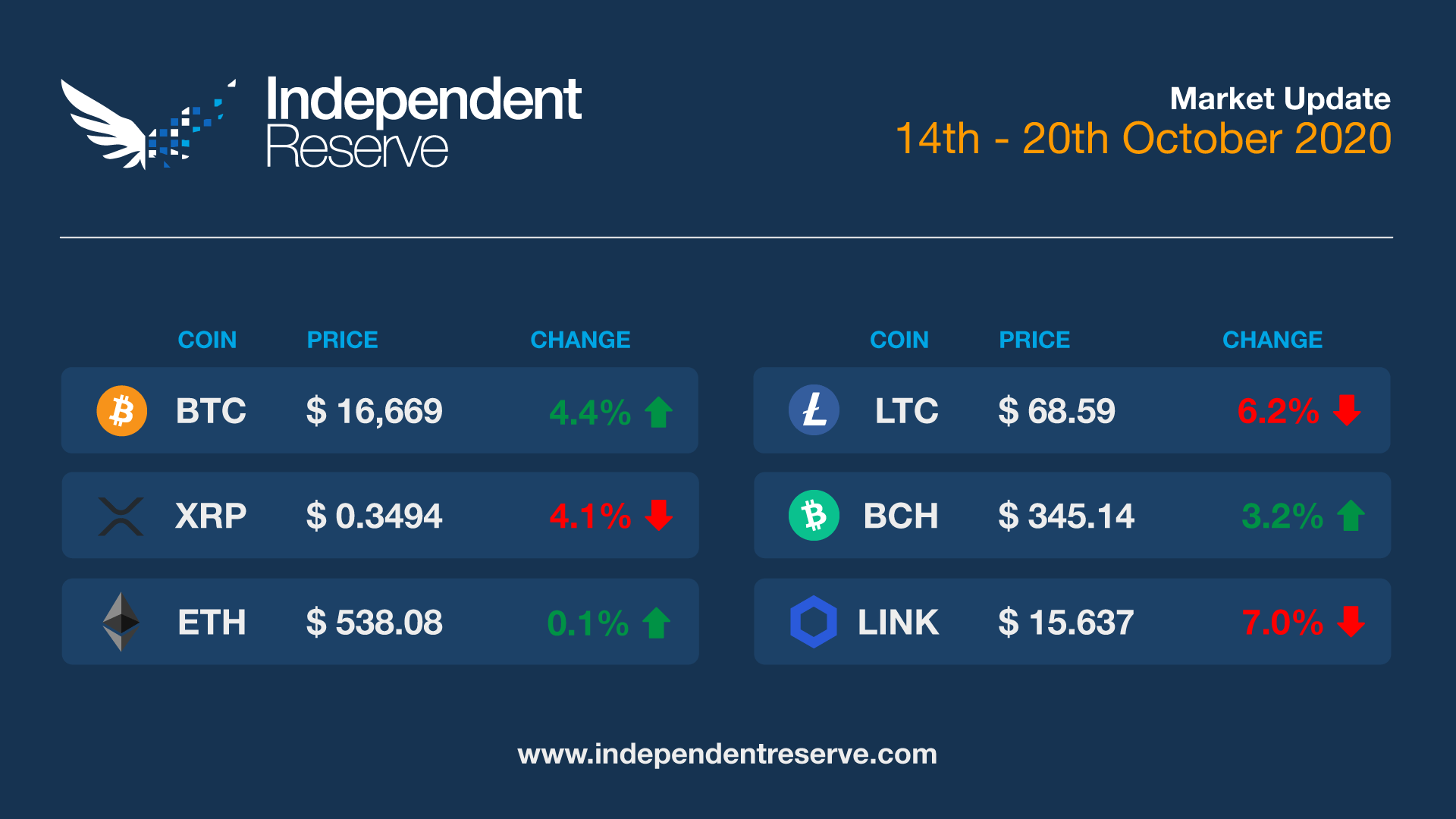

Bitcoin finishes the week close to where it began, around $16,700. Bitcoin is above its 10 day and 50-day moving average, which is a bullish sign. Katie Stockton, a technical analyst for Fairlead Strategies, believes we’re likely to soon see a “test of August’s high” above $17,500. Bitcoin has only spent 93 days in its history above US$11,500 (A$16,278) according to data from Skew. This means virtually every BTC holder is now in profit. Bitcoin Cash gained 3.2% and Stellar was up 9.3% this week but most other coins lost ground, including Ethereum (-3.7%), XRP (-4.1%), Chainlink (-7%), Litecoin (-6.2%) and EOS (-3.4%).

In Markets

After a mid-week slump, Bitcoin took the elevator up a thousand dollars on the weekend and has continued to climb. Renewed hopes of a stimulus deal in the US and public company Square buying up 4,709 Bitcoin helped the bullish sentiment. Bitcoin finishes the week up 7.4% at just over $16,000 (around US $11,500). DeFi tokens also staged a minor comeback this week with Chainlink up 19.3% and Synthetix up 10.7%. Ethereum finishes the week up 9.9%, Bitcoin Cash (8.6%), Litecoin (10%), Bitcoin SV (4.9%), EOS (4.9%), Stellar (6.1%). The Fear and Greed Index moved up overnight from 52 to 56 or from Neutral to Greed.

In Markets

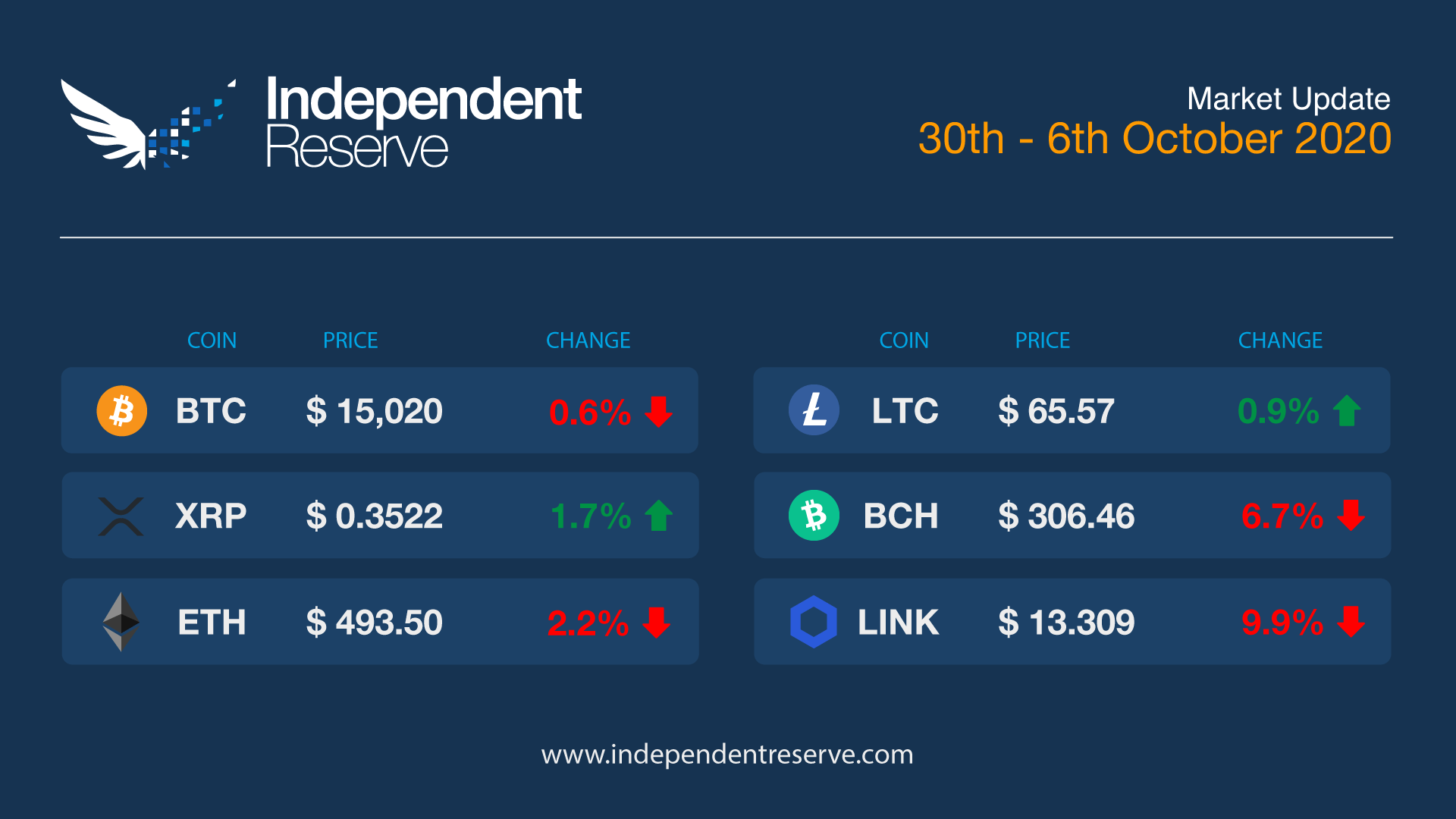

Despite the KuCoin hack, regulators taking action against BitMEX and President Trump getting coronavirus, the Bitcoin price has remained essentially unmoved. “Historically, these three collective events would have sent markets reeling. This shows that the market is increasingly filled with more bullish investors [who] believe in the fundamentals,” Zachary Friedman, COO of Global Digital Assets told Coindesk. Bitcoin traded mostly within a $600 range, ending the week 0.6% down at around $15,000. Bitcoin’s 30 day volatility is at a near-record low of 0.85% and the last time BTC was this stable was in January 2013 and April 2016, before the price exploded 1,000% or more. Ethereum finished the week 2.2% down while XRP was up 1.7% and Litecoin was up 1%. Everything else declined including Chainlink (-9.6%), Bitcoin SV (-5.3%), EOS (-2.9%) and Stellar (-2.2%).

In Markets

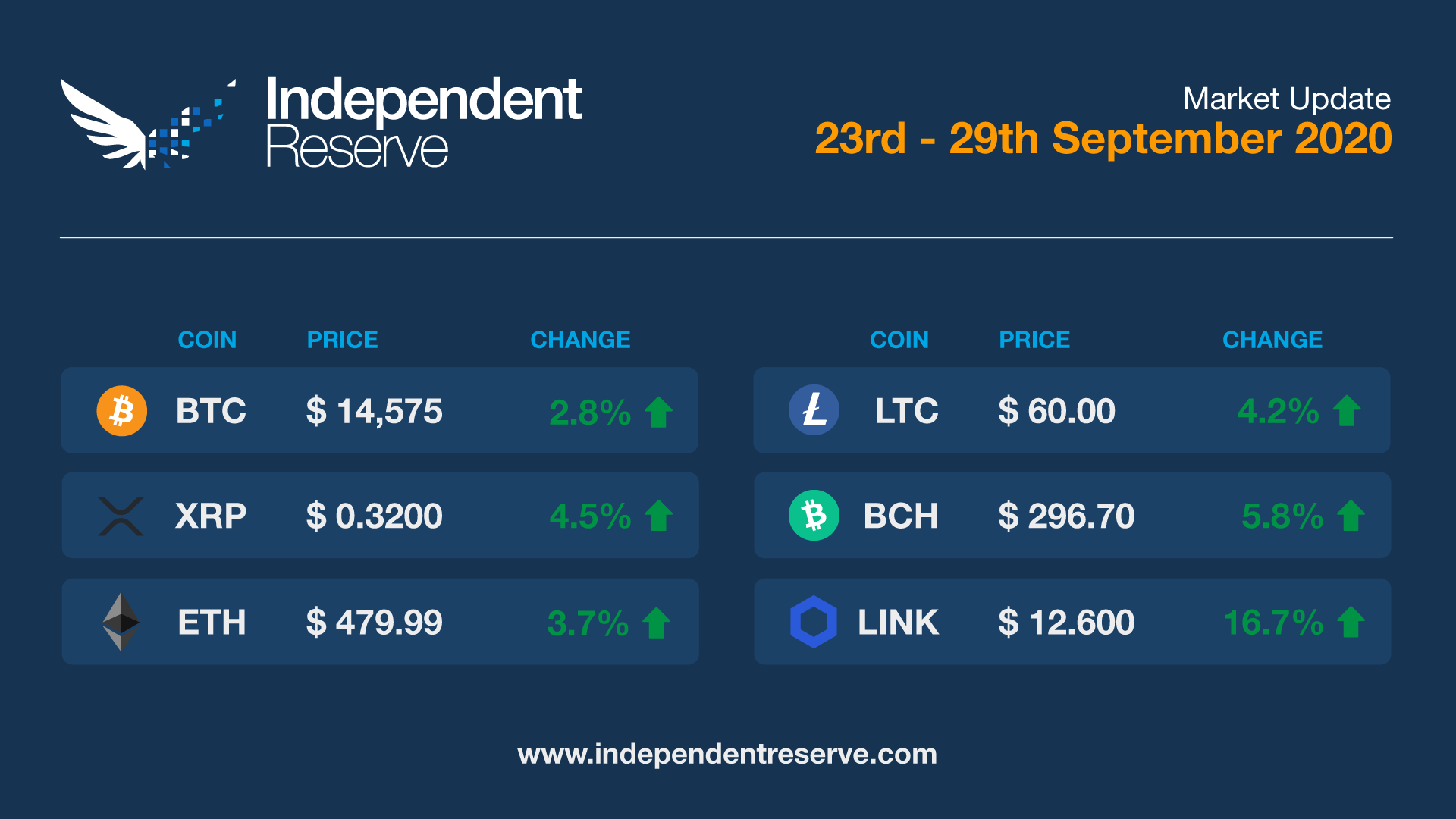

Bitcoin had a positive week, increasing 2.8% to trade just under $15,300 at the time of writing. Bitcoin has now spent a record 64 days above the US$10,000 ($14,100) level and podcaster Anthony Pompliano says “it’s only showing signs of going higher.” Will it break the US$11,000 ($15,525) mark this week? Altcoins were a sea of green, with Ethereum up 3.7%, XRP (4.5%), Bitcoin Cash (5.8%), Chainlink (16.7%) and Bitcoin SV (15.3%). Outside of the top 10 Litecoin was up 4.2%, EOS (2%), Stellar (4.1%), Synthetix (32.8%) and OMG (45%).

In Markets

Bitcoin ended the week lower alongside the US stock market, which fell to a two month low on Monday amid fears of a surge in pandemic cases. But the price floor of US$10,000 ($13,800) has been holding well. Bitcoin is currently 2.2% down for the week at just above $14,500. Everything else was down – with DeFi tokens the hardest hit including Chainlink (-27.2%) and Synthetix (-29.8%). Ethereum lost 8.7% Bitcoin Cash (-7%), XRP (-5.7%), Litecoin (-11.5%), EOS (-8.2%) and Stellar (-12.3%).